Marc Faber "You Don't Own Gold And You Are In Great Danger"

Commodities / Gold and Silver 2013 Jan 31, 2013 - 08:06 PM GMTBy: GoldCore

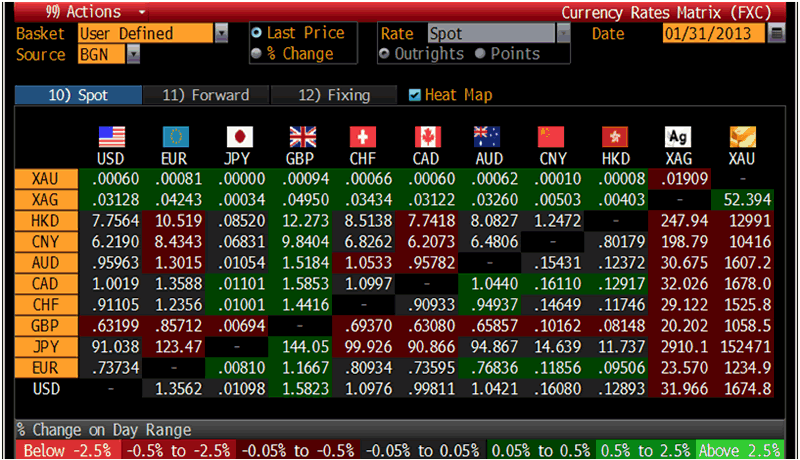

Today’s AM fix was USD 1,674.50, EUR 1,234.88, and GBP 1,058.47 per ounce.

Today’s AM fix was USD 1,674.50, EUR 1,234.88, and GBP 1,058.47 per ounce.

Yesterday’s AM fix was USD 1,666.25, EUR 1,230.70, and GBP 1,057.20 per ounce.

Silver is trading at $32.08/oz, €23.76/oz and £20.40/oz. Platinum is trading at $1,677.50/oz, palladium at $736.00/oz and rhodium at $1,200/oz.

Cross Currency Table – (Bloomberg)

Gold rose $13.80 or 0.83% in New York yesterday and closed at $1,676.50/oz. Silver slipped to a low of $31.24 in the morning, but it then ran up to a high of $32.24 and finished with a gain of 2.01%.

Gold hovered nearly unchanged after surprise GDP figures showed that the U.S. economy contracted and the U.S. Federal Reserve maintained asset purchases. Platinum is on track for its most stellar month’s performance in a year.

The U.S. GDP was -0.1% for Q4 and it was expected at 1%. This was its largest drop since 2Q 2009 as U.S. military defence spending plummeted. The Fed left their $85 billion bond-buying stimulus plan intact, citing the monetary stimulus was critical to decrease unemployment, however mentioned this lull in the U.S. economic recovery was temporary.

Investors will be watching the nonfarm payrolls data out tomorrow.

Gold reached multi year highs in Japanese yen again overnight.

TOCOM's December contract, reached a record 4,944 yen a gram or 153,000 yen per ounce. Gold as climbed more than 6% this year on a weakening yen after Prime Minister Shinzo Abe called on Japan's central bank to ease policy even more aggressively.

XAU/JPY 5 Year – (Bloomberg)

Reuters reported a dealer in Tokyo saying "Of course a weaker yen attracts buyers, but I think we shall wait for the price to hit 5,000 yen before we see some selling."

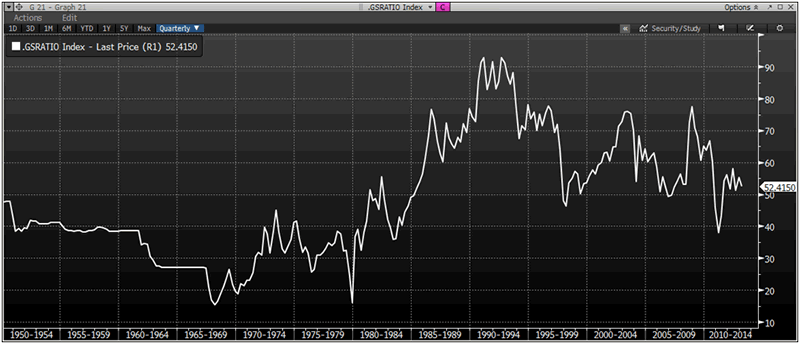

Gold Silver Ratio, Quarterly – (Bloomberg)

India's government announced it does not have plans to for additional taxes or curbs on imports of gold as it waits to see the impact of recent tax increases, said a finance ministry official yesterday.

Respected CNBC financial journalist Maria Baritromo interviewed Marc Faber, a contrarian Swiss investor and publisher of the Gloom Boom and Doom Report.

“You said a minute ago that markets go up and down, doesn’t gold go up and down too?” said Baritromo.

“Yes it does go up and down but I am fearful of a systemic crisis, wars and so on and it is because I am fearful that I own gold,” said Faber.

Maria Baritromo and Marc Faber – (CNBC)

Faber then asked Baritromo if she owned any gold. Her response was that I own earrings and jewellery.

Faber relied, “Sorry to say you are in great danger because you don't own any gold...but you have a golden personality!”

This tiny snippet of an interview highlights what research at GoldCore has been saying for years. Although many people think gold is a huge bubble like the housing market that burst, it is simply not the case.

How many people do you know that diversify their portfolios with precious metals like silver and gold bullion? Systemic risk is defined as "financial system instability, potentially catastrophic, caused or exacerbated by idiosyncratic events or conditions in financial intermediaries". This is akin to the effect of the proverbial pebble when dropped in the pond, it ripples outward.

The global marketplace is interconnected and potential danger across the pond such as the Lehman Brothers catastrophe affects investors across the world. Bullion investment is a proven hedge to diversify against systemic risk.

For the latest news and commentary on financial markets and gold please follow us on Twitter.

GOLDNOMICS - CASH OR GOLD BULLION?

'GoldNomics' can be viewed by clicking on the image above or on our YouTube channel:

www.youtube.com/goldcorelimited

This update can be found on the GoldCore blog here.

Yours sincerely,

Mark O'Byrne

Exective Director

IRL |

UK |

IRL +353 (0)1 632 5010 |

WINNERS MoneyMate and Investor Magazine Financial Analysts 2006

Disclaimer: The information in this document has been obtained from sources, which we believe to be reliable. We cannot guarantee its accuracy or completeness. It does not constitute a solicitation for the purchase or sale of any investment. Any person acting on the information contained in this document does so at their own risk. Recommendations in this document may not be suitable for all investors. Individual circumstances should be considered before a decision to invest is taken. Investors should note the following: Past experience is not necessarily a guide to future performance. The value of investments may fall or rise against investors' interests. Income levels from investments may fluctuate. Changes in exchange rates may have an adverse effect on the value of, or income from, investments denominated in foreign currencies. GoldCore Limited, trading as GoldCore is a Multi-Agency Intermediary regulated by the Irish Financial Regulator.

GoldCore is committed to complying with the requirements of the Data Protection Act. This means that in the provision of our services, appropriate personal information is processed and kept securely. It also means that we will never sell your details to a third party. The information you provide will remain confidential and may be used for the provision of related services. Such information may be disclosed in confidence to agents or service providers, regulatory bodies and group companies. You have the right to ask for a copy of certain information held by us in our records in return for payment of a small fee. You also have the right to require us to correct any inaccuracies in your information. The details you are being asked to supply may be used to provide you with information about other products and services either from GoldCore or other group companies or to provide services which any member of the group has arranged for you with a third party. If you do not wish to receive such contact, please write to the Marketing Manager GoldCore, 63 Fitzwilliam Square, Dublin 2 marking the envelope 'data protection'

GoldCore Archive |

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.