IMF Selling 400 Tonnes of Mexican and Brazilian Gold as its Own!

Commodities / Market Manipulation Feb 19, 2008 - 12:53 PM GMT There has been a lot of talk of late of potential sales of I.M.F. gold. The more we look at the subject, contrary to our previous view, the more likey it seems possible [not yet probable], but if it does happen, it will not happen again thereafter for solid reasons. If the sales do take place they will happen from September 2008 onwards.

There has been a lot of talk of late of potential sales of I.M.F. gold. The more we look at the subject, contrary to our previous view, the more likey it seems possible [not yet probable], but if it does happen, it will not happen again thereafter for solid reasons. If the sales do take place they will happen from September 2008 onwards.

It will still have to get past the U.S. Congress a most formidable and possibly insurmountable obstacle.

The first question that will be asked is just whose gold do they want to sell, after all the gold held by the I.M.F. belongs to each individual nation that contributed it, so how dare the administrative side of the I.M.F. propose selling its members gold and how dare some members of the I.M F. approve of the sale without getting the OK from other members?

The answer is quite simple. The I.M.F. does not believe that the gold they propose selling belongs to any member at all, but in fact, belongs to the I.M.F itself . Consequently, the only discussion surrounds the disposal of the I.M.F.'s own assets! How could the I.M.F. get its own gold?

The purchase of two members gold by the I.M.F.

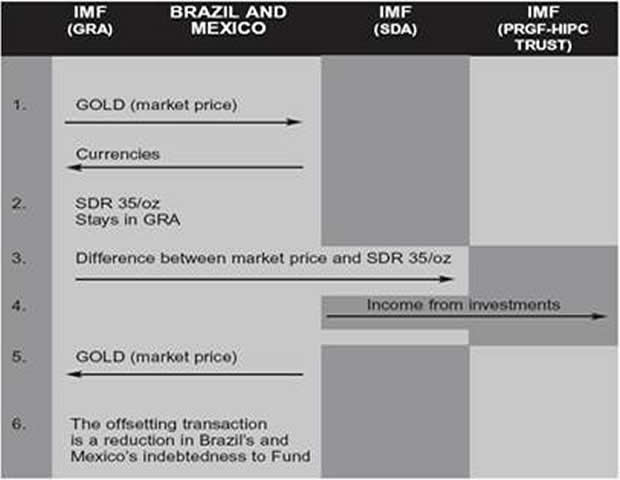

Between December 1999 and April 2000, separate but closely linked transactions involving a total of 400 tonnes [12.9 million ounces] of gold were carried out between the I.M.F. and two members (Brazil and Mexico) that had financial obligations falling due to the I.M.F.

But this was not a sale into the open market, but an "internal sale". In the first step, the I.M.F. sold gold to the members at the prevailing market price and the profits were placed in a special account and then invested for the benefit of the HIPC Initiative.

In the second step, the I.M.F. immediately accepted back, at the same market price, the same amount of gold from the member in settlement of that member's financial obligations falling due to the Fund. The net effect of these transactions was to leave the balance of the I.M.F.' holdings of physical gold unchanged. However, ownership of that gold moved from Brazil and Mexico to the I.M.F.

To emphasize the point and giving it relevance to the present proposals, this 400 tonnes of gold no longer belongs to Brazil or Mexico it now belongs to the I.M.F. itself!

This could change the attitude of the members of the I.M.F. as it has changed the attitude of the largest members, the G-7 countries, the Group of Seven rich nations [U.S. Japan, Germany, Britain, France, Italy and Canada] already.

This increases the chances of a sale this time, while not affecting any other member's gold. To give you a little more background on the I.M.F. so as to make sense of this, a brief look at the I.M.F. and its business will help.

The Business of the I.M.F.

The I.M.F. acquired all its holdings [gold and other] from member states through the original Articles of Agreement. [The Articles were amended in 1978, eliminating the direct use of gold in the exchange rate system].

Founded at the end of World War II with donations of cash and gold from its member nations, the I.M.F. works at "crisis prevention", monitoring and hoping to avoid policy mistakes that could lead to big financial problems. The I.M.F. also lends to countries facing balance of payments problems from its 'cash' of $338 billion. By charging interest on short-term loans, the I.M.F. earns its keep. The I.M.F. also makes loans to low-income countries implementing poverty reduction programs, currently helping 23 countries from Afghanistan to Sierra Leone.

Founded at the end of World War II with donations of cash and gold from its member nations, the I.M.F. works at "crisis prevention", monitoring and hoping to avoid policy mistakes that could lead to big financial problems. The I.M.F. also lends to countries facing balance of payments problems from its 'cash' of $338 billion. By charging interest on short-term loans, the I.M.F. earns its keep. The I.M.F. also makes loans to low-income countries implementing poverty reduction programs, currently helping 23 countries from Afghanistan to Sierra Leone.

Since the Argentine crisis of 2001, however [blamed on the I.M.F.'s advised policies] new I.M.F. lending, has shrunk dramatically as the world's emerging economies have developed remarkably.

In essence, the I.M.F. in the light of the changed global scene, should be downsizing considerably, in line with its reduced business, a principle that should govern all monetary institutions. This would enable it to match its costs to its reduced income. The fund is spending $1 billion a year but only bringing in $600 million! The I.M.F. is not an interest earning institution, there to maintain redundant economists. The thought of increasing income to an institution that can no longer justify its size should send alarm signals to its members. This was emphasized by a report submitted to the I.M.F. Executive Board, the Committee, headed by Bank of International Settlement head Sir Andrew Crockett, who concluded that the I.M.F.'s current income model, which relies heavily on the interest it earns from loans to member nations, is "no longer appropriate ." But there it is, they feel they should bail out the I.M.F. from its present mess.

Poor reasons for selling

The reason the G7 gave for approving these sales is: - "This is arguably a good time to consider selling some of these gold holdings and investing the proceeds in financial securities with positive yields."

It is amazing that such a statement is made by such qualified men, but they do have to promote paper instruments. That is their business. Of course, with gold having quadrupled in the last four or five years, no solid financial securities with positive yields has come anywhere near to matching this performance, nor is any likely to. Indeed the Credit crunch has confirmed just how risky alternative investments to gold can be.

It is amazing that such a statement is made by such qualified men, but they do have to promote paper instruments. That is their business. Of course, with gold having quadrupled in the last four or five years, no solid financial securities with positive yields has come anywhere near to matching this performance, nor is any likely to. Indeed the Credit crunch has confirmed just how risky alternative investments to gold can be.

The fund holds 3216.17 tonnes [103.4 million ounces] of gold worth some $92 billion at current market prices. But we are talking here about only the 400 tonnes of gold deemed to belong to the I.M.F. as an institution. [Thin ground, but that's why it is only this 400 tonnes]

We have produced fuller articles on the I.M.F. potential gold sales which are needed to properly understand the I.M.F. and its gold, in the current issues of the Gold Forecaster - Global Watch for subscribers.

"Is there good reason for the I.M.F. to sell this gold?

For the entire report, please visit www.GoldForecaster.com .

![]()

Please subscribe to: www.GoldForecaster.com for the entire report.

By Julian D. W. Phillips

Gold-Authentic Money

Copyright 2008 Authentic Money. All Rights Reserved.

Julian Phillips - was receiving his qualifications to join the London Stock Exchange. He was already deeply immersed in the currency turmoil engulfing world in 1970 and the Institutional Gold Markets, and writing for magazines such as "Accountancy" and the "International Currency Review" He still writes for the ICR.

What is Gold-Authentic Money all about ? Our business is GOLD! Whether it be trends, charts, reports or other factors that have bearing on the price of gold, our aim is to enable you to understand and profit from the Gold Market.

Disclaimer - This document is not and should not be construed as an offer to sell or the solicitation of an offer to purchase or subscribe for any investment. Gold-Authentic Money / Julian D. W. Phillips, have based this document on information obtained from sources it believes to be reliable but which it has not independently verified; Gold-Authentic Money / Julian D. W. Phillips make no guarantee, representation or warranty and accepts no responsibility or liability as to its accuracy or completeness. Expressions of opinion are those of Gold-Authentic Money / Julian D. W. Phillips only and are subject to change without notice.

Julian DW Phillips Archive |

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.