Pensions Catastrophe, Government Tricks Digging a Very Deep Hole

Economics / Pensions & Retirement Feb 14, 2013 - 09:30 AM GMTBy: John_Mauldin

“The government is the prisoner of the bureaucracy. We have 4,021 associations and 6,200 codes. You simply cannot change things. There are 600,000 tax elements. No one really knows who pays what.” – A journalist in Greece

“The government is the prisoner of the bureaucracy. We have 4,021 associations and 6,200 codes. You simply cannot change things. There are 600,000 tax elements. No one really knows who pays what.” – A journalist in Greece

For all the focus on the unfunded liabilities of Social Security and Medicare, there is another unfunded crisis brewing, and this one is in your own back yard. It’s coming to you even if you live outside of the US; it just might take a little longer to get there. I wrote ten years ago that state and local pension funds might be underfunded by as much as $2 trillion. It turns out that I was being overly optimistic. New government research suggests that the figure might be as high as $3 trillion. But what if you take into account that retirees are living longer? An IMF study that we’ll look at in a few minutes does just that. And if we live a lot longer? Oh my. The problems are not universal – some cities and states will do fine, while others are already in deep kimchee – but it’s a big problem and getting worse.

At the end of the letter, I’ll add a personal note on housing. Longtime readers know that I was bearish on housing well before the bubble. I sold my home (for personal reasons) and decided to lease until things became more settled. I have said several times that I would tell you if and when I decided to buy a home. Now, I have put an offer in on an apartment and it has been accepted. But it’s more complicated than that. (Isn’t it always?)

Before we get rolling, though, I want to announce the speaker lineup for my 10th annual Strategic Investment Conference, May 1-3. Here they are, in alphabetical order: Kyle Bass; Ian Bremmer; Mohamed El-Erian; Niall Ferguson and his wife, Ayaan Hirsi Ali; Lacy Hunt; Charles and Louis Gave; Jeff Gundlach; Anatole Kaletsky; David Rosenberg; Nouriel Roubini; and Gary Shilling. The noted geopolitical analyst Ian Bremmer (a professor at Columbia and founder of the Eurasia Group) has now been added to the list. I heard Ian last year speak on his theme of a G-Zero World and was blown away. You have to hear this one. We subsequently met in NYC and compared notes. I am really happy we could get him.

Seriously, where else can you find a roster like that? And the attendee list has a “who’s who” feel to it, as well. Those who come regularly know that the real value is in meeting the other attendees. David Rosenberg noted last year that this is the top investment conference he has ever addressed. The speakers all seem to bring their “A” game. The attendees agree, and this year we will have more interaction than ever.

The conference is cosponsored by my longtime partner Altegris Investments. All the credit for hosting a first-class conference goes to the staff at Altegris, who do a massive amount of work to pull off an event of this size and scope. All I do is get a few friends to come and speak. Oh, and this year Bloomberg will cover the conference live.

The conference always sells out, so I suggest you register at your earliest convenience. Invitations have been sent out to past attendees and those who are members of the Mauldin Circle. Registration is now open. Because of security regulations, we do have to limit attendance to accredited investors and those in the securities/investment business. You can start the process by going to the Strategic Investment Conference page. There is a significant early-bird registration discount.

How Not to Run a Pension

It is almost too easy to pick on California and Illinois, but I am going to do it anyway in order to create a teaching moment. Plus, this sorry tale will make us think about the nature of the social contract and the fabric of society. It would be almost be funny if it were not so serious.

Let’s start with a few paragraphs that appeared in the Wall Street Journal. Carl Demaio writes this week:

Consider California, where just 10 individual pensioners will cash $50 million in pension checks from state and local governments over the next 25 years. Already some 30,000 retired California government employees pull in pensions higher than $100,000 a year. One retired librarian in San Diego receives a $234,000 annual pension. Beach lifeguards in Orange County are retiring at age 51 with $108,000 annual pensions plus health-care benefits.

Note that those benefits are cost-of-living-adjusted. But the problem is not just in California; it is nationwide.

A 2011 study by the Congressional Research Service pegged the combined liabilities faced by state and local pension funds at over $3 trillion. That is more than all the bonded debt officially listed on state and local balance sheets combined. To put the issue in perspective, all the federal tax hikes approved by Congress on Jan. 1 would pay less than 20% of America's state and local pension debt over the next 10 years. (Wall Street Journal)

Another study by the Congressional Budget Office comes to the same general conclusion. You can read it here.

Steven Malanga wrote a powerful essay for the City Journal exposing the huge problems in just one California pension fund, CalPERS (California Public Employees’ Retirement System). It is a well-written chronicle of how one fund has locked California into a debt spiral that threatens the solvency of the state: The Pension Fund that Ate California.

It is almost impossible to read Malanga’s report without comparing it to Michael Lewis’ essay on Greece. For the past two weeks I have written about regulatory capture in Greece and how the Greeks must break the control of vested interests over government. The corruption that Malanga chronicles is similar: the vested interest of public employee unions trying to get the “best deal” for their members is no different from what I described going on with various Greek industries. Whether it is Greek or California taxpayers, someone has to pay for all those promised benefits.

The State of California recently passed a “balanced budget.” But it is only balanced if you ignore the sound accounting practices detailed in the Congressional Research Service report cited above. And even that report assumes investment returns that CalPERS has not achieved for the last five years.

CalPERS manages $230 billion. The fund now calculates that it is underfunded by $80 billion. The management arrives at this number by assuming they will make 7.5% (which they only recently dropped from 7.75%). In 2009, they estimated that the fund was underfunded by only $49 billion. That means they missed their targets by $30 billion in a roaring bull market.

In a December 2011 study, former Democratic assemblyman Joe Nation, a public finance expert at Stanford University, estimated that CalPERS’s long-term pension debt is a sizable $170 billion if CalPERS achieves an average annual investment return of 6.2 percent in years to come. If the return is just 4.5 percent annually – a rate close to what more conservative private pensions often shoot for – the fund’s long-term liability rises to a forbidding $290 billion. (Malanga)

I was just in Norway. It has a sovereign fund that is larger than CalPERS but that benefits from some of the best management in the world. My talks with people involved in the fund and those who are very familiar with it suggest that they would be very happy to get 4% over the next 5-10 years. And CalPERS ranks in the bottom 1% of all pension fund managers. Given all the resources they have, they are spectacularly bad at managing money. And when I say “they,” I mean the board of directors.

Malanga points out that CalPERS is a wholly owned subsidiary of the government-employee trade unions that control the board. He painstakingly chronicles the extent to which the unions dictate policy and investment decisions, leaving the professional management shackled.

Remember the Greek journalist who told us this?:

The government is the prisoner of the bureaucracy. We have 4,021 associations and 6,200 codes. You simply cannot change things. There are 600,000 tax elements. No one really knows who pays what.

The number of regulations differs from Greece to California, but the principle is the same: regulatory capture of the bureaucracy by government workers’ unions has handcuffed government, not just in California but all over the US.

Let’s think about what it means for a pension fund to be $290 billion underfunded in a state with a (plus or minus) $100 billion annual budget. And bear in mind that instead of the $3 billion a year in taxpayer support CalPERS assumes it will need, it could soon be 4-5 times that much. Go to your own state budget and figure out how to carve out 10-15% from it. Given that a huge percentage goes to health care, education, and security, there is just not that much “waste” in state budgets. And the states with pension problems tend to be the ones with higher taxes already.

CalPERS now consumes (or will shortly) more than the 23-campus California State University System, which gets $2 billion annually. And that is not the entire shortfall in California; it is just one fund, albeit the largest. Other funds have similar issues. Taxpayers’ costs are projected to rise to more than $7 billion by 2014-‘15 – if you believe the funds’ own expectations for investment returns. You shouldn’t.

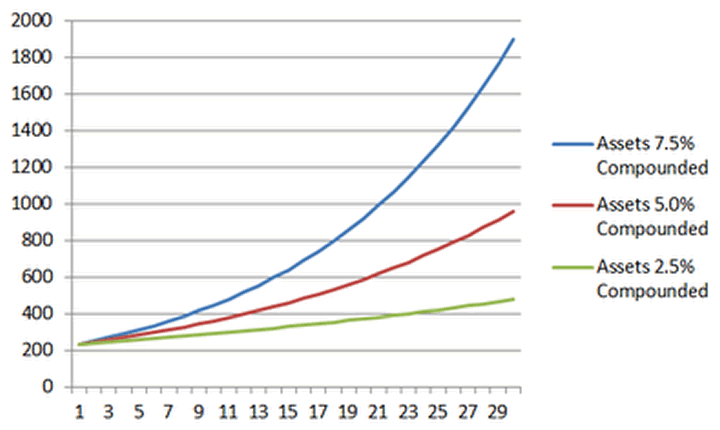

Above we see a chart of projected CalPERS returns, showing what they would be over the next 30 years if they ran at 7.5% or 5% or 2.5% (hat tip to Mike Shedlock). The numbers on the left are in billions. The fund might be doing quite well in 30 years at a steadily compounded 7.5%, but at 2.5% or even 5%? Not so good.

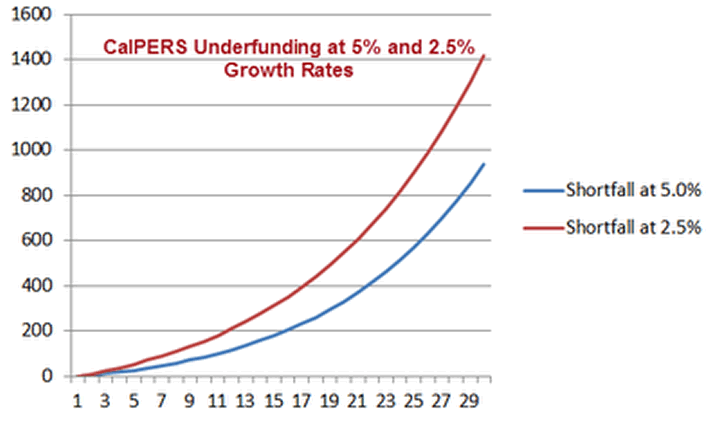

The next chart shows that even if you assume a 5% return, you are down almost $1 trillion in 30 years.

Think 5% or 2.5% is pessimistic? CalPERS made a 1% return over the past year it reported, to June 2012. In a bull market, thank you. Over the last five years? A negative 0.1%, basically flat. (CalPERS annual report)

Let me say a small word in defense of the CalPERSes of the world. If you are a fund this size, you don’t invest in the market; you are the market. The fund did very well in the ‘90s. CalPERS has lagged its peers badly, but I know of no very large ($50-100 billion+) public pension fund that has gotten 7.5% over the last five years. There may be one, but I can’t find it. Smaller funds can be more nimble in selecting investments. CalPERS has to invest an average of $230 million in 1,000 different assets and funds and strategies. That is an impossible task and one that will only get harder as it grows, which it must if it is to meet the needs of its 1.3 million (and swelling) current and future beneficiaries.

I must admit, it is fascinating to Google “California pension problems.” You can spend hours swept up in the sheer scandal of it all. Hundreds of state employees who are managers and who theoretically get no overtime are allowed to work second jobs in their departments and get paid for them. Doctors in the prison system can make hundreds of thousands of extra dollars a year. Prison guards retire with $100,000 a year – and can then take another job and get more benefits from another pension fund! Cool.

Stupid Government Tricks

Until this past January 1, California state employees were allowed to buy “air time” of up to five years to shorten their required time on the job before they would qualify for a full pension. The rationale by CalPERS was that as long as the fund got 7.5% annually there would be no risk to the fund.

“Ultimately, we don’t truly know until everybody who has purchased dies,” said Amy Norris, a Calpers spokeswoman, referring to the size of the payouts. “Our actuaries say that it is safe to say it is cost-neutral at this point.” Fifty thousand employees have elected to participate.

California public-sector employees now earn approximately 30% more for doing the same jobs as workers in the private sector. California did pass some modest pension reforms last year, mostly affecting future workers and retirees. Current retirees saw no reductions. But within a few months legislation was introduced that exempted 20,000 workers, and unions are looking for other such exemptions. In a Democrat-controlled legislature, they could quite possibly pass.

“Double dipping” is my personal favorite of the scams that are being run. Why not retire with your $100,000 pension and then take another job and earn another $100,000 pension? One San Jose police chief now gets over $400,000 a year, after he retired from his San Jose job and went to work in San Diego.

The current San Jose police chief will retire at 51 with a $150,000 pension, and he too can take another job, although he has “no immediate plans.” He is not alone.

Illinois Is Digging a VERY Deep Hole

Illinois has a $33 billion state budget – and five pension funds that are officially underfunded by almost $100 billion. Remember that sky-high projection of investment returns by CalPERS? Illinois pension funds estimate they will earn anywhere from 7.5% to as much as 8.5%. But the state-employee fund made less than 0.1% last year, barely beating out CalPERS.

(By the way, you can see the projected returns of your state funds in a January 2013 NASRA Issue Brief. Scroll to the bottom. I was aghast to see that much of Texas was looking to make 8%! The Houston firefighters project 8.5%! I keep reading about problems with the funding of liabilities in Houston. As I said, this is a nationwide scandal. California and Illinois are just the easiest to pick on.)

Without 8% returns, the shortfall for the Texas Employees Retirement System (ERS) could be twice the current projections. The system is scheduled to pay out $133 billion between now and 2045. It has $11 billion. For these assets to cover future payouts, ERS would need to see average investment returns of 21.5% per year – or see big-time payouts from the government budget. Think they can find an extra $5 billion a year for the next 20 years? From a $30 billion budget? And get 8%?

But back to Illinois, which has a legal problem. It is one of two states (New York being the other) that in its Constitution is prohibited from impairing promised retiree benefits. This makes for a rather tough negotiating stance.

You can find the same exotic stories about large pensions in Illinois that you do in California; but it seems to me the pension for rank-and-file teachers is not overly generous, considering that they pay 9.5% of their salary into the pension fund, while the state is supposed to fund less than 10% of that amount and then doesn’t even manage to do that. Putting the teachers on Social Security would cost the state a lot more (6.2% in matching funds).

Yes, there are the 28 Illinois state troopers who retired at 51 and draw over $100,000 a year. And the politicians get eye-popping amounts, but their retirement fund is underfunded by 74%. Care to make a wager which pension fund gets enough money to survive, the teachers’ or the politicians’?

And while all this sounds delectably scandalous, it is actually very sad. Consider this story:

Last Thursday night, 57-year-old Dick Ingram, a bald guy in a dark suit, stepped onto the stage in a cramped, muggy auditorium at a south suburban high school. In his remarks to an audience full of teachers, Ingram repeated the same message he's been delivering for months: Be afraid. Be very afraid.

Ingram is in charge of Illinois’ biggest pension fund, called the Teachers Retirement System. With $52 billion in unfunded liabilities, it’s arguably worse off than any state pension fund in Illinois – which is saying something, considering Illinois has the worst-funded pensions in the country.

“I don’t think it’s any secret that finances in the state of Illinois are a train wreck,” he told the crowd of about 350 working and retired teachers. “We cannot, today, feel secure in telling a 45-year-old or a 25-year-old teacher in Illinois that they’re gonna get their pension,” he told the crowd. “We face the possibility, and the real likelihood, of insolvency.”

Several teachers at last week’s meeting excoriate[d] Ingram for talking too much, saying he’s just providing fodder to politicians who want to cut teachers’ retirement benefits.

But if you stop and consider what’s going on here, it’s pretty radical: Ingram, the guy in charge of the retirement savings for 370,000 people, is telling anyone who will listen that the money may not be there when they quit working – that teachers, in his words, have “been getting screwed for decades.” (Illinois Public Media)

These teachers put in 9.5% of their salaries, and their retirement could be in jeopardy. Think about what it would be like to work for 35 years, doing the right thing and saving. You make your retirement plans, and then at some point, say 10 or 15 years into your career, the deal changes.

This is rubber-meets-road sort of stuff. Much of our society is finding itself severely burdened to meet past promises made by politicians. It is pretty easy to make them when you are spending someone else’s money, especially when that someone is 30 years in the future. Except that now the future is here. The bellwether is San Jose, whose citizens voted last year (70% in favor) to cut current pensions and benefits for municipal employees. That’s liberal, socially progressive San Jose, which finds itself under severe funding pressure just to fulfill basic city services.

I have talked about the “abuse” of the California pension system, with double-dipping by policemen, et al. – except they are doing nothing illegal or even unethical. They are taking deals offered to them under terms both parties agreed to. The fault, dear Brutus, is not in our stars but in our politicians and we who elect them.

Catastrophic Success

Underfunded pensions are not a problem that is going to go away. Let’s assume that the secular bear market finally runs its course, the financial repression of the Fed and ECB ends, and interest rates go back to normal so that pension funds again have a chance at those juicy 7% returns. We make up for lost time with a few more dollars of funding, and then it’s problem solved, right? That is the line you hear from pension consultants.

But what almost no pension fund does is to plan for the current trend of people living longer to continue. We have added almost two years of life expectancy every decade for the past century, although the number of additional years you can expect to live if you make it to 65 is not as dramatic. Still, the increase is significant.

The International Monetary Fund did a study last year that asked, “What if we live three years longer by 2050?” That is far less than trend for the last century, but even that small increase yields some very interesting conclusions:

...if individuals live three years longer than expected – in line with underestimations in the past – the already large costs of aging could increase by another 50 percent, representing an additional cost of 50 percent of 2010 GDP in advanced economies and 25 percent of 2010 GDP in emerging economies.… [F]or private pension plans in the United States, such an increase in longevity could add 9 percent to their pension liabilities. Because the stock of pension liabilities is large, corporate pension sponsors would need to make many multiples of typical annual pension contributions to match these extra liabilities.

Thus, we may need to add 50% to the pension underfunding I highlighted earlier. It gets ugly. (You can access the IMF study and see commentary here.)

I can hear a few of you objecting that this is a problem that remains far in our future. Why worry about 2043? Well, because pension returns rely upon compound interest, the eighth wonder of the world. A dollar in a pension fund doubles every 10 years at 7.5%, and in 30 years that dollar invested now is $8. If we wait for ten years to invest it, it only becomes $4 in 30 years. And there will be only $2 in the pot if we wait 20 years to find out that today’s retirees are living another three years on average.

Pensions require initial savings and compound interest to work. If you fail to properly fund your pension or if you get low returns, your retirement will suffer. We all know that is the case for private funds, but it is the same for public funds as well. Taxpayers will have to make up the difference if returns are lower or benefits rise due to longer lives. Or retirees will not get what they were promised. Ask Irish pensioners what a 15% cut in their pensions feels like. Ask people in any country that has seen the ravages of inflation.

When you sit down with your financial planner, you make assumptions about how long you will live. And then, if you are prudent, you make plans to live much longer than that. You want to make sure you will have enough funds to meet your needs for your entire life. And that means planning on living a few years longer than the average person in your family has in the past.

Yet we don’t do that with our pension funds. Just as we assume that the past performance of 8% returns in the last bull market will somehow materialize in our future, we also assume that the actuarial tables of the past will continue to apply, even though they have been regularly updated for a century.

Most of us would deem it a success if we lived ten years longer than the current average. Yet such a success on the personal level would be catastrophic for our pension funds, if we all managed it. Thus, living longer may turn out to be a catastrophic success!

I happen to be part of the bunch who thinks the biotech revolution is just beginning and that we will end up living a lot longer (on average) than anyone now expects, and be healthier to boot! Of course, the counterargument is that many of us won’t get there because we refuse to take care of the basics of eating right, exercising, not smoking, and taking our medicines.

Whatever your view on longevity, a three-year average increase over the next 40 years seems a most reasonable and conservative assumption – which means that every dollar our public and private pension funds save now is even more important for future retirees. Unless we want to burden our children and grandchildren in the rapidly approaching future, we need to deal with our pension issues today, before we find them consuming the funds we need for basic services or forcing tax increases that will hurt overall growth and job creation. The choices are difficult now, but they will only get harder if we wait.

Time to Buy a House?

Let’s move briefly to another topic. The lease on my home here in Dallas was going to be up at the end of this year, and I more or less intended not to renew it and to start to pay attention to what the housing market is doing, come fall. Then my landlord dropped me a note a few weeks ago saying he would let me out of my lease if I moved out in a month. He evidently thinks the real estate market is good in Dallas, which is what I am hearing from my realtor friends.

A few months ago I dropped by the new apartment of my good friend David Tice. (Some of you will remember him as the man who started and ran the Prudent Bear funds.) He had purchased two apartments in a local high-rise with stunning views of downtown Dallas, and combined them into one apartment. I fell in love with the energy of the views and the location.

As it turns out, I can get two adjoining spaces in the same building with slightly different views but still that dramatic downtown view I love. The odds of getting two adjoining apartments to come on the market at the same time are not high, so I decided to go ahead and accept the offer to move. Prices have dropped considerably for comparable places in Dallas and are now beginning to find a market. So we made an offer, and it was accepted. Now comes the hard part: getting financing, taking on a construction project to turn the two units into one, finding a place to live in the meantime, and then moving.

I am finding out that financing is not straightforward. I asked my investment-banker friends what the loan would be and got quoted a very nice rate for a ten-year ARM. But the mortgage desk would not do it (this is a very large, name-brand bank). Since it is two apartments and two titles and someone is leasing one of the units right now, and since there will be significant construction costs, what I want to do does not fit into a simple, check-the-box home mortgage. No exceptions allowed! I was rather surprised that it would be that hard. I clearly qualified, or so I thought. I dropped back to punt, and the realtor quickly introduced me to two local banks that do custom projects like this. So that process begins this week.Additionally, David (and another local friend) did something that I want to do, too. He got a yen-denominated loan. We are working out how to do that. (I would love to speak to a senior investment-bank executive of a large Japanese bank. I sense an opportunity here.)

As I promised years ago when I last talked about buying, I will let you know the details as they develop – costs, interest rates, interim loans, etc. But at least here in the Dallas market (and I know it’s true in other markets as well), this bear is coming out of hibernation. Stay tuned.

Looking Over My Shoulder

The world doesn't sit still, and as you all know, neither do I. Each week I delve into 100-plus articles, economic forecasts, investment outlooks, financial reports, etc., all of which come to me through my own extensive network. My goal, of course, is to be constantly building on my own research, staying right on top of what's going on out there. This learning experience is a labor of love for me, and one I'm pleased to share with you through my Over My Shoulder service.

As I filter through my weekly reading, I pick out the 5-10 items that I think will be most important to your investments and money management. This research, compiled by my contacts, is generally information you will not come across in your own ongoing reading – and that's why I think you will find a subscription to Over My Shoulder very useful. Subscribers have given me very positive feedback, and I encourage you to join us in reading, thinking, and preparing for the events of 2013 – this most pivotal of years.

Palm Springs, Argentina, and Singapore

I will be in Palm Springs at the California Resource Investment Conference February 23-24. My good friend Grant Williams, who writes the blockbuster Things That Make You Go Hmmm… and the Mauldin Economics' Bull’s Eye Investor letter, will be there, as will the best resource investor I know, Rick Rule, along with my favorite data maven, Greg Weldon. There is a full two-day slate of speakers. The event is free to investors and is always fun, and it’s a great time of year to be in California (hate the pensions, love the weather). Come see us! You can read all about it and register at the Cambridge House website.

I will be in Cafayate, Argentina in the middle of March, working on a book and relaxing a little while with my partners and friends at their resort. (If you are interested, you can come as well. Just click on this link.) In April, I will do a speech in Singapore and hope to take a few days off to visit Cambodia and Angkor Wat. My old friend Tony Sagami is planning to come over from Bangkok to show me around Cambodia.

It has been an emotional day for me. I attended the memorial for Chris Kyle, whom I wrote about last week. He is the former Navy SEAL and author of American Sniper who was tragically murdered last week. They had to hold the service in the Dallas Cowboys stadium. His casket rested on the star in the center of the field. I will never again be able to look at that star without thinking of him.

A remarkable number of former SEALs and other military attended, honoring a gentle man who is now legend. Hearing the stories from his comrades and friends made for the most moving memorial service I have ever attended. You can donate to a family trust fund being set up for his wife and two young children at Craft International.

Then I went to yet another funeral service, this one for an elderly relative, only a few miles away. The contrast in emotions was palpable. And then on the way home, I got a text from my daughter Melissa. Last year about this time she had her thyroid and some large tumors in her lymph nodes removed. They felt they got it all, and subsequent checkups seemed OK. But today they noticed some large lymph nodes in various parts of her chest and neck. They got her in to see her specialist on an hour’s notice, which seems fast. It could be just an infection, but more scans are now on order.

And now I face the joys of jury duty in a few hours, although no sane attorney would want me on a jury. At least I will get in some reading time, waiting for them to reject me. And with that I will hit the send button.

Your contemplating life more than usual analyst,

John Mauldin

subscribers@MauldinEconomics.com

Outside the Box is a free weekly economic e-letter by best-selling author and renowned financial expert, John Mauldin. You can learn more and get your free subscription by visiting www.JohnMauldin.com.

Please write to johnmauldin@2000wave.com to inform us of any reproductions, including when and where copy will be reproduced. You must keep the letter intact, from introduction to disclaimers. If you would like to quote brief portions only, please reference www.JohnMauldin.com.

John Mauldin, Best-Selling author and recognized financial expert, is also editor of the free Thoughts From the Frontline that goes to over 1 million readers each week. For more information on John or his FREE weekly economic letter go to: http://www.frontlinethoughts.com/

To subscribe to John Mauldin's E-Letter please click here:http://www.frontlinethoughts.com/subscribe.asp

Copyright 2013 John Mauldin. All Rights Reserved

Note: John Mauldin is the President of Millennium Wave Advisors, LLC (MWA), which is an investment advisory firm registered with multiple states. John Mauldin is a registered representative of Millennium Wave Securities, LLC, (MWS), an FINRA registered broker-dealer. MWS is also a Commodity Pool Operator (CPO) and a Commodity Trading Advisor (CTA) registered with the CFTC, as well as an Introducing Broker (IB). Millennium Wave Investments is a dba of MWA LLC and MWS LLC. Millennium Wave Investments cooperates in the consulting on and marketing of private investment offerings with other independent firms such as Altegris Investments; Absolute Return Partners, LLP; Plexus Asset Management; Fynn Capital; and Nicola Wealth Management. Funds recommended by Mauldin may pay a portion of their fees to these independent firms, who will share 1/3 of those fees with MWS and thus with Mauldin. Any views expressed herein are provided for information purposes only and should not be construed in any way as an offer, an endorsement, or inducement to invest with any CTA, fund, or program mentioned here or elsewhere. Before seeking any advisor's services or making an investment in a fund, investors must read and examine thoroughly the respective disclosure document or offering memorandum. Since these firms and Mauldin receive fees from the funds they recommend/market, they only recommend/market products with which they have been able to negotiate fee arrangements.

Opinions expressed in these reports may change without prior notice. John Mauldin and/or the staffs at Millennium Wave Advisors, LLC and InvestorsInsight Publishing, Inc. ("InvestorsInsight") may or may not have investments in any funds cited above.

Disclaimer PAST RESULTS ARE NOT INDICATIVE OF FUTURE RESULTS. THERE IS RISK OF LOSS AS WELL AS THE OPPORTUNITY FOR GAIN WHEN INVESTING IN MANAGED FUNDS. WHEN CONSIDERING ALTERNATIVE INVESTMENTS, INCLUDING HEDGE FUNDS, YOU SHOULD CONSIDER VARIOUS RISKS INCLUDING THE FACT THAT SOME PRODUCTS: OFTEN ENGAGE IN LEVERAGING AND OTHER SPECULATIVE INVESTMENT PRACTICES THAT MAY INCREASE THE RISK OF INVESTMENT LOSS, CAN BE ILLIQUID, ARE NOT REQUIRED TO PROVIDE PERIODIC PRICING OR VALUATION INFORMATION TO INVESTORS, MAY INVOLVE COMPLEX TAX STRUCTURES AND DELAYS IN DISTRIBUTING IMPORTANT TAX INFORMATION, ARE NOT SUBJECT TO THE SAME REGULATORY REQUIREMENTS AS MUTUAL FUNDS, OFTEN CHARGE HIGH FEES, AND IN MANY CASES THE UNDERLYING INVESTMENTS ARE NOT TRANSPARENT AND ARE KNOWN ONLY TO THE INVESTMENT MANAGER.

John Mauldin Archive |

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.