Gold Will Prove A Safe Haven From Currency Storms

Commodities / Gold and Silver 2013 Jan 18, 2013 - 02:44 PM GMTBy: GoldCore

Today’s AM fix was U.S.D 1,690.00, EUR 1,265.82, and 1,060.49 GBP per ounce.

Today’s AM fix was U.S.D 1,690.00, EUR 1,265.82, and 1,060.49 GBP per ounce.

Yesterday’s AM fix was U.S.D 1,683.25, EUR 1,260.11 and GBP 1,050.85 per ounce.

Silver is trading at $31.79/oz, €23.91/oz and £20.04/oz. Platinum is trading at $1,695.25/oz, palladium at $723.00/oz and rhodium at $1,150/oz.

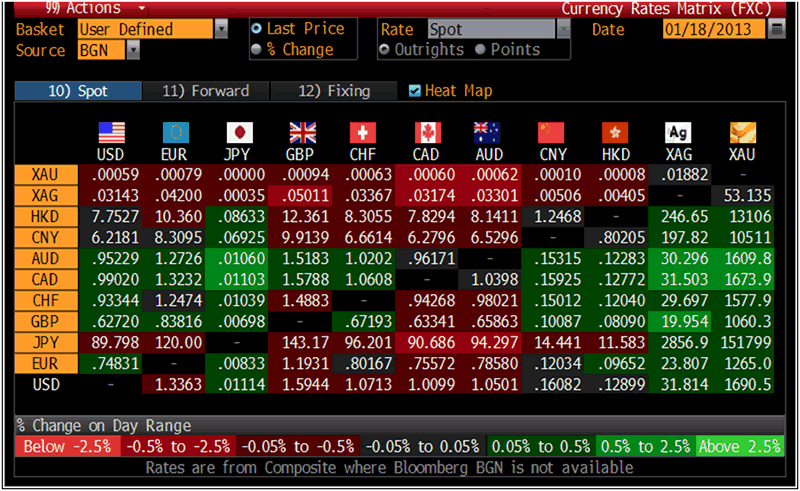

Cross Currency Table – (Bloomberg)

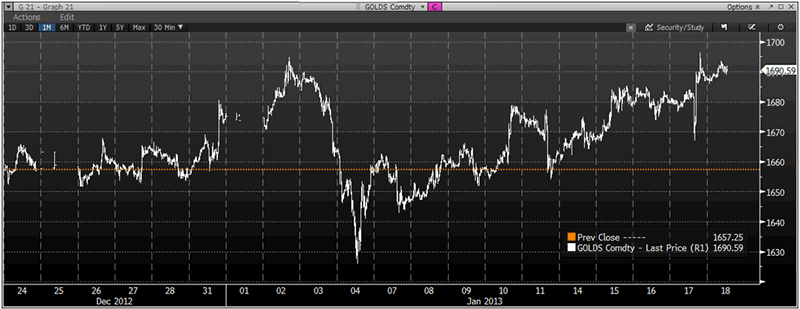

Gold rose $7.00 or 0.42% in New York yesterday and closed at $1,686.90/oz. Silver fell to a low of $31.038 in early New York trade, but then it surged to a high of $31.891 at about 1800 GMT and finished with a gain of 0.7%.

Gold in USD, 2 Months & 30 Minutes – (Bloomberg)

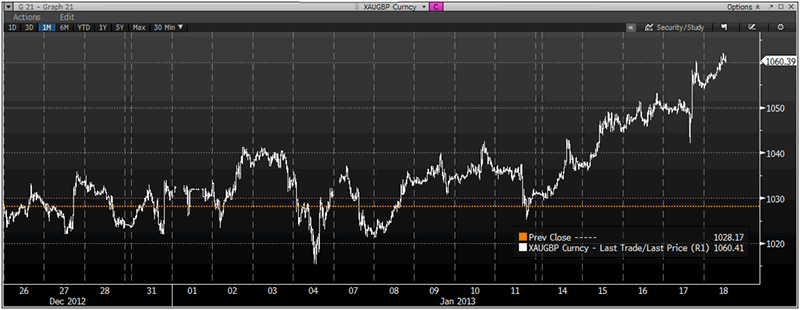

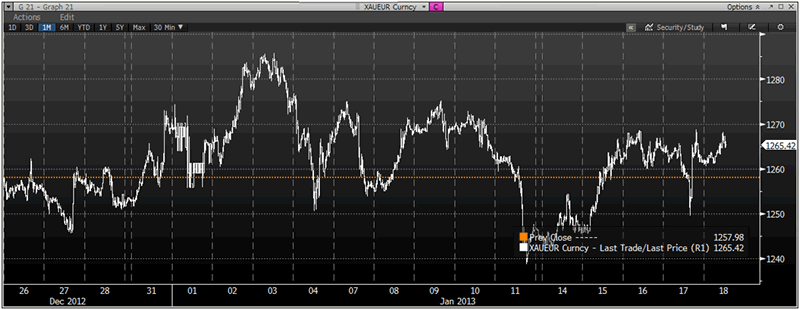

Gold is higher in all currencies this week. It is up 1.7% in dollar terms, 1.5% in euro terms, 2.4% in yen terms and 2.8% in pound terms.

Some investors see the recent sell off as overdone and are buying gold on the dip in anticipation of further gains in 2013. While gold looks poor from a technical point of view, after a series of weekly losses, its fundamentals of robust investment and central bank demand remain intact.

The almost certain higher weekly close today may embolden bulls who are expected to come back into the market.

Gold will be supported by the U. S. political standoff about the debt ceiling and expectations of continual quantitative easing.

Gold trading on the Tokyo Commodity Exchange hit a new high of 4,911 yen a gram when the yen plummeted to a 2 ½ year low against the dollar and a 33 year low against gold.

XAU/EUR, 2 Months & 30 Minutes – (Bloomberg)

Silver has surged in all currencies this week. It is up 4.5% in dollar terms, 4.2% in euro terms, 5% in yen terms and 5.4% in pound terms.

Sterling’s sharp falls against gold and particularly silver are due to increasing concerns about the outlook for sterling – including concerns of a currency crisis.

Palladium hit a 16 month high on Friday and platinum was near the 3 month high hit in the prior trading session.

Gold bullion approached a 1 month high on economic data from China and the U.S. yesterday and more importantly as traders digested the surprising German gold repatriation news.

CNBC reports that traders are concerned about the German repatriation of gold (see video).

The concern is that the U.S. Federal Reserve and other central bank gold reserves are not backed ounce for ounce. This is fertile ground for so called “conspiracy theorists” and the Bundesbanks’s actions have ironically highlighted the issue and led to deeper suspicions.

Questions are being asked regarding the extremely long delay of 7 years to repatriate just some of their gold from the U.S. Federal Reserve's subterranean vault in flood prone lower Manhattan.

Venezuala managed to have all their reserves transferred from the Bank of England to Caracas in weeks.

A lack of trust regarding central bank gold reserves could lead to a form of a run on central banks gold reserves. The concern is and it is alleged that they are, in effect, fractional like our modern banking system.

U.S. housing and labour market data out yesterday were somewhat better than expected and China broke the pattern of 7 quarters of contraction – although the data out of China in particular is being examined more dubioU.S.ly recently.

The U.S. Mint has already sold out its 2013 American Eagle silver bullion coins due to soaring demand in the first two weeks of January.

The jump in the silver ETF holdings to a new all time high shows how some investor's see poor man's gold as a cheaper alternative to the yellow metal and are allocating to it. Yet, allocations to silver remain very small which suggests that the holdings could go higher resulting in higher silver prices again in 2013.

XAU/GBP, 2 Months & 30 Minutes – (Bloomberg)

Demand for gold is likely to rise as the world heads towards a multi-currency reserve system under the impact of uncertainty about the stability of the dollar and the euro, the main official assets held by central banks and sovereign funds.

This is the conclusion of a wide-ranging analysis of the world monetary system by Official Monetary and Financial Institutions Forum, (OMFIF), the global monetary think-tank, in a report commissioned by the World Gold Council, the gold industry’s market development body.

The report warns of “twin shocks” to the dollar and the euro and of a “coming dollar shock” and points out how gold would be a safe haven in a dollar crisis.

“Gold has a lot going for it; it correlates negatively with the greenback, and no other reserve asset seems safe from the coming dollar shock.”

“The world is preparing for possible twin shocks from the parlous. position of the two main reserve currencies, the dollar and the euro. As China weighs up its options for joining in the reserve asset game, gold – the official asset that plays no formal part in the monetary system, yet has never really gone away – is poised, once again, to play a pivotal role.

Many dismiss gold as a relic of the past or as an inadequate hedge against inflation. But from an asset management point of view, as well as on the basis of political analysis, gold has a lot going for it; it correlates negatively with the greenback, and no other reserve asset seems safe from the coming dollar shock.”

The OMFIF offers a confidential, convenient and discreet forum to a unique membership of central banks, sovereign funds, financial policy-makers and market participants who interact with them.

They note that “western economies have attempted to dismantle gold's monetary role. This has failed.”

The report says China's yuan is emerging as a genuine international currency.

“As China aspires to take the lead politically and economically, it is unlikely to be satisfied with storing its wealth simply in liabilities of other countries.”

"The world is headed toward uncharted waters of a durable multi-currency reserve system," it said.

During this uncertain transition period, central banks around the world are expected to increase their interest in gold.

They believe “that the role of gold in the international monetary system will be further enhanced in the coming 10 years as a result of basic uncertainties over the dollar and the euro.”

“For central banks, concerned with preserving value and naturally politically cautious, gold will prove a haven from currency storms.”

GoldCore have long pointed out the real possibility that the world will return to some form of gold standard. Not through a decision of the U.S. Federal Reserve, ECB or BOE but rather through a decision by the People’s Bank of China or the Bank of Russia. They may bring some form of gold backing to their currencies. This would force the hand of western central banks and make them follow suit in order to maintain faith in their currencies.

The unchartered waters and choppy seas of today’s international monetary system make owning physical gold more important than ever.

For the latest news and commentary on financial markets and gold please follow us on Twitter.

GOLDNOMICS - CASH OR GOLD BULLION?

'GoldNomics' can be viewed by clicking on the image above or on our YouTube channel:

www.youtube.com/goldcorelimited

This update can be found on the GoldCore blog here.

Yours sincerely,

Mark O'Byrne

Exective Director

IRL |

UK |

IRL +353 (0)1 632 5010 |

WINNERS MoneyMate and Investor Magazine Financial Analysts 2006

Disclaimer: The information in this document has been obtained from sources, which we believe to be reliable. We cannot guarantee its accuracy or completeness. It does not constitute a solicitation for the purchase or sale of any investment. Any person acting on the information contained in this document does so at their own risk. Recommendations in this document may not be suitable for all investors. Individual circumstances should be considered before a decision to invest is taken. Investors should note the following: Past experience is not necessarily a guide to future performance. The value of investments may fall or rise against investors' interests. Income levels from investments may fluctuate. Changes in exchange rates may have an adverse effect on the value of, or income from, investments denominated in foreign currencies. GoldCore Limited, trading as GoldCore is a Multi-Agency Intermediary regulated by the Irish Financial Regulator.

GoldCore is committed to complying with the requirements of the Data Protection Act. This means that in the provision of our services, appropriate personal information is processed and kept securely. It also means that we will never sell your details to a third party. The information you provide will remain confidential and may be used for the provision of related services. Such information may be disclosed in confidence to agents or service providers, regulatory bodies and group companies. You have the right to ask for a copy of certain information held by us in our records in return for payment of a small fee. You also have the right to require us to correct any inaccuracies in your information. The details you are being asked to supply may be used to provide you with information about other products and services either from GoldCore or other group companies or to provide services which any member of the group has arranged for you with a third party. If you do not wish to receive such contact, please write to the Marketing Manager GoldCore, 63 Fitzwilliam Square, Dublin 2 marking the envelope 'data protection'

GoldCore Archive |

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.