Gold Price Compression, Risk vs Reward

Commodities / Gold and Silver 2012 Dec 18, 2012 - 12:35 PM GMTBy: Submissions

Robert M. Williams writes:

Whenever you invest there are two things you want to keep in mind. The first is whether or not you will get your capital back and the second is how much can you make considering the risk you have to take. With respect to the second, the possible return on capital must always be greater than the risk you are going to have to accept. In today’s world of “too big to fail”, quantitative easing to infinity, and debt expansion at an almost exponential rate, it´s hard to judge risk. Markets are being manipulated by central banks across the board. Look at the Libor scandal! The English justice system will put mid level employees of some UK financial institutions in jail for doing what the Bank of England requested, i.e. manipulate the Libor rate. Meanwhile, the “big fish” will swim free.

Robert M. Williams writes:

Whenever you invest there are two things you want to keep in mind. The first is whether or not you will get your capital back and the second is how much can you make considering the risk you have to take. With respect to the second, the possible return on capital must always be greater than the risk you are going to have to accept. In today’s world of “too big to fail”, quantitative easing to infinity, and debt expansion at an almost exponential rate, it´s hard to judge risk. Markets are being manipulated by central banks across the board. Look at the Libor scandal! The English justice system will put mid level employees of some UK financial institutions in jail for doing what the Bank of England requested, i.e. manipulate the Libor rate. Meanwhile, the “big fish” will swim free.

Such an atmosphere makes “trading” almost impossible. Trying to catch the daily or weekly trend, unless you are privy to insider information, is a losing proposition. So what is the alternative? You have to find a market where there is an identifiable primary trend, and then take a position while there are still several years left in the move. That is easier said than done! In the first place most investors do not have the time or inclination to do the research needed to make such a determination. Unfortunately, the majority of investors dedicate more time to buying a wash machine than they do to what goes into their IRA. That’s where we come in, and this is what we discovered.

As I mentioned earlier, in order to make an investment you need to know that your capital is safe. That leaves most paper assets out in the cold since paper creation is merely a matter of chopping down trees and tapping on a keyboard. There is an old adage: give a computer to a monkey and in a million years he’ll type the Bible. I now suspect that monkeys are finding employment opportunities within central banks creating fiat money. Commodities are no picnic either due to spoilage, storage and transportation costs, changes in weather, uniformity and so on… Through the process of elimination I eventually arrived at gold and silver, and for the purposes of this report I will lump them both into one category that I will label “gold”.

Gold has been around for more than four thousand years and has served as money in every great society that has ever existed. That includes the United States, and our Founding Fathers thought so much of the yellow metal that they inserted a clause in the US Constitution that requires the use of gold as money. Article 1, Section 10, Clause 1 states that “No State shall… make any thing but gold and silver coin a tender in payment of debts.” Personally I like gold because the supply is finite and the recovery of gold requires considerable time and financial sacrifice. Unlike a dollar it cannot be created out of thin air. What’s more gold is accepted around the world, it is easily transported, small amounts add up to large dollar amounts, it doesn’t spoil and I can hide a kilo or two in a shoebox.

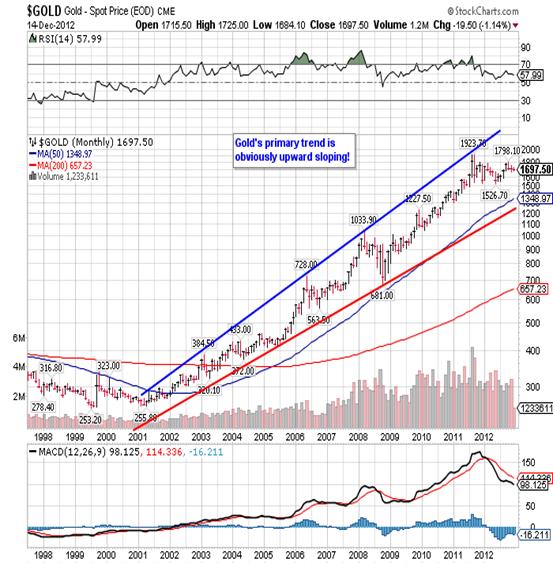

For more than a decade demand has outpaced supply and that is one reason why gold has posted ten straight yearly gains, and 2012 will be the eleventh. That tells me I’ve met my first criteria, identifying that the primary trend is intact and upward sloping:

This is what the financial news channels would label a “bull” market.

For those who pay attention to the mainstream media, you may have heard that the bull market in gold is over. Nothing could be further from the truth and the commentary demonstrates a complete lack of understanding of what constitutes a bull market. Bull markets, especially those that are counted in decades, tend to move in three phases:

- An initial phase whereby smart investors with deep pockets take a very long-term position. This happened when gold was at US $252.00 an ounce and continued through the first couple of years of the move higher.

- The second phase began once gold exceeded US $450 an ounce and is highlighted by big institutions taking a long-term position. I estimate that we are now at the end of this second phase.

- The third phase is where the general public jumps in with both feet, and that has yet to occur.

Anyone who thinks the bull market will come to an end without a third phase, the most lucrative phase I might add, is committing a serious error in judgment.

Prices rallied more that 300% during the second phase, and if history is any indicator, it will at least double again during the third phase. That means we’ll see a minimum US $3,500 gold price before it’s all said and done. Since so many investors are still on the sidelines, you have to ask yourself if we are now ready to see the third phase, and is it time to jump in? In order to answer that I want to take a look at the current reaction and compare it to the previous reaction:

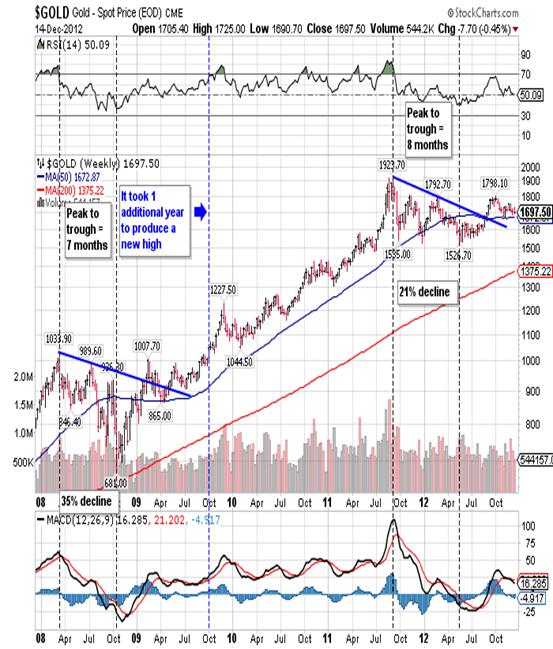

The last correction occurred when gold reached a 1,033.90 all-time high back in March 2008 and then proceeded to give back 35% over seven months. The current correction began in September 2011 with a 1,923.70 all-time high and declined 21% over eight months. Assuming the bottom is in, and I do make that assumption, the current decline is much shallower and occurred over a slightly longer period of time.

With respect to the 2008 correction, once the bottom was in it took one year to break out to a new all-time high. The current correction as seen below in more detail lasted eight months:

and then it took one year to move back above the downward sloping trend line. (It is interesting to note that it is identical to the 2008 correction.) Since the May bottom the “recovery has retraced approximately 47% of the decline over a seven month period. (Again this is very close percentage wise to the move off of the 681.00 bottom in 2008.)

As far as comparisons go we are following a road that has already been traveled, so how is it that the mainstream media is so anxious to call an end to a bull market that still has its best days in front of it? Then add to the mix a resumption of the decline in the US dollar, the anti-gold if you will, and you really have to ask yourself what the agenda is. In order to answer that question you need to understand that gold is the only true “store of wealth” and the stronger the move higher in the price of gold, the more it usurps the power of the central banks. Gold is the check engine light light that tells you something is wrong. The fact that gold has risen for ten straight years as a result of excessive central bank intervention is a dirty little secret that they´ll do anything to hide.

The end result is constant intervention on the part of the US Federal Reserve, and other major central banks, in an effort to restrain the primary trend. It used to be that they were trying to change the primary trend from bullish to bearish, but now it’s simply a defensive action in an effort to gain time. As strange as it may seem the primary weapon is the paper (futures) gold market. The Fed simply prints dollars in an effort to sell gold short in the futures market and prays that no one big player (like China) comes along and buys one hundred thousand contracts for delivery. You see the COMEX never has in storage more than 2% of the physical gold required to back the contracts at any given time. Sooner or later the Fed will get burned and that will destroy the paper markets along with US credibility.

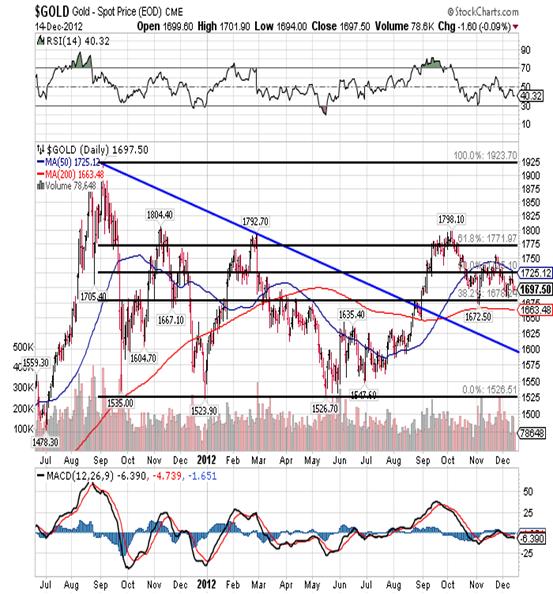

At present gold is caught in a trading range that runs from 1,673.30 on the low side to 1,745.10 on the high side and is pictured here:

Although difficult to prove at this point, I believe the November low of 1,673.30 was significant and a higher low, so the yellow metal should now work its way higher in spite of deflationary pressures. Finally, I know that lots of analysts are calling for high inflation, even hyperinflation, but so far I haven’t seen any of that. The Commodities Research Bureau Index (CRB) continue to carve out lower highs and lower lows:

That of course is one of the numerous headwinds that gold must deal with, but it will not change the fact that it will work its way higher. Slowly at first, but sooner or later it will wreak havoc on anything and anybody that gets in the way. For those looking to establish an initial position, it doesn’t matter if you do it here or US $50.00 lower. No one can tell a bottom as it happens and it isn’t important anyway. What´s important is that gold will go to a minimum of US $3,300.00, and should go considerably higher if the dollar begins to melt down, so US $50.00 is not worth the discussion. The point is to take a position and then slowly add on if and when weakness appears. There will always be reactions so you apply patience and wait for them.

(I very seldom write for public consumption, content to talk to myself when I feel I have made some worthwhile observations. I do however feel that we are at a critical stage, and since so little is known about gold, some comment is necessary. Should you have any questions, you can reach me at robmwilliams@hotmail.com and I will do my best to respond in a timely manner.)

Robert M. Williams

St. Andrews Investments, LLC

Nevada, USA

Copyright © 2012 Robert M. Williams - All Rights Reserved

Disclaimer: The above is a matter of opinion provided for general information purposes only and is not intended as investment advice. Information and analysis above are derived from sources and utilising methods believed to be reliable, but we cannot accept responsibility for any losses you may incur as a result of this analysis. Individuals should consult with their personal financial advisors.

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.