What Will Gold Do in 2013

Commodities / Gold and Silver 2013 Jan 15, 2013 - 11:16 PM GMTBy: Jeff_Clark

As we turn the calendar over, there are probably two dominant questions on the minds of most precious-metals investors: Will gold and silver have a better year than the last two? And will gold stocks finally break out of their funk?

As we turn the calendar over, there are probably two dominant questions on the minds of most precious-metals investors: Will gold and silver have a better year than the last two? And will gold stocks finally break out of their funk?

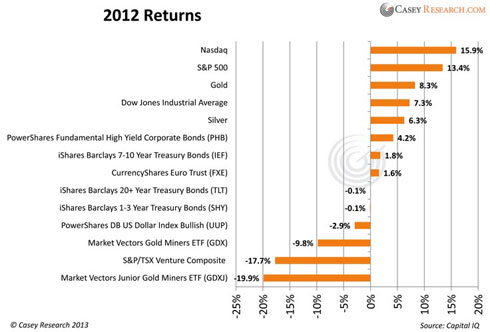

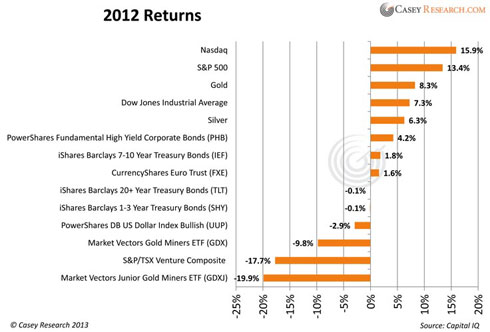

2012 was an interesting year for our favorite metal. On one hand, gold was up only single-digit percentages for the second consecutive year: 8.3%, after rising just 9.1% in 2011. It was also outperformed by the S&P 500 Index, though this was the first time since 2004 and only the third since 1999. On the other hand, the price has now risen 12 consecutive years, overshadowing most other bull markets in modern history.

Gold stocks as a group were down for the second consecutive year. GDX (Gold Miners ETF) fell 9.8%, after dropping 16.3% in 2011. GDXJ (Junior Gold Miners ETF) lost 19.9% last year, after sinking 38% in 2011.

Here's a snapshot of our industry for 2012, along with how it compares to other asset classes.

Perhaps a more constructive way to view things is from a longer-term perspective. How have these same sectors performed since the 2008 financial crisis?

Over the past four years, gold and silver have provided the best returns among major asset classes. Gold producers, meanwhile, have collectively underperformed the metal, while the juniors as a whole have lost money.

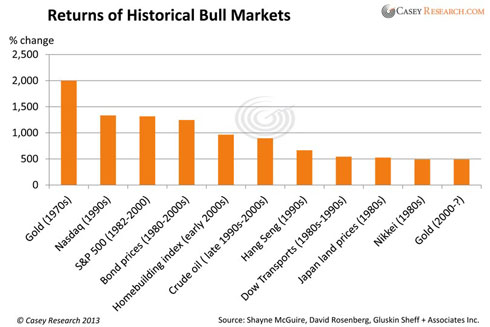

Some claim that gold is in a bubble, because it has advanced so much. "It's already gone up a lot," they say. The reality is, however, that this bull market is small compared to most others in modern history.

Over the past 40+ years, our bull market would be among the smallest of the major bull markets listed, in terms of percent gains. It's about a quarter of what the 1970s bull market returned. A good number of them also lasted longer than ours. Based strictly on percentages, I'd bet that ours isn't over.

Further, history shows that bull markets tend to end in a climactic blow-off top. For example, gold rose 120% in 1979. Our best year was 32% in 2007. Hardly meteoric, and contrary to how the typical bull market culminates.

And this is all without getting into all the fundamental reasons to continue buying gold.

So what does the gold price do in 2013?

I think that's the wrong question. Since gold is the best and longest-lasting way to store wealth ever adopted in history, and not technically an investment, the more accurate query is: will gold continue to protect my purchasing power?

Worded that way, we begin to see gold its proper light: real money. If we're holding gold as money, the question then becomes: how much is our purchasing power in dollars or other alternatives to gold likely to decrease this year? And in future years?

If there's one thing we're certain of, it's that the current path of debt accumulation, deficit spending, and money printing will continue to devalue dollars and other unbacked currencies – and probably at an accelerating speed in the not-too-distant future. That makes gold a must-own asset despite its 500+% advance since 2001.

I've read some analysts claim that these things are already factored into the gold price. That's debatable, but even if they're right, what's not priced in are the delayed and indirect consequences from all those actions...

- What fallout have we experienced from our growing pile of national debt? The world economy is still functioning and some say improving.

- What spillover has occurred from our government spending more than it takes in? My retired parents still get their Social Security checks every month.

- Is there any negative backlash from printing all this money? Most would point to rising stock-market and real-estate prices, both positive things.

The problem is that overindebtedness, overspending, and printing currency is not all candy, lollipops, and romantic horseback rides on the beach. It's not free of consequences. We have yet to experience the full ramifications of how these actions are undermining our currency. And that won't be a fun or pain-free process.

For this month's issue of BIG GOLD, we interviewed 19 noted economists, gold analysts, best-selling authors, fund managers, and senior Casey Research staff – and not one of them believes the fallout from the reckless monetary policies of governments around the world has peaked. Most believe the worst is yet to come, with varying degrees of aftereffects. And they all recommend continuing to buy gold. If you're not reading BIG GOLD, this is the perfect issue to start with… following the investment recommendations from this highly successful group, your portfolio will be positioned for maximum effect for 2013 and beyond.

As a free preview, I'll mention that most of the experts I surveyed believe that the coming fallout will take an inflationary form. All are concerned. Even those who think deflation is more likely urge investors to hold gold as one of the best ways to protect themselves for what lies ahead.

They also point out that while gold stocks have been disappointing, they represent an incredible bargain at present, and that while they could get cheaper, the potential upside far outweighs the downside at this point. I'm also happy to point out that while GDX dropped 9.8% last year, the BIG GOLD portfolio was up 7.8% – and that's without averaging down, which many subscribers took advantage of. I'm convinced that our portfolio holds the best gold producers, and most of our experts name their BIG GOLD favorites.

In the hot-off-the-presses International Speculator, Casey Research Senior Metals Investment Strategist Louis James names a stock currently on the deep-discount rack that he's convinced won't stay there for long. The first two sentences from his introduction were very clear and direct, and spurred me to log on to my brokerage account and take action.

So, what will gold do this year and beyond? Whatever crazy and unpredictable twists and turns history takes in the future, gold will still be gold, and the best way yet devised to safeguard wealth.

The ultimate question then is: what standard of living would you like to maintain?

Most people would say: "As high as I can!" That's why we continue to buy gold. And based on our research, lessons from history, and some of the most successful investors in the sector, we have a long way to go in this gold bull market.

© 2013 Copyright Casey Research - All Rights Reserved

Disclaimer: The above is a matter of opinion provided for general information purposes only and is not intended as investment advice. Information and analysis above are derived from sources and utilising methods believed to be reliable, but we cannot accept responsibility for any losses you may incur as a result of this analysis. Individuals should consult with their personal financial advisors.

Casey Research Archive |

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.