British Pound at Risk Of "Large-Scale Devaluation" As Currency Wars Intensify

Commodities / Gold and Silver 2013 Feb 19, 2013 - 12:19 PM GMTBy: GoldCore

Today’s AM fix was USD 1,613.50, EUR 1,208.80 and GBP 1,041.57 per ounce.

Today’s AM fix was USD 1,613.50, EUR 1,208.80 and GBP 1,041.57 per ounce.

Yesterday’s AM fix was USD 1,611.25, EUR 1,206.39 and GBP 1,041.53 per ounce.

Silver is trading at $30.13/oz, €22.68/oz and £19.56/oz. Platinum is trading at $1,700.25/oz, palladium at $765.00/oz and rhodium at $1,245/oz.

Gold slipped 0.1 percent to $1,607.06/oz on Monday after falling as low as $1,598.04/oz on Friday, its weakest since August.

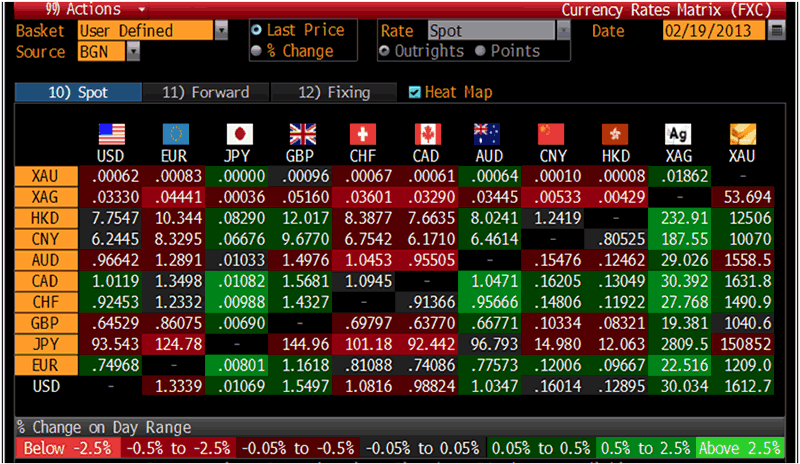

Cross Currency Table – (Bloomberg)

Gold inched up Tuesday morning, however the dollar’s rise to a one month high limited bullion’s gains.

European markets are cautious ahead of Italy’s elections on Feb. 24-25th, including candidate and former Prime Minister, Silvio Berlusconi. Mario Draghi urged finance chiefs from the G20 to be “prudent” when talking about currency movements.

The Bank of Japan’s minutes to their policy meeting noted that the government’s asset purchasing plan could continue for 5 years.

The U.S. Federal Reserve’s policy minutes are available tomorrow, and will be closely scrutinized.

India's duties on gold imports may increase in an effort to decrease the country’s account deficit said an employee from the largest state run gold importer.

More violence in South Africa as 4 security guards were disfigured with machetes and at least 13 people were injured, in a labour fight at Anglo American Platinum.

Iran said it will not close the Fordow nuclear plant yesterday. Ramin Mehmanparast, spokesman for Iran's foreign ministry, commented that the reported offer was unacceptable. However, they are ready for logical negotiations, he noted.

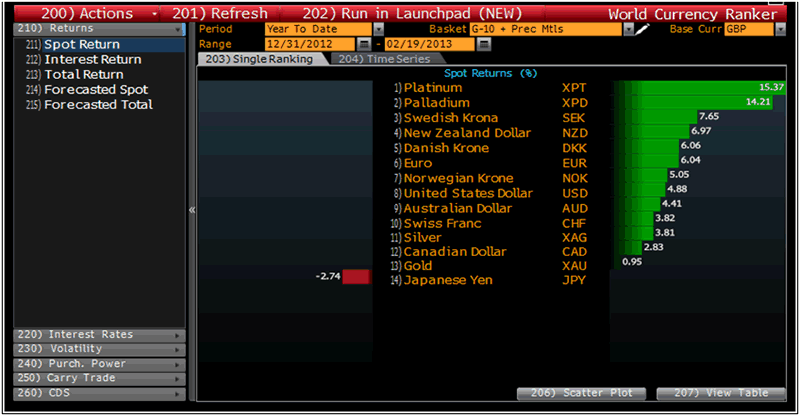

Currency Ranked Returns in Great British Pounds – (Bloomberg)

The pound took a fresh beating yesterday as concerns of currency wars and debasement of sterling led to another sell-off and experts said the currency was at risk of a "large-scale devaluation".

Sterling trails only Japan's yen as the worst performer against a basket of international currencies this year as a 4.5 per cent decline fuels import prices and pushes up the cost of food, insurance and other necessities for hundreds of thousands of households.

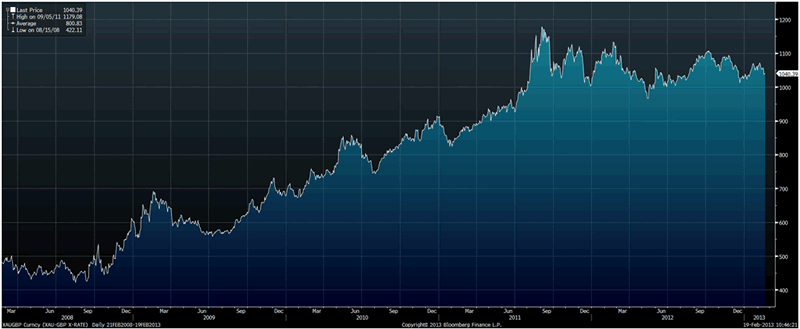

As central banks tolerate higher levels of inflation, the pound is set to weaken further across the board particularly against safe haven gold.

UBS warned that the pound seems clearly at risk of following the yen and "suffering the next large-scale devaluation."

Dealers also noted weekend comments from Bank of England rate-setter Martin Weale, who warned the pound was still too high to help the UK economy rebalance effectively. The continued pressure on the currency comes after its biggest weekly loss since June last year amid gloom over weak growth prospects.

The Bank of England has signalled it is willing to tolerate higher inflation for longer, while the pound's safe-haven appeal has also waned as the European Central Bank makes explicit commitments to prop up Eurozone strugglers and preserve the single currency.

XAU/GBP Daily, FEB2108-19FEB13– (Bloomberg)

The yen also fell as the G20's finance ministers in Moscow shied away from criticism of Japan for weakening its currency. Prime Minister Shinzo Abe has repeatedly called for a cheaper currency in order to help the country's exporters compete.

GoldCore Webinar - How to Protect and Grow Your Wealth

Join us for a webinar this Wednesday 20th February at 1pm with guest presenter Eddie Hobbs. Eddie will provide valuable insight into the outlook for the US and the global economies. He will also outline why he believes that gold, and now also silver, are important from a diversification point of view for Irish people who wish to both protect and grow their wealth in the coming years.

Join Eddie in this 45 minute webinar as he untangles the complexity of the global economy and how it will affect you, and presents his findings in a no-nonsense and easy-to-understand manner.

Click here to register.

For the latest news and commentary on financial markets and gold please follow us on Twitter.

GOLDNOMICS - CASH OR GOLD BULLION?

'GoldNomics' can be viewed by clicking on the image above or on our YouTube channel:

www.youtube.com/goldcorelimited

This update can be found on the GoldCore blog here.

Yours sincerely,

Mark O'Byrne

Exective Director

IRL |

UK |

IRL +353 (0)1 632 5010 |

WINNERS MoneyMate and Investor Magazine Financial Analysts 2006

Disclaimer: The information in this document has been obtained from sources, which we believe to be reliable. We cannot guarantee its accuracy or completeness. It does not constitute a solicitation for the purchase or sale of any investment. Any person acting on the information contained in this document does so at their own risk. Recommendations in this document may not be suitable for all investors. Individual circumstances should be considered before a decision to invest is taken. Investors should note the following: Past experience is not necessarily a guide to future performance. The value of investments may fall or rise against investors' interests. Income levels from investments may fluctuate. Changes in exchange rates may have an adverse effect on the value of, or income from, investments denominated in foreign currencies. GoldCore Limited, trading as GoldCore is a Multi-Agency Intermediary regulated by the Irish Financial Regulator.

GoldCore is committed to complying with the requirements of the Data Protection Act. This means that in the provision of our services, appropriate personal information is processed and kept securely. It also means that we will never sell your details to a third party. The information you provide will remain confidential and may be used for the provision of related services. Such information may be disclosed in confidence to agents or service providers, regulatory bodies and group companies. You have the right to ask for a copy of certain information held by us in our records in return for payment of a small fee. You also have the right to require us to correct any inaccuracies in your information. The details you are being asked to supply may be used to provide you with information about other products and services either from GoldCore or other group companies or to provide services which any member of the group has arranged for you with a third party. If you do not wish to receive such contact, please write to the Marketing Manager GoldCore, 63 Fitzwilliam Square, Dublin 2 marking the envelope 'data protection'

GoldCore Archive |

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.