U.S. Eagle Gold Coins Strongest Since 1999

Commodities / Gold and Silver 2012 Dec 03, 2012 - 06:05 AM GMTBy: GoldCore

Today’s AM fix was USD 1,718.00, EUR 1,317.59, and GBP 1,069.67 per ounce.

Today’s AM fix was USD 1,718.00, EUR 1,317.59, and GBP 1,069.67 per ounce.

Friday’s AM fix was USD 1,728.25, EUR 1,329.53, and GBP 1,077.87 per ounce.

Silver is trading at $33.49/oz, €25.80/oz and £20.94/oz. Platinum is trading at $1,599.50/oz, palladium at $676.50/oz and rhodium at $1,055/oz.

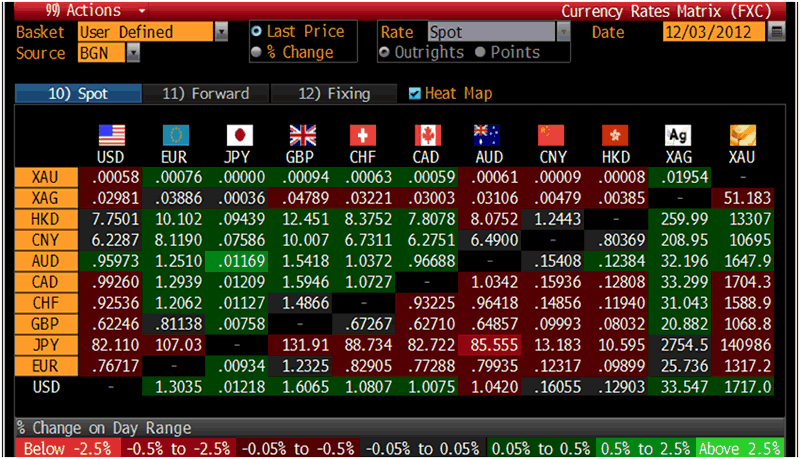

Cross Currency Table- (Bloomberg)

Gold fell $12.40 or 0.72% in New York on Friday and closed at $1,713.20/oz. Silver slid to a low of $33.15 and finished with a loss of 2.43%. Gold was down 1.94% for the week and silver was also off 1.97%.

Gold is marginally higher today, after finishing its 2nd monthly decline in a row, despite safe haven demand due to US ‘fiscal cliff’ and currency debasement concerns.

Interest in the yellow metal as diversification remains robust. Yesterday, holdings in exchange-traded products backed by gold climbed to a record for the 10th straight session, reaching 2,619.4 metric tons, the latest data compiled by Bloomberg show.

Late Friday from Frankfurt, Moody’s downgraded the euro zone’s bailout funds from the top rating of Aaa to Aa1 on long-term debt. The rating cut includes the European Stability Mechanism (ESM), the currency zone’s brand new permanent rescue fund, and the temporary European Financial Stability Facility (EFSF) were given continued negative rating outlooks by Moody’s.

The Luxembourg-based funds issued a statement noting that Moody’s decision “follows the recent change of France’s long term rating from Aaa to Aa1.”

The continuing financial mess that is the Eurozone will support gold and gold prices in euros above €1,300/oz.

China’s PMI increased to a seven month high in November offering tentative signs that their economy is recovering.

U.S. economic highlights on Monday are Construction Spending and the ISM Index. Wednesday follows with ADP Employment, Productivity, Factory Orders, and ISM Services. The Initial Jobless Claims are published on Thursday. Friday’s highlights are the November’s jobs data, Michigan Sentiment, and Consumer Credit.

GOLDS Commodity Daily, 2 Years – (Bloomberg)

November sales of U.S. American Eagle gold coins are on track to be the best in 14 years as uncertainty surrounding the U.S. fiscal cliff and the election of President Obama led to safe haven buying.

Buyers timing the market also increased coin sales by buying during sharp price movements that occurred in the beginning and end of November, coin dealers noted.

Bullion dealers in the U.S. report an influx of high net worth individuals that are buying gold coins in volume and taking physical possession of their bullion.

Month to date 131,000 ounces of American Eagles sold, that tripled last year's November sales and is the strongest November since 1998, data from the U.S. Mint's website shows.

In October, the U.S. Mint sold 59,000 vs 50,000 ounces the previous year, while November marked its 2nd successive monthly rise.

Coin banks have come in to buy the stock as the mint usually ends 2012 coin production in early December so it can begin minting the 2013 coins.

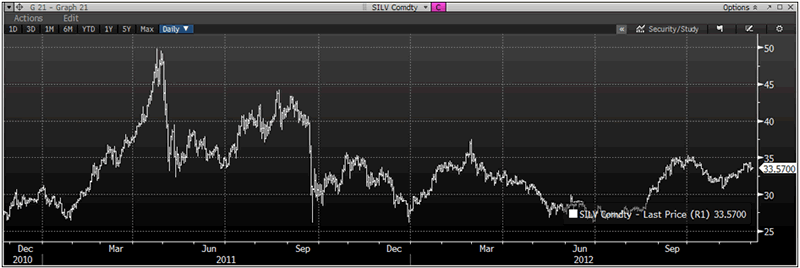

SILV Daily 2 Years, (Bloomberg)

American Eagle silver coin sales more than doubled in November going from 1.384 million to 3.135 million ounces. Silver coin sales were just shy of October's figure of 3.153 million ounces.

Coin sales have not only been boosted by dealers and collectors but by the uncertainty of the U.S. presidential election and the US fiscal cliff as investors have turned to them as a safe haven to protect their wealth.

American Eagle gold coin sales are very seasonal with a bulk of investment seen at the start of the year for the newly minted coins. Sales usually fall off in the summer and then increase in September in sync with the Indian wedding season and also following the lunar New Year, between January and February.

For the latest news and commentary on financial markets and gold please follow us on Twitter.

GOLDNOMICS - CASH OR GOLD BULLION?

'GoldNomics' can be viewed by clicking on the image above or on our YouTube channel:

www.youtube.com/goldcorelimited

This update can be found on the GoldCore blog here.

Yours sincerely,

Mark O'Byrne

Exective Director

IRL |

UK |

IRL +353 (0)1 632 5010 |

WINNERS MoneyMate and Investor Magazine Financial Analysts 2006

Disclaimer: The information in this document has been obtained from sources, which we believe to be reliable. We cannot guarantee its accuracy or completeness. It does not constitute a solicitation for the purchase or sale of any investment. Any person acting on the information contained in this document does so at their own risk. Recommendations in this document may not be suitable for all investors. Individual circumstances should be considered before a decision to invest is taken. Investors should note the following: Past experience is not necessarily a guide to future performance. The value of investments may fall or rise against investors' interests. Income levels from investments may fluctuate. Changes in exchange rates may have an adverse effect on the value of, or income from, investments denominated in foreign currencies. GoldCore Limited, trading as GoldCore is a Multi-Agency Intermediary regulated by the Irish Financial Regulator.

GoldCore is committed to complying with the requirements of the Data Protection Act. This means that in the provision of our services, appropriate personal information is processed and kept securely. It also means that we will never sell your details to a third party. The information you provide will remain confidential and may be used for the provision of related services. Such information may be disclosed in confidence to agents or service providers, regulatory bodies and group companies. You have the right to ask for a copy of certain information held by us in our records in return for payment of a small fee. You also have the right to require us to correct any inaccuracies in your information. The details you are being asked to supply may be used to provide you with information about other products and services either from GoldCore or other group companies or to provide services which any member of the group has arranged for you with a third party. If you do not wish to receive such contact, please write to the Marketing Manager GoldCore, 63 Fitzwilliam Square, Dublin 2 marking the envelope 'data protection'

GoldCore Archive |

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.