How to Play the Current Gold and Silver Bear Market

Commodities / Gold and Silver 2013 Feb 26, 2013 - 11:34 PM GMTBy: Casey_Research

Given the profoundly bearish sentiment that has gripped so many participants in the resource sector, particularly gold investors, we decided to poll the chief editors at Casey Research regarding the current sell-off. We recognize the severity of the situation and want readers to know we're taking it very seriously.

Given the profoundly bearish sentiment that has gripped so many participants in the resource sector, particularly gold investors, we decided to poll the chief editors at Casey Research regarding the current sell-off. We recognize the severity of the situation and want readers to know we're taking it very seriously.

We also want readers to know that the "Casey consensus" is not a single view imposed on all, but the result of a constant conversation we have among ourselves, questioning our own premises, making sure we don't ignore new data if and when it contradicts our expectations. This is why some of the thoughts below will seem less positive than others; we see this sort of open discourse as a good and healthy thing for out business.

Without further ado, then, here are the thoughts of the principal members of the Casey Brain Trust (click on the names to read bios).

David Galland, Managing Director (The Casey Report): Of course, gold and silver being taken to the woodshed (or is it the gallows?) at a time when some central banks around the world have committed themselves to the wanton printing of currency units, while others have committed themselves to aggressive purchases of gold, makes no sense at all. It "should" be going up by $100 an ounce, not the opposite.

But when it comes to any investment market, there are no absolutes. Clearly, there are powerful interests aligned against gold right now. And I'm not referring to government suppression schemes which may or may not lurk in the shadows. Instead, I refer to institutional money managers who are loaded to the eyeballs with cash and itching for a return. That gold is a relatively small market – certainly against stocks and bonds – makes it fairly easy to push around. That institutional traders invariably keep at least one eye on technical indicators has, in my opinion, led to something of a self-fulfilling prophecy, resulting in this latest move downward.

So is gold in the woodshed or on the gallows, waiting for the final blow? While the market may currently be ignoring the fundamentals, the fundamentals exist nonetheless; and no amount of hoping they be otherwise is going to change the basic setup. And that setup is simply government debt that can't be paid, with more being piled up every day in the tens of billions, an active currency war, and the wholesale debasement of the major currencies. The precious metals should be owned primarily as an insurance policy, and like an insurance policy pretty much tucked into a drawer and forgotten about. As Doug Casey likes to point out, there are also times that the precious metals (and related investments) are also good speculations. Given the speed and severity of the latest pullback, I think we could see a reverse of sentiment sooner than would otherwise be the case. So maybe that's a good speculation. Personally, I'm going to hold my fire until and unless gold gets oversold below $1,500 – at which point I suspect the temptation to buy more will become hard to resist.

Marin Katusa, Chief Energy Investment Strategist (Casey Energy Report): It's no secret that I've been bearish on most things in the resource sector for the last 18+ months. At the Casey Conference in September 2011, I stated that I believed a deflation in resource stocks would occur, meaning lower prices. It is during times like these that the greatest opportunity exists, when there is blood on the streets. And I can confirm that there is blood in the streets in Vancouver, the epicenter of junior resource stocks in the world. Stock brokers, money managers, IR firms, geologists – are all hurting. This is good for us, because we look to buy things cheap. Sector pain is good, because we are on the right track.

I think this will continue for another year or two, but because there is so little to be optimistic about, the stories that do show great potential will have the masses rushing into them. Look at Africa Oil, for example. That was a story we were first to recommend – but for years subscribers had to suffer from the boredom of a stock that passed all of the Casey 8 Ps and had to wait until the company drilled its 10BB block. Africa Oil showed a lot of promise, and the big funds flooded to it because it was one of the few stories that had liquidity and warranted the speculation. Our mantra in the energy side has been risk mitigation and to book profits whenever possible. It was one of the few stories the big money could speculate in – and that is a trend for investors to watch, because if a junior does hit something tangible, the money is there to push the share price a lot higher.

An investor needs to ask, "What is my time frame?" I will give a personal example. Copper Mountain, which today produces copper, gold, and silver, is Canada's third-largest operating copper mine. I was extremely bullish when I became one of the largest investors in the company in 2006 and invested even more money in 2007 – I had a seven-year time horizon for the project. Copper Mountain went public in 2007, the stock doubled to over C$2.50 a share, then in a blink of the eye, November 2008 came along... and I had a penny stock on my hands. I ended up buying a lot more stock at those prices in the open market, because the company more than exceeded the Casey 8 Ps, and I had nothing but the utmost respect for the management team and believed that Jim O'Rourke and his team would deliver. Which they did: within 36 months, the stock went to C$8/share, a 2,500+% gain from where I bought stock in the open market in late 2008. It was one of the stories that survived the "valley of darkness." However, if I didn't have a longer-term time horizon and sold at the low of 2008, Copper Mountain would have been one of my largest losses, rather than what it is – a major success.

After an investor understands his time frame, he must stick with the due diligence and make sure the company can survive the "valley of darkness." Things do change along the way, and the company and its project may not have what it takes, and if so you have to sell and cut your losses. But if the story is getting better and the company is cheaper due to crappy markets, why would you sell?

So, I don't expect the overall good times for the resource industry to come soon, but I view that as a major positive. I view it as a positive because if you are able to find companies that pass the Casey 8 Ps, you will be buying stocks for dimes on the dollar. Fortune favors the bold.

Olivier Garret, CEO: The current technical indicators for gold, silver, and mining stocks are quite bearish, telling us there will most likely be continued pressure on the sector for a while longer and that we are likely to test lower levels. It's possible that we'll see market capitulation before this is over. While investors will find this period painful as they look at their brokerage statements, they should not lose sight of the fundamental reasons why they are invested in the sector. Have these changed? Absolutely not. In fact, there is a lot of evidence to the contrary.

That said, times of steep market declines like these should be times to reassess one's portfolio. While strong companies with great people, property, and the cash to pursue their strategies for the next one or two years without going back to the markets will survive and even likely to do very well (even if their stock prices are disappointing right now), the weaker players are likely to be wiped out entirely. So review your portfolio and no matter what the loss might be, liquidate any positions except the strongest of companies. You will be thankful you did so before it was too late.

Experienced investors in the resource sector know that it is times like these when real money gets made. For example, in the first quarter of 2009, our markets were absolutely decimated – but the investors who stuck to best-of-breed companies and had the courage to carefully add to their positions did extremely well in the two years that followed. With the caveat that we may not have seen the bottom yet, disciplined investors will again make a lot of money when the markets turn around. Hopefully Casey subscribers have followed our advice to hold lots of cash and take free rides on existing positions. It is too early to be aggressive, but the current liquidation will present us with another incredible opportunity.

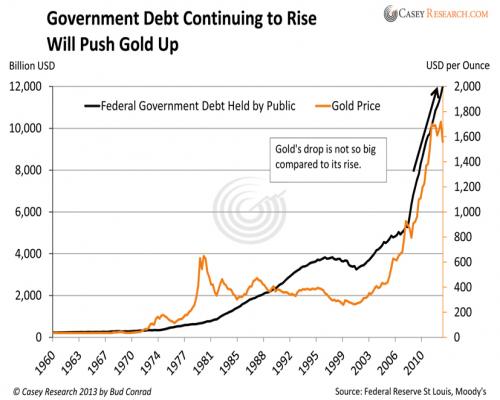

Bud Conrad, Chief Economist (The Casey Report): My main reason for believing that gold is a long-term, solid investment is that government debt is continuing to grow, so the Fed is "printing" up new currency and that will debase the dollar. Gold is the best investment in the face of the inflationary pressures of deficits and complicit central-bank printing.

The chart below shows the size of US federal government debt and the price of gold. The point is that the deficit is continuing because the government finds it easier to let the Fed buy up debt than to raise taxes or cut spending. The very public failure of Democrats and Republicans to even discuss solutions, combined with the $75 trillion of unfunded liabilities for baby boomer retirees, guarantees rising debt levels.

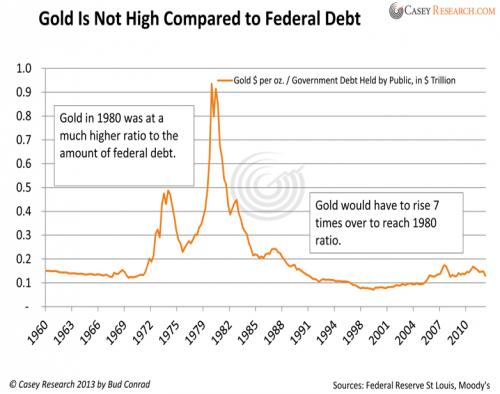

The above two lines can be presented as one line by dividing the price of gold by the federal debt to show how much higher gold rose in the inflationary 1980s. Presented this way, as the next chart shows, gold has a long way to go to meet the level of that prior bubble's peak.

The safe haven is gold.

Jeff Clark, Senior Precious Metals Analyst (BIG GOLD): To a large extent, the hedge fund managers and institutional investors don't see a second crisis coming and therefore conclude gold is no longer necessary. They see the signs that point to an improving global economy – and then notice that inflation is not the big bad scare they assumed it would be by now. So they sold. Technical levels were hit in the eyes of some, triggering further selling. Throw in some panicked retail investors and forced redemptions, and the rout was on.

All of this ignores the macro picture – bloated balance sheets around the world and economies being flooded with paper money. Yes, that's been the case for a while, but none of it has been unwound – a process that will be difficult to time, messy to carry out, and punishing to our standard of living. The reality is that inflation is inevitable, regardless of what those who were pimply teenagers the last time gold was in a bull market might think.

The way to view this is short-term sentiment versus long-term reality. Don't let the weak hands pull you under. For gold stocks, the blood-in-the-streets process is under way. I'm personally turning over couch cushions to get ready. It may or may not reverse soon, but sooner or later fundamentals trump shortsighted theories and lines crossing on a chart. We'll have a lot more to say – as well as what to do – in the upcoming issue of BIG GOLD.

Kevin Brekke, Managing Editor, World Money Analyst: The duration and altitude of the current bull run in gold has been impressive. Over a decade of annual gains is enough to swell the fortunes and add a bit of swagger to one's gait. A raging market produces more geniuses than any university. But it will also lull investors who lack conviction in the underlying fundamentals into complacency.

The vicious '08 gold sell-off was easily excused away: global financial crisis, banking system on verge of collapse, selling gold to meet margin calls… the memory is painful and vivid. But the relatively quick return to former highs in '09 was just the balm needed to heal old wounds and not leave a scar.

The subsequent horns-lowered charge from 2009 to 2011 was a gold crowd-pleaser, persuading many that they were ready for grad school. The swagger was back.

The last six months have dealt a harsh blow to gold and silver and sucker-punched the miners. Compounding investor anxiety is that the recent sell-off is happening within the broader context of 18 months of the metals and miners grinding lower since gold hit its all-time nominal high.

Yet, whether you are watching the Fed's balance sheet or candlestick chart patterns, the fundamental evidence has not changed. The spending, borrowing, and leveraging behavior of today is the same kind as seen throughout the millennia, but to a far greater degree. We should not expect a different outcome.

Now is not the time to run a "conviction deficit." If luck is the confluence of opportunity and preparedness, then I see some lucky days ahead. But be prepared for the payoff to happen on someone else's schedule. "Imminent" does not lurk dead ahead.

Louis James, Chief Metals and Mining Investment Strategist (Casey International Speculator): On days like last Wednesday, when gold was falling hard and fast, I feel such strong, mixed emotions. Gold stocks plummeted, and I couldn't wait to wrap up my work fast enough to start buying.

I've learned from Doug how to make volatility my friend. As I've been writing for years, when an asset goes on sale due to market psychology or other factors having nothing to do with the asset's actual value – especially when nothing changes in the fundamentals – it's a buying opportunity. I'm excited by the opportunity. But I'm also concerned, because I know many investors are panicking, realizing losses they don't have to.

Putting my money where my mouth is, I went down to my local coin shop Wednesday, buying among other things a one-ounce Canadian Maple Leaf that caught my eye. Am I worried that gold might drop further? No. I didn't buy this Maple Leaf because I expect the price of gold to rise, but because it's gold.

No matter what happens in the financial world or the world at large, my Maple Leaf will always be one ounce of pure gold, a value I'll be able to carry and use anywhere in the world. As Doug taught me, I buy gold for prudence, not speculation. And the weight of my new coin in my pocket was a happy comfort all the way home.

But the gold stocks are another matter. Even though +$1,500/oz. is a very good price for gold miners with quality operations, market sentiment is so bearish that a retreat to $1,500 could cause a panic among gold investors that would trash the share prices of good companies along with the bad. We could be very close to what none of us have seen in this cycle so far: true market capitulation. That is to say, regardless of the fundamentals, investors could just give up on precious-metals stocks. And without bids, prices plummet. We should be so lucky!

Our technical-analyst friends tell us that the likely bottom to the current correction should come around $1,545. Some technical analysts are even saying that this gold bull market has topped – I mean absolutely topped, and it's going to be a long bumpy ride downhill from here. I see no reason to believe the latter and no inescapable logic for accepting the former, but it's clear that there's blood in the water and the sharks are circling. Such expectations could even become self-fulfilling prophecies. With many gold-stock investors already close to panic, if gold breaks below one of these TA support levels, things could get really ugly... or beautiful, depending on your perspective.

All of this is very clear to me, as is what to do about it. The first thing to do is to cancel all my stink bids. If gold stocks are going to crash, I'm going to wait until they have clearly done so – when people are cursing me for being a fool or a knave and true market capitulation is obvious. Then I'll step in to see how low I can place my bids and get filled. The potential for profit may exceed 2008 levels and possibly even blow away 2001 levels – that's what a real panic can do for a savvy buyer.

Of course, gold may not go down to $1,545, and any of the factors Jeff, Doug, and I have discussed many times could send it sharply northward again tomorrow – or today. If Doug is right about the economy coming apart this year, it won't be too long before journalists are trying to outguess each other about how high gold will go by the end of the year, rather than the opposite we see today.

This is why am not selling anything – not unless I think the company no longer has what it takes to weather the storm. If unfolding events on the global economic stage drive investors back to gold, they'll do so with gusto, and it'll be off to the races. I do not want to be short.

I wish I had the eloquence of Shakespeare's King Henry V, so I could make a Crispin's Day speech that would give everyone the courage and discipline to fight through to victory. If you have this courage and are able to act if stocks in great companies go on sale at stupid prices, you will make yourself a lot of money.

Terry Coxon, Senior Economist (The Casey Report): For the last year or so, I have leaned toward the idea that if would be a while before gold moved much higher, since most of the people who understood how the deficits and money printing that have been propelling gold have now bought in. I don't expect gold to move to new highs until something happens that the other 98% of investors will see as a reason to buy gold – such as conspicuously higher rates of price inflation. The recent drop may be from impatience or from worries that the Fed is going to throttle back from reckless printing of new money to a money-creating program that is merely incautious. But I don't believe that the bull market in gold is over, because the dollars that the Fed has produced since 2008 are not going to get unprinted and will eventually come out of hiding and fuel double-digit rates of price inflation.

Junior gold stocks are another matter. People don't buy them as a store of value and won't keep them if they are going sideways. So either they go up – which is hard to do when gold is steady to down – or they drop. I wouldn't expect a recovery until speculators are willing to bet on the metal rising, which I don't expect to happen this year.

Doug Casey, Chairman (The Casey Report): Frankly, I don't care about short-term fluctuations in the gold market – or any market. They're random and unpredictable. It makes no sense to clutter your mind with guesses about what might happen in the next hour, day, week, or even month. If you try to trade on that basis, you'll be eaten alive by commissions, bid-ask spreads, taxes, and the vagaries of your own psychology. I'm only concerned with the long term.

As for gold, it's not a bargain at $1,600, but in light of what governments all over the world are doing – creating trillions of new currency units – it's going higher. I continue to accumulate it mainly for safety, not gain. Right now I'm especially bullish on gold-mining stocks, which offer extraordinary speculative potential.

© 2013 Copyright Casey Research - All Rights Reserved

Disclaimer: The above is a matter of opinion provided for general information purposes only and is not intended as investment advice. Information and analysis above are derived from sources and utilising methods believed to be reliable, but we cannot accept responsibility for any losses you may incur as a result of this analysis. Individuals should consult with their personal financial advisors.

Casey Research Archive |

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.