Will Obama Confiscate Guns and Gold?

Politics / Gold and Silver 2013 Feb 20, 2013 - 10:17 AM GMTBy: Jeff_Berwick

Wendy McElroy writes: Barack Obama often compares himself to Franklin D. Roosevelt. When he does, gold owners reach for a gun, of which they usually have several. Gold and guns are becoming politically entangled, and a connecting word is often “confiscation.”

Wendy McElroy writes: Barack Obama often compares himself to Franklin D. Roosevelt. When he does, gold owners reach for a gun, of which they usually have several. Gold and guns are becoming politically entangled, and a connecting word is often “confiscation.”

The prospect of gun confiscation is fueling discussion of FDR's 1933 nationalization of gold ownership, which resembled Hugo Chavez's nationalization of Venezuelan gold mines in 2011. FDR did so by executive order; Chavez did so by decree. If guns in America are also 'nationalized', then the 1933 gold grab may have insights on how the state could proceed and how American public may react.

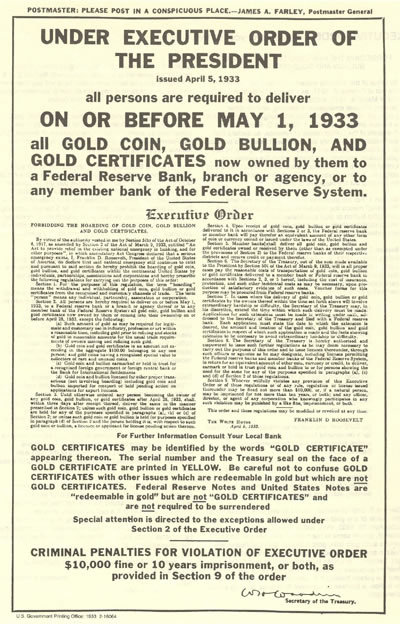

IMPLEMENTATION OF THE 1933 GOLD HEIST

Roosevelt was inaugurated as President on March 4th, 1933. He immediately moved to outlaw the private ownership of gold. He proceeded in several steps.

On March 6th, FDR issued Proclamation 2039 that declared a bank holiday in order to halt “heavy and unwarranted withdrawals of gold and currency from our banking institutions for the purpose of hoarding”; that is, to cease redeeming money for gold or releasing client-held gold from its vaults. FDR blamed the “severe drain on the Nation's stocks of gold” on foreign speculation and individual hoarding, which were causing a “national emergency.” The President assumed the power to “investigate, regulate or prohibit” the so-called wrongful use of gold. Americans violating the Proclamation or the regulations produced under its authority would “be fined not more than $10,000” or “imprisoned for not more than ten years, or both.”

On March 6th, FDR issued Proclamation 2039 that declared a bank holiday in order to halt “heavy and unwarranted withdrawals of gold and currency from our banking institutions for the purpose of hoarding”; that is, to cease redeeming money for gold or releasing client-held gold from its vaults. FDR blamed the “severe drain on the Nation's stocks of gold” on foreign speculation and individual hoarding, which were causing a “national emergency.” The President assumed the power to “investigate, regulate or prohibit” the so-called wrongful use of gold. Americans violating the Proclamation or the regulations produced under its authority would “be fined not more than $10,000” or “imprisoned for not more than ten years, or both.”

On March 9th, the Emergency Banking Act passed Congress without being read because it had not been distributed. The Act affirmed all of FDR's orders since March 4th, and amended the WWI Trading with the Enemy Act to give the President “absolute control over the national finances and foreign exchange” not only in times of war but also in emergencies. It required that “any individual or organization...deliver any gold that they possess or have custody of to the Treasury” in return for other lawful currency. Only Federal Reserve-approved and accountable banks were to remain open; private or independent banks were no longer permitted. In effect, all banks had to meet Fed regulations, including reporting and turning over gold in their vaults upon demand.

On April 5th, FDR signed Executive Order 6102 that prohibited the ownership, called “hoarding,” of “gold coin, gold bullion, and gold certificates...by individuals, partnerships, associations and corporations.” (There were minor exceptions such as jewelry.) Gold-holders had until the end of April to surrender gold to the Federal Reserve. They were reimbursed in currency worth $20.67, which had been the gold price per troy ounce since the late 1800s.

On January 30th, 1934, the Gold Reserve Act required the Federal Reserve to surrender its gold and gold certificates to the US Treasury. It also arbitrarily changed the price of gold from $20.67 to $35. This caused a 69% devaluation of the dollar. Otherwise stated, the government increased the value of its gold by 41%.

The process: a declaration of absolute Presidential authority; Congressional affirmation; an executive order of implementation; and, an arbitrary devaluation of the dollar to increase government's wealth.

Remember that Obama models himself on FDR [A good reason to get your larger gold holdings out of Dodge and beyond his reach while you can. --Ed.]. Obama actively pursues a path of regulation through executive orders. For example, a January 16th, 2013 Forbes headline reads, “Here Are The 23 Executive Orders On Gun Safety Signed Today By The President.” Obama also favors rule through policies imposed by massive and unaccountable federal agencies of which there are close to 70; their counterparts in FDR's time were called Alphabet Agencies. Congressional approval is rarely required. Executive power has swelled since FDR's days and Congress has been largely reduced to a funding role. As for devaluing the dollar, what else can you call the incessant increase in the currency supply? The increase enriches government because it is first to spend the new dollars before they can devalue through circulation. The main element missing from the FDR procedure is the executive order that provides implementation.

But how will the American people respond?

A PASSIVE PEOPLE NO MORE?

FDR was able to confiscate private gold for a combination of reasons. A major one was the cooperation of banks under the Federal Reserve. But what of the multitudes who directly surrendered their wealth? (In 1933, gold still circulated as currency and private ownership was widespread.)

One reason was fear of punishment. Another was patriotism. The Austrian economist Thomas Woods explained yet another reason. “The paper currency [$20.67] they were receiving in exchange for the gold had always been redeemable in gold in the past.” It was only later that they realized “they weren't getting that gold back, and that the paper dollars they were being given in exchange would be devalued.” In short, they were duped.

One reason was fear of punishment. Another was patriotism. The Austrian economist Thomas Woods explained yet another reason. “The paper currency [$20.67] they were receiving in exchange for the gold had always been redeemable in gold in the past.” It was only later that they realized “they weren't getting that gold back, and that the paper dollars they were being given in exchange would be devalued.” In short, they were duped.

Today's gold-holding public is not so naïve or patriotic. Gold is not a circulating currency and those who buy it do so knowing that government is devaluing every dollar through inflation. Moreover, they know history.

Will Obama move to confiscate gold? No one knows. If he does, I expect it will not start as a direct confiscation from individuals. It would probably begin through steps to nationalizing private retirement accounts such as IRAs. This could happen in one of two ways: require accounts to hold some percentage of government security, especially Treasury bonds; or, have a government agency manage the accounts.

On the Austrian economic LewRockwell site (August 21st, 2010), Ron Holland (contributing editor to the Swiss Mountain Vision Newsletter and Swiss Confidential) wrote:

“Just as with the...nationalization of Healthcare, the tremendous amount of funds in private retirement plans and IRA accounts are also being targeted to meet future revenue needs. Bills have just been introduced in both the House and Senate to create the new Auto IRA accounts which will at first be voluntary but later will become mandatory like Social Security and I expect the early 3% employee after tax contribution levels to eventually rise to 10 to 15% of compensation rising even more than Social Security has increased over the years....The Auto IRA is the first step to... replace our private system with a forced, government controlled Social Security type program. In addition they will force much of your retirement funds into buying junk treasury bonds along with the Federal Reserve when the dollar/national debt crisis hits as billions of retirement funds become the buyer of last resort...” (Auto IRA bills remain in both the House and the Senate, a glaring sign that you should get into a self-directed IRA while there's still time.)

The relevance of such “pension reform” to gold is twofold: many retirement funds contain a considerable amount of gold in some form; and, the state control would set a precedent.

Gold confiscation would likely begin with pension accounts because the state mechanisms to do so are already in place. Moreover, as with the gold in FDR-era bank vaults, the location and quantity is known; the organizations holding it would cooperate fully. (Again, more reason to make sure your IRA is self-directed and that you can internationalize the assets therein.)

Direct confiscation from individuals would be more problematic, and not merely because of its comparative anonymity. Direct confiscation returns us to guns. Given the personality of the typical gold bug and the simmering state of society, Obama must know that gun confiscation is a political prerequisite of a direct gold grab. On February 13th, the UK Market Oracle predicted for 2013, “The collection programs for guns will be eclipsed by collection of private pension funds and perhaps gold itself.” Guns and gold are blurring.

Wendy McElroy is a renowned individualist anarchist and individualist feminist. She was a co-founder along with Carl Watner and George H. Smith of The Voluntaryist in 1982, and is the author/editor of twelve books, the latest of which is "The Art of Being Free". Follow her work at http://www.wendymcelroy.com.

Anarcho-Capitalist. Libertarian. Freedom fighter against mankind’s two biggest enemies, the State and the Central Banks. Jeff Berwick is the founder of The Dollar Vigilante, CEO of TDV Media & Services and host of the popular video podcast, Anarchast. Jeff is a prominent speaker at many of the world’s freedom, investment and gold conferences as well as regularly in the media.

© 2013 Copyright Jeff Berwick - All Rights Reserved Disclaimer: The above is a matter of opinion provided for general information purposes only and is not intended as investment advice. Information and analysis above are derived from sources and utilising methods believed to be reliable, but we cannot accept responsibility for any losses you may incur as a result of this analysis. Individuals should consult with their personal financial advisors.

Jeff Berwick Archive |

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.