Silver Price Set to Soar by 400% in 3 Years

Commodities / Gold and Silver 2012 Nov 13, 2012 - 07:25 AM GMTBy: GoldCore

Today’s AM fix was USD 1,724.75, EUR 1,360.86, and GBP 1,085.23 per ounce. Yesterday’s AM fix was USD 1,735.75, EUR 1,365.44, and GBP 1,091.39 per ounce.

Today’s AM fix was USD 1,724.75, EUR 1,360.86, and GBP 1,085.23 per ounce. Yesterday’s AM fix was USD 1,735.75, EUR 1,365.44, and GBP 1,091.39 per ounce.

Silver is trading at $32.63/oz, €25.76/oz and £20.61/oz. Platinum is trading at $1,591.00/oz, palladium at $614.50/oz and rhodium at $1,085/oz.

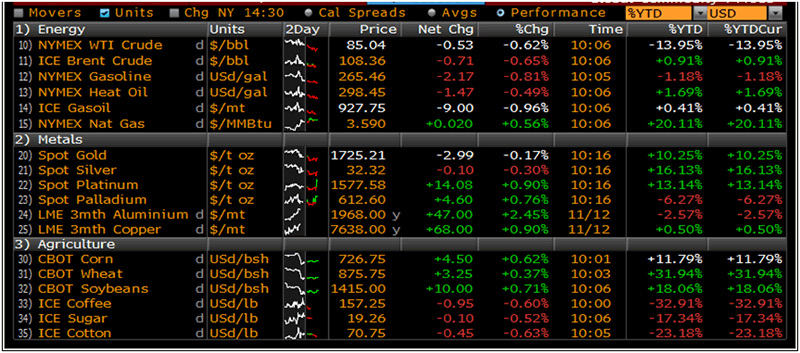

Global Commodity Prices & Data – (Bloomberg)

Gold fell $3.10 or 0.18% in New York yesterday and closed at $1,727.90. Silver slipped to a low of $32.186 and finished with a loss of 0.49%.

Gold edged down on Tuesday on low volumes when the euro dropped to a 2 month low against the US dollar despite confusion about a deeper bailout package for Greece has driven many investors to wait on the sidelines.

Eurozone finance ministers suggested that Athens should be given until 2022 to lower its debt to GDP ratio to 120% but IMF chief Christine Lagarde insisted the current target of 2020 should remain.

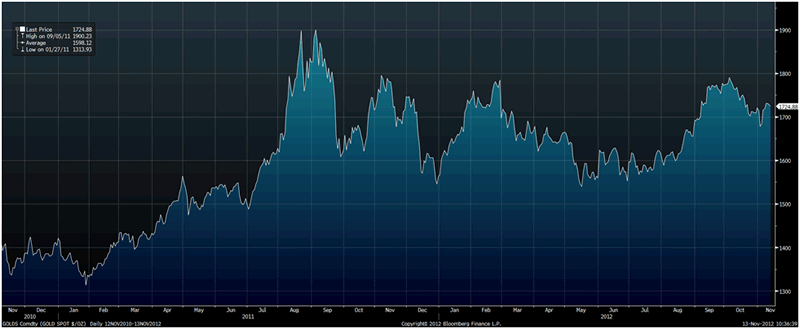

Gold’s rally in 3Q saw it hit just short of $1,800, down from the all time nominal record of $1,920 in 2011 when investors turned to the yellow metal as an inflation hedge and safe haven during the height of the European debt crisis.

Barrick Gold’s (the largest mining producer) CEO, Jamie Sokalsky, said prices may rise to $2,000 in 2013 as costs and barriers to production restrict supply, while demand from central banks and Chinese consumers keeps climbing.

New York’s SPDR Gold Trust, the largest ETF, dropped 0.07% on Friday from Thursday, while those of the largest silver-backed ETF, New York’s iShares Silver Trust rose 0.45% percent over the same period.

The Telegraph has an interesting article on silver which suggests that it might rise by over five times in the next few years.

Emma Wall interviews fund manager Ian Williams who says that "silver is about to enter a sustained bull market that will take the price from the current level of $32 an ounce to $165 an ounce and we expect this price to be hit at the end of October 2015."

"This forecast is based entirely using technical & cyclical analysis and is in keeping with the mathematical form displayed so far in the bull run that has taken silver from $8/oz in 2008 to its current price of $32 an ounce – having hit $50 an ounce in 2011."

Mr Williams noted that the silver price was more volatile than gold, but that he predicts silver to continue to dramatically outperform gold.

The Charteris manager said that macro fundamentals were supportive for the silver price, such as the re-election of President Obama, who supports Ben Bernanke's policy of quantitative easing.

Gold Spot $/oz, 2 Years – (Bloomberg)

"Strong demand for precious metals will remain as long as we have QE, which do well with each round of money printing. QE is bound to lead to inflation at some point and at that time, real assets will do best," he said.

"Investing in a fund that holds a range of precious metals gives you positive diversification and less reliance on just gold."

We have long been more bullish on silver than on gold and have said since 2003 that silver will likely reach its inflation adjusted high of $150/oz in the coming years. Indeed, we believe that the end of the precious metal bull markets may see the gold silver ratio return to its geological long term average of 15:1.

Therefore were gold to trade at over its inflation adjusted high of $2,500/oz (as we believe likely) then silver would be priced at $166.66/oz or $2,500/oz divided by 15.

We have also long suggested that owning both gold and silver was sensible from a diversification point of view. Gold is more of a safe haven asset and currency in general and is more of a hedge against macroeconomic and monetary risk.

Silver is similar, while more volatile, but continues to have the potential for far higher returns.

For the latest news and commentary on financial markets and gold please follow us on Twitter.

GOLDNOMICS - CASH OR GOLD BULLION?

'GoldNomics' can be viewed by clicking on the image above or on our YouTube channel:

www.youtube.com/goldcorelimited

This update can be found on the GoldCore blog here.

Yours sincerely,

Mark O'Byrne

Exective Director

IRL |

UK |

IRL +353 (0)1 632 5010 |

WINNERS MoneyMate and Investor Magazine Financial Analysts 2006

Disclaimer: The information in this document has been obtained from sources, which we believe to be reliable. We cannot guarantee its accuracy or completeness. It does not constitute a solicitation for the purchase or sale of any investment. Any person acting on the information contained in this document does so at their own risk. Recommendations in this document may not be suitable for all investors. Individual circumstances should be considered before a decision to invest is taken. Investors should note the following: Past experience is not necessarily a guide to future performance. The value of investments may fall or rise against investors' interests. Income levels from investments may fluctuate. Changes in exchange rates may have an adverse effect on the value of, or income from, investments denominated in foreign currencies. GoldCore Limited, trading as GoldCore is a Multi-Agency Intermediary regulated by the Irish Financial Regulator.

GoldCore is committed to complying with the requirements of the Data Protection Act. This means that in the provision of our services, appropriate personal information is processed and kept securely. It also means that we will never sell your details to a third party. The information you provide will remain confidential and may be used for the provision of related services. Such information may be disclosed in confidence to agents or service providers, regulatory bodies and group companies. You have the right to ask for a copy of certain information held by us in our records in return for payment of a small fee. You also have the right to require us to correct any inaccuracies in your information. The details you are being asked to supply may be used to provide you with information about other products and services either from GoldCore or other group companies or to provide services which any member of the group has arranged for you with a third party. If you do not wish to receive such contact, please write to the Marketing Manager GoldCore, 63 Fitzwilliam Square, Dublin 2 marking the envelope 'data protection'

GoldCore Archive |

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.