Can Gold Keep Its Luster in 2013?

Commodities / Gold and Silver 2013 Dec 07, 2012 - 03:01 AM GMTBy: Clif_Droke

Gold took a double hit recently based partly on a news item from the rumor mill that a large fund in Asia was selling to "run the stops."

Gold took a double hit recently based partly on a news item from the rumor mill that a large fund in Asia was selling to "run the stops."

"The sale looks like a carefully crafted trade prepped and successfully executed by a well known $14b US fund," according to one source. "Prior to the sale there had been an unusually large purchase of gold 'puts' - a leveraged options play that profits from a downward spike in prices. There had also been some early selling on the overnight electronic platform presumably to test the waters before the big guns fired a devastating salvo."

The short sell at the opening bell last week had the desired effect on prices, as the $1,730 level was breached where it triggered stops. The reason behind the trade is a matter of speculation with no clear motive. One source believed the selling was a bet that the U.S. "fiscal cliff" will be averted and that both sides of the Congressional isle will be able to reconcile their differences long enough to meet the upcoming deadline for the expiration of the Bush tax cuts.

This brings up another question concerning the 2013 outlook for gold. Pundits believe that if the fiscal cliff is averted and the U.S. economy picks up steam in the coming months that it could put downside pressure on the yellow metal.

Many analysts have also called into question whether the 17% year-over-year compounded rise in the gold price over the past decade can be sustained going forward. Perhaps not, but as Sharps Pixley points out, "Some bulls now seem to see single digit growth as a bear market." The point here being that even a single digit gold price increase in 2013 would still be preferable to an outright bear market and is still an attainable gold.

Analysts' median forecast for the 2013 year-end gold price has risen from $1,832 as of September to $1,850 currently. Commerzbank expects gold to reach $2,000/oz next year, citing supporting factors such as additional central banks buying due to ultra-loose monetary policy or addition to reserves, more active Indian buyers, continued low real interest rates, a rebound in Chinese growth rate. Deficits in the gold supply are also expected to continue into 2013.

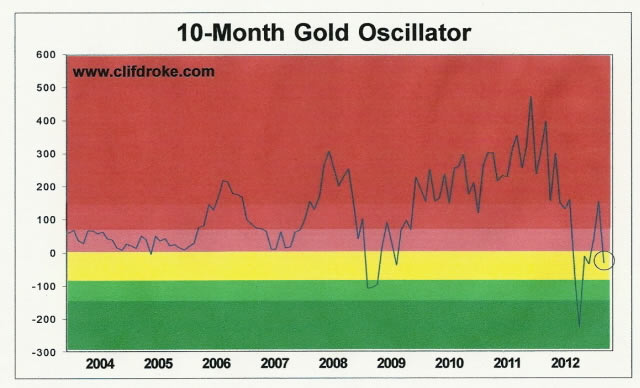

From a technical perspective, the 10-month gold price oscillator showed some improvement in early December from last month, falling back from the "overbought" red zone shown in the following graph to a neutral reading in the yellow zone. That should help gold to stabilize a bit in the coming days and weeks as the metal tries to establish support and chew its way through the supply overhang created by recent selling.

It should be noted that despite the recent sell-off, gold is currently showing a net gain for the year-to-date (as of Dec. 4). The iShares Gold Trust (IAU), our proxy for gold, is above its opening level from the start of 2012 as you can see here. But it's also below its 30-day moving average, and this important trend line also has a downward slope. It's also below the 60-day MA. This signifies that the interim trend is still sketchy and the buyers haven't regained control of the market yet. The best trading signals - the ones that signal a sustainable rally has begun - are when the gold ETF is above the rising 30-day and 60-day moving averages.

U.S. Economy

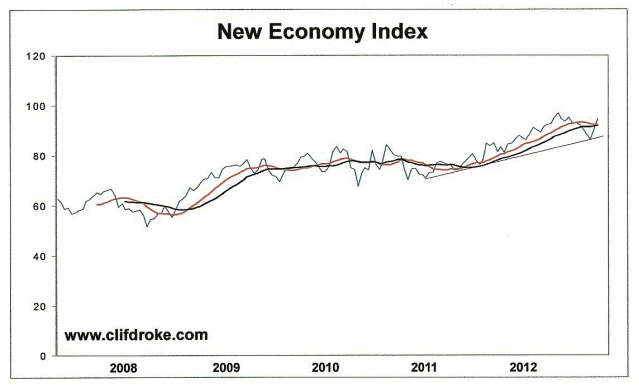

A few weeks ago our New Economy Index (NEI) was looking dicey. I even speculated that by December we might even see a "sell" signal in the NEI - the first one since 2010. But as the latest NEI update shows the U.S. retail economy is still managing to maintain its intermediate-term rising trend and shows no sign of breaking down.

As you can see, the index remains above its rising 12-week and 20-week moving averages as well as staying above the interim uptrend line (see below). That means that the outlook for U.S. retail sales in the near term future is still positive, and it practically guarantees a fairly strong holiday sales trend for December. So it looks like Santa is coming to the rescue this year once again for retailers.

2014: America's Date With Destiny

Take a journey into the future with me as we discover what the future may unfold in the fateful period leading up to - and following - the 120-year cycle bottom in late 2014.

Picking up where I left off in my previous work, The Stock Market Cycles, I expand on the Kress cycle narrative and explain how the 120-year Mega cycle influences the market, the economy and other aspects of American life and culture. My latest book, 2014: America's Date With Destiny, examines the most vital issues facing America and the global economy in the 2-3 years ahead.

The new book explains that the credit crisis of 2008 was merely the prelude in an intensifying global credit storm. If the basis for my prediction continue true to form - namely the long-term Kress cycles - the worst part of the crisis lies ahead in the years 2013-2014. The book is now available for sale at: http://www.clifdroke.com/books/destiny.html

Order today to receive your autographed copy and a FREE 1-month trial subscription to the Gold & Silver Stock Report newsletter. Published twice each week, the newsletter uses the method described in this book for making profitable trades among the actively traded gold mining shares.

By Clif Droke

www.clifdroke.com

Clif Droke is the editor of the daily Gold & Silver Stock Report. Published daily since 2002, the report provides forecasts and analysis of the leading gold, silver, uranium and energy stocks from a short-term technical standpoint. He is also the author of numerous books, including 'How to Read Chart Patterns for Greater Profits.' For more information visit www.clifdroke.com

Clif Droke Archive |

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.