U.S. Fiscal Cliff, Asian Currency Wars, Buoys the Gold market

Commodities / Gold and Silver 2012 Nov 15, 2012 - 12:58 PM GMTBy: Gary_Dorsch

Texas Republican Ron Paul’s maverick crusade to “audit the Fed”, and to rein-in the “fourth branch” of the US-government, suffered a major blow in the wake of the November 6th elections that saw President Barack Obama prevailing over his Republican challenger Mitt Romney. Adding insult to injury, the Republican Party not only failed to secure a majority in the Senate, but it lost 2-seats. Mr Paul is the author of a bill to audit the clandestine activities of the Fed that passed the House by a 327-98 vote on July 25th, exceeding the two-thirds majority needed. Astoundingly, 89 Democrats joined 238 Republicans to approve it.

Texas Republican Ron Paul’s maverick crusade to “audit the Fed”, and to rein-in the “fourth branch” of the US-government, suffered a major blow in the wake of the November 6th elections that saw President Barack Obama prevailing over his Republican challenger Mitt Romney. Adding insult to injury, the Republican Party not only failed to secure a majority in the Senate, but it lost 2-seats. Mr Paul is the author of a bill to audit the clandestine activities of the Fed that passed the House by a 327-98 vote on July 25th, exceeding the two-thirds majority needed. Astoundingly, 89 Democrats joined 238 Republicans to approve it.

Many Republicans and some Democrats have criticized the Fed’s heavy handed activities in the marketplace, such as its multi-trillion dollar bailouts of the Wall Street banking Oligarchs, its massive monetization of the US-Treasury’s debt, through its radical “Quantitative Easing” (QE) scheme, and its basement of the purchasing power of the US-dollar. “The Fed has more power over the economy than anyone else in the country. Yet they are virtually unaccountable and the American people have very little idea what goes on behind closed doors at the Fed. The Fed operates in almost complete secrecy, and the whole idea that they can deal in trillions of dollars and that nobody is allowed to ask them a question is a moral hazard,” Mr Paul says. Dennis Kucinich, a Ohio Democrat agrees, “It’s time that we stood up to the Federal Reserve that right now acts like some kind of high, exalted priesthood, unaccountable to democracy.”

Commenting on the Nov 6th election results, Mr Paul lamented that the US-economy has already veered over the “Fiscal Cliff,” and that the nation is being transformed into a European style socialist welfare state. Mr Paul sees no chance of righting the ship in a country where too many people are already dependent upon $1-trillion of welfare assistance provided by states and the federal government. “We’re so far gone. We’re already over the cliff. We cannot get enough people in Congress in the next 5-to-10-years who will do wise things.”

Mr. Paul, who is retiring after 12-terms in the House, said “The people in the Midwest voted against Romney: ‘Oh, they have to be taken care of!’ So that vote was sort of like laughing at Greece. People do not want anything cut. They want all the bailouts to come. They want the Fed to keep printing the money. And they don’t believe that we’ve gone off the cliff or are close to going off the cliff. They think we can patch it over, that we can somehow come up with some magic solution. But you can’t have a budgetary solution if you don’t change what the role of government should be. As long as you think we have to police the world and run this welfare state, all we are going to argue about is who will get the loot,” Paul added.

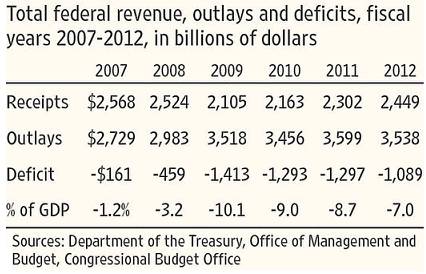

During Mr Obama’s first term in office, US-federal spending jumped +18% to a record $3.52-trillion and spending has remained constant since then. There’s never been a serious effort to cutback on expenditures. As a result, the US-government has run deficits totaling $5.1-trillion over the past four years. There’s never been a string of budget deficits that even remotely approaches these staggering amounts; the last year of George W. Bush’s tenure, the previous record budget deficit was $459-billion. In order to finance these budget deficits, the White House has mostly relied upon the Federal Reserve and foreign central banks, to buy the lion’s share of the newly auctioned Treasury debt, and to a lesser extent, risk adverse investors fleeing the stock markets and Euro-zone bond markets, have been avid buyers.

Scaling the Fiscal Cliff - Now that the Nov 6th election is over, the vast majority of the US-public is learning for the first time about a dirty little secret, - it’s called the “Fiscal Cliff,” and it refers to a wicked combination of $500-billion of tax increases and $110-billion of spending cuts that will take effect next year, unless the Republicans in the House and the Obama White House can agree on ways to turn the cliff into the “Fiscal Hill.” Both political parties recognize the need to pare down the size of future budget deficits, in order to maintain the solvency of the country over the longer-term. There is no way to avoid the fiscal cliff, and if a recession ensues next year, both sides want to be able to win the public relations war, by pinning the blame for the fallout on the other political party.

The basic Republican framework for tackling the fiscal cliff calls for a reduction in spending on entitlements and capping social welfare programs. The fiscal cliff also provides tax reformers with a golden opportunity to overhaul the tax code, - by eliminating many of the deductions and credits, that reduce tax payments from individuals and corporations by about $1-trillion per year. Republican leaders are willing to eliminate many loopholes that disproportionately benefit the higher-income earners and scale back deductions for the business sector that earned $1.5-trillion in after-tax profits in the past 12-months. “In a good-faith effort to make progress on boosting the economy and government’s long-term solvency, Republicans like me are open to new revenue in exchange for meaningful reforms to the entitlement programs,” said Senate Minority Leader Mitch McConnell (R-Ky.) on Nov 13th.

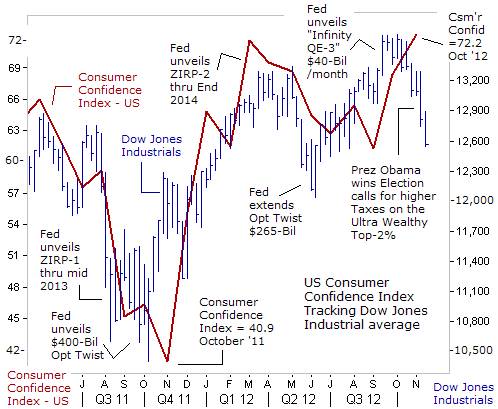

The War on the Ultra-Wealthy - Mr Obama owes a big debt of gratitude to Fed chief Ben Bernanke, who helped to engineer his re-election, by masterminding a improbable +3,000-point rally in the Dow Jones Industrials from the Oct 4th, 2011 low of 10,500, to above 13,500 in Sept ’12. The rally helped to boost US-consumer confidence, and lifted Obama’s approval rating with a sizeable segment of the voting population. However, now that Obama has been re-elected to a second term, his emphasis is already shifting 180-degrees, - from boosting the fortunes of the Ultra-wealthy, - that’s heavily tied-up in the artificially inflated - stock market, - to waging war on the Ultra-wealthy, by aiming to hike their tax rates on dividends, capital gains, and ordinary income. Such a move is expected to raise about $80-billion in extra revenues for the US Treasury, according to some estimates.

Mr Obama will begin talks on the Fiscal Cliff with a proposal to raise $1.6-trillion in new tax revenue, with 80% of the tax increases paid by high-income earners, and 20% from Corporate America. That means the top-1% would pay $121,000 more in taxes each year. The top 20% of income earners would pay an average $14,000 more each year. That’s important, because the top-1% of the wealthiest Americans own 38% of the stocks traded on the NYSE and Nasdaq. The next 9% tier of wealthy investors control 44% of the total shares. Jacking up taxes on capital gains and dividends and eliminating tax loopholes for Corporate America has spooked the top-10% richest investors, into dumping their stocks before year end.

“When it comes to the top-2%, what I am not going to do is extend further a tax cut for folks who don’t need it which would cost close to a $1-trillion. The math does not work, in some proposals to raise taxes on the wealthy by just closing tax loopholes,” Obama said on Nov 14th. Obama said he is “very eager” to reform the tax code, (ie eliminate many of the tax loopholes for Corporate America), and said entitlements like Medicare and Social Security need a “serious look as part of a deficit deal.” While there is no sympathy for the Ultra-wealthy, the broader US-economy would be at risk of a renewed downturn, because tackling the fiscal cliff would require some degree of “fiscal austerity,” just like in recession ravaged Europe.

At the end of the day, no matter what amount of austerity is agreed upon, the US-federal government is still expected to run a budget deficit of $700-billion or more. In order to finance the shortfall, traders can expect the Obama White House to call upon the political puppets that sit at the Federal Reserve, to create hundreds of billions of electronically printed US-dollars through its Infinity QE-3 program. That message has already been transmitted to the Fed. At the Fed’s October meeting, a number of Fed officials spoke about the need to step-up Treasury bond purchases next year. Fed deputy Janet Yellen said that the federal funds rate could stay locked near zero-percent until early 2016 in order to help keep the US-Treasury’s financing costs as low as possible. Through the Fed’s totalitarian control of credit, - financing the US Treasury can be done cheaply in spite of the mushrooming of the national debt, - until an inflection point is reached, where hyper-inflation begins to take-off.

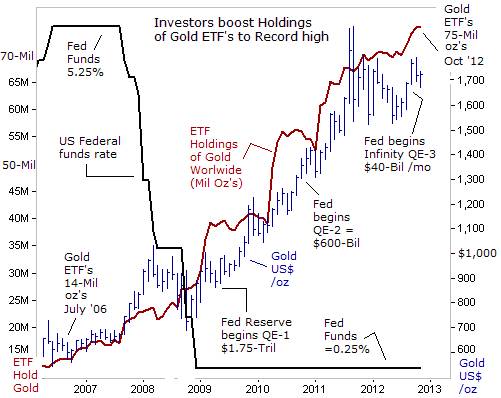

The Fed slashed the overnight federal funds rate to near zero-percent in December 2008 and has pumped $2.3-trillion of freshly printed dollars into the money markets. In turn, investors seeking a safe haven from the debasement of paper money, turned to Gold, - bidding-up the price of the yellow metal from $700 /oz four years ago, to above $1,700 /oz today. The price of Silver nearly quadrupled from $9 /oz to above $32 /oz today. Gold Bugs and Silver Bulls alike can breathe a big sigh of relief, knowing that Bernanke will have his fingers on the printing press in the year ahead. Since Sept 13th, the Fed has begun printing $40-billion per month, an open-ended scheme, with no pre-determined timeline. Mrs Yellen, an addicted money printer, advocates a “highly accommodative policy,” even “if inflation overshoots the Fed’s 2% inflation target objective for several years,” she said.

Many investors have turned to exchange traded funds (ETF’s), listed on the stock exchanges which issue securities backed by physical holdings of Gold. Demand for these funds has increased five-fold since July 2006. Collectively, they hold 75-million ounces in the vaults, - that’s up from 14-million ounces in July of 2006. Gold is a highly liquid vehicle that can preserve an investor’s purchasing power over the longer-term. In fact, the central banks that are the world’s most notorious money printers were net buyers of 252-tons of Gold in the first half of 2012, after purchasing 456-tons in the year before.

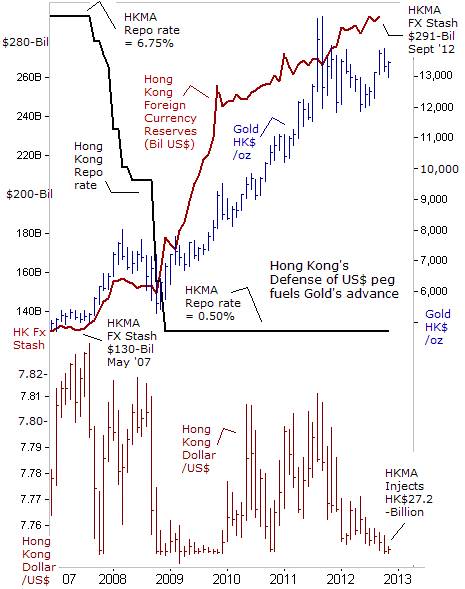

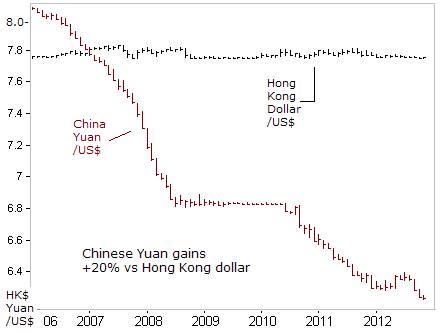

Defending the HK$ per against the US-dollar, Given the vast amount of US Treasury debt that will be monetized by the Fed in the years ahead, - many currency traders have already begun to shift capital into the Hong Kong dollar, - acting as a temporary safe haven currency. Holding Hong Kong dollars also makes sense, since it will inevitably merge with the strenghtening Chinese yuan. To assist in the development of the Chinese capital markets, the authorities in Beijing have already established a new currency - the Chinese dollar in Hong Kong that can be used by foreigners to buy and sell equities and bonds in Shanghai.

The Hong Kong Monetary Authority (HKMA) pegs its currency at HK$7.8 to the US-dollar, but allows it to trade between a band of HK$7.75 to HK$7.85. Under the arrangement, the HKMA is mandated to step in when the Hong Kong dollar hits 7.75 or 7.85 to keep the band intact. On Nov 2nd, the HKMA stepped into the currency market for the 10th time in less than a month by selling HK$5-billion ($650-million) as the local currency briefly slipped below the lower end of its trading range with the US-dollar. According to inflow figures from EPRF Global, which tracks nearly 45,000 funds managing more than $17.5 trillion in total assets, roughly $600 million flowed into HK-listed funds tracking Chinese equities during the final week of October.

Equity prices reacted quickly to the inflows. The benchmark Hang Seng Index was up more than +5% over the past month and +14% since the last week of September. The Fed’s Infinity QE-3 scheme has raised fears in Hong Kong because it can draw huge amount of funds from overseas to Hong Kong, and create asset bubbles. In 2008 and 2009, more than HK$640 billion flowed into Hong Kong in search of a safe haven, which helped double property prices. The Hong Kong property market is buoyant despite an Oct 26th decision to impose a 15% buyers’ stamp duty on non-locals.

For now, the Hong Kong-US currency peg is safe. It is much easier for the HKMA to defend the US-dollar by simply printing more HK$’s to buy US dollars. Hong Kong’s Exchange Fund, which is used to defend the US-dollar peg, stands at HK$2.65-trillion ($340-billion). In its latest moves, HKMA said it injected HK$27.2-billion into the foreign exchange market since October 20th to purchase US$3.5-billion. Such intervention is likely to show-up in Hong Kong’s foreign currency reserves, which hit a record $291-billion in September.

The HKMA’s foreign currency stash has been climbing on an upward trajectory for the past five-years, and in turn, the massive injections of HK$ liquidity has doubled the price of Gold to above HK$13,000 today. The money-printing and currency intervention used to defend the US-dollar peg, has caused such a big build-up of liquidity, that the overnight Hong Kong Interbank Offered Rate stood at just 0.06 percent. Such ultra-low low interest rate levels encourage borrowing and threaten to further inflate asset bubbles.

There are more than 100 underground banks operating in Hong Kong that have been increasing their positions in the Chinese yuan since September. Overall, the growth of yuan deposits stood at 546-billion yuan at the end of September, with traders betting on a further strengthening of the yuan compared to the Hong Kong dollar. The Hong Kong Stock Exchange rolled out the first yuan futures contract in September. These activities will keep the HKMA very busy, requiring further injections of liquidity, and helping to buoy the price of Gold.

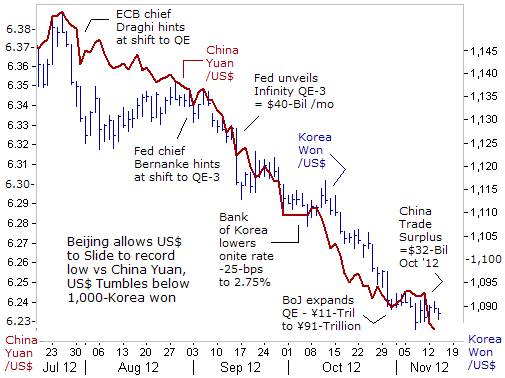

“Currency Wars” is a term used by central bankers of several Emerging countries that must take measures to either slow or stop the appreciation their currencies against the US-dollar, in order to maintain the competitiveness of their exporters. Worldwide, Emerging central bank holdings of foreign currency reserves, mostly acquired through intervention, have increased +50% over the past four years to $10.5-trillion. The Bank of Korea’s (BoK) foreign currency reserve has increased +60% compared with 4-years ago to a record $321-billion in October. Tracking the upward trajectory of Korea’s FX stash, the price of Gold has more than doubled to just below 2-million won /oz today.

So far this year, the US$ has lost -6% versus the Korean won, skidding below the psychological 1,100-Korean won level, a 13-month low. That threatens to reduce the profits of Korea’s exporters. South Korea is Asia’s fourth-largest economy, but its tiger economy slowed to a standstill in the third quarter, due to depressed demand from abroad for its exports. Korea exported $47.2-billion of goods in October, just +1% higher than a year earlier. Traders are closely watching to see if Korea’s ministry of finance authorizes intervention in the currency market, after the US$ slipped below 1,100-won. Seoul could also decide to tighten existing curbs on capital inflows. Besides the liquidity injections by the big-4 central banks in Europe, Japan, and the Fed, that’s depressing the US’s value, traders are also utilizing the South Korean won, as a surrogate for investing in the Chinese yuan.

On Nov 7th, the US-dollar fell to a record low versus the Chinese yuan. In the offshore yuan market in Hong Kong, where the yuan floats freely, the US$ was offered at CNY6.2265, marking its weakest level since Beijing unhinged its currency in 1994. The US-dollar fell to record lows versus the yuan, following news that China netted a trade surplus of $32-billion in October, up from $27.7-billion in September. Beijing is allowing the yuan to inch higher in a gesture to appease the US Treasury Department ahead of its semi-annual report on exchange rate policies that addresses China’s manipulation of its currency. However, Korea’s won has gained +3% versus the Chinese yuan since late July, making Korea’s goods less affordable in the Middle Kingdom. That could soon prompted further liquidity injections by the Bank of Korea in the days or weeks ahead, and helping to support the price of Gold in Seoul.

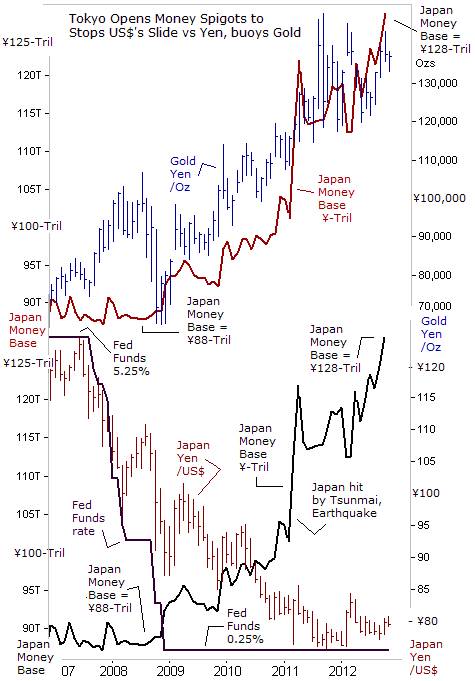

Tokyo boosts its Intervention Pipeline, The Bank of Japan (BoJ) has unveiled its latest effort to prevent the US$ from falling against the Japanese yen - adding ¥11-trillion ($138-billion) of liquidity to its intervention arsenal, after it warned that its economy has fallen into another recession. The BoJ is acting in response to the Fed’s “Infinity QE-3” scheme. The BoJ’s bond buying bazooka now totals a staggering ¥91-trillion ($1.1-trillion).

Japan posted its worst trade figures in more than 30-years, as a territorial dispute with China and a super strong yen hit exports. Japan’s exports plunged -10.3% in September from a year earlier, weighed down by Europe’s deepening recession and a surge in antagonisms with China that have damaged close economic ties. For the first nine months of this year, Japan’s trade deficit widened to ¥4.73 trillion ($60.6 billion). On Nov 12th, BoJ chief Masaaki Shirakawa said the central bank will continue to pursue nuclear QE - taking into account the risk that a stronger yen hurts Japan’s economy.

So far, “the BoJ’s powerful monetary easing has had limited effect in stemming the yen’s strength,” Shirakawa said on Nov 12th. He warned there is no clear relationship between increasing the size of Japan’s high powered money supply (monetary base), and the yen’s exchange-rate moves, countering views held by some lawmakers that the BoJ could weaken the yen by pumping vast quantities of liquidity into the Tokyo money market. Still, Japanese companies have been badly hurt by the worsening Euro-zone economy, and the side effects of a super strong yen exchange rate against the Euro and the US-dollar. In the July-to-September quarter, the net income earned by 191-companies listed in the Nikkei-225 index, plunged by -31% on average compared with a year ago..

Shinzo Abe, the chief of Japan’s Liberal Democratic Party (LDP) and frontrunner in next month’s election, wants the Bank of Japan to lower short-term interest rates below zero-percent in order to weaken the yen. Signs that the LDP will step up efforts to weaken the yen if it comes to power lifted the US$ to ¥81.24 today, its highest since April 27th. Abe, a vocal critic of the BoJ, has called for setting a +3% inflation target, three times the current 1% target, and for the bank to inject “unlimited liquidity” until the inflation target is hit, while cutting the BoJ’s 0.1% policy rate to zero or below

Already, Japan’s monetary base has been increased to ¥128-trillion, up from ¥88-trillion four years ago, but the easing hasn’t been able to overcome the powerful effects of the Fed’s own Zero Interest Rate Policy, (ZIRP) and QE-scheme. The BoJ has been able to manage a dirty float, - pegging the US’s value within a very narrow range between ¥81 and its historic low of ¥76. The US Treasury has given its approval for the yen’s dirty float, because Tokyo recycles the US-dollars it acquires through intervention, into US Treasury notes, thereby helping the Fed to finance the US-budget deficit at artificially low interest rates. Japan has boosted its holding of US Treasury notes by $207-billion since August 2011. Still, the biggest winner from this backdoor QE arrangement between the Japanese ministry of finance and the US Treasury, - is the price of Gold in Tokyo has doubled from four years ago to ¥140,000 /oz today.

Under the new QE target set on October 31st, the BoJ would have to pump ¥31-trillion more into the banking system via asset purchases and market operations by the end of next year. That would add to the BoJ’s already increasing presence in the local bond market. However, Japanese banks have parked a record ¥44.2-trillion ($566-billion) of excess cash with the BoJ. It suggests that the money the central bank is pumping into the banking system is piling up in its own reserve account instead of being funneled to broader sectors of the economy, casting doubt on what more the central bank can do to stimulate growth.

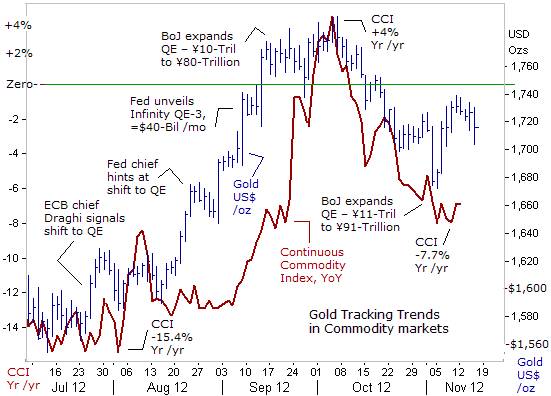

The continuation of the “Currency Wars” is expected to extend into 2014, leading to a further expansion of the world’s supply of paper currency – and providing a favorable backdrop for the precious metals markets, especially Gold and Silver. Ultra-low interest rates are another supporting factor. Still, it’s not a straight line upward for Gold. There are pullbacks along the way, sometimes triggered by slumping commodity prices, which react negatively to signs of economic downturns in the Asian, European, US and other global economies.

In the Euro-zone, factory output plunged -2.5% in September, its steepest fall since January 2009. Germany’s industrial output, - the engine of the Euro-zone economy, fell -2.1% in September, showing it’s no longer immune to the deepening recession. Industrial output also fell -2.7% in France and -1.5% in Italy. Japan’s economy contracted at an annualized -3.5% in the three months through September, and will probably shrink further in the fourth quarter. The US-economy could stumble into a mild recession, as it’s forced to adopt some measure of austerity, all of which can exert selling pressure in the commodities markets. Gold and Silver would be rattled at times, however, ----

“You have to choose between trusting the natural stability of Gold and the honesty and intelligence of members of the government. With due respect for these gentlemen, I advise you, as long as the capitalist system lasts, to vote for Gold,” - George Bernard Shaw, 1928.

This article is just the Tip of the Iceberg of what’s available in the Global Money Trends newsletter. Subscribe to the Global Money Trends newsletter, for insightful analysis and predictions of (1) top stock markets around the world, (2) Commodities such as crude oil, copper, gold, silver, and grains, (3) Foreign currencies (4) Libor interest rates and global bond markets (5) Central banker "Jawboning" and Intervention techniques that move markets.

By Gary Dorsch,

Editor, Global Money Trends newsletter

http://www.sirchartsalot.com

GMT filters important news and information into (1) bullet-point, easy to understand analysis, (2) featuring "Inter-Market Technical Analysis" that visually displays the dynamic inter-relationships between foreign currencies, commodities, interest rates and the stock markets from a dozen key countries around the world. Also included are (3) charts of key economic statistics of foreign countries that move markets.

Subscribers can also listen to bi-weekly Audio Broadcasts, with the latest news on global markets, and view our updated model portfolio 2008. To order a subscription to Global Money Trends, click on the hyperlink below, http://www.sirchartsalot.com/newsletters.php or call toll free to order, Sunday thru Thursday, 8 am to 9 pm EST, and on Friday 8 am to 5 pm, at 866-553-1007. Outside the call 561-367-1007.

Mr Dorsch worked on the trading floor of the Chicago Mercantile Exchange for nine years as the chief Financial Futures Analyst for three clearing firms, Oppenheimer Rouse Futures Inc, GH Miller and Company, and a commodity fund at the LNS Financial Group.

As a transactional broker for Charles Schwab's Global Investment Services department, Mr Dorsch handled thousands of customer trades in 45 stock exchanges around the world, including Australia, Canada, Japan, Hong Kong, the Euro zone, London, Toronto, South Africa, Mexico, and New Zealand, and Canadian oil trusts, ADR's and Exchange Traded Funds.

He wrote a weekly newsletter from 2000 thru September 2005 called, "Foreign Currency Trends" for Charles Schwab's Global Investment department, featuring inter-market technical analysis, to understand the dynamic inter-relationships between the foreign exchange, global bond and stock markets, and key industrial commodities.

Copyright © 2005-2012 SirChartsAlot, Inc. All rights reserved.

Disclaimer: SirChartsAlot.com's analysis and insights are based upon data gathered by it from various sources believed to be reliable, complete and accurate. However, no guarantee is made by SirChartsAlot.com as to the reliability, completeness and accuracy of the data so analyzed. SirChartsAlot.com is in the business of gathering information, analyzing it and disseminating the analysis for informational and educational purposes only. SirChartsAlot.com attempts to analyze trends, not make recommendations. All statements and expressions are the opinion of SirChartsAlot.com and are not meant to be investment advice or solicitation or recommendation to establish market positions. Our opinions are subject to change without notice. SirChartsAlot.com strongly advises readers to conduct thorough research relevant to decisions and verify facts from various independent sources.

Gary Dorsch Archive |

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.