Japanese Yen Falls To Lowest Price Against Gold Since 1980

Commodities / Gold and Silver 2013 Jan 15, 2013 - 02:15 PM GMTBy: GoldCore

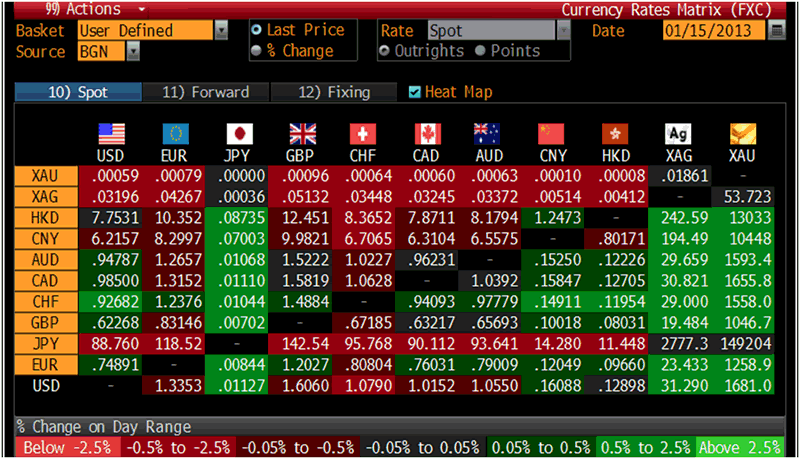

Today’s AM fix was USD 1,681.00, EUR 1,257.67 and GBP 1,045.92 per ounce.

Today’s AM fix was USD 1,681.00, EUR 1,257.67 and GBP 1,045.92 per ounce.

Yesterday’s AM fix was USD 1,667.75, EUR 1,246.82 and GBP 1,034.39 per ounce.

Silver is trading at $31.14/oz, €23.48/oz and £19.49/oz. Platinum is trading at $1,690.50/oz, palladium at $704.00/oz and rhodium at $1,125/oz.

Cross Currency Table – (Bloomberg)

Gold climbed $5.20 or 0.31% in New York yesterday and closed at $1,668.40/oz. Silver surged to as high as $31.16 and finished with a gain of 1.94%.

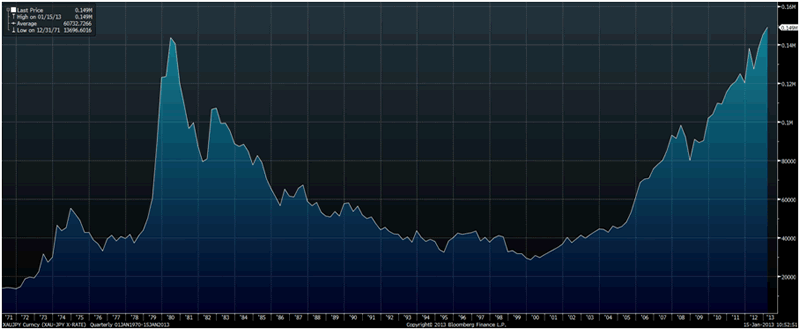

XAU/JPY Exchange Rate, Quarterly, 1970-2013 - (Bloomberg)

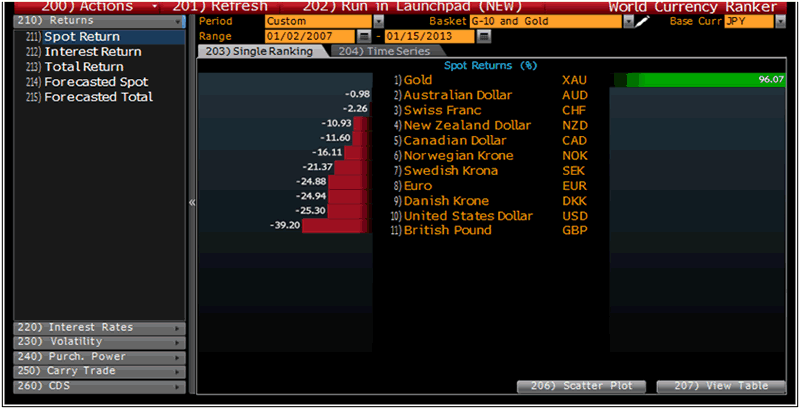

The yen fell to 149,588.2 yen against gold, its lowest level since 1980. According to the data on Bloomberg, the all-time record high for gold priced in yen was 204,850 yen on January 21, 1980.

Thus, yen gold remains 37% below the record intraday nominal high from 1980. Given the Japanese determination to devalue the yen to escape deflation, the record nominal high will almost certainly be reached in the next year or two.

Asian demand has definitely picked up again ahead of Chinese New Year. Gold bar premiums in Hong Kong are $1.25 an ounce, the most since July, and in Singapore $1.10 an ounce, the highest since March, Barclays Plc said according to Bloomberg.

Thus, reports of a record gold high in yen are not 100% accurate. The benchmark gold contract on the Tokyo Commodity Exchange rose to a record high of 4,821 yen a gram. The Tokyo Gold Exchange was only founded in February, 1982 so data does not capture gold’s record nominal highs in yen in 1980.

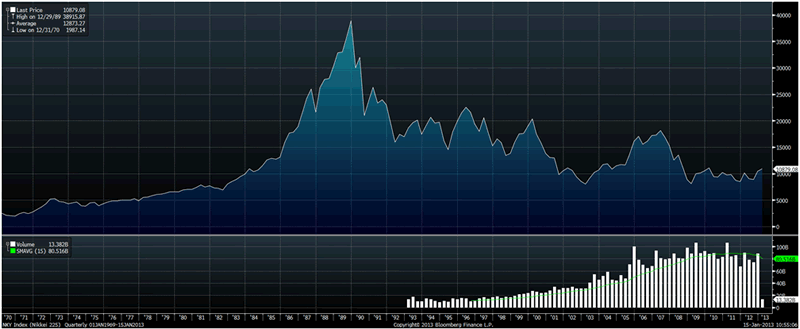

Nikkei Index, Quarterly, 1969-2013 – (Bloomberg)

Gold’s significant outperformance over stocks in Japan and internationally is leading to increased diversification into gold bullion from pension funds and institutions in Japan and internationally and this is set to continue.

The gold-platinum spread closed in to $12.30/oz, its smallest in nine months. Supply concerns plus the perception of an improving global economic outlook drove investors to metals with industrial applications, such as platinum and palladium.

A LBMA panel of invited precious metal experts is predicting a 5% increase in the average gold price for 2013, slightly more for silver and platinum while palladium is seen as the precious metals biggest gainer.

Goldman Sachs is recommending “fresh tactical longs in gold” as the U.S. government debates whether to raise the debt ceiling.

Yesterday, Federal Reserve Chairman Ben Bernanke urged U.S. lawmakers to raise the country's borrowing limit to avoid a potentially disastrous debt default, warning that the economy was still at risk from a political standoff over the budget deficit.

Bernanke’s comments that the U.S. central bank isn't in a hurry to stop buying bonds and would continue its current ultra loose monetary policies saw the dollar fall on international markets.

U.S. Treasury 10-year note yields fell one basis point to 1.83 percent. Treasury Secretary Timothy F. Geithner warned yesterday that failure to raise the debt ceiling would “impose severe economic hardship.”

Bernanke gave only a brief response to the bizarre idea of the government issuing a $1 trillion platinum coin to try and avoid the debt ceiling and pay its bills. Over the weekend, the Treasury Department and the Fed both ruled out the idea, saying it wasn’t the right way to go.

“I’m not going to give that any oxygen,” he said.

The yen fell by more than 20% against gold in 2012 and analysts are concerned that Prime Minister Abe and his new government’s determination to stoke inflation, devalue the currency and promote growth could lead to further falls in 2013.

Economy Minister Akira Amari said today that Japan faces risks from declines in the yen after it weakened 3% this year against a basket of developed market currencies and by more than 20% against gold.

The monetary and financial system remains fragile. Therefore, we recommend investors who wish to grow and protect their wealth to allocate physical gold to a diversified portfolio.

For breaking news and commentary on financial markets and gold, follow us onTwitter.

Currency Ranked Returns in Yen – (Bloomberg)

For the latest news and commentary on financial markets and gold please follow us on Twitter.

GOLDNOMICS - CASH OR GOLD BULLION?

'GoldNomics' can be viewed by clicking on the image above or on our YouTube channel:

www.youtube.com/goldcorelimited

This update can be found on the GoldCore blog here.

Yours sincerely,

Mark O'Byrne

Exective Director

IRL |

UK |

IRL +353 (0)1 632 5010 |

WINNERS MoneyMate and Investor Magazine Financial Analysts 2006

Disclaimer: The information in this document has been obtained from sources, which we believe to be reliable. We cannot guarantee its accuracy or completeness. It does not constitute a solicitation for the purchase or sale of any investment. Any person acting on the information contained in this document does so at their own risk. Recommendations in this document may not be suitable for all investors. Individual circumstances should be considered before a decision to invest is taken. Investors should note the following: Past experience is not necessarily a guide to future performance. The value of investments may fall or rise against investors' interests. Income levels from investments may fluctuate. Changes in exchange rates may have an adverse effect on the value of, or income from, investments denominated in foreign currencies. GoldCore Limited, trading as GoldCore is a Multi-Agency Intermediary regulated by the Irish Financial Regulator.

GoldCore is committed to complying with the requirements of the Data Protection Act. This means that in the provision of our services, appropriate personal information is processed and kept securely. It also means that we will never sell your details to a third party. The information you provide will remain confidential and may be used for the provision of related services. Such information may be disclosed in confidence to agents or service providers, regulatory bodies and group companies. You have the right to ask for a copy of certain information held by us in our records in return for payment of a small fee. You also have the right to require us to correct any inaccuracies in your information. The details you are being asked to supply may be used to provide you with information about other products and services either from GoldCore or other group companies or to provide services which any member of the group has arranged for you with a third party. If you do not wish to receive such contact, please write to the Marketing Manager GoldCore, 63 Fitzwilliam Square, Dublin 2 marking the envelope 'data protection'

GoldCore Archive |

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.