The Best Rides a Market Trader Can Take is on a Third Wave

InvestorEducation / Elliott Wave Theory Oct 25, 2012 - 12:07 PM GMTBy: EWI

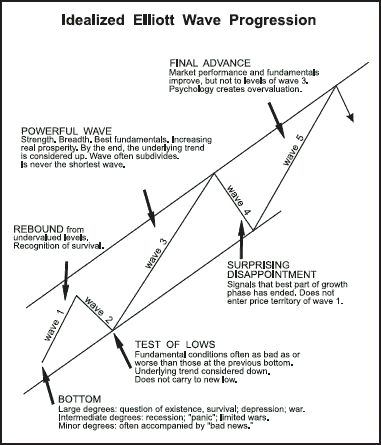

The Elliott Wave Principle states that in financial markets, prices unfold in 5 wave patterns:

The Elliott Wave Principle states that in financial markets, prices unfold in 5 wave patterns:

In wave 1, the trend has begun. Wave 2 makes a sucker outta you. Wave 3 is a powerful sight to see. Wave 4 is a corrective chore. And wave 5 is time to look alive -- once more.

Elliott Wave Principle -- Key to Market Behavior (the ultimate resource for all things Elliott) provides this definition for wave 3:

"Third waves are wonders to behold. They are strong and broad, and the trend at this point is unmistakable. Increasingly favorable fundamentals enter the picture as confidence returns...

AND: "It follows, of course, that the third wave of a third wave and so on will be the most volatile point of strength in any wave sequence. Such points invariably produce breakouts... and runaway price movement."

This chart shows the personalities of each of the five waves. As you can see, wave three usually begins just when investors are convinced the bear market is back. (You can flip this chart for a five-wave move to the downside -- in which case, wave three begins just as investors think the bull market is back.)

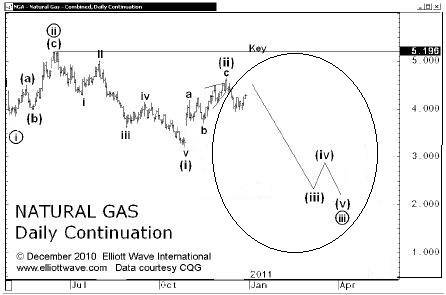

To witness a wave 3 in action is "a powerful sight to see." The first chart below of natural gas comes from EWI's January 2011 Global Market Perspective. It showed prices gearing up for a third-of-a-third wave decline to $2 -- a level the market had not seen in over a decade.

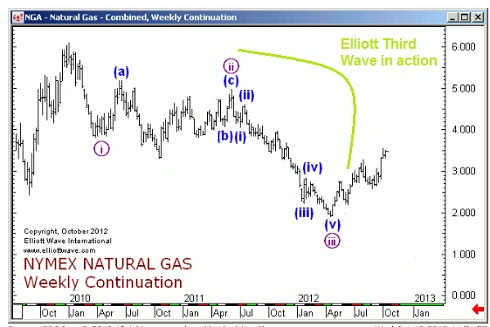

The 2nd chart moves ahead to current day. It shows exactly how prices followed their Elliott third wave script to a T -- as in a 60%, 16-month long TUMBLE.

Get on Board for the Ride in Wave Three with the Wave Principle Learn the Wave Principle with a free, 10-lesson comprehensive online course. The Elliott Wave Basic Tutorial describes each of the patterns and explains how they relate to one another. You'll learn the basic patterns, the rules and guidelines, wave personalities and the common Fibonacci relationships between waves. Plus, you'll learn when to expect Wave Three! |

This article was syndicated by Elliott Wave International and was originally published under the headline Third Waves are "Wonders to Behold". EWI is the world's largest market forecasting firm. Its staff of full-time analysts led by Chartered Market Technician Robert Prechter provides 24-hour-a-day market analysis to institutional and private investors around the world.

About the Publisher, Elliott Wave International

Founded in 1979 by Robert R. Prechter Jr., Elliott Wave International (EWI) is the world's largest market forecasting firm. Its staff of full-time analysts provides 24-hour-a-day market analysis to institutional and private investors around the world.

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.