Pacific Group Becomes Latest Hedge Fund Converting Assets to Physical Gold

Commodities / Gold and Silver 2013 Jan 21, 2013 - 01:04 PM GMTBy: GoldCore

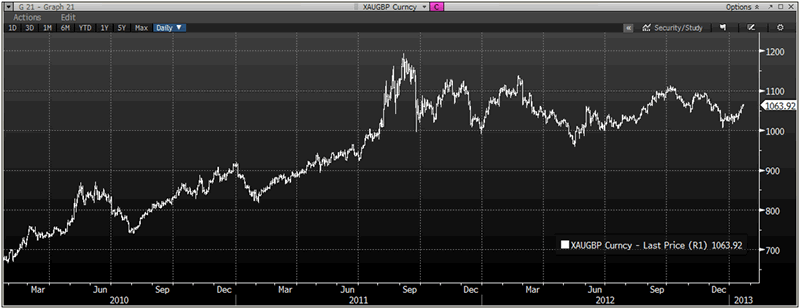

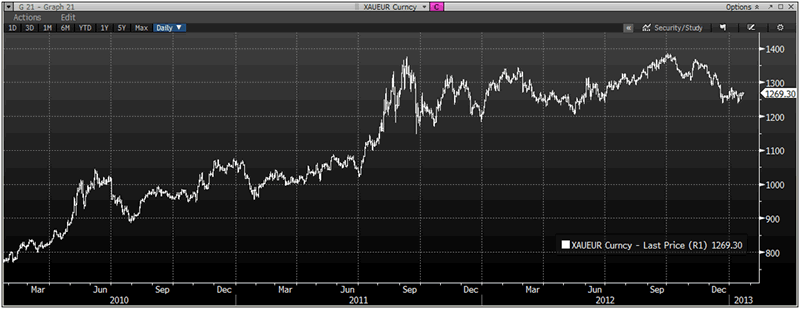

Today’s AM fix was USD 1,688.00, EUR 1,269.08, and GBP 1063.58 per ounce.

Today’s AM fix was USD 1,688.00, EUR 1,269.08, and GBP 1063.58 per ounce.

Friday’s AM fix was USD 1,690.00, EUR 1,265.82, and GBP 1,060.49 per ounce.

Silver is trading at $31.98/oz, €24.10/oz and £20.21/oz. Platinum is trading at $1,672.00/oz, palladium at $716.00/oz and rhodium at $1,200/oz.

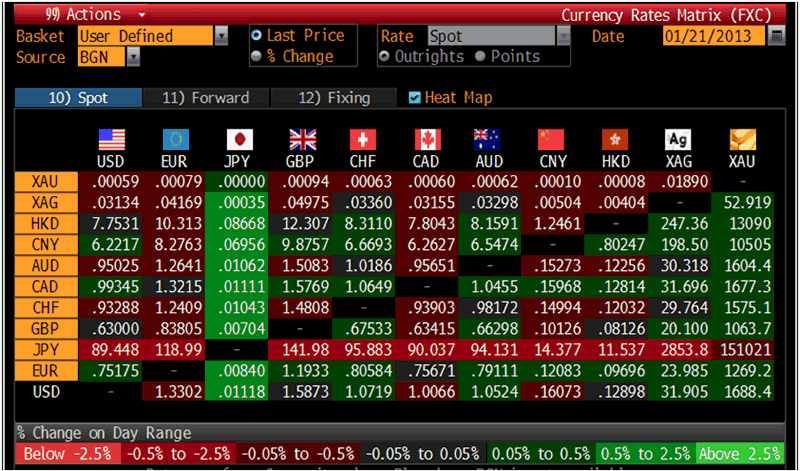

Cross Currency Table – (Bloomberg)

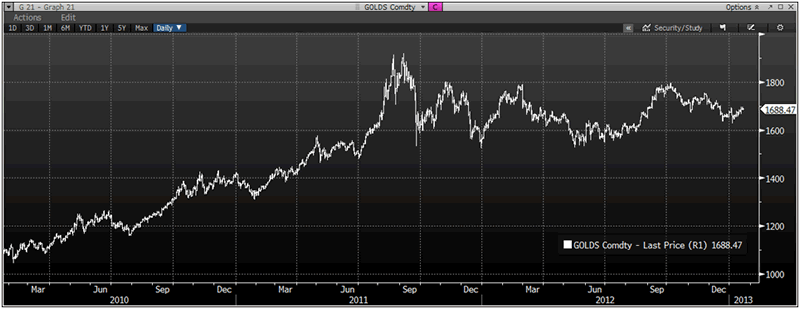

Gold was up 1.26% for the week and silver was up 4.60%. Gold fell $2.80 or 0.17% in New York on Friday and closed at $1,684.10/oz. Silver surged to a high of $32.11 before it also edged off, but it still finished with a gain of 0.47%.

Gold in USD, Daily, 2010-1013 – (Bloomberg)

Gold inched up on Monday on concerns about currency debasement and even looser monetary policies to be announced from the Bank of Japan.

BOJ is examining an open-ended pledge to buy assets until a 2% inflation target is near which is pushing the yen to a 2 ½ year low. Gold bullion on the TOCOM soared to match a multiyear record of 4,911 yen a gram before giving up gains.

Physical gold demand is also ramping up in Asia with the upcoming Lunar New Year festivities just around the corner on February 10th.

This week’s economic highlights include Existing Home Sales on Tuesday, the FHFA Housing Price Index on Wednesday, Initial Jobless Claims and Leading Economic Indicators on Thursday, and New Home Sales on Friday. Next week investors will closely watch to the U.S. Federal Reserve's policy meetings on the 29th and 30th.

XAU/GBP Daily, 2010-2013 – (Bloomberg)

Sweden’s central bank hasn’t carried out any physical checks of its gold reserves deposited with central banks abroad and relies on the respective authorities to do so, Dagens Industri reported, citing the Riksbank.

Central banks internationally, from Ireland to Germany and now in Sweden, are being forced to answer legitimate questions about their gold reserves by concerned citizens.

Swedish gold reserves are 126 metric tonnes and are valued at almost 45 billion Swedish krone.

The Riksbank confirmed that the majority of Swedish gold reserves are located abroad.

XAU/EUR Daily, 2010-2013 – (Bloomberg)

Another respected hedge fund, the Pacific Group, has decided to convert one third of its hedge-fund assets into physical gold.

The Pacific Group Ltd., which manages over a $100 million worth of assets, believes that gold will continue to rise as governments print more money to pay off debt, according to Bloomberg.

Thus, continues the trend of some of the smartest money in the world diversifying some of their holdings into physical gold.

Respected hedge fund managers and investors such as George Soros, John Paulson, Bill Gross, David Einhorn and Kyle Bass have diversified into gold - the latter two opting for the safety of allocated physical gold bars.

The Hong Kong-based asset manager plans to take delivery of $35 million worth of gold bars that can be traded on the London Bullion Market Association and other international markets, William Kaye, its founder and chief investment officer, said in a telephone interview on January 18.

It has secured vault space at Hong Kong International Airport to store the gold, he said.

Investors disillusioned with government money printing to service “insurmountable” public debt may seek alternatives to fiat currencies, Kaye said.

Fiat currencies have no tangible backing, such as gold or silver, except governments’ good faith and can become worthless due to hyperinflation or loss of public faith.

Central banks have so far been able to manipulate interest rates to allow governments to service their debt at low costs, averting market seizures, Kaye said. Still, the next big rally in precious-metal prices may be 18 months to two years away, triggered by a “financial catastrophe,” he added.

Ownership of gold through financial instruments based on it, such as Comex futures contracts, now represents more than 100 times the physical gold that exists above ground worldwide, Kaye said, citing the Pacific Group’s own analysis.

“Gold, the way we look at it, is anywhere from being undervalued to being seriously undervalued,” Kaye said. “We’re in the early stages, in our judgment, of what would likely be the world’s largest short squeeze in any instrument.”

The likelihood of a massive short squeeze has been predicted for some years by GATA, the Gold Anti Trust Action Committee and by financial journalist, Max Keiser and many others, including GoldCore.

The idea appears to be becoming accepted in the wider investment world.

“All you actually need for a major upward revaluation of gold is for a small fraction of people to physically reclaim from major central banks or other depositories that are holding your gold and using it for their purposes,” he added.

The Pacific Group has just converted the first tranche of such investments, buying gold bars from local refineries, Kaye said without giving the exact value of the delivery.

For the latest news and commentary on financial markets and gold please follow us on Twitter.GOLDNOMICS - CASH OR GOLD BULLION?

'GoldNomics' can be viewed by clicking on the image above or on our YouTube channel:

www.youtube.com/goldcorelimited

This update can be found on the GoldCore blog here.

Yours sincerely,

Mark O'Byrne

Exective Director

IRL |

UK |

IRL +353 (0)1 632 5010 |

WINNERS MoneyMate and Investor Magazine Financial Analysts 2006

Disclaimer: The information in this document has been obtained from sources, which we believe to be reliable. We cannot guarantee its accuracy or completeness. It does not constitute a solicitation for the purchase or sale of any investment. Any person acting on the information contained in this document does so at their own risk. Recommendations in this document may not be suitable for all investors. Individual circumstances should be considered before a decision to invest is taken. Investors should note the following: Past experience is not necessarily a guide to future performance. The value of investments may fall or rise against investors' interests. Income levels from investments may fluctuate. Changes in exchange rates may have an adverse effect on the value of, or income from, investments denominated in foreign currencies. GoldCore Limited, trading as GoldCore is a Multi-Agency Intermediary regulated by the Irish Financial Regulator.

GoldCore is committed to complying with the requirements of the Data Protection Act. This means that in the provision of our services, appropriate personal information is processed and kept securely. It also means that we will never sell your details to a third party. The information you provide will remain confidential and may be used for the provision of related services. Such information may be disclosed in confidence to agents or service providers, regulatory bodies and group companies. You have the right to ask for a copy of certain information held by us in our records in return for payment of a small fee. You also have the right to require us to correct any inaccuracies in your information. The details you are being asked to supply may be used to provide you with information about other products and services either from GoldCore or other group companies or to provide services which any member of the group has arranged for you with a third party. If you do not wish to receive such contact, please write to the Marketing Manager GoldCore, 63 Fitzwilliam Square, Dublin 2 marking the envelope 'data protection'

GoldCore Archive |

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.