Gold and the Universal Truth

Commodities / Gold and Silver 2013 Feb 15, 2013 - 11:01 PM GMTBy: Richard_Mills

Fascism is a totalitarian system of government that bases its economy on a later, more mature stage of capitalism, it's a marriage of government authority and military/police power managed by corporate influence.

Fascism is a totalitarian system of government that bases its economy on a later, more mature stage of capitalism, it's a marriage of government authority and military/police power managed by corporate influence.

"The liberty of a democracy is not safe if the people tolerate the growth of private power to a point where it comes stronger than their democratic state itself. That, in its essence, is fascism - ownership of government by an individual, by a group." Franklin D. Roosevelt

Consider the following, all are characteristics of fascism:

- A dictatorial ruling cabal runs the country

- The military is increasingly being used to control the civilian population

- The government repeatedly violates the U.S. Constitution

- Government informants are spying on their fellow citizens

- Controlled mass media

- Fraudulent elections

- Powerful and continuing nationalism, calls for national unity

- Militaristic values are spreading in society and the power of the military is increasing, glorification of war

- Obsession with national security

- Disdain for the recognition of human rights, racism

- Radical opposition to Communism/Socialism, Modernism and attacks on Liberals

- Identification of enemies as a unifying cause

- Corporate power is protected while labors power is suppressed - Fascism and capitalism are inseparable because the corporate power structure is authoritarian, and is geared to reward the elite owners, but not the workers. Few would argue against the fact that corporations control our government and have the dominant role in our society

- Obsession with crime and punishment

- Militarization of the police - Since the terrorist attacks in 2011 the US has spent close to $700 billion to militarize its police forces

- A trend toward corporatism and systematic destruction of the middle class

- Rampant cronyism and corruption

- Intertwining of government and religion

- A cult like leader

Consequences of fascism to the governed are the loss of rights and the enhancement of the elitists.

"We have had a decade of highly visible evidence of the construction of a police state: the PATRIOT Act, illegal spying on Americans in violation of the Foreign Intelligence Surveillance Act, the initiation of wars of aggression--war crimes under the Nuremberg Standard--based on intentional lies, the Justice Department's concocted legal memos justifying the executive branch's violation of domestic and international laws against torture, the indefinite detention of US citizens in violation of the constitutionally protected rights of habeas corpus and due process, the use of secret evidence and secret "expert witnesses" who cannot be cross-examined against defendants in trials, the creation of military tribunals in order to evade federal courts, secret legal memos giving the president authority to launch preemptive cyber attacks on any country without providing evidence that the country constitutes a threat, and the Obama regime's murder of US citizens without evidence or due process." Paul Craig Roberts, It Has Happened Here

The price of gold has doubled since the election of Barack Obama as U.S. President in November 2008.

Precious metals sales, in the form of bullion, has continually increased since Obama was reelected for a second term.

November 2012 sales of 136,500 ounces of gold coins were more than double October's tally and the most in more than two years.

December sales of 76,000 ounces was the third strongest month of 2012.

U.S. Mint gold-coin sales had their strongest January in 14 years.

According to the US Mint, gold bullion coin sales totaled 150,000 ounces, up 97.4 percent from December. Sales for the month were up 18.1 percent from comparable sales of 127,000 ounces year over year.

January sales of 150,000 ounces of American Eagle gold bullion coins was the sixth largest on record and represents a multi-year high in sales since July 2010 when 152,000 ounces were sold.

The previous record months were:

- June 2010 with 151,500 ounces

- December 2009 with 231,500 ounces

- April 2009 with 157,500 ounces

- December 2008 with 176,000 ounces

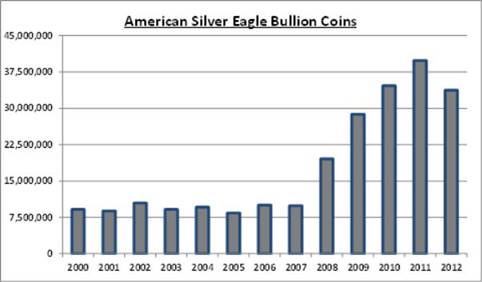

While gold coin sales were at a multiyear high * American Silver Eagle sales soared to an all time high in January 2013 reaching total sales of 7,498,000.

This exceeds the previous monthly sales record of 6,422,000 achieved in January 2011 - prior to 2008, total annual sales of the silver bullion coin were 9.5 million coins - opening day sales for the 2013 Silver Eagle were the largest on record with total sales of 3,937,000 coins.

* Considering purchasers were only able to place orders from the launch of the 2013 dated coins - January 7 - until the mint was temporarily sold out on January 17 and that sales were not resumed till January 28, and have since continued on a rationed basis, this is a pretty impressive feat.

But precious metals are not the only thing enjoying improved popularity during Obama's presidency.

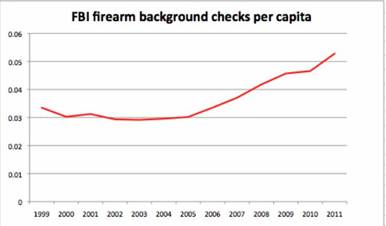

In the first four years of Barack Obama's Presidency an estimated 67 million firearms were purchased in the United States. That's more than were sold in the seven years preceding his first election in November of 2008. The F.B.I. conducted nearly 156 million background checks for gun purchases from November 1998 to October 2012 and a full 40 percent of those checks occurred in Obama's first term.

Since 1998, anyone wanting to buy a firearm from a licensed dealer must undergo a federal background check to ensure that they are not a criminal, mentally ill or otherwise disqualified from ownership. The check is carried out by referencing a national database, the FBI's National Instant Criminal Background Check System (NICS).

In 2005 there were 8,952,945 NICS checks. In 2006 the number topped 10 million. In 2007 NICS checks passed 11 million.

In 2008 NICS checks passed 12 million, they hit the 14 million mark in 2009 and had increased another four percent by the end of 2011. There were over 1.5 million NICS checks in November of 2011. The only other November to break 1.5 million NICS checks was November of 2008 - when President Obama first won the presidency.

"After the surprisingly comfortable win by Barack Obama last month, the election of more women and wins in state referenda for issues like gay marriage and legalising dope smoking (including for medical use), you'd have thought the Land of the Free had relaxed a little.

Not so on the Right: applications for gun purchases soared in November to an all-time high of more than two million, as records from the FBI reveal.

That's the first time in the 14-year history of FBI background checks on prospective gun buyers that the number of applications had topped 2 million in a month. This year looks likely to see more than 18 million background checks for firearms, well up on 2011's 16.5 million." Glenn Dyer and Bernard Keane, Guns'n'gold on the up as Right takes fright from Obama

The FBI reported the number of background checks for firearms shot up 18.4 percent in October, 2012. According to FBI stats gun sales really began to soar after Obama was reelected. More than a quarter of all background checks in 2012 occurred in November and December, December alone having 2.7m.

The background checks carried on into the new year with more than 2.4m checks initiated in January, 2013 (8,980 of the checks resulted in gun purchase denials), that's a million more checks than January 2012. The data does not indicate exactly how many weapons might have been purchased - some customers buy more than one gun at a time and no one tracks the real numbers.

According to a recent Gallup poll, 47 percent of Americans own a gun - the highest percentage share since 1993.

Obama, Bush and Clinton are not personally responsible for the increased popularity of gold and guns during their presidencies - they simply represent failure and fear. Their parties failed policies, a failed republic and increasing fascism, the failure of human integrity - pork barrel politics and corporate greed run amuck - and the unwillingness, the absolutely disgusting failure of politicians of all stripes to work together to lift the U.S. out of its current morass.

Americans are jumping off the mainstream media headline train, they want to understand what's happening around them so they dig a little deeper than three second sound bites.

"A democratic government isn't based on trust. It's based on skepticism--thus the system of checks and balances--and the ability of people to remain informed about the workings of their government. A trusting populace is likely to feel secure in its own ignorance; an ignorant populace is unlikely to remain free." Wendy Kaminer, Fear of Freedom

What they discover is deeply disturbing - the methods used to bypass the concept of limited government and forcing collective rights over individual rights scares them.

Each and every day, the U.S. police state grows larger and more powerful. With the increasing militarization of ever more of the population - state and local police, TSA, Homeland Security and with the increasing rhetoric on civilian gun control - gun sales soar.

"Every tyrant in the 20th century began his tyranny by confiscating guns and gold from the people over whom he ruled." Judge Andrew Napolitano

The twin policies of zero interest rates and the continual creation of money and credit being enacted today, by all governments and central banks, means that the purchase of precious metals is the only way to protect the value of your assets. Precious metals also act as trusted assets in times of political turmoil.

Consider

Gold no longer has a legal role in the world's monetary system, but gold, throughout the centuries, has performed two jobs that today's fiat, paper money, or any other financial innovation, cannot do;

- Gold acts as a safe haven in times of turmoil - to escape Nazi Germany, or buy food and water in a crisis

- Gold preserves your purchasing power - in 1913 (the year the US Federal Reserve was born) the US dollar was, well, a dollar, gold was US$20 an ounce. Today, at almost the 100 year anniversary of the Fed the dollar has lost 95 percent of its purchasing power and gold is almost $1700 an ounce

Conclusion

"...our experiment in democracy could be closed down by a process of erosion...Early on, as WH Auden put it, the horror is always elsewhere - while someone is being tortured, children are skating, ships are sailing: "dogs go on with their doggy life ... How everything turns away/ Quite leisurely from the disaster."

As Americans turn away quite leisurely, keeping tuned to internet shopping and American Idol, the foundations of democracy are being fatally corroded. Something has changed profoundly that weakens us unprecedentedly: our democratic traditions, independent judiciary and free press do their work today in a context in which we are "at war" in a "long war" - a war without end, on a battlefield described as the globe, in a context that gives the president - without US citizens realising it yet - the power over US citizens of freedom or long solitary incarceration, on his say-so alone.

That means a hollowness has been expanding under the foundation of all these still- free-looking institutions - and this foundation can give way under certain kinds of pressure." Naomi Wolf, Fascist America, in 10 easy steps

"It is a universal truth that the loss of liberty at home is to be charged to the provisions against danger, real or pretended, from abroad." James Madison, Father of the U.S. Constitution

Is Joe & Suzie America buying precious metal coins and guns? Sales for both are soaring. Are wealthier Americans stashing gold offshore? U.S. gold exports are at a record, yes a lot went to Hong Kong for perhaps entry into China/Asia but a considerable amount also went to Switzerland and London.

Global investments in gold ETFs in 2012 was up by 51 percent yoy.

Ironic isn't it? There's a creeping Fascism in the U.S., and the U.S., which stored a lot of the world's gold during WWII (to keep it safe from an invading fascist Germany), is now seeing huge outflows of gold with Germany even wanting a significant part of its stored gold (stored in the U.S. because of the Cold War) audited, sent home, melted down and tested for purity.

The world's governments and central banks (central bank purchasing was up 29 percent over Q4 2011 marking the eighth consecutive quarter of official sector net purchasing, 2012 saw the highest levels of central bank purchasing since 1964 rising 17 percent over 2011) are not only bringing home their gold but buying gold, a lot of gold. Perhaps they already know what Joe and Suzie are just starting to figure out - the supply of fiat paper money is infinite while the supply of gold is finite.

In troubled times we should all have buying some gold and silver on our radar screens. Are precious metals on yours?

If not, maybe they should be.

By Richard (Rick) Mills

If you're interested in learning more about the junior resource and bio-med sectors please come and visit us at www.aheadoftheherd.com

Site membership is free. No credit card or personal information is asked for.

Richard is host of Aheadoftheherd.com and invests in the junior resource sector.

His articles have been published on over 400 websites, including:

Wall Street Journal, Market Oracle, SafeHaven , USAToday, National Post, Stockhouse, Lewrockwell, Pinnacledigest, Uranium Miner, Beforeitsnews, SeekingAlpha, MontrealGazette, Casey Research, 24hgold, Vancouver Sun, CBSnews, SilverBearCafe, Infomine, Huffington Post, Mineweb, 321Gold, Kitco, Gold-Eagle, The Gold/Energy Reports, Calgary Herald, Resource Investor, Mining.com, Forbes, FNArena, Uraniumseek, Financial Sense, Goldseek, Dallasnews, Vantagewire, Resourceclips and the Association of Mining Analysts.

Copyright © 2013 Richard (Rick) Mills - All Rights Reserved

Legal Notice / Disclaimer: This document is not and should not be construed as an offer to sell or the solicitation of an offer to purchase or subscribe for any investment. Richard Mills has based this document on information obtained from sources he believes to be reliable but which has not been independently verified; Richard Mills makes no guarantee, representation or warranty and accepts no responsibility or liability as to its accuracy or completeness. Expressions of opinion are those of Richard Mills only and are subject to change without notice. Richard Mills assumes no warranty, liability or guarantee for the current relevance, correctness or completeness of any information provided within this Report and will not be held liable for the consequence of reliance upon any opinion or statement contained herein or any omission. Furthermore, I, Richard Mills, assume no liability for any direct or indirect loss or damage or, in particular, for lost profit, which you may incur as a result of the use and existence of the information provided within this Report.

Richard (Rick) Mills Archive |

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.