Gold Volatility – Are You Worried?

Commodities / Gold and Silver 2013 Feb 14, 2013 - 06:25 PM GMTBy: DeviantInvestor

Does this sound familiar? “Gold is going nowhere – up one day and down the next! I’m scared! Maybe I should bail out.”

Does this sound familiar? “Gold is going nowhere – up one day and down the next! I’m scared! Maybe I should bail out.”

Unlike buying stocks, which Wall Street and the media are constantly touting, gold is difficult to buy and hold. Proof: The S&P500 Index has made essentially no gain in 13 years, while gold has increased in price about 15% per year for the past 13 years. Yet few people own gold, and many people still listen to the siren song of Wall Street – “buy and hold stocks forever.” Going against the herd is difficult, and buying gold is a contrarian investment. Few people buy gold, fewer still hold on through bull and bear markets, and most still believe the nonsense that “gold is in a bubble.”

Question

Should I be worried when I see gold go down for several days, or even several weeks? Good question! What does the data show?

Big Picture

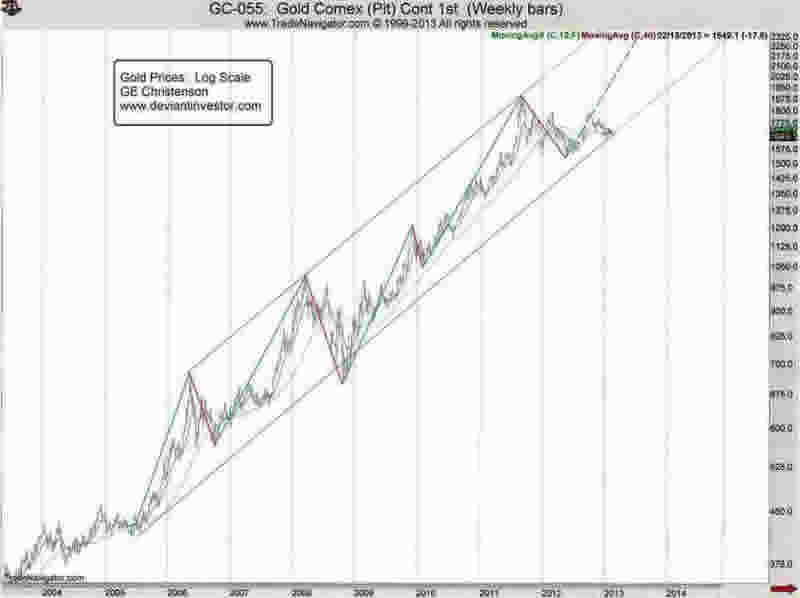

Examine a long term chart of gold prices and select the bull and bear market periods. Over the past eight years, I separated the gold chart into five bull periods and four bear periods. The bull periods are:

| Beginning | Ending | Total Calendar Days |

% Price Change |

| 5/31/2005 | 5/11/2006 | 345 | 73.3% |

| 10/4/2006 | 3/18/2008 | 531 | 77.2% |

| 11/13/2008 | 12/3/2009 | 385 | 72.8% |

| 2/5/2010 | 8/22/2011 | 563 | 79.5% |

| 5/16/2012 | ? | ? | ? |

The bear periods occur between the bull periods.

Quick Summary

Over eight years there have been five bull markets and four bear markets. Each bull market lasted roughly 1 to 1.5 years and moved upward in that time by around 70%. There is nothing wrong with a 70% gain!

What about daily and weekly action? We tend to think of bull markets as continuous rises in price followed by bear markets in which the price drops relentlessly. Is that accurate? Look at the data!

In the four large bull markets from May 2005 to August 2011, gold went from $413 to $1923, up a total of 365%. But, in those four large bull markets, the daily price went up on average only 58% of the time and down 42% of the time. (Actual data, up 57.6%, 55.1%, 56.6%, and 62.0%) Even the weekly prices only went up 70% of the time.

Let me repeat: In the four large gold bull markets since May 2005, the daily price of gold went up less than 60% of the time and down over 40% of the time. Those bull markets were not constructed upon relentless upward moves, but upon chaotic sometimes up, sometimes down moves. On average, the daily upward moves occurred slightly more often than the daily downward moves. Yet, each bull market moved up over 70% in price from beginning to end. Using weekly data, those gold bull markets still had 30% of their weeks going down.

Conclusion

Bull markets include many down days and weeks. If we became discouraged every time gold moved down on a particular day, we would live 40% of our life feeling discouraged by the quite common downward moves. Bull markets move up slightly more often than down and bear markets do the opposite. Think three steps forward and two steps backwards. That is the nature of markets.

So the next time you feel discouraged by the daily moves in the gold market (or any market), return to your basic analysis and remember:

•Even in powerful bull markets, the price will probably go down about 40% of the time, based on daily prices and 30% based on weekly prices.

•The “bull” will do everything it can to buck you off and force you out of the market.

•Bull markets never make it easy. By the time it looks easy (say early 2000 in the NASDAQ), it is too late to buy and it is time to exit.

•It takes emotional stamina to hold your positions, and it takes determination to maintain perspective. Look at the weekly and monthly trends, look at the fundaments, and look at the sentiment.

•If “everyone” knows that a market is going up, it is time to exit.

•If the media is obsessing over a particular market, it is probably time to exit.

•If your neighbors think you are crazy for buying gold, then it is probably time to add to your position.

•When your neighbors and your hairdresser are telling you they are buying gold, it is probably time to sell.

Maintain perspective, and remember that investing in gold is not easy if you listen to Wall Street or the media or if you become discouraged on the 40% of the days when the price of gold goes down, even during bull markets. Read Ten Steps to Safety.

Keep it simple: As the dollar goes down in purchasing power, gold goes up. The dollar’s purchasing power has gone down, on average, every decade for the last 100 years. The actions of the Federal Reserve, printing $85,000,000,000 in new dollars from “thin air” each month, will decrease the purchasing power of the dollar. Hence, buy gold. Fool proof – No! Better than most other choices – Yes! Read $4,000 Gold! Yes, But When?

GE Christenson

aka Deviant Investor

If you would like to be updated on new blog posts, please subscribe to my RSS Feed or e-mail

© 2013 Copyright Deviant Investor - All Rights Reserved Disclaimer: The above is a matter of opinion provided for general information purposes only and is not intended as investment advice. Information and analysis above are derived from sources and utilising methods believed to be reliable, but we cannot accept responsibility for any losses you may incur as a result of this analysis. Individuals should consult with their personal financial advisors.

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.