Obama Four More Years, A Dangerous World Begins

Politics / US Politics Nov 10, 2012 - 11:31 AM GMTBy: John_Mauldin

There have been many competing analyses of the results of the election last Tuesday. I am still trying to absorb the longer-term implications. One of the more thought-provoking pieces I read was from my friends at GaveKal. Four of their writers give us their initial thoughts, and not surprisingly (for them!) they don’t agree. But the piece does give us a broader take on the ramifications. And I love the first line in the lead paragraph (different dreams, indeed):

There have been many competing analyses of the results of the election last Tuesday. I am still trying to absorb the longer-term implications. One of the more thought-provoking pieces I read was from my friends at GaveKal. Four of their writers give us their initial thoughts, and not surprisingly (for them!) they don’t agree. But the piece does give us a broader take on the ramifications. And I love the first line in the lead paragraph (different dreams, indeed):

The American electorate may share the same national bed, but they have vastly different dreams. In this report, our take on the election’s significance is similarly bifurcated. Anatole see it as a cathartic political cleansing allowing for a deal on the fiscal cliff, but Charles as a disaster. Arthur asks whether the Republican Party can win nationally without reconciling itself to America’s changed demographics and the realities of the new knowledge-intense economy. Will Denyer contends that an Obama win is probably bad for the dollar and gold – but he doubts that would have been different with Romney.

I write this afternoon from Buenos Aires, in between media interviews, having done my last speech. Soon, I’ll head to the airport and back to Dallas. Randomly, Grant Williams, who writes Things That Make You Go Hmmm, and his partner Stephen Diggle of Vulpes Management (based in Singapore) will be in Dallas tomorrow night, so I get to connect up. They are at the end of their own three-week road trip, and it will be good to compare notes.

I will be writing about my impressions of Argentina this week, as well as adding a few other observations. While I’m ready to be home for a few days, it has been a most interesting trip. It has made me think a lot about how to deal with governmental chaos, and perhaps more positively than you might imagine. I am now more Muddle Through than ever.

I encourage you to sign up for the free internet “summit” I’m organizing, along with my friends at Real Clear Politics. It’s called “The Post-Election Economy: A Clear-Eyed Analysis of the Risks and Opportunities for Investors.” I’ll be sharing the stage with Mohamed El-Erian, Barry Ritholtz, Richard Yamarone, Gary Schilling, Barry Habib, and James Bianco; and Lauren Lyster of RT America will be moderating. And as a very special part of the event, I will be doing a session with the chiefs of staff for both Senator Harry Reid (current Majority Leader) and Senator Rob Portman (one of the true GOP experts on the budget), discussing together the problems we face as a country.

This event will be a no-holds-barred discussion on where we can expect the economy and investment markets to go, post-election. And most importantly, you'll learn how the unfolding events will impact you and your money.

This 90-minute online video event is completely free to attend. You'll be able to watch directly from your home or office computer. All you have to do to register is visit http://www.PostElectionEconomy.com/?ppref=MEC011TF1112A

Cafayate was far more restful and restorative than I thought it would be. It is muy tranquilo and remarkably beautiful. The town has real character and energy to it, especially in the night life and restaurants ringing the square. The resort of La Estancia de Cafayate is world-class, by even the most discriminating tastes. I can see why so many people are buying property and building vacation homes or moving there as their primary residence. I can guarantee you that I will be trying to figure out how to get back there and stay longer next time.

Spending time with my partners in Mauldin Economics (David Galland and Olivier Garret) while we were there has me energized and excited about all the new things in our (your and my) journey together. Talking with Doug Casey and Terry Coxon and a host of their libertarian friends, thinking and debating about the implications of the elections, has gotten me excited and drifting off down all sorts of intellectual paths. And I did get to read some very stimulating books, which I will write about later.

Right now it’s time for some hard questions from Argentinean TV. The demonstration last night was rather large, and the frustration I felt from all those asking questions is still palpable. I guess 30% inflation can do that to you. Still, they seem to cope, and the restaurants were full late at night. The demonstration did not even start till nine. Quite peaceful, if noisy, with a million people banging away on their pots & pans; and families brought out their children to enjoy the chaos. Rather a surreal moment for your analyst. But a lot to think about.

Your trying to see a bigger big picture analyst,

John Mauldin, Editor

Outside the Box

JohnMauldin@2000wave.com

Four More Years

GaveKal

The American electorate may share the same national bed, but they have vastly different dreams. Our take on the election’s significance is similarly bifurcated—a cathartic political cleansing allowing for a deal on the fiscal cliff (Anatole) to disaster (Charles). Arthur asks whether the Republican Party can win nationally without reconciling itself to America’s changed demographics and the realities of the new knowledge-intense economy. Will contends that an Obama win is probably bad for the dollar and gold—but he doubts that would have been different with Romney.

Arthur: The Knowledge Economy Speaks

Despite the apocalyptic rhetoric coming out of some quarters, the US presidential election is unlikely to result in much of a change in national economic policy—and the same could have been said if Mitt Romney had been elected. Both Obama and Romney are pragmatic centrists whose differences are mainly stylistic. More important, any president’s room to maneuver is severely constrained by the hard facts of a federal deficit and debt at the limits of its sustainability, a divided Congress, and an electorate that has repeatedly made clear its strong desire for a bunch of goodies that it just as strongly refuses to pay for.

The president did not win an expanded mandate for social engineering or increased deficit spending. His share of the popular vote will be less than in 2008, and he lost a couple of big states —North Carolina and Indiana—that he carried last time. The popular verdict on his first term thus seems to be: no great shakes, but good enough.

The real lessons lie on the Republican side. The party nominated an energetic, obviously competent businessman who evinced a can-do ethic and performed superbly in debates. He ran against a stiff incumbent who presided over the worst election-eve economy of any sitting president since the ill-fated Jimmy Carter in 1980. Still he lost—narrowly in the popular vote, but decisively in the electoral college. And this result seemed foreordained months in advance: however close he got in the national popularity polls, Romney always faced daunting electoral arithmetic.

The key reason is that the Republican strategy of marrying the interests of high finance and big business with the social resentments of an increasingly white and male lower-class bloc has painted the party into a corner. It has conceded region after region and constituency after constituency by enslaving itself to shrill and intolerant voices. The Asian vote, the Latino vote, the women’s vote, all up for grabs a decade ago, have drifted inexorably Democratic. This is not because these voters have become more left-wing, but because they feel themselves increasingly disrespected by the Tea-Party inflected GOP.

It is now virtually impossible for a Republican presidential candidate to win anywhere in the Northeast, the upper Midwest, or the West coast. North Carolina, a state Obama won in 2008 and narrowly lost this time, will soon fall out of reach once the Research Triangle Park technologists outnumber the tobacco farmers, as inevitably they must.

In short, everywhere the knowledge economy is growing, Republican credibility is shrinking. This is astonishing given that in knowledge economy hubs like Silicon Valley, entrepreneurship is prized and libertarian values hold sway. As we have written time and again, the US economy is becoming ever more knowledge based. If the Republican Party is to stay relevant, and have a shot at electing a president in four years, it will need to give up its affection for faith-based resentment and engage with the changing economic and social reality of America.

Will Denyer: Romney Wouldn’t Have Helped The Dollar

Being a libertarian, I agree with Arthur that the practical differences between Obama and Romney are far too marginal. But markets are made on the margin; and with that in mind I look at the relative impact of this election on fiscal policy, monetary policy, and markets in the near term.

First and foremost, the key issue is how the “fiscal cliff” is resolved, and more specifically, how taxes are changed. This is because roughly three- quarters of the fiscal cliff’s first bite in 2013 comes from tax hikes.

The Obama victory is less bullish for equities. This is because Romney promised to take ALL of the tax bite out of the fiscal cliff, Obama did not. Much of the tax hit will still be softened under Obama, and markets will welcome this when it happens (this is why I say “less bullish” instead of “bearish”); but Obama still plans to let “the rich” take a hit. Rich people buy lots of assets (houses, equities, small businesses, etc.), and so taking more of their investible funds is not bullish for asset prices.

Some expect the Obama win to be bad for the dollar (and good for gold). But would Romney have been better? I doubt it, for two reasons: deficits and monetary policy.

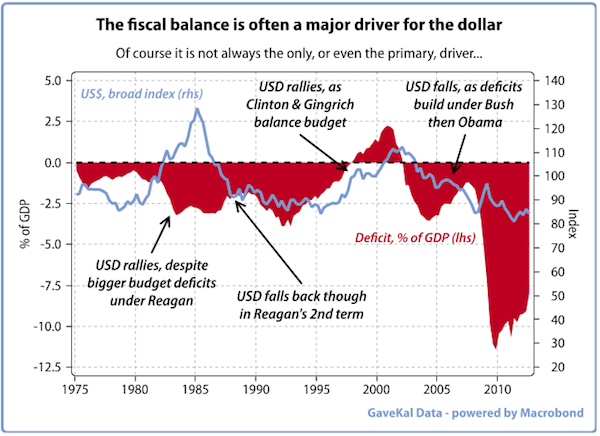

Ironically, deficits would have been even worse under Romney, at least initially. Romney promised to cut taxes and increase defense spending. Sound familiar? It would likely prove politically and economically impossible for Romney to counter these huge impacts, with cuts elsewhere or with roaring growth. So, on the fiscal front, a Romney win may have been even worse for the dollar. Indeed, since 1990, the USD has generally followed the direction of US fiscal balances (see chart previous page).

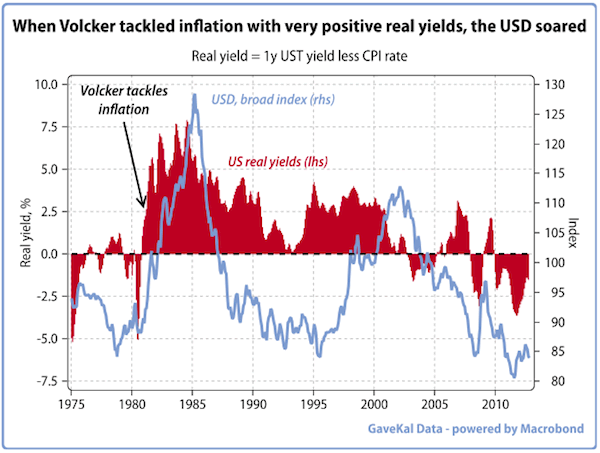

Of course, fiscal balances are not always the dominant driver. Take the 80s for example. While Reagan was racking up huge deficits in his first term, the dollar rallied. The primary reason was that as Volcker came in to fight inflation, a rise in real rates took over as the dominant driver.

Romney promised to replace the current Fed leadership in 2014, with someone who would be less trigger-happy with the printing presses. Perhaps the new Chairman would also return real rates at least to neutral levels. And thus, on the margin, a Romney win might seem bullish for the dollar (and bearish gold). But I have my doubts that Romney’s chosen chairman would act all that differently from Bernanke or Yellen, and I think it is very unlikely that the new chairman would hike real rates anywhere near as aggressively as Volcker did. Inflation measures today are not (at least not yet) nearly as high and demanding of a fight, and government debt levels are much higher, and would likely have gotten worse under Romney. Like Obama, Romney would not want to see the government’s interest costs rise.

Anatole: Political Uncertainty Ends

The main effect of the election will be the removal of political uncertainty that has dominated the US economy and financial markets for the past 12 months. This is more important than the modest differences between the candidates on fiscal and monetary policy or trade or regulation. As a result, investors will start to switch their attention away from headline political issues in favour of economic fundamentals, business strategies and corporate financial performance—and once this happens, they will notice that a distinct improvement has taken place.

Investors may dislike Ben Bernanke’s monetary policy, but they now know that it is unlikely to be reversed at least until 2014. The same certainty applies to healthcare reform. Instead of waiting for Obamacare to be clarified by the Congress or the Supreme Court, businesses will adapt to the new costs and regulations. They will get on with the hiring and investment decisions that make financial sense in this new regulatory environment – and if they refrain from hiring and investment, it will be for business reasons, not in political protest.

Most surprisingly, electoral clarity will transform political calculations in Washington and should facilitate a settlement over fiscal policy. Until November 6, the Republicans’ main objective was to make Obama unelectable—even if that meant blocking efforts to revive the US economy, threatening a Treasury default or pushing the economy over a fiscal cliff. That destructive motivation is now gone; the Republicans have much to lose if their obstruction threatens the jobs of voters or the business interests of corporate supporters.

Obama’s calculations are also transformed. Until this week, his main objective was to maximise his probability of re-election requiring him to motivate Democratic activists. Hence forth his goal will be to secure his legacy as the president who not only introduced universal healthcare and decapitated Al Qaeda, but also pulled the US economy out of its deepest economic crisis since the 1930s and assured the Treasury’s long-term solvency.

He knows that he can only secure this legacy and avoid lame-duck status by breaking the gridlock in Washington. These changing political calculations mean that a new willingness to compromise is virtually guaranteed on both sides of the US political divide. With the job market improving, the housing crisis largely over and the financial system returning to normal, President Obama and the Republican congressional leaders will quickly realise that they have to work together and compromise if they want to claim any credit for the US economic recovery that lies ahead.

Charles: A Dangerous World Begins

The sovereign (people) have spoken. The US electorate has made a sharp move to the left, following the lead of the president. Obama’s choice not to move to the center after the midterm election has been vindicated.

The results of the vote have not only to be acknowledged but also interpreted in economic and financial terms. The "sovereign" made a choice between two competing visions:

Reduce government, or

Increase taxes on the "wealthy"

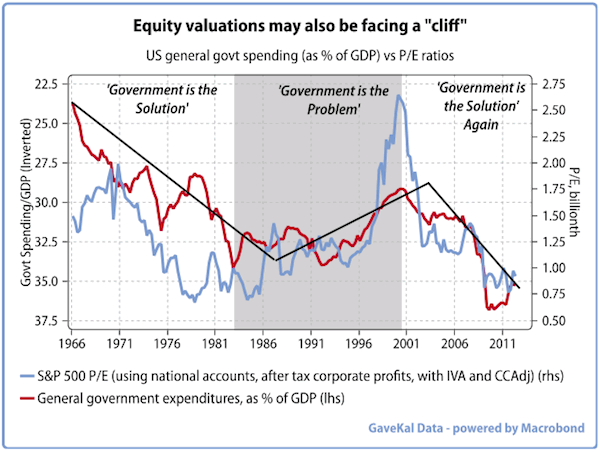

The choice is going to be to an increase in taxes. Obamacare will become the law of the land, adding greatly to the cost of labor. As I have tried to show in the past higher government spending and higher taxes lead always to lower growth and lower PE.

There is also no doubt the US monetary policy will remain under the control of Ben Bernanke, or those with similar biases, which implies a continuation of negative real rates with all the terribly bad side effects that they always bring (see A Measure Of Keynesianism). The combination of these budget and monetary policies should lead to a weaker dollar, slowing the wheels of global trade and raising the odds of another financial crisis erupting somewhere (if not everywhere). We are entering into a very dangerous world indeed.

John Mauldin, Editor

Outside the Box

JohnMauldin@2000wave.com

By John F. Mauldin

Outside the Box is a free weekly economic e-letter by best-selling author and renowned financial expert, John Mauldin. You can learn more and get your free subscription by visiting www.JohnMauldin.com.

Please write to johnmauldin@2000wave.com to inform us of any reproductions, including when and where copy will be reproduced. You must keep the letter intact, from introduction to disclaimers. If you would like to quote brief portions only, please reference www.JohnMauldin.com.

John Mauldin, Best-Selling author and recognized financial expert, is also editor of the free Thoughts From the Frontline that goes to over 1 million readers each week. For more information on John or his FREE weekly economic letter go to: http://www.frontlinethoughts.com/

To subscribe to John Mauldin's E-Letter please click here:http://www.frontlinethoughts.com/subscribe.asp

Copyright 2012 John Mauldin. All Rights Reserved

Note: John Mauldin is the President of Millennium Wave Advisors, LLC (MWA), which is an investment advisory firm registered with multiple states. John Mauldin is a registered representative of Millennium Wave Securities, LLC, (MWS), an FINRA registered broker-dealer. MWS is also a Commodity Pool Operator (CPO) and a Commodity Trading Advisor (CTA) registered with the CFTC, as well as an Introducing Broker (IB). Millennium Wave Investments is a dba of MWA LLC and MWS LLC. Millennium Wave Investments cooperates in the consulting on and marketing of private investment offerings with other independent firms such as Altegris Investments; Absolute Return Partners, LLP; Plexus Asset Management; Fynn Capital; and Nicola Wealth Management. Funds recommended by Mauldin may pay a portion of their fees to these independent firms, who will share 1/3 of those fees with MWS and thus with Mauldin. Any views expressed herein are provided for information purposes only and should not be construed in any way as an offer, an endorsement, or inducement to invest with any CTA, fund, or program mentioned here or elsewhere. Before seeking any advisor's services or making an investment in a fund, investors must read and examine thoroughly the respective disclosure document or offering memorandum. Since these firms and Mauldin receive fees from the funds they recommend/market, they only recommend/market products with which they have been able to negotiate fee arrangements.

Opinions expressed in these reports may change without prior notice. John Mauldin and/or the staffs at Millennium Wave Advisors, LLC and InvestorsInsight Publishing, Inc. ("InvestorsInsight") may or may not have investments in any funds cited above.

Disclaimer PAST RESULTS ARE NOT INDICATIVE OF FUTURE RESULTS. THERE IS RISK OF LOSS AS WELL AS THE OPPORTUNITY FOR GAIN WHEN INVESTING IN MANAGED FUNDS. WHEN CONSIDERING ALTERNATIVE INVESTMENTS, INCLUDING HEDGE FUNDS, YOU SHOULD CONSIDER VARIOUS RISKS INCLUDING THE FACT THAT SOME PRODUCTS: OFTEN ENGAGE IN LEVERAGING AND OTHER SPECULATIVE INVESTMENT PRACTICES THAT MAY INCREASE THE RISK OF INVESTMENT LOSS, CAN BE ILLIQUID, ARE NOT REQUIRED TO PROVIDE PERIODIC PRICING OR VALUATION INFORMATION TO INVESTORS, MAY INVOLVE COMPLEX TAX STRUCTURES AND DELAYS IN DISTRIBUTING IMPORTANT TAX INFORMATION, ARE NOT SUBJECT TO THE SAME REGULATORY REQUIREMENTS AS MUTUAL FUNDS, OFTEN CHARGE HIGH FEES, AND IN MANY CASES THE UNDERLYING INVESTMENTS ARE NOT TRANSPARENT AND ARE KNOWN ONLY TO THE INVESTMENT MANAGER.

John Mauldin Archive |

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.