Gold Set to Return to Run of Records in 2013

Commodities / Gold and Silver 2013 Dec 06, 2012 - 10:59 AM GMTBy: GoldCore

Today’s AM fix was USD 1,693.00, EUR 1,295.14, and GBP 1,050.77 per ounce.

Today’s AM fix was USD 1,693.00, EUR 1,295.14, and GBP 1,050.77 per ounce.

Yesterday’s AM fix was USD 1,703.00, EUR 1,300.79, and GBP 1,057.90 per ounce.

Silver is trading at $32.73/oz, €25.15/oz and £20.40/oz. Platinum is trading at $1,586.00/oz, palladium at $680.00/oz and rhodium at $1,045/oz.

Gold fell $3.10 or 0.18% in New York yesterday and closed at $1,693.60/oz. Silver climbed to $33.24 then slid to $32.51, but finished after an afternoon rally with a loss of 0.33%.

Gold inched down on Thursday, near the monthly low reached in the prior session under pressure from a stronger greenback as players await the European Central Bank rate decision at 1245 GMT and US Initial Jobless Claims at 1330 GMT.

Physical buying of gold bullion has increased on the dip, particularly in Asia, and many are seeing these levels as a floor for prices.

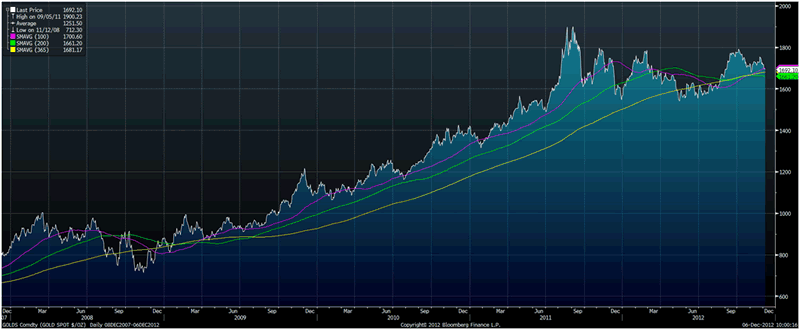

The massive consolidation seen in the last 16 months means that gold and silver are now right on their long term moving averages (See charts showing 100, 200 and 365 daily moving averages)

Gold will revisit its record breaking form of the past four years in 2013 after gains were tempered this year by reduced jewelry demand.

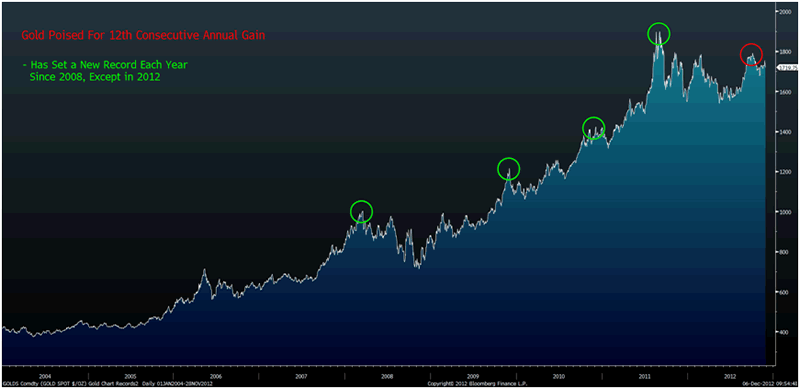

Bloomberg Chart of the Day – Gold Poised For 12th Consecutive Gain

Bloomberg's 'CHART OF THE DAY' shows gold climbed to records every year since 2008 until this year, with the all-time high still the $1,921.15 an ounce set in September 2011.

Gold has consolidated on previous years gains this year and has risen another 8.2% so far in 2012.

Gold bullion will average a record $1,925 in the fourth quarter next year, the median of 16 analyst estimates compiled by Bloomberg last month show. This would be a return of 13% in 2013.

The Federal Reserve said Oct. 24 it will maintain $40 billion in monthly purchases of mortgage debt and probably hold interest rates near zero until mid-2015.

Gold rose 70% as the Fed bought $2.3 trillion of debt in two rounds of monetary easing from December 2008 through June 2011. The Bank of Japan and the European Central Bank have pledged more action and China has approved a $158 billion subways-to-roads construction plan.

European peoples struggle while their governments rack up huge debts and then force unbearable austerity measures on them, as they continue to cheapen the value of the single currency’s purchasing power. With little to no extra cash to spend consumers can’t organically put extra money in their struggling economies.

In nearly the 4th year of the European debt crisis, it doesn’t take a rocket scientist to figure out that the current policies are not working. People are beginning to look at gold and silver as safer stores of value than paper and electronic currencies.

Gold Spot $/oz, 2007-2012 – (Bloomberg)

Gold bullion is becoming many central banks safe haven again and it will again become the public’s safe haven of choice in the coming years.

Investors, hedge funds and institutions boosted assets in gold-backed exchange-traded products to a record this year, holding more than the official reserves of every nation except the U.S. and Germany. Investors held a record 2,627 metric tons in gold ETPs on December 4, data compiled by Bloomberg show.

Gold jewelry demand slumped 9.8% in the first nine months this year, World Gold Council data show.

Importantly, gold has yet to exceed previous records when adjusted for inflation, with its 1980 peak of $850 equal to $2,398 today, data compiled by the Federal Reserve Bank of Minneapolis show.

This puts gold rise in price in recent years in context.

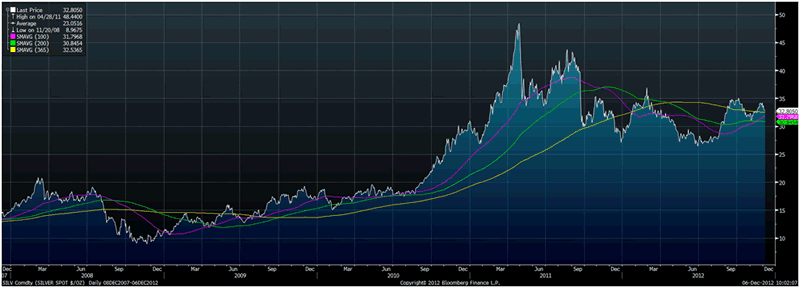

Silver To Outperform Gold In 2013 – Morgan Stanley

Gold and silver remain Morgan Stanley’s ‘top picks’ for 2013. Morgan Stanley maintains its long standing recommendation to be overweight precious metals, analysts including Peter Richardson write in a report according to Bloomberg.

Morgan Stanley said the yellow metal may average $1,853/oz in 2013 – for a return of 9.5%.

Silver Spot $/oz, 2007-2012 – (Bloomberg)

Gold investment demand will remain strong against weaker USD, low real interest rates, central bank buying, enhanced geopolitical uncertainty.

Silver more volatile but cheaper safe-haven play than gold; expect silver to outperform gold in 2013.

For the latest news and commentary on financial markets and gold please follow us on Twitter.

GOLDNOMICS - CASH OR GOLD BULLION?

'GoldNomics' can be viewed by clicking on the image above or on our YouTube channel:

www.youtube.com/goldcorelimited

This update can be found on the GoldCore blog here.

Yours sincerely,

Mark O'Byrne

Exective Director

IRL |

UK |

IRL +353 (0)1 632 5010 |

WINNERS MoneyMate and Investor Magazine Financial Analysts 2006

Disclaimer: The information in this document has been obtained from sources, which we believe to be reliable. We cannot guarantee its accuracy or completeness. It does not constitute a solicitation for the purchase or sale of any investment. Any person acting on the information contained in this document does so at their own risk. Recommendations in this document may not be suitable for all investors. Individual circumstances should be considered before a decision to invest is taken. Investors should note the following: Past experience is not necessarily a guide to future performance. The value of investments may fall or rise against investors' interests. Income levels from investments may fluctuate. Changes in exchange rates may have an adverse effect on the value of, or income from, investments denominated in foreign currencies. GoldCore Limited, trading as GoldCore is a Multi-Agency Intermediary regulated by the Irish Financial Regulator.

GoldCore is committed to complying with the requirements of the Data Protection Act. This means that in the provision of our services, appropriate personal information is processed and kept securely. It also means that we will never sell your details to a third party. The information you provide will remain confidential and may be used for the provision of related services. Such information may be disclosed in confidence to agents or service providers, regulatory bodies and group companies. You have the right to ask for a copy of certain information held by us in our records in return for payment of a small fee. You also have the right to require us to correct any inaccuracies in your information. The details you are being asked to supply may be used to provide you with information about other products and services either from GoldCore or other group companies or to provide services which any member of the group has arranged for you with a third party. If you do not wish to receive such contact, please write to the Marketing Manager GoldCore, 63 Fitzwilliam Square, Dublin 2 marking the envelope 'data protection'

GoldCore Archive |

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.