German Gold Repatriation Is Victory For Transparency And GATA

Commodities / Gold and Silver 2013 Jan 29, 2013 - 04:10 PM GMTBy: GoldCore

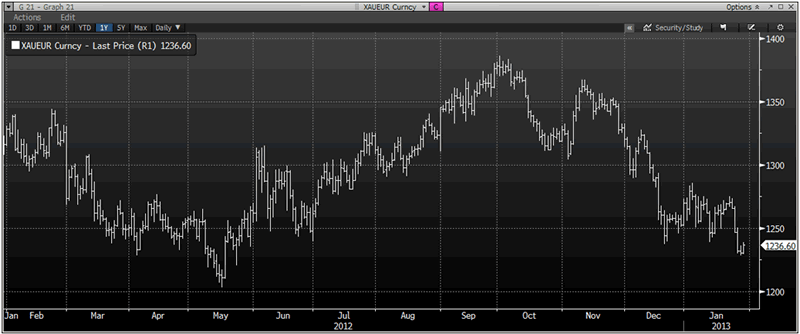

Today’s AM fix was USD 1,660.50, EUR 1,235.12, and GBP 1,057.17 per ounce.

Today’s AM fix was USD 1,660.50, EUR 1,235.12, and GBP 1,057.17 per ounce.

Yesterday’s AM fix was USD 1,656.75, EUR 1,232.43, and GBP 1,052.77 per ounce.

Silver is trading at $31.09/oz, €23.23/oz and £19.84/oz. Platinum is trading at $1,675.50/oz, palladium at $737.00/oz and rhodium at $1,200/oz.

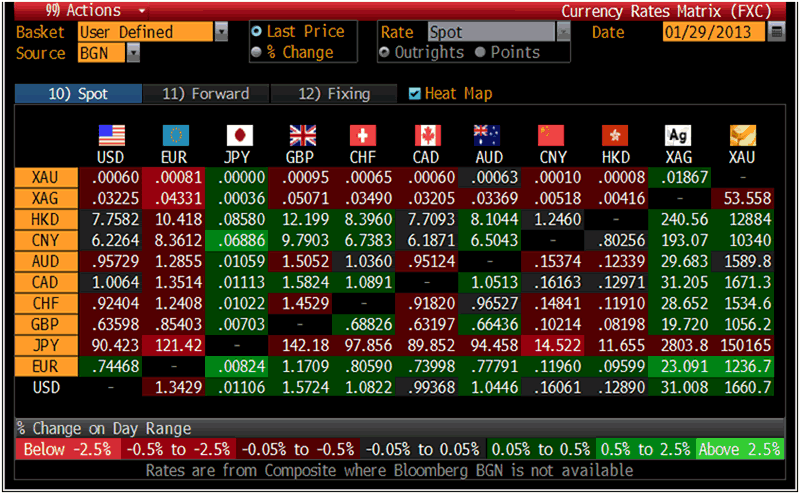

Cross Currency Table – (Bloomberg)

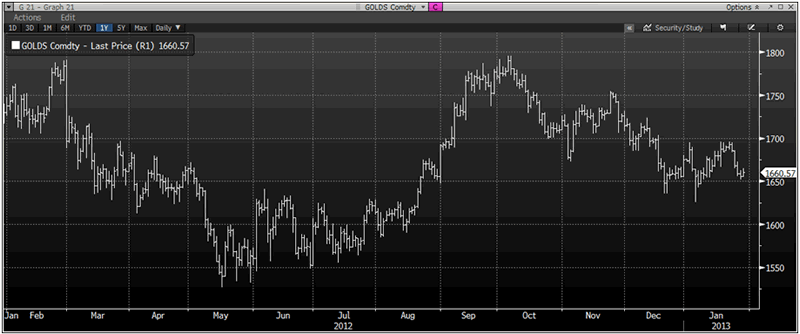

Gold fell $4.00 or 0.24% in New York yesterday and closed at $1,654.90/oz. Silver climbed to $31.30 in Asia before it eased off to $30.73 and finished with a loss of 1.09%.

Gold in USD, 1 Year – (Bloomberg)

Gold inched up on Tuesday as some investors judged the recent sell off overdone. Recent positive U.S. economic data is stirring misguided optimism of an economic recovery and may have led less aware investors to recently reduce allocations to gold.

Fitch’s rating agency said it is scaling back the chance of removing the U.S.’s AAA rating status, based on the recent deal reached on the debt limit. They cite this exercise in kicking the can down the road again as a reason to avoid the cut however they warned of continuing danger due to the appalling U.S. fiscal position.

Fitch said that the U.S. is not completely in the clear – which is putting it mildly.

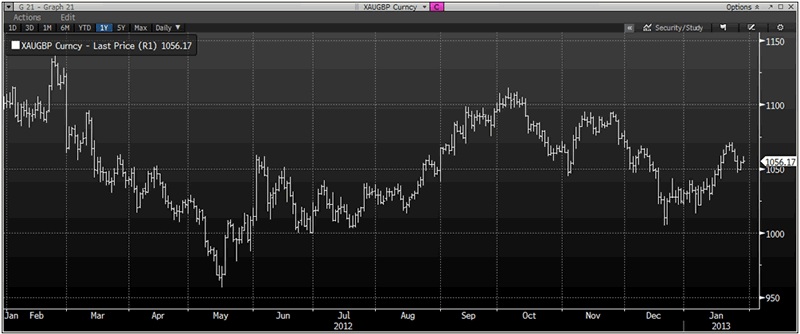

XAU/GBP, 1 Year – (Bloomberg)

England’s risk of a credit downgrade is said to have led to the sterling’s dive into a 13 month low against the euro and a 5 month low versus the greenback.

It also led to sterling falling 2.2% against gold in 2012 and those losses have accelerated in 2013 with sterling already down 2.4% in January alone.

The U.S. Federal Open Market Committee meets today and tomorrow they will announce their policy statement but most economists expect their loose monetary stance to be unchanged which will support gold.

Economic data reporting today in the U.S. is the Case-Shiller 20-city Index (1400 GMT) and Consumer Confidence (1500 GMT). ADP Employment, GDP, and a FOMC Rate Decision on tomorrow, Initial Jobless Claims, Personal Income and Spending, Core PCE Prices, the Employment Cost Index, and Chicago PMI on Thursday, and January’s jobs data, Michigan Sentiment, the ISM Index, and Construction Spending on Friday.

The Financial Times has said that the Bundesbank’s move to repatriate 674 tonnes of the German gold reserves from Paris and New York to Frankfurt is a victory for openness, transparency and for those who have campaigned for transparency in the gold market for years.

The FT said that the move is important -

“not for what it says about Germany’s faith in French or American vaults; nor for the cost of shifting 674 tonnes of gold; but because it is a major victory for transparency in the gold market.”

The move by the Bundesbank to be more transparent about the location of gold reserves was welcomed by the FT and the FT’s commodities correspondent Jack Farchy noted that while central banks should not have to reveal their trading strategies to the world, there is a world of difference between this and –

“disclosing simple facts about your reserves – such as their quantity, where they are held, whether they have been lent or swapped, and so forth – with a delay if need be.”

XAU/EUR, 1 Year – (Bloomberg)

The article concluded:

“That the Bundesbank has been nudged into this new-found transparency must be chalked up as a victory for the groups of investors – most prominent among them, the Gold Anti-Trust Action Committee, or GATA – that have for years been asking central banks to reveal their activities in the gold market.”

“If central banks wish to refute suggestions from such groups that their gold does not exist, or that they are scheming to manipulate prices, they could do worse than to follow the Bundesbank’s lead.”

Those who have dismissed the Gold Anti-Trust Action Committee or GATA as “conspiracy theorists” may now wish to apologise and acknowledge the documentation and evidence that GATA have amassed over the years.

GATA have long made a strong case that certain banks may have been manipulating gold and silver prices lower. In the same way that banks conspired to rig LIBOR and interest rates.

The CFTC in the U.S. has been investigating the allegations for some years but have yet to come to a conclusion or adjudicate, leading to concerns that their extensive and lengthy investigations will come to nought.

The FT article is an important development and may help bring about a free market in gold and silver prices. This should lead to a revaluation of precious metal prices to the higher levels that have been expected by more astute analysts for some time and which are merited due to the very strong fundamentals.

The inflation adjusted highs for gold and silver of $2,400/oz and $140/oz remain likely medium term price targets.

What's Going To Happen To The Price Of Gold And Silver In 2013?

Join us for a webinar on Jan 30, 2013 at 1300 GMT.

Join two experts - Money Week columnist, Dominc Frisby and GoldCore's Head of Research, Mark O'Byrne for a one hour webinar as they discuss the outlook for gold and silver in 2013.

For the latest news and commentary on financial markets and gold please follow us on Twitter.

GOLDNOMICS - CASH OR GOLD BULLION?

'GoldNomics' can be viewed by clicking on the image above or on our YouTube channel:

www.youtube.com/goldcorelimited

This update can be found on the GoldCore blog here.

Yours sincerely,

Mark O'Byrne

Exective Director

IRL |

UK |

IRL +353 (0)1 632 5010 |

WINNERS MoneyMate and Investor Magazine Financial Analysts 2006

Disclaimer: The information in this document has been obtained from sources, which we believe to be reliable. We cannot guarantee its accuracy or completeness. It does not constitute a solicitation for the purchase or sale of any investment. Any person acting on the information contained in this document does so at their own risk. Recommendations in this document may not be suitable for all investors. Individual circumstances should be considered before a decision to invest is taken. Investors should note the following: Past experience is not necessarily a guide to future performance. The value of investments may fall or rise against investors' interests. Income levels from investments may fluctuate. Changes in exchange rates may have an adverse effect on the value of, or income from, investments denominated in foreign currencies. GoldCore Limited, trading as GoldCore is a Multi-Agency Intermediary regulated by the Irish Financial Regulator.

GoldCore is committed to complying with the requirements of the Data Protection Act. This means that in the provision of our services, appropriate personal information is processed and kept securely. It also means that we will never sell your details to a third party. The information you provide will remain confidential and may be used for the provision of related services. Such information may be disclosed in confidence to agents or service providers, regulatory bodies and group companies. You have the right to ask for a copy of certain information held by us in our records in return for payment of a small fee. You also have the right to require us to correct any inaccuracies in your information. The details you are being asked to supply may be used to provide you with information about other products and services either from GoldCore or other group companies or to provide services which any member of the group has arranged for you with a third party. If you do not wish to receive such contact, please write to the Marketing Manager GoldCore, 63 Fitzwilliam Square, Dublin 2 marking the envelope 'data protection'

GoldCore Archive |

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.