U.S. Economic Recovery, Monetary Policy, and Demographics Analysis

Economics / US Economy Oct 16, 2012 - 02:37 AM GMTBy: Mike_Shedlock

Fresh on the heels of my 3:38 AM post Charting Errors in BLS Participation Rate Projections came an interesting speech by William Dudley, president of the Federal Reserve Bank of New York.

Fresh on the heels of my 3:38 AM post Charting Errors in BLS Participation Rate Projections came an interesting speech by William Dudley, president of the Federal Reserve Bank of New York.

Please consider these snips from Dudley's speech today The Recovery and Monetary Policy.

My remarks will focus on the economic outlook. I do this with some trepidation, of course. In the private sector there are two adages about forecasting that underscore the need to be humble in this endeavor: First, forecast often. Second, specify a level or a time horizon, but never specify both, together.

The disappointing recovery

Turning to the first question, U.S. economic growth has been quite sluggish in recent years. For example, annualized real GDP (gross domestic product) growth has averaged only about 2.2 percent since the end of the recession in 2009. As a consequence, we have seen only modest improvement in the U.S. labor market.

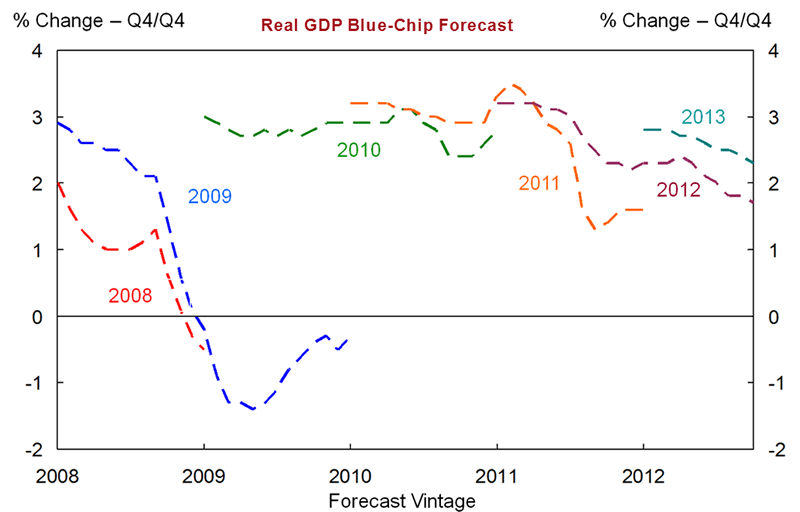

Not only has growth been slow, it has also been disappointing relative to the forecasters' expectations. For example, the Blue Chip Consensus have been persistently too optimistic in recent years. This is illustrated in Exhibit 1 [following] which shows how private sector forecasts for 2008 through 2013 have evolved over time.

Two aspects of this exhibit are noteworthy. First, forecasters have consistently expected the U.S. economy to gather momentum over time. Second, with only one exception, the growth forecasts for each year have been revised downward over time, as the expected strengthening did not materialize.

Although I have focused on the private forecasting record here, the FOMC participants' forecasts show a similar pattern. It is on the growth side where there have been chronic, systematic misses.

In my view, the primary reason for the poor performance of the U.S. economy over this period has been inadequate aggregate demand. There are several explanations for this. Although some were well-known earlier, others have only become more obvious as the recovery has unfolded.

During the credit boom, finance is available on easy terms and the economy builds up excesses in terms of leverage and risk-taking. When the bust arrives, credit availability drops sharply and financial deleveraging occurs. Wealth falls sharply, precautionary liquidity demands increase, desired leverage drops further. In the U.S. case, there were some idiosyncratic elements, such as subprime lending and collateralized debt obligations. But, in the end, the U.S. experience included the major elements of most booms: Too much leverage, too little understanding of risk, too easy credit terms, and then a very sharp reversal.

When the bust arrives, over-indebted households and businesses want to increase their saving and liquidity buffers, and financial intermediaries want to raise credit standards. Both responses restrain demand and make a cyclical rebound more difficult. In the U.S. case, because the bust was concentrated in housing, the scope for a strong cyclical recovery was particularly constrained because the interest-rate sensitive sector that would typically lead such a rebound could not recover until the overhang of unsold homes and the impairment of housing finances was corrected.

The U.S. recovery has also been subpar because it has been taking place in the context of a weak global economy. Historically, after a country experienced a financial crisis, growing foreign demand and currency depreciation have often led to a sharp improvement in the trade account that has put a floor under economic activity. In such circumstances, rising exports substitute for domestic consumption in supporting aggregate demand. This demand, in turn, encourages businesses to hire and invest. In contrast, this time the shock generated by the U.S. housing bust had global consequences, exposing economic vulnerabilities outside of the United States, especially in Europe. Under these circumstances, the scope for trade as a support for U.S. growth, while positive, has been very limited.

These two factors--the dynamics following financial crises and the weakness of foreign demand--help explain why U.S. growth has been weak, but I don't think these factors explain why it has been consistently weaker than expected.

So why has the recovery disappointed?

One possibility is that the negative dynamics of a post-bubble environment are even more potent than had been appreciated. Feedback loops may be more powerful and frictions may be larger. In the U.S. case, this is particularly germane with respect to housing and mortgage finance. For example, we have found significant shortcomings in those institutional structures available to support the workout of the overhang of mortgage debt in an efficient and timely manner.

A second reason may be the series of additional negative shocks experienced since the initial phase of the financial crisis. The largest of these relate to the crisis in the eurozone. But one could also add the periodic commodity price shocks, the disruptive impact of the tragic Japanese earthquake and tsunami on global trade and production, and the effect of the uncertainties around the impending fiscal cliff on hiring and investing.

A third reason for the weaker than expected recovery likely lies in the interplay between secular and cyclical factors. In particular, I believe that demographic factors have played a role in restraining the recovery. The developed world's populations are aging rapidly. In the United States, for example, the baby boom generation, which is a particularly large cohort, is now beginning to retire. As the population ages, this has two consequences. First, the spending decisions of the older age cohorts are less likely to be easily stimulated by monetary policy. That is because such age groups tend to spend less of their incomes on consumer durables and housing. Second, as the population ages and the number of retirees climbs, the costs associated with Social Security, government pensions, and healthcare retirement benefits increase. This creates budgetary pressure and leads to a choice of raising revenue to fund these costs, cutting other government programs, or cutting benefits.

Now if this all had been fully anticipated by retirees and near-retirees, then this would already be factored into their spending and saving decisions. But, I doubt that this has been the case. I suspect that many have been surprised by the swift change in economic circumstances as the housing boom went bust. I doubt that many fully anticipated the budget crunch and the prospect that their future retiree and healthcare benefits would likely be curbed or their taxes would have to rise in the future. When households begin to anticipate this, they reduce their assessment of their sustainable living standards. This downward reassessment then feeds back to current spending and saving decisions.

A fourth reason why the recovery has been slower than expected may be that we overestimated the capacity for fiscal policy to continue to provide support to growth until a vigorous recovery was achieved. On the fiscal side, the authorities can cut taxes or increase spending to support income and demand during the deleveraging phase that follows the financial crisis. But the ability of such stimulus to continue to support economic activity ultimately encounters budgetary limits. For example, the need to keep the long-term fiscal trajectory on a sustainable path limits the size and duration of federal fiscal stimulus measures. For state and local governments, the statutory requirements for balanced budgets meant that fiscal policies turned restrictive relatively quickly once budget surpluses and rainy day funds were exhausted, and this was only temporarily mitigated by federal transfers to the states as part of the initial fiscal stimulus program. Fiscal policy is now a drag rather than a support to growth in the United States, and this will likely continue.

NY Fed vs. Mish Analysis

I have talked about all of the reasons cited by Dudley on this blog, numerous times, many before the financial crisis even hit.

Yet, we all have our misses, for me it was the stock market, not the economy that is in question. The financial recovery was far greater that I imagined in the face of what I thought was rather easy-to-see reasons why the real economy would not respond well to unprecedented stimulus globally, not just in the US.

Others have had misses as well. The group that was furthest off in projections were the staunch inflationists and hyperinflationists. Once again I though inflation was an easy call. Credit, except for student loans and other government-sector credit has gone nowhere.

As measured by credit (subtracting government sector loans), inflation is barely positive. As measured by prices, I happen to think inflation is a bit higher that the Fed states, especially when it comes to food and energy. Regardless, inflation is nowhere near out of control and hyperinflation calls look rather silly.

By the way, there is much more to the above article including four other exhibits and corresponding discussion. Inquiring minds may wish to take a look.

Reflections on Stimulus

First, please note that stimulus measures are actually way larger now than anyone talks about.

For a discussion please see US Runs 4th Straight $1 Trillion-Plus Bu...

Simply put, trillion dollar deficits are nothing but monstrous (and misguided) Keynesian stimulus proposals. All the more reason for the Fed, to be puzzled over the weak recovery.

I have written about this numerous times before, but here are a few of them.

- Bernanke, a Complete Dunce, "Puzzled by Weak Consumer Spending"

- Bernanke Puzzled Over Jobs, Cites Okun's Law; Six Things Bernanke is Clueless About

- Panic!

Where To From Here?

The Fed has not helped the real economy much, even if it has helped financial assets. The thing is, recovery of financial assets has minimal correlation to consumer spending. In contrast, rising home prices do.

People make all kinds of home improvements if they think they will "get their money back". However, consumers have rightfully thrown in the towel on such thinking.

Businesses did not hire in response to stimulus as I expected and I still do not think they will. Why should they? The problem is lack of customers, not ability to get loans.

Moreover, Obamacare is a real drag on business hiring. For a discussion, please see Is Obamacare Responsible...

I wrote about Obamacare about a week ago and received numerous responses from people that their businesses are indeed acting the way I said they are. I will have a follow-up shortly.

In general, businesses are running pretty lean. Should consumer spending pick up in a big way, perhaps there will be a spurt in hiring.

However, tax hikes starting in 2013 will be a drag on spending. Businesses, already lean, may have little room to fire. The choice then would be to fire workers (who would then have no money to spend, or keep the workers and take a big profit hit).

Alternatively, there are half-way measures of reducing hours across the board.

Many think the US is heading for recession. I think the US is in one already, as of June. Regardless, corporate profits will have only one way to go if the recession strengthens in a major way.

Can the stock market stay elevated in the face of priced-for-perfection results, demographics, and structural forces at play? I do not think so, but that is what I have thought for the last year and a half.

By Mike "Mish" Shedlock

http://globaleconomicanalysis.blogspot.com Click Here To Scroll Thru My Recent Post List

Mike Shedlock / Mish is a registered investment advisor representative for SitkaPacific Capital Management . Sitka Pacific is an asset management firm whose goal is strong performance and low volatility, regardless of market direction.

Visit Sitka Pacific's Account Management Page to learn more about wealth management and capital preservation strategies of Sitka Pacific.

I do weekly podcasts every Thursday on HoweStreet and a brief 7 minute segment on Saturday on CKNW AM 980 in Vancouver.

When not writing about stocks or the economy I spends a great deal of time on photography and in the garden. I have over 80 magazine and book cover credits. Some of my Wisconsin and gardening images can be seen at MichaelShedlock.com .

© 2012 Mike Shedlock, All Rights Reserved.

Disclaimer: The above is a matter of opinion provided for general information purposes only and is not intended as investment advice. Information and analysis above are derived from sources and utilising methods believed to be reliable, but we cannot accept responsibility for any losses you may incur as a result of this analysis. Individuals should consult with their personal financial advisors.

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.