Fed To Prompt Currency Crash and Return to Gold Standard

Commodities / Gold and Silver 2013 Feb 27, 2013 - 12:21 PM GMTBy: GoldCore

Today’s AM fix was USD 1,608.50, EUR 1,228.80 and GBP 1,062.28 per ounce.

Today’s AM fix was USD 1,608.50, EUR 1,228.80 and GBP 1,062.28 per ounce.

Yesterday’s AM fix was USD 1,597.25, EUR 1,219.65 and GBP 1,052.07 per ounce.

Silver is trading at $29.13/oz, €22.32/oz and £19.33/oz. Platinum is trading at $1,611.00/oz, palladium at $736.00/oz and rhodium at $1,200/oz.

Gold climbed $19.30 or 1.3% yesterday in New York and closed at $1,613.90/oz. Silver surged to as high as $29.456 and ended with a gain of 1.2%.

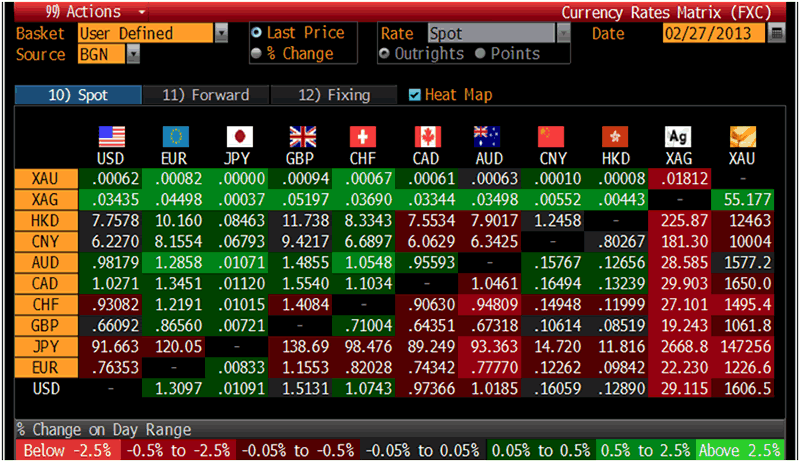

Cross Currency Table – (Bloomberg)

Gold’s 1.3% gain yesterday was its biggest one-day gain in three months, as Federal Reserve Chairman Ben Bernanke's defense of U.S. debt monetisation confirmed bullion's inflation hedging appeal.

‘Helicopter Bernanke’ confirmed the Fed’s ultra dovish monetary policies are to continue which supported gold as a hedge against central banks' cash printing.

Gold is trading flat today near a one and a half week high hit yesterday as Federal Reserve Chairman Ben Bernanke defended the U.S. ultra loose monetary policy.

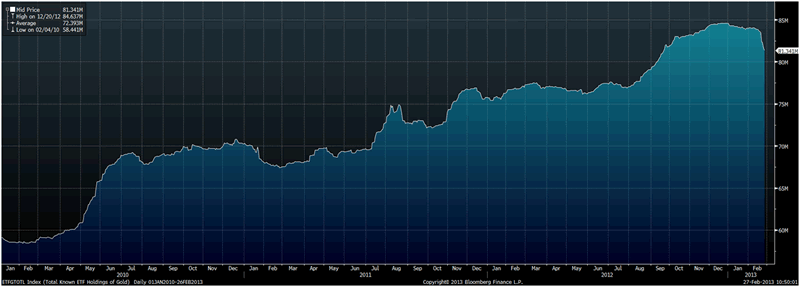

The selloff in gold ETFs in February underscores the weakness in gold sentiment among retail investors that has been prominent recently.

Our trading desk has never been so busy – on the sell side - as weak hands and lack of conviction buyers have engaged in panic selling.

However, the sell off’s genesis was again hedge fund and bank paper players on the COMEX many of whom still have large concentrated short positions.

Total Known ETF Holdings of Gold – (Bloomberg)

February is set to be the weakest month in terms of gold ETF outflows thus far, and the decline is set to exceed the 2.3 million ounces liquidated back in January 2011.

Total known gold holdings held by exchange traded funds worldwide include the SPDR, ETF Securities, ZKB, iShares, Swiss & Global, Central Fund, Credit Suisse, Source, New Gold, Sprott Gold, Deutsche Bank, Central Goldtrust, Claymore (now iShares), and Goldist.

It is important to note that despite the significant decline in gold holdings in January 2011, gold bottomed at $1,313/oz on January 27, 2011 and then embarked on its nearly 50% increase or $600 increase to record nominal highs above $1,900/oz.

World powers and Iran ended two-days of talks over the Islamic Republic’s disputed nuclear program with a pledge to hold further discussions at both technical and political levels, an Iranian official said.

The officials adjourned without an announcement on a proposal by the U.S. and its partners to ease some banking, petrochemical and gold sanctions if Iran curbs its atomic activities.

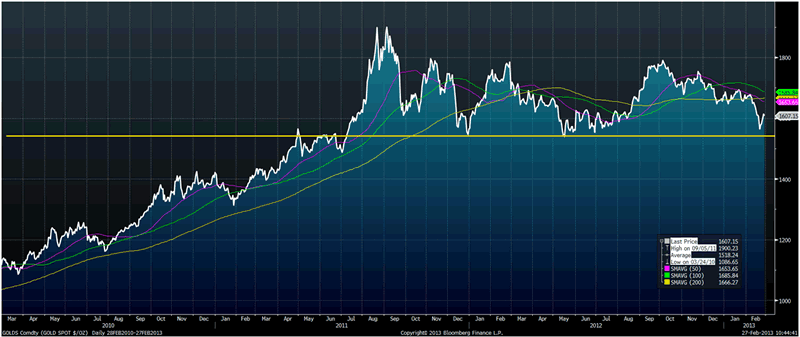

Gold in USD (February 2010 To Today) - Support At $1,540/oz to $1,550/oz Level – (Bloomberg)

Jim Grant, astute monetary economist and respected author of the Interest Rate Observer said in a Bloomberg interview overnight that the dollar would crash and a new Gold Standard would be the end result of the U.S. Federal Reserve’s irresponsibilities.

Although the interviewer said that Grant’s remarks were inflammatory Grant said that it is important to examine our monetary affairs over the sweep of time.

“Over 100 years ago the U.S. Fed was founded and in 1944 at Bretton Woods they decided there would be no more Gold Standard but rather a U.S. dollar that was backed by gold. If you fast forward to the present we now have a full blown PhD standard where the former heads of Economic Departments are running federal institutions. Central Banks across the world are waging an all out struggle against the price mechanism which is going against Adam Smith’s invisible hand.”

A guest host said that no one in academia is calling for a Gold Standard and suggested it would result in a deflationary period for the U.S.

Grant disagreed and said that the Gold Standard is the only answer as it was monetary system good practice for the 100 years ending in 1914, whereas everything else since has been a “try out”.

Grant says that he expects more quantitative easing from the U. S. Fed, and likens their single mindedness to a doctor prescribing to a patient that is clearly overmedicated.

He notes, credit in the world is an infinite sum of numerous simultaneous equations. He notes that if humans knew how to allocate credit than the USSR would have been a success. Socialists unions over manipulating credit don’t work.

Therefore, just as central banks are continually try to print their way out of our current global debt crisis their manipulation is not working.

Click here in order to read GoldCore Insight - Currency Wars: Bye Bye Petrodollar – Buy, Buy Gold

For the latest news and commentary on financial markets and gold please follow us on Twitter.

GOLDNOMICS - CASH OR GOLD BULLION?

'GoldNomics' can be viewed by clicking on the image above or on our YouTube channel:

www.youtube.com/goldcorelimited

This update can be found on the GoldCore blog here.

Yours sincerely,

Mark O'Byrne

Exective Director

IRL |

UK |

IRL +353 (0)1 632 5010 |

WINNERS MoneyMate and Investor Magazine Financial Analysts 2006

Disclaimer: The information in this document has been obtained from sources, which we believe to be reliable. We cannot guarantee its accuracy or completeness. It does not constitute a solicitation for the purchase or sale of any investment. Any person acting on the information contained in this document does so at their own risk. Recommendations in this document may not be suitable for all investors. Individual circumstances should be considered before a decision to invest is taken. Investors should note the following: Past experience is not necessarily a guide to future performance. The value of investments may fall or rise against investors' interests. Income levels from investments may fluctuate. Changes in exchange rates may have an adverse effect on the value of, or income from, investments denominated in foreign currencies. GoldCore Limited, trading as GoldCore is a Multi-Agency Intermediary regulated by the Irish Financial Regulator.

GoldCore is committed to complying with the requirements of the Data Protection Act. This means that in the provision of our services, appropriate personal information is processed and kept securely. It also means that we will never sell your details to a third party. The information you provide will remain confidential and may be used for the provision of related services. Such information may be disclosed in confidence to agents or service providers, regulatory bodies and group companies. You have the right to ask for a copy of certain information held by us in our records in return for payment of a small fee. You also have the right to require us to correct any inaccuracies in your information. The details you are being asked to supply may be used to provide you with information about other products and services either from GoldCore or other group companies or to provide services which any member of the group has arranged for you with a third party. If you do not wish to receive such contact, please write to the Marketing Manager GoldCore, 63 Fitzwilliam Square, Dublin 2 marking the envelope 'data protection'

GoldCore Archive |

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.