The Great Lie That Will Bankrupt America

Interest-Rates / US Debt Feb 13, 2013 - 03:55 PM GMTBy: DailyWealth

Porter Stansberry writes: The world's markets are beginning to go haywire.

Porter Stansberry writes: The world's markets are beginning to go haywire.

The world's money system – the scales upon which the world's market functions – is being deliberately destroyed. And so, the monetary signals that guide the markets – which are supposed to represent the supply and demand decisions of billions of people – have become distorted.

You can see the signs everywhere... You could see it in the equity markets a year ago. Never before had stocks been so tightly correlated to each other and to currencies, commodities, and bonds. Not everything should move in the same direction at once... but it did.

And you can see it now in the incredible bond bubble going on... Interest rates across all types of fixed-income products have never been so low. And junk bonds have never traded at such an average high price – a significant premium to par ($105).

And until recently... you could have seen it in the prices of gold and platinum. Over the past 25 years, gold has almost never traded for more than platinum. And yet, from September 2011 until just last month, it did. But both gold and silver have doubled against the dollar since 2008. Platinum was hard-pressed to keep up...

Any one of these examples, considered in isolation, seems harmless enough. But taken together, they clearly demonstrate that the markets are not working normally.

These weird situations in the markets are linked. They are all warning signs.

We believe the world's markets have gotten "out of whack." As a result, these aberrations will continue in size and scope until, at some point, they begin to seriously affect the world economy's ability to function.

You see, central banks are inflating the world's money supply at an unprecedented pace. Never before has the entire world's monetary system been completely untethered from both gold and real rates of interest. Monetary theorists believe these manipulations can deliver the benefits of free markets – wealth, abundance, a cornucopia of choices – without any of the costs: savings, investment, labor, and interest.

But we agree with Seth Klarman. The legendary value investor and head of the Baupost hedge fund described the situation like this in his annual letter:

The short-term palliatives we are currently pursuing go against everything a long-term-oriented society should aspire to achieve. Today's policies encourage spending over savings, reward the profligate over the prudent, and support the failing at the expense of the successful. The antidote now being dispensed puts us squarely in uncharted territory in which the risks are outside the range of historical experience...

The distortions in the markets are the result of the deliberate manipulation of currency values around the world by central bankers. The central bankers are responding to their political masters' demands for easier money and cheaper credit. There is now, around the world, a widespread belief that the symbol of wealth (paper money) alone can deliver all the benefits of the market.

This is the great lie. It is the final modern delusion.

Watching this tragedy unfold around the world is horrifying. The Baupost letter reminded us of the studies of Edward Gibbon, the great British historian who chronicled the rise and fall of the first great Western civilization:

In the end, more than freedom, they wanted security. They wanted a comfortable life and they lost it all – security, comfort, and freedom. When the Athenians finally wanted not to give to society but for society to give to them, when the freedom they wished for most was freedom from responsibility, then Athens ceased to be free and was never free again.

Today... these words don't merely apply to my fellow Americans – a group of people I scarcely recognize anymore. They describe almost all of the free people living in the West.

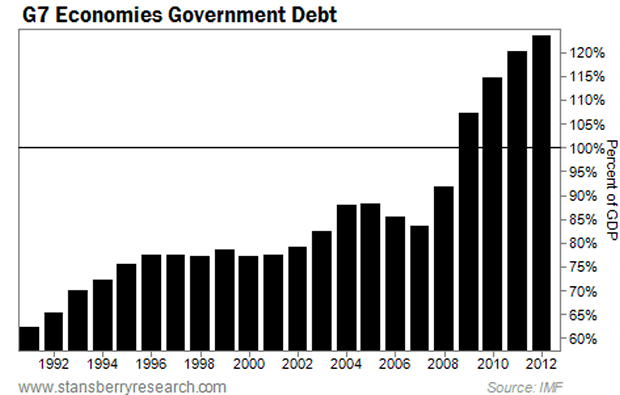

The drive for freedom and a better life through hard work, saving, and independence has been replaced by a craven need for the illusion of security. Rather than trying to leave our children in possession of a better world – with more financial security – political leaders around the world now bicker about how to change the rules so that still more debt can be stacked upon their grandchildren. You can see the result in the chart below.

This sea change in the culture of the West will have an appalling effect on our standard of living. The first changes are already being felt... real wages haven't risen in the U.S. since we left the gold standard in 1971. Much bigger declines are coming.

We believe the world's economy is now entering a kind of blind alley. By willfully abdicating the responsibilities of the markets – by monetizing our debts, by deliberately inflating our currencies, by bailing out failed companies, and by promising to deliver more benefits than can be afforded – the major economies of the West (including America's) have chosen the path of socialism.

We know there is no escape from this path, which will soon lead to massive dislocations, huge price increases, and poverty on a scale unseen during our lifetimes.

Sadly, the best way to protect yourself from this looming catastrophe is to benefit from the same policies that are causing it. That means making sure you have your wealth not in paper money, but in blue-chip businesses, productive real estate, and gold. Make sure you buy them before it's too late.

Good investing,

Porter Stansberry

The DailyWealth Investment Philosophy: In a nutshell, my investment philosophy is this: Buy things of extraordinary value at a time when nobody else wants them. Then sell when people are willing to pay any price. You see, at DailyWealth, we believe most investors take way too much risk. Our mission is to show you how to avoid risky investments, and how to avoid what the average investor is doing. I believe that you can make a lot of money – and do it safely – by simply doing the opposite of what is most popular.

Customer Service: 1-888-261-2693 – Copyright 2013 Stansberry & Associates Investment Research. All Rights Reserved. Protected by copyright laws of the United States and international treaties. This e-letter may only be used pursuant to the subscription agreement and any reproduction, copying, or redistribution (electronic or otherwise, including on the world wide web), in whole or in part, is strictly prohibited without the express written permission of Stansberry & Associates Investment Research, LLC. 1217 Saint Paul Street, Baltimore MD 21202

Disclaimer: The above is a matter of opinion provided for general information purposes only and is not intended as investment advice. Information and analysis above are derived from sources and utilising methods believed to be reliable, but we cannot accept responsibility for any losses you may incur as a result of this analysis. Individuals should consult with their personal financial advisors.

Daily Wealth Archive

|

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.