Gold Rush Bubble? US Gold Coin Sales Fall 25% In 2012

Commodities / Gold and Silver 2013 Jan 07, 2013 - 08:35 AM GMTBy: GoldCore

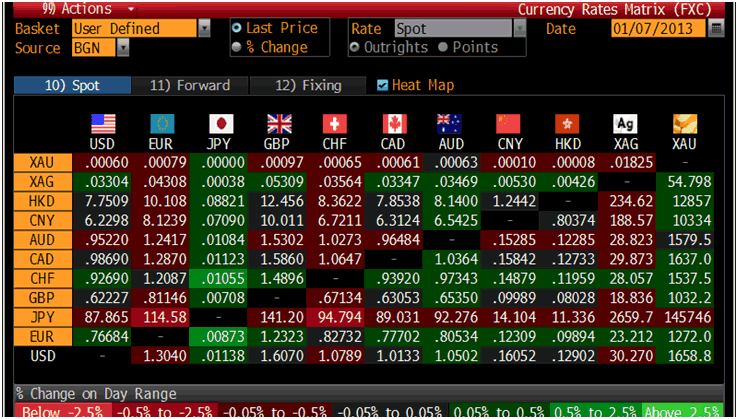

Today’s AM fix was USD 1,653.75, EUR 1,029.60 and GBP 1,267.82 per ounce. Friday’s AM fix was USD 1,632.25, EUR 1,254.32 and GBP 1,018.37 per ounce. Silver is trading at $30.21/oz, €23.29/oz and £18.89/oz. Platinum is trading at $1,565.50/oz, palladium at $682.00/oz and rhodium at $1,150/oz.

Today’s AM fix was USD 1,653.75, EUR 1,029.60 and GBP 1,267.82 per ounce. Friday’s AM fix was USD 1,632.25, EUR 1,254.32 and GBP 1,018.37 per ounce. Silver is trading at $30.21/oz, €23.29/oz and £18.89/oz. Platinum is trading at $1,565.50/oz, palladium at $682.00/oz and rhodium at $1,150/oz.

Cross Currency Table – (Bloomberg)

Gold dropped $8.20 or 0.49% in New York on Friday and closed at $1,656.30/oz. Silver slipped to as low as $29.22 in London, but it then rallied to as high as $30.25 in New York and finished with a gain of 0.2%. Gold finished down 0.05% for the week, while silver was up 0.53%.

Friday’s U.S. nonfarm payrolls for December were 155K, 150K was expected and this was down from the previous data of 161K. The unemployment rate was still an elevated 7.8% suggesting a frail U.S. jobs market.

Gold edged up on Monday on the heels of uninspiring U.S. jobs data which supported market expectations for continued quantitative easing from the U.S. Federal Reserve.

In gold futures and options hedge funds and institutions increased the size of their net longs in gold in the week to Dec. 31, ending two weeks of declines, CFTC data showed.

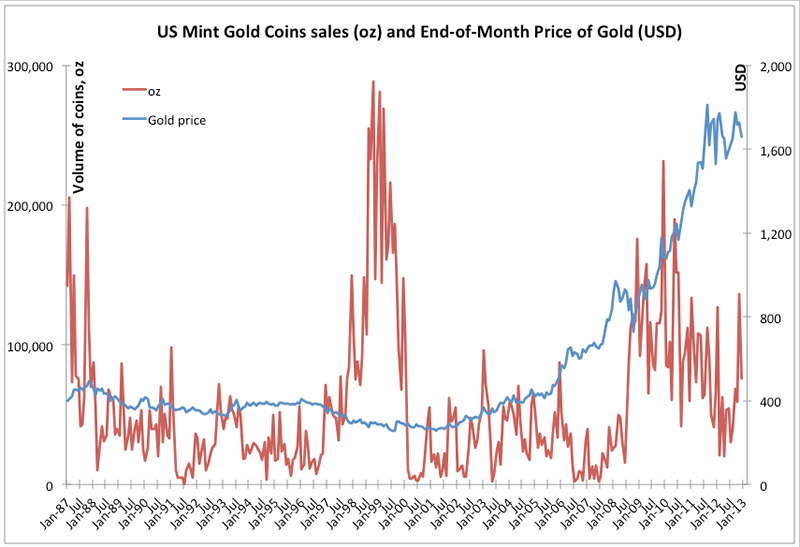

The U.S. Mint's gold coin sales slid for a third consecutive year in 2012 showing how demand for gold bullion among the retail public remains lacklustre at best. Demand remains well below the record levels seen preceding the Y2K scare in 1999 and below the levels seen when the coins were first launched in 1987 and in the aftermath of the Wall Street Crash of October 1987. Falling demand for coins in the U.S. and elsewhere is likely due to the false perception that the worst of the global debt crisis has been seen. American Eagles are more popular in the U.S. but other government mints such as the Perth Mint of Western Australia have said that they saw a fall in demand in 2012.

The U.S. Mint sold 753,000 troy ounces of American Eagle gold coins in 2012, according to data posted on its website, down 25% from a year earlier and the lowest full-year sales since 2007.

US Mint Gold Coin sales(oz) & End-of-Month Price of Gold(USD) – (True Economics)

Dr. Constantin Gurdgiev has analysed the data of US Mint coin sales in December 2012 and has looked at them in their important historical context going back to 1986. He is one of the few academics in the world to have researched and written academic papers about gold.

His analysis of demand for US minted gold coins was published on his excellent, must read blog – True Economics and can be read here: US Mint Gold Coins Sales: 1986-2012 Data

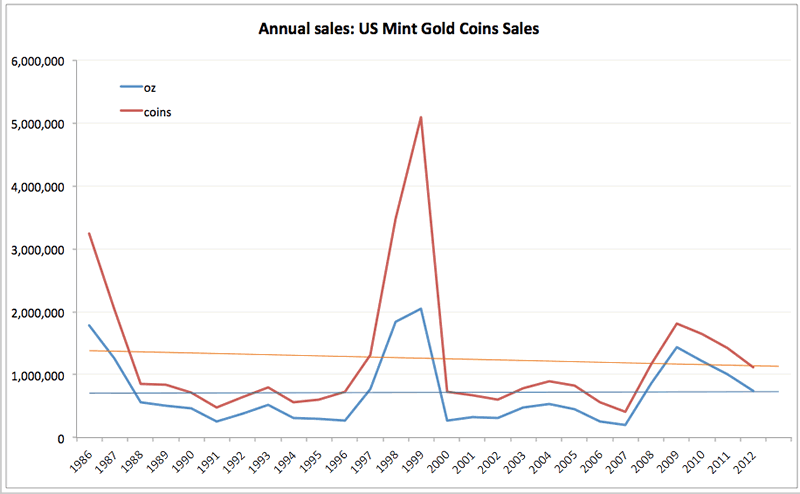

US Mint December 2012 Sales GoldCore believe that the fall in demand is due to renewed complacency regarding the global debt crisis. It is also likely due to the fact that traditional buyers of gold coins and bars have secured their allocation to store of wealth gold bullion in recent years. It may also be because there are only a few new retail buyers coming into the bullion market in western countries - unlike in Asian countries and particularly China.

U.S. Mint data does not support the view of a dramatic, reckless, greedy buying of gold by the fabled speculatively crazed retail buyer or the fabled 'gold rush' that some headline writers and media commentators have claimed is taking place.

Three consecutive years of falling demand for gold coins and the lowest demand for U.S. gold coins since 2007 shows how those still calling gold a bubble, for very simplistic reasons, remain ill informed.

Bubbles are of course characterised by mass participation by the public and surging demand to record levels.

Annual sales: US Mint Gold coins Sales – (True Economics) The general public 'Joe and Josephine sixpack' or the public in most western countries remain far from the gold market. Media tech darlings such as Apple and Facebook shares are far more appealing to today's shoeshine boys and girls. Indeed, property, despite the bursting of bubbles in some countries, remains the investment of choice for the retail public in many countries.

Despite, the risk of becoming massively indebted, the significant risk of sharp prices falls in many property markets -particularly London and the UK - and of subsequently being in negative equity and possibly even losing the family home.

Many frightened citizens have also piled into cash in the false belief that 'cash is king.' This is particularly the case in many European countries where bank deposits now have a "government guarantee". The public has yet to realise that the state guarantee comes from a state that's solvency is far from guaranteed in the coming months and years.

The man and woman in the street in most western countries continues to be a more of a seller of gold (jewellery for cash) than a buyer of gold as seen in the western world phenomenon that is ‘cash for gold.’

The shoeshine boys and girls of today continue to be sellers of gold in the international phenomenon that is 'cash for gold'. In fact, the general public, 'Joe Public', is selling gold jewellery in order to raise cash rather than buying gold bullion in order to protect and grow wealth.

Germany, Austria and Switzerland are the exceptions in western retail markets as there is increased retail demand for gold bullion in these countries. This is due to the German and Austrian understanding of the risk of inflation and currency devaluation from historical experience and due to the Swiss understanding of how physical gold bullion stored in Swiss vaults has been used to protect and preserve wealth throughout history.

It is also important to remember that demand for gold bullion coins and bars is not a good contrarian indicator of retail demand and the typical mass mania or greedy buying that accompanies most market tops and most bubbles.

Buyers of gold coins and bars are store of wealth financial insurance long term gold owners. In many cases the buyers do not intend ever selling their gold unless they are forced to by economic circumstances. They are not speculative buyers motivated by greed or simply to make a profit. The final stages of a bull market is characterised by reckless buying by more speculative buyers whose sole motivation is to make a capital gain. Thus, more speculative types of gold ownership such as gold futures, CFDs, mining, junior mining and exploration shares are and will be the preferred vehicles for such buyers.

Therefore, a far better indicator of animal spirits and whether there is "irrational exuberance" in the gold market is COMEX data and the price movement of companies involved in the gold mining sector. Such vehicles are for investors and speculators and cater for the less risk averse stock trading and investing public and are a proper benchmark of retail exuberance for gold.

The Commitment of Traders (COT) data from the COMEX and data from the global gold market and the increasingly important gold spot and futures markets in Dubai (DMCC) and Shanghai (SGE) should be monitored to gauge whether the animal spirits of a bubble are developing.

COT data from the COMEX remains below the record levels seen in recent years and sentiment remains lukewarm today.

Gold ETF holdings are at record highs but SEC data shows that the majority of the buyers of ETFs remain hedge funds and other institutions.

Indeed, a large part of the recent increase in demand for gold has come from hedge funds, pension funds and central banks. They are allocating into gold for safe haven diversification reasons.

More speculative gold mining stocks have had a torrid time and have massively underperformed the gold market. The XAU or the Philadelphia Gold and Silver Index is one of the most watched gold indices on the market.

Today it is trading at 162.53. In September 1987 it was trading at 154.25. It has risen just over 5% in over 25 years and is not far above its long term average of the last 29 years (since January 1984).

A gold bubble is likely to see gold mining companies becoming house hold names and the more popular gold mining companies being owned by more speculative stock picking retail buyers internationally.

The data strongly suggests that there is little in the way of ‘animal spirits’ associated with investment bubbles in the physical gold bullion market or in the wider gold market.

There are no signs of a gold mania or ‘gold rush’ whatsoever and prudent people should continue to have an allocation to safe haven gold.

For the latest news and commentary on financial markets and gold please follow us on Twitter.

GOLDNOMICS - CASH OR GOLD BULLION?

'GoldNomics' can be viewed by clicking on the image above or on our YouTube channel:

www.youtube.com/goldcorelimited

This update can be found on the GoldCore blog here.

Yours sincerely,

Mark O'Byrne

Exective Director

IRL |

UK |

IRL +353 (0)1 632 5010 |

WINNERS MoneyMate and Investor Magazine Financial Analysts 2006

Disclaimer: The information in this document has been obtained from sources, which we believe to be reliable. We cannot guarantee its accuracy or completeness. It does not constitute a solicitation for the purchase or sale of any investment. Any person acting on the information contained in this document does so at their own risk. Recommendations in this document may not be suitable for all investors. Individual circumstances should be considered before a decision to invest is taken. Investors should note the following: Past experience is not necessarily a guide to future performance. The value of investments may fall or rise against investors' interests. Income levels from investments may fluctuate. Changes in exchange rates may have an adverse effect on the value of, or income from, investments denominated in foreign currencies. GoldCore Limited, trading as GoldCore is a Multi-Agency Intermediary regulated by the Irish Financial Regulator.

GoldCore is committed to complying with the requirements of the Data Protection Act. This means that in the provision of our services, appropriate personal information is processed and kept securely. It also means that we will never sell your details to a third party. The information you provide will remain confidential and may be used for the provision of related services. Such information may be disclosed in confidence to agents or service providers, regulatory bodies and group companies. You have the right to ask for a copy of certain information held by us in our records in return for payment of a small fee. You also have the right to require us to correct any inaccuracies in your information. The details you are being asked to supply may be used to provide you with information about other products and services either from GoldCore or other group companies or to provide services which any member of the group has arranged for you with a third party. If you do not wish to receive such contact, please write to the Marketing Manager GoldCore, 63 Fitzwilliam Square, Dublin 2 marking the envelope 'data protection'

GoldCore Archive |

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.