Stock Market Dam is Ready to Burst

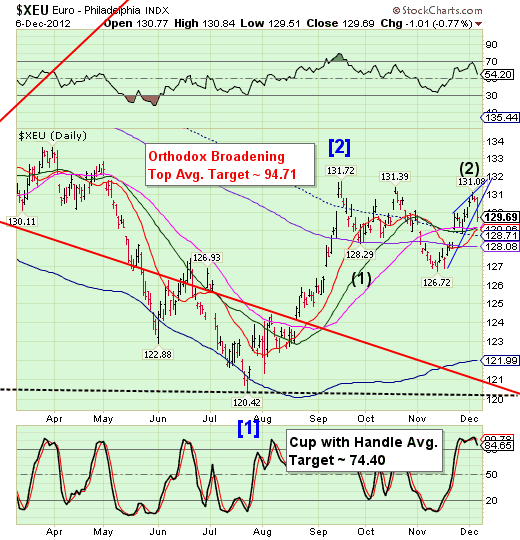

Stock-Markets / Stock Markets 2012 Dec 07, 2012 - 04:50 AM GMT We finally caught the break we have been waiting for in the Euro. It broke its Bearish Wedge today, leaving no doubt of its destination. This is the first major “crack in the dam.” With the Euro uptrend broken, the rest of the markets will follow. Those who are long will be like the people living beneath the dam burst. They won’t even have time to make for higher ground.

We finally caught the break we have been waiting for in the Euro. It broke its Bearish Wedge today, leaving no doubt of its destination. This is the first major “crack in the dam.” With the Euro uptrend broken, the rest of the markets will follow. Those who are long will be like the people living beneath the dam burst. They won’t even have time to make for higher ground.

There are several subscribers who are becoming impatient that nothing has yet happened. To them I simply say, “Stay on higher ground.” Please review the details from Edwards & Magee’s Technical Analysis of the Markets on the Orthodox Broadening Top. It is a very deceptive formation.

Here is an hourly view of what has transpired in the SPX so far. There is a less-than-50-50 chance that the SPX could be edged up higher (to 1418.91, the 50-day moving average) in the opening hour tomorrow. But neither the action so far nor the potential of a slightly higher open tomorrow changes the bearish outlook. This is the final and most dangerous stage of the Orthodox Broadening Top formation, equivalent to the dam burst mentioned earlier. Too many people will be looking for an exit and the doors will be blocked (due to a lack of buyers).

It would pay to read today’s ZeroHedge article on record margin debt. In addition, Net Free Credit has plunged -$44 billion in October. Investors are already invested beyond their capabilities to handle a downturn.

In summary, investors are swimming in debt and banks are becoming very concerned about extending credit any further.

Yesterday’s record sell-off in AAPL for no apparent reason should give one pause. Some of my Wall Street contacts have suggested that the Fed may have even stepped in today to prevent a rout in the market due to the AAPL sell-off, since Margin Calls would start on Friday. Whether the rumor is true or not, this is no place to “buy the dip.” NDX has been stopped at its 50-day moving average, its 50% retracement and its Broadening Wedge (slightly less bearish than the Orthodox Broadening Top). Although it made a slight gain today, the dip below the final support is a warning that the support may not hold the next time.

I did a triangulation of the different cycles in the Dow, the NDX and SPX. The ideal date for a cycle bottom now appears to be next Thursday, December 13. The fractal pattern starting at the high on Monday morning agrees with this analysis. Several of my compatriots also agree that December 13 may be a pivotal date for a significant low.

Be patient. The market does what it will in its own time. Fortunately, the Cycles Model appears to be making order out of what seems to be a disorderly market.

Regards,

Regards,

Tony

Our Investment Advisor Registration is on the Web

We are in the process of updating our website at www.thepracticalinvestor.com to have more information on our services. Log on and click on Advisor Registration to get more details.

If you are a client or wish to become one, please make an appointment to discuss our investment strategies by calling Connie or Tony at (517) 699-1554, ext 10 or 11. Or e-mail us at tpi@thepracticalinvestor.com .

Anthony M. Cherniawski, President and CIO http://www.thepracticalinvestor.com

As a State Registered Investment Advisor, The Practical Investor (TPI) manages private client investment portfolios using a proprietary investment strategy created by Chief Investment Officer Tony Cherniawski. Throughout 2000-01, when many investors felt the pain of double digit market losses, TPI successfully navigated the choppy investment waters, creating a profit for our private investment clients. With a focus on preserving assets and capitalizing on opportunities, TPI clients benefited greatly from the TPI strategies, allowing them to stay on track with their life goals

Disclaimer: The content in this article is written for educational and informational purposes only. There is no offer or recommendation to buy or sell any security and no information contained here should be interpreted or construed as investment advice. Do you own due diligence as the information in this article is the opinion of Anthony M. Cherniawski and subject to change without notice.

Anthony M. Cherniawski Archive |

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.