Gold Death Cross Now Unavoidable

Commodities / Gold and Silver 2013 Feb 21, 2013 - 10:26 AM GMTBy: Bob_Kirtley

The Cross of Death is now unavoidable for gold prices as the 50dma is set to cross over the 200dma in a downward swing. The chart below shows that there was considerable damage done to gold following the last cross of death with gold prices dipping to the $1550/oz level. However this was short lived as gold recovered and managed to form a golden cross as the 50dma crossed over the 200dma in an upward swing. So it’s a crisscross situation that we find ourselves in as nervous investors, swing traders, speculators and fund managers go with the trend of day and trade accordingly.

The Cross of Death is now unavoidable for gold prices as the 50dma is set to cross over the 200dma in a downward swing. The chart below shows that there was considerable damage done to gold following the last cross of death with gold prices dipping to the $1550/oz level. However this was short lived as gold recovered and managed to form a golden cross as the 50dma crossed over the 200dma in an upward swing. So it’s a crisscross situation that we find ourselves in as nervous investors, swing traders, speculators and fund managers go with the trend of day and trade accordingly.

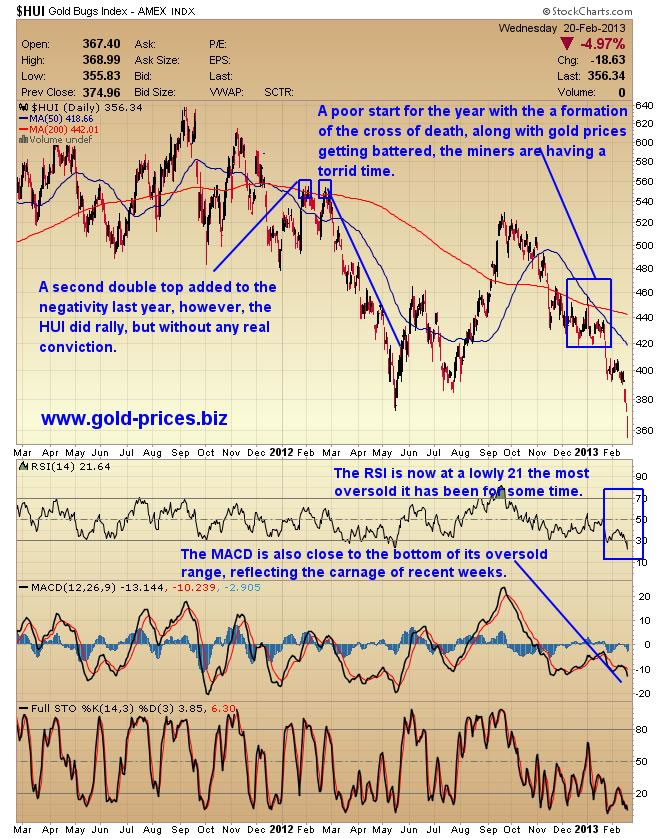

The sell-off of both gold and silver has had a dramatic effect on the producers as they take it on the chin, depicted on the chart below.

They also have the added problems of rising energy and labor costs along with a myriad of other impediments that impact on their operations. The bears are out in force, looking for blood and the bulls are doing their very best to defend their corner. This is a difficult ask as sentiment appears to be at an all-time low with investors reluctant to put their cash on the line. It is a bit like trying to catch a falling knife, why shoulder the risk? For those with the cash to invest allowing the time for this sell-off to play itself out, is a sensible strategy for now.

Gold may have further to fall before establishing a bottom. When it does we will need to assess the situation as to whether this marks a suitable entry point or is it a just a relief rally in disguise. Sooner or later the good quality mining stocks will represent bargain buying, so we will need to leave our emotions at the door and gently implement a program of acquisitions. That’ll take guts I hear you say; well let’s face it, it takes guts to invest in gold and silver and their associated mining stocks. But try and remember that this sector of the market has been the best performing sector for a decade or so, despite the days like this.

Have a good one.

Bob Kirtley

Email:bob@gold-prices.biz

URL: www.silver-prices.net

URL: www.skoptionstrading.com

To stay updated on our market commentary, which gold stocks we are buying and why, please subscribe to The Gold Prices Newsletter, completely FREE of charge. Simply click here and enter your email address. Winners of the GoldDrivers Stock Picking Competition 200

DISCLAIMER : Gold Prices makes no guarantee or warranty on the accuracy or completeness of the data provided on this site. Nothing contained herein is intended or shall be deemed to be investment advice, implied or otherwise. This website represents our views and nothing more than that. Always consult your registered advisor to assist you with your investments. We accept no liability for any loss arising from the use of the data contained on this website. We may or may not hold a position in these securities at any given time and reserve the right to buy and sell as we think fit.

Bob Kirtley Archive |

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.