Italian Prosecutor Charges Fitch and S&P Employees With Culpable Incompetence

Interest-Rates / Credit Crisis 2012 Nov 14, 2012 - 03:51 AM GMTBy: Andrew_Butter

I noticed that the public prosecutor in some remote corner of Italy is attempting to get a clutch of hapless employees of S&P and Fitch charged with…well I‘m not quite sure what? Public disorder…incompetence…economic terrorism…driving whilst under the influence of America?

I noticed that the public prosecutor in some remote corner of Italy is attempting to get a clutch of hapless employees of S&P and Fitch charged with…well I‘m not quite sure what? Public disorder…incompetence…economic terrorism…driving whilst under the influence of America?

Apparently about a year ago they downgraded Italy, which caused a bit of a stir, particularly since they released the news when the markets were open and didn’t warn the Italian government they were going to do that. Fitch of course are denying all charges, they maintain that they have the right to be as incompetent as they like and if they want to stamp AAA on the rump of a collateralized debt obligation lovingly fabricated by God’s Workers, prior to being sold to pension funds run by dumb foreigners who don’t read English too good, then that is up to them, particularly if they make good fees doing that.

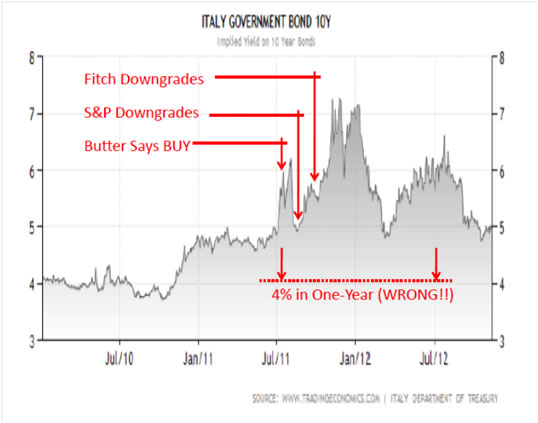

I took a view on the Italian 10-Year eighteen months ago when the yield hit 6%, I said “BUY”, as is illustrated by this chart; http://seekingalpha.com/article/283240-it-s-a-good-time-to-buy-italy-s-debt

OK, that’s not one of my best predictions (not the worst either, I got gold more wrong than that in the past). And well, if you bought at 6% then and held, you would still be in the money, although you might have had a few moments of nervousness on the way; but if you had sold a month later at 5% (well I’m not going to give the whole story away am I?)…and then gone back in again at 6% you would have double-dipped.

There again my prediction of a fall to 4% in a year was, let’s say, somewhat optimistic; although there was an element of winding up the doomsayers in that, how many times must a doomsayer say the world is going to end…before it ends? There again also, if those economic terrorists from S&P and Fitch had not stepped in and started manipulating the market and spreading fear and panic for their own evil-ends, my prediction might have worked out. Personally I think they should be dressed up in orange jump-suits and blindfolds and get sent to Guantanamo for some good-old-fashioned water-boarding.

I noticed in the reports that one of the hapless Fitch incompetents apparently put out a memo that said Italian debt is owed mainly by foreigners, as I said, and as one of the less incompetent analysts at Fitch pointed out to the more incompetent one; that is not true. I say again:

- Total Italian debt burden (private plus public) is 250% of GDP (compared with over 350% in USA). Granted the public debt is 120% of GDP, but over 50% of that is owed to Italians living in Italy; hardly a flight-risk.

- Net external liabilities are 15% of GDP compared with more than 100% for Portugal and Greece.

- The country makes things, it has tourism and it has opera, and food and football, and guys who live with their mom until they get married; until recently its trade deficit was negligible (goods + services). Right now that’s about 2% of GDP mainly due to having to buy oil on the spot market to replace oil traditionally supplied by Libya. By comparison, USA’s trade deficit is about 3.5% of GDP (last four quarters).

There was never any doubt that the Europeans would figure out a way to get around the rules so they could do a TALF (not a TARP), just like I predicted Mein Liebste Angela bless her heart would do in September 2011, http://www.marketoracle.co.uk/Article30719.html

So I guess the world hasn’t quite come to an end and no one is using wheelbarrows or the electronic equivalent to buy groceries, just yet. Well fancy that? Of course the world could end tomorrow, now that’s something to look forward to.

With regard to the charges, the prosecutor says he has a strong case, and indeed it’s easy to see how a charge of incompetence by rating agencies, could fly. But is incompetence a crime?

Now that’s an interesting one, imagine the defense of the 9/11 mastermind. ”Well your honor I just told them to fly around and cause fear and panic, the fact they flew into a building is just because they were incompetent, how can you say that’s my fault?”

By Andrew Butter

Twenty years doing market analysis and valuations for investors in the Middle East, USA, and Europe. Ex-Toxic-Asset assembly-line worker; lives in Dubai.

© 2012 Copyright Andrew Butter- All Rights Reserved

Disclaimer: The above is a matter of opinion provided for general information purposes only and is not intended as investment advice. Information and analysis above are derived from sources and utilising methods believed to be reliable, but we cannot accept responsibility for any losses you may incur as a result of this analysis. Individuals should consult with their personal financial advisors.

Andrew Butter Archive |

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.