U.S. Looming Pensions Crisis: State Budgets Soon to Be Under Siege

Politics / Pensions & Retirement Dec 08, 2012 - 07:41 AM GMTBy: John_Mauldin

In 2003, I was writing about the unfunded liabilities of state and local pensions. It was part of Bull’s Eye Investing, which came out in 2004. I caught some flak for being so pessimistic about the potential problems. Quoting:

In 2003, I was writing about the unfunded liabilities of state and local pensions. It was part of Bull’s Eye Investing, which came out in 2004. I caught some flak for being so pessimistic about the potential problems. Quoting:

Unless steps are taken soon, it is possible we can see shortfalls approaching $1 trillion–$2 trillion in state-sponsored pension funds within 10 years. A deficit of this size on the state level can truly be called a crisis. A tax increase or other adjustments to fund this will be a large drag on the economy.

Today in Outside the Box we explore the very sad fact that once again I was unduly optimistic. My good friend Ed Easterling shows that it is quite likely that the pension shortfalls are approaching $4 trillion. And the longer we wait to deal with the problem, the worse it will get.

The biggest part of the problem, as I wrote back in 2003, is unrealistic assumptions about future investment returns. That has not changed. You can find consultants who will tell you there is “only” a $1 trillion problem. However, if you assume that interest rates will remain low and equity returns will look like they did the last ten years, then the underfunding might look more like $4.6 trillion.

What Ed does is show how these numbers are reached and how to make your own assumptions. But whatever you assume, the largest contributor to the future ability of pension funds to make the agreed-upon payments is growth in the assets they hold. Even doubling contributions might not be enough. This is a class A problem, and most public-sector pension agreements cannot be legally changed, unlike those of private pension funds. This has serious implications for the taxpayers of the funds that are in trouble.

You can see more of Ed’s work at www.crestmontresearch.com . Long-time readers will be quite familiar with him – he is one of my favorite analysts. We are working together on a two-part series for the end of the year on the implications of slower US and global growth.

Life is what happens when you are making plans. When I don’t write a weekly Thoughts from the Frontline letter, it is almost always because I planned not to. In fact, this week was the first time in 13 years when I simply had to deal with “issues” and could not write. I kept hoping that I could get some thoughts on paper, but it did not happen. I will be back on track this Sunday. I apologize to those of you who wondered what planet I had left for.

It has been wild week of ups and downs. I seem to oscillate between reading and discussing very optimistic assessments of the future to contemplating rather stark ones. It’s enough to give one a serious case of whiplash. And speaking of dysfunctionality, I was in Washington DC for a day this week and will report this coming weekend on what I learned and what I contributed to the discussion, as well as deliver the report I promised you on the Bakken. But now, let’s turn to Ed and the problems with pensions.

Your drinking life through a firehose analyst,

John Mauldin, Editor

Outside the Box

JohnMauldin@2000wave.com

Looming Crisis: State Budgets Soon to Be Under Siege

By Ed Easterling, Crestmont Research

December 7, 2012 All rights reserved

There are numerous problem-solving and decision-making processes in the military and civilian sectors. All of them start with a common first step: Identify and define the problem. Get the first step wrong, and there is no chance for success.

Public employee retirement systems across the nation have a major problem. Yet the issues are not isolated to investment portfolios managed in the basements of cold, dark government buildings. Nor is the impact limited to retirees or near-retirees of those programs. The tentacles reach out to the taxpayers that backstop those plans and the people served by the government workers in those plans.

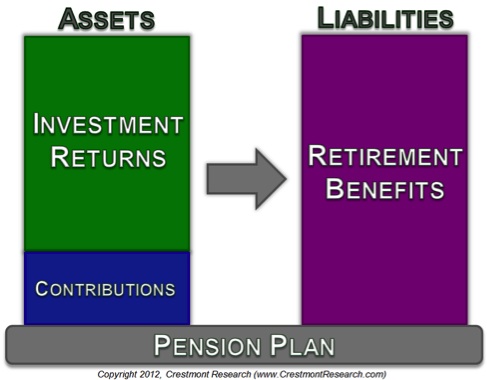

Pension plans are simple programs. They are set-up to receive contributions from employers and employees to be distributed later back to the employees as retirement benefits. But the plans expect to distribute more than the contributions that go in—and it almost always can. Down in the basement, the pension plan invests the contribution money over many years to produce a return. The return and the contributions combine to meet the obligations promised to the workers upon retirement. However, if that combination of funds is insufficient, then the taxpayers are expected to make up the shortfall.

So there are three components to the pension machine: contributions, returns, and distributions. Two of them can be easily and accurately estimated. The third component is an assumption—a very important assumption.

PENSION ANALYSIS

Most often, the process starts with an estimate of retirement benefits. For each worker that the pension plan covers, the analysts (called “actuaries”) estimate the expected years in retirement, the time to retirement, and the inflation rate across the entire period. This exercise is not very accurate for any single worker, yet it is surprisingly accurate across a population of workers. The total of all expected retirement payments is known as the pension plan’s liability.

Contributions are also easy to estimate because they relate to a percentage of workers’ wages that are covered by the pension plan. The same actuaries grind numbers in big computers with good accuracy. They estimate the expected total contributions to the pension plan as well as the ultimate distributions for retirement benefits. The accumulated total of the past contributions is known as the pension plan’s assets.

This is where the third component comes in. The contributions alone are never sufficient to cover the liabilities. Pension plans expect the contributions to earn a return while they wait in the basement between employees’ working years and the retirement years. And, as they say, there is the rub.

What is a reasonable assumption for returns?

Well, it’s complicated. The return assumption should reasonably relate to the types of investments that are used by the pension plan. The mix of investments depends upon the risk profile that the pension plan is willing to accept.

IT’S YOUR RISK

Actually, the pension plan is not accepting the risk. The pension plan is just a conduit, a legal entity that stands between the retirees and the taxpayers. Most states have laws that provide some or complete protection for specified benefits promised to retirees. Therefore, the ultimate risk falls upon the taxpayers—not on retirees or the pension plan itself. It is more accurate to say that the mix of investments depends upon the risk profile that pension plan managers are willing to place on the taxpayers.

The Social Security trust fund invests exclusively in bonds and securities issued by the U.S. Government. These investments are considered to be virtually risk-free and have little risk of loss. As a result, taxpayers bear little risk from a loss in the value of investments in the Social Security trust fund.

In 2005, there was an effort to change the investment mix for the Social Security trust fund to include stock market investments. That initiative failed because the public rejected the additional risk that it represented. The stock market was considered to be far too risky for nation’s largest retirement plan. Taxpayers refused to accept the risk associated with potential losses from stock market investments.

Nonetheless, states have convinced taxpayers to accept stock market risk for their government retirement plans. Ironically, the national plan would have had national taxpayers accept stock market risk for virtually everyone’s potential benefit; the state program has state taxpayers accepting stock market risk for plans that are limited to state and local government workers.

REASONABLE RETURNS

State pension plan investments are not limited to the stock market. They include corporate bonds, U.S. Treasury debts, real estate, private companies, hedge funds, commodities, and a wide variety of other investments. This mix of investments enables state pension funds to justify the assumption of a higher rate of return.

This is critical because a higher rate of return means that state pension funds can contribute a significantly smaller amount of upfront contributions based upon worker’s wages. If state pension funds were investing in less risky, lower return state and federal bonds, the states would have to contribute a lot more money at each payroll.

It’s the Big Tradeoff: contributions vs. returns. Lower expected returns means that higher contributions are needed so that the combination of contributions and returns can pay for retirement benefits. By assuming and hoping for a higher rate of return, the amount of contributions is less because the states expect for investment returns to make up the difference.

To illustrate the tradeoff, assuming typical pension plan assumptions—including an expected annual return of 8%, the combined contribution between employee and employer is approximately 19% of the payroll. That’s about 8% or 9% of the employee’s wages paid by each of the employee and the employer. It’s not too far from the rates that have been used by many states and public employment plans.

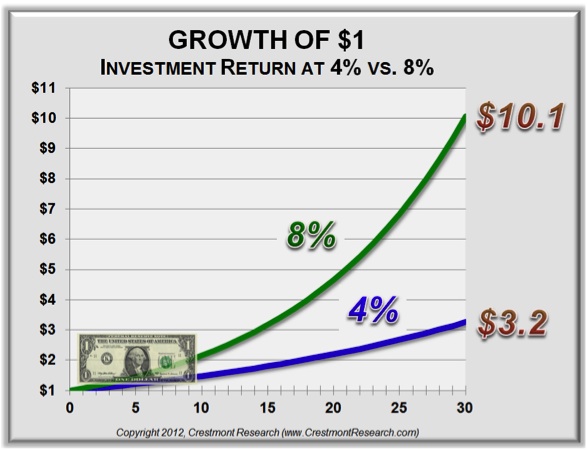

But if the outlook for future annual returns falls to 4% (as current conditions warrant), the required contribution rises substantially to 68% of the payroll—more than three times typical current contribution rates. The reason is the power of compounded returns, the eighth wonder of the world that so enamored Albert Einstein. Unachieved or underachieved returns significantly reduce the ability of public pension plans to meet retirement promises in the future.

To illustrate the effect that investment return has on supplying funds for retirement benefits, consider the following example. Assume for simplicity that the time horizon is thirty years. That’s about the amount of time from the first dollar of wages to the first dollar of retirement. It’s also about the time from the last dollar of wages to the last dollar of retirement. Clearly there are other considerations including wage gains and retirement benefit adjustments, yet thirty years provides a representative example.

One dollar grows to just over $3 after thirty years of investment returns at 4%. But, the same dollar grows to more than $10 after thirty years when returns are 8%. That is more than three times the assets to pay retirement benefits. Investment return does not change the amount paid in retirement benefits, it only changes the amount of funds provided by investment returns. The difference must be provided through additional contributions.

Clearly, taxpayers have a strong interest in the riskiness of the investment portfolio and the reasonableness of the assumption for returns. The only investment that assures its rate of return is a U.S. bond. Beyond that, the rate of return from investments generally increases as the chances of investment success decreases. Risk is not a knob that can be turned for higher returns. Instead, as investment risk increases, the odds of investment success decrease. Taxpayers accurately read the situation with Social Security and rejected accepting the risk of reaching for higher returns; yet they are now on the hook for substantial risk at the state level.

Why? And what can be done about it?

The “why” goes back to the assumption for returns from investments. Pension plan administrators know that higher return expectations make it easier to appear to meet the retirement benefit obligations. Despite the well-known tenant that “past performance is not an indication of future returns,” state pension funds rely upon the results of past years to set the expectation for future years—the rate of return assumption for the pension plans.

CONDITIONS CHANGE

The reason that past performance is not a reasonable indicator is that conditions change. For example, as recently as five years ago you could walk into a bank and receive 4% on a certificate of deposit; the U.S. Government paid 5% for investments in its short-term notes. Today, with the same money, the interest rate is less than 1%. It is not reasonable to assume yesteryear’s rate of return for the future.

Yet that is exactly what the public pension plans are doing. They continue to assume that their investments will average around 8% annually despite the change in conditions.

Bonds held by public pension plans return far less than 8%. Real estate and other non-traditional investments struggle to achieve 8%. Finally, the largest part of the portfolio for most public pension plans, investments in the stock market, has not been priced to return 8% for more than a decade!

What? Conventional wisdom attributes the 2008 recession and stock market losses to current pension plan shortfalls. How and why could this discussion relate to the past decade?

This leads to the most important point in this discussion—defining the problem. If the current shortfalls for public pension plans are the result of a unique gap created by the 2008 recession, then the solution is to refill the gap over time. Many states are attempting to do this by increasing slightly the level of contributions over the next ten or twenty years to plug the hole.

But instead, if the shortfalls are the result of a trend that was merely recognized by the 2008 recession, then the current and future gap is destined to be ever-widening. That is the $4 trillion question.

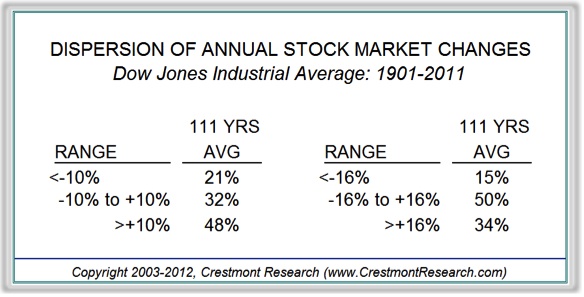

Markets go up and down, especially the stock market. The stock market has historically gone up or down by more than 10% each year during almost seventy percent of the years; it has gone up or down by more than 16% each year about half of years. That is a lot of up and down.

More importantly, for long-term investors like pension plans, the combination of ups and downs across the decades is not driven by good or bad news. Nor is it a random walk of years that provides some constant average rate of return. Instead, longer-term returns from the stock market vary depending upon the starting point. As a result, longer-term returns from the stock market are quite predictable.

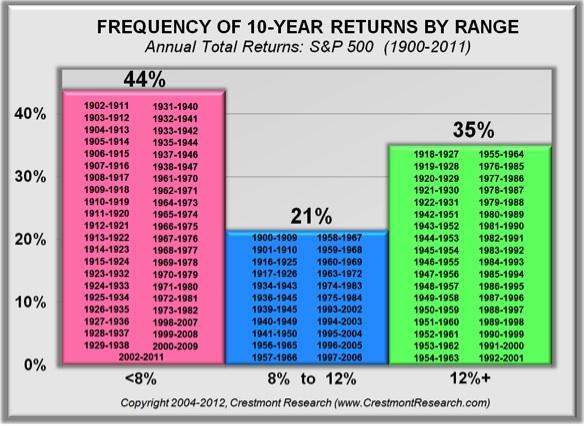

To understand the predictability, consider that the average long-term annual return from the stock market has been almost 10%. Yet the so-called “long-term returns” refers only to one really long period, typically 1926 to present. Instead, consider long-term returns across each and every ten-year period since 1900.

As it turns out, the average annualized return for decades of ten consecutive years is also near 10%. But the range for decade-long returns is quite wide and few of them deliver near 10% returns. Almost eighty percent of the decade-long periods over the past century ended with annualized stock market returns either above 12% or below 8%. So the odds-on bet for stock market investors is an outlook of well-above average or well-below average. Average is a bad assumption.

Why can we say that long-term returns from the stock market are relatively predictable? The thirty-five percent of periods that averaged 12% or more have a common element—they started with the stock market having a value that was fairly low. The value of the stock market can be measured by comparing its price to the amount of annual profits generated by its companies. This is known as the price/earnings ratio, or simply P/E.

The forty-four percent of periods when returns averaged 8% or less started when the stock market had a value that was fairly high. In general, the higher the starting value, the lower the decade-long returns. This is particularly relevant because today’s stock market on a normalized basis is priced fairly high. It was very, very high after the market bubble in the late 1990s. Since the early 2000s, the stock market has been treading water—with normally dramatic ups and downs—as its value has settled from very-high to high. But it is still high. And that means that future returns from today are destined to be below-average.

Here’s where it gets tricky. As we know from history, at some point in the future the stock market will again be cheap. That will enable new, future contributions to be invested at lower prices with the expectations of higher returns. But, and it’s an important but, current investments are destined to deliver low returns when measured from today. Returns from existing assets are baked-in at current prices.

So not only will today’s bond investments fall short of the current assumptions currently used by state pension plans, stock market investments will also fall short. The level of shortfall is dramatic. Bonds can be expected to contribute 2% to 4% annualized returns. Stocks can be expected to contribute 0% to 6%, depending upon the future inflation rate and the level of economic growth. Real estate and other non-traditional investments could reasonably be included at 4% to 10%. All in, depending upon the relative mix of investments that are used, the blended rate of return will more likely be 3% to 5% instead of the 7.5% to 8% currently assumed by most state pension plans.

The result is an ongoing gap of near 4% annually that will cause an ever-widening shortfall for state pension plans. The problem is not a gap created by a unique event in 2008, but rather it is the result of an environment that started about a decade ago.

That gap, moreover, will not move at glacial pace presenting a subtle 4% shift each year. Rather, with the force of an earthquake, periodic market declines will reveal large chasms. Subsequent surges may cure much of the hole until the next plunge. Yet over time, the gap will never seem to close and will attract excuses for why it is widening. Hope will spring eternal as the ship slowly succumbs to drowning waters.

CONCLUSION

The implications are significant.

First, public pension plans have very large gaps to fill as well as ongoing shortfalls. Solutions must be dedicated to shore up the plans. Policy makers must resist the temptation to use pension reform as a way to fund obligations outside of the plans.

Second, solutions will require additional contributions that will further challenge the budgets of state and local government employers. The magnitude of the additional funding will only increase with delay. Every year that additional funding is missed compounds and concentrates the problem into fewer future years. Further, state and local governments will be able to make much better decisions about sourcing additional funding if they are aware of the full magnitude of the problem. Likewise, the participants in these retirement pension plans will experience less change and will have more time to plan if their part of the solution is decided and implemented sooner.

Additionally, there are significant implications for citizens. Budget shortfalls at the state and local level will drive higher taxes: income, property, sales, and other taxes. Higher taxes among the broad citizenry to fund retirement benefits—where the benefits are greater than in the private sector—may generate resentment and unrest. Such emotional responses often result in less-rational solutions. Higher taxes and social anxiety can lead to slower economic growth, which can reduce standards of living over time. The last comment is intended to recognize a significant risk with the hope of encouraging solutions; it is not intended to be a foresight.

Finally, there are significant implications for investors. Some municipal bond issuers that appear solvent under current investment return assumptions will fail under the more realistic assumptions. Caveat emptor. Investors also tend to be targets for higher income and wealth taxes, which can lower net returns from their other investments.

The solution to public pension woes is not a stopgap series of contributions; it will require fundamental reform to address the ongoing effects of the existing conditions. A successful solution requires an accurate assessment of the problem. An inaccurate assessment begs disaster. Without a comprehensive solution, the likely actions will be marginal plugs introduced with hope that ultimately result in ineffective results.

Ed Easterling is the author of recently-released Probable Outcomes: Secular Stock Market Insights and award-winning Unexpected Returns: Understanding Secular Stock Market Cycles. Further, he is President of an investment management and research firm, and a Senior Fellow with the Alternative Investment Center at SMU’s Cox School of Business where he previously served on the adjunct faculty and taught the course on alternative investments and hedge funds for MBA students. Mr. Easterling publishes provocative research and graphical analyses on the financial markets at www.CrestmontResearch.com.

John Mauldin

subscribers@MauldinEconomics.com

Outside the Box is a free weekly economic e-letter by best-selling author and renowned financial expert, John Mauldin. You can learn more and get your free subscription by visiting www.JohnMauldin.com.

Please write to johnmauldin@2000wave.com to inform us of any reproductions, including when and where copy will be reproduced. You must keep the letter intact, from introduction to disclaimers. If you would like to quote brief portions only, please reference www.JohnMauldin.com.

John Mauldin, Best-Selling author and recognized financial expert, is also editor of the free Thoughts From the Frontline that goes to over 1 million readers each week. For more information on John or his FREE weekly economic letter go to: http://www.frontlinethoughts.com/

To subscribe to John Mauldin's E-Letter please click here:http://www.frontlinethoughts.com/subscribe.asp

Copyright 2012 John Mauldin. All Rights Reserved

Note: John Mauldin is the President of Millennium Wave Advisors, LLC (MWA), which is an investment advisory firm registered with multiple states. John Mauldin is a registered representative of Millennium Wave Securities, LLC, (MWS), an FINRA registered broker-dealer. MWS is also a Commodity Pool Operator (CPO) and a Commodity Trading Advisor (CTA) registered with the CFTC, as well as an Introducing Broker (IB). Millennium Wave Investments is a dba of MWA LLC and MWS LLC. Millennium Wave Investments cooperates in the consulting on and marketing of private investment offerings with other independent firms such as Altegris Investments; Absolute Return Partners, LLP; Plexus Asset Management; Fynn Capital; and Nicola Wealth Management. Funds recommended by Mauldin may pay a portion of their fees to these independent firms, who will share 1/3 of those fees with MWS and thus with Mauldin. Any views expressed herein are provided for information purposes only and should not be construed in any way as an offer, an endorsement, or inducement to invest with any CTA, fund, or program mentioned here or elsewhere. Before seeking any advisor's services or making an investment in a fund, investors must read and examine thoroughly the respective disclosure document or offering memorandum. Since these firms and Mauldin receive fees from the funds they recommend/market, they only recommend/market products with which they have been able to negotiate fee arrangements.

Opinions expressed in these reports may change without prior notice. John Mauldin and/or the staffs at Millennium Wave Advisors, LLC and InvestorsInsight Publishing, Inc. ("InvestorsInsight") may or may not have investments in any funds cited above.

Disclaimer PAST RESULTS ARE NOT INDICATIVE OF FUTURE RESULTS. THERE IS RISK OF LOSS AS WELL AS THE OPPORTUNITY FOR GAIN WHEN INVESTING IN MANAGED FUNDS. WHEN CONSIDERING ALTERNATIVE INVESTMENTS, INCLUDING HEDGE FUNDS, YOU SHOULD CONSIDER VARIOUS RISKS INCLUDING THE FACT THAT SOME PRODUCTS: OFTEN ENGAGE IN LEVERAGING AND OTHER SPECULATIVE INVESTMENT PRACTICES THAT MAY INCREASE THE RISK OF INVESTMENT LOSS, CAN BE ILLIQUID, ARE NOT REQUIRED TO PROVIDE PERIODIC PRICING OR VALUATION INFORMATION TO INVESTORS, MAY INVOLVE COMPLEX TAX STRUCTURES AND DELAYS IN DISTRIBUTING IMPORTANT TAX INFORMATION, ARE NOT SUBJECT TO THE SAME REGULATORY REQUIREMENTS AS MUTUAL FUNDS, OFTEN CHARGE HIGH FEES, AND IN MANY CASES THE UNDERLYING INVESTMENTS ARE NOT TRANSPARENT AND ARE KNOWN ONLY TO THE INVESTMENT MANAGER.

John Mauldin Archive |

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.