New U.S. Sanctions To End "Turkey's Game Of Gold For Natural Gas"

Commodities / Gold and Silver 2012 Nov 28, 2012 - 07:44 AM GMTBy: GoldCore

Today’s AM fix was USD 1,741.00, EUR 1,347.00, and GBP 1,087.38 per ounce.

Today’s AM fix was USD 1,741.00, EUR 1,347.00, and GBP 1,087.38 per ounce.

Yesterday’s AM fix was USD 1,747.25, EUR 1,349.54, and GBP 1,090.46 per ounce.

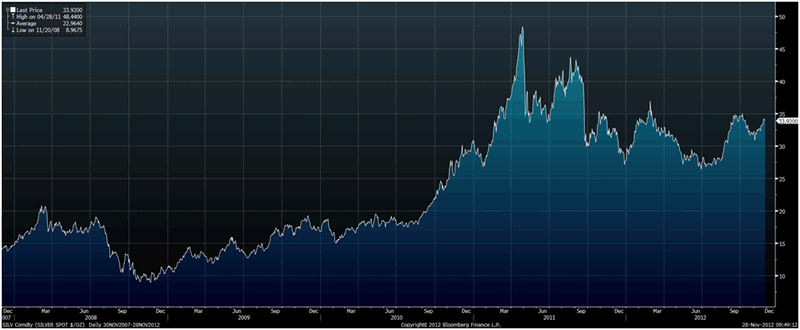

Silver is trading at $33.80/oz, €26.32/oz and £21.23/oz. Platinum is trading at $1,605.00/oz, palladium at $652.25/oz and rhodium at $1,065/oz.

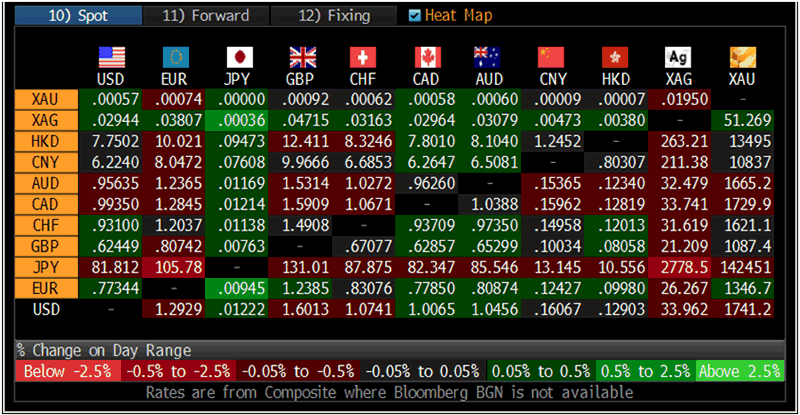

Cross Currency Table – (Bloomberg)

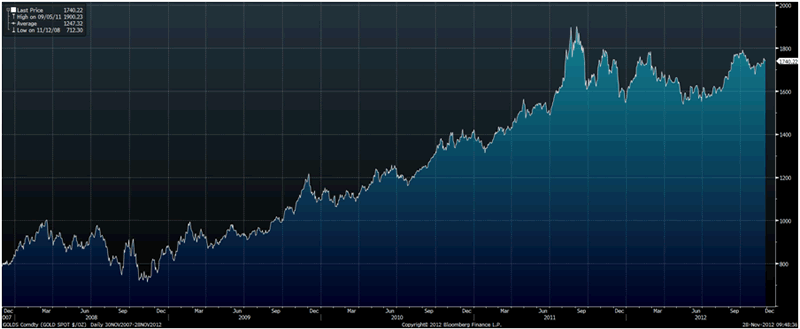

Gold and silver appear to be consolidating after their recent gains. Gold fell $7.10 or 0.41% in New York yesterday and closed at $1,741.30. Silver slipped to a low of $33.92 and finished with a loss of 0.23%.

Gold remains unchanged on Wednesday and is likely being supported by the realisation that the Greek bailout deal may not be the success it was hailed to be, and also the time is running out for negotiations on the US fiscal cliff.

Gold Spot $/oz, 2007-2012 – (Bloomberg)

Gold prices will rise in 2013 Citi has said and gold remains one of their favoured commodities.

Despite some investors turning less bullish on gold, Citi continues to be bullish on gold in 2013. President Obama's victory was expected to be positive for gold since it would benefit from "a continuation of dovish monetary policy". Gold prices have also been supported by central bank gold purchases. Moreover muted gold demand in India is expected to have picked up during Diwali.

Silver Spot $/oz, 2007-2012 – (Bloomberg)

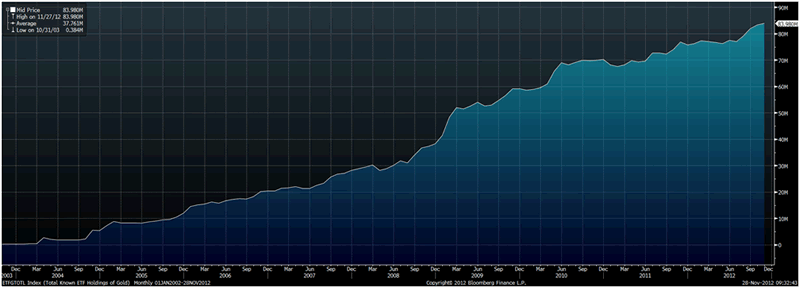

The yellow metal’s appeal is still strong as evidenced by recent investments by Soros, Paulson and other respected hedge fund managers. This buying and buying by other institutions such as PIMCO has led to continuing growth in holdings of the SPDR Gold Trust, the world's largest gold-backed ETF, which hit a record high of 1,345.813 tonnes on November 27th.

Global gold ETP holdings have climbed to a record for an eighth straight session showing robust demand for gold. The amount in exchange-traded products backed by the metal rose 0.2% to 2,612.1 metric tons, data tracked by Bloomberg showed.

Total Known ETF Holdings of Gold, 2002-2012 – (Bloomberg)

In its weekly note on technicals, Commerzbank said gold is supported by a short-term uptrend at $1,735. "We will retain our bullish view while the current November low at $1,672.50 underpins," it said in its note picked up by Thomson Reuters.

"Support above this level can be seen at $1,739.09/$1,737.17 (9 November high and late September low) as well as around the mid-November $1,705.66 low and around the minor psychological $1,700 mark. Only if unexpectedly fallen through, would our short term bullish view be neutralised."

Currency wars are set to intensify as the US Senate is considering new sanctions against Iran that would prevent Iran getting paid for its natural resource exports in gold bullion.

The new sanctions aimed at reducing global trade with Iran in the energy, shipping and precious metals sectors may soon be considered by the U.S. Senate as part of an annual defense policy bill, senators and aides said on Tuesday, according to Reuters.

The sanctions would end "Turkey's game of gold for natural gas," Reuters reported a senior Senate aide as saying, referring to reports that Turkey has been paying for natural gas with gold due to sanctions rules.

The legislation "would bring economic sanctions on Iran near de facto trade embargo levels with the hope of speeding up the date by which Iran's economy will collapse," the aide said.

Last week Turkish Deputy Prime Minister Ali Babacan has revealed a critical detail about a widely discussed Turkey-Iran gold trade boom, disclosing that the Islamic republic was exporting gas to Turkey in exchange for payment in gold bullion.

It is also reported that Iranians are buying Turkish gold with the Turkish Lira, which is deposited into their bank accounts in exchange for Turkey’s natural gas purchases, the deputy prime minister said at midnight Nov. 22 during a parliamentary session.

Iran cannot transfer monetary payments to Iran in U.S. dollars due to U.S sanctions against the country’s alleged nuclear weapons program.

Iran has been forced to shun the international financial system and the petrodollar as means of payment and turn to the international gold market to ensure it gets paid for its natural resources in order to prevent absolute economic collapse.

The law of unintended consequences may apply here and should the Iranian currency and economy collapse there is likely to be a war with Israel and turbulence in the Middle East akin to, if not worse, than that seen in the 1970’s.

For the latest news and commentary on financial markets and gold please follow us on Twitter.

GOLDNOMICS - CASH OR GOLD BULLION?

'GoldNomics' can be viewed by clicking on the image above or on our YouTube channel:

www.youtube.com/goldcorelimited

This update can be found on the GoldCore blog here.

Yours sincerely,

Mark O'Byrne

Exective Director

IRL |

UK |

IRL +353 (0)1 632 5010 |

WINNERS MoneyMate and Investor Magazine Financial Analysts 2006

Disclaimer: The information in this document has been obtained from sources, which we believe to be reliable. We cannot guarantee its accuracy or completeness. It does not constitute a solicitation for the purchase or sale of any investment. Any person acting on the information contained in this document does so at their own risk. Recommendations in this document may not be suitable for all investors. Individual circumstances should be considered before a decision to invest is taken. Investors should note the following: Past experience is not necessarily a guide to future performance. The value of investments may fall or rise against investors' interests. Income levels from investments may fluctuate. Changes in exchange rates may have an adverse effect on the value of, or income from, investments denominated in foreign currencies. GoldCore Limited, trading as GoldCore is a Multi-Agency Intermediary regulated by the Irish Financial Regulator.

GoldCore is committed to complying with the requirements of the Data Protection Act. This means that in the provision of our services, appropriate personal information is processed and kept securely. It also means that we will never sell your details to a third party. The information you provide will remain confidential and may be used for the provision of related services. Such information may be disclosed in confidence to agents or service providers, regulatory bodies and group companies. You have the right to ask for a copy of certain information held by us in our records in return for payment of a small fee. You also have the right to require us to correct any inaccuracies in your information. The details you are being asked to supply may be used to provide you with information about other products and services either from GoldCore or other group companies or to provide services which any member of the group has arranged for you with a third party. If you do not wish to receive such contact, please write to the Marketing Manager GoldCore, 63 Fitzwilliam Square, Dublin 2 marking the envelope 'data protection'

GoldCore Archive |

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.