Dow 14000: Why the US Economy Matters Less to US Corporations

Stock-Markets / Corporate Earnings Mar 11, 2013 - 03:59 PM GMTBy: Keith_Hilden

A question remains on many people's minds regarding the US economy. Amidst a moribund recovery, stagnant job growth, lower household income, and US corporations being cash poor, how exactly can the stock market be reaching new all time highs?

A question remains on many people's minds regarding the US economy. Amidst a moribund recovery, stagnant job growth, lower household income, and US corporations being cash poor, how exactly can the stock market be reaching new all time highs?

It is precisely due to the fact that the stock price of US corporations are no longer dependent on strong domestic US performance to the degree that they previously were. Overseas profits continue to steadily amass over the decade as a higher percentage of revenues against their domestic US revenues. This needs to be understood in order to see why there is a Dow at an all time high. Cash poor in the US while cash rich abroad is due to corporations avoiding the repatriation of those profits due to a 35% penalty taxed upon those profits.

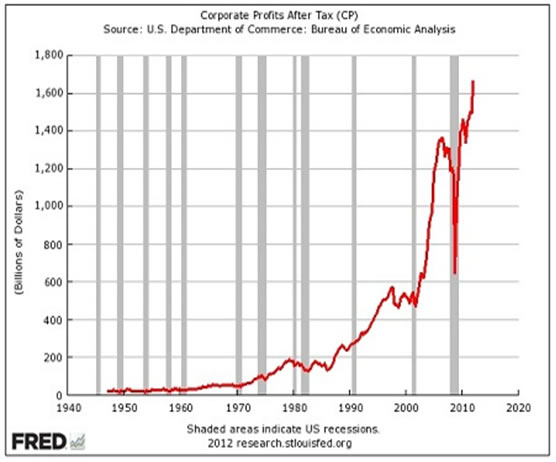

So while QE Infinity and the $85 billion/month stimulus is a factor, no doubt, as to why US stocks appear so strong, the real fundamentals behind this quantitative easing-created anomaly is due to record profits and a general trend towards an increased share of profits outside the US, and consequently a decline of share of profits within the US. Thus cash rich US corporations are at all time profit highs since 1950, yet are not translating into job growth and economic revival within the US. Looking at this over a wide range of time rather than a snapshot of what is currently happening aids to explain much better why there is such a strong stock market. Make no mistake, quantitative easing is definitely having its effect on stock prices. But that doesn't explain the over a decade rise in percentage of overseas profit vs. US domestic profit. Quantitative easing is a short-term driver as to why the stock market is so high, but the underlying shift in corporate profits towards overseas nations is the long-term driver.

So if the US percentage of world GDP continues to decline it is thus only natural to expect a lower percentage of domestic profits for US corporations against their overseas profits.

It is important to see declining overseas revenues in Europe and China as a transitory event, and revenues will again be on an uptick, either through a recouping of revenue in Europe and China, or new revenue growth in markets such as Africa and Southeast Asia, or any of the other countries in the world. Either way, the overseas profits as percentage of total corporate profits will continue to rise until the US GDP recoups its loss of global GDP against the World's GDP. It is important to remember that even though US GDP is nominally rising, its share in the world is decreasing.

So the total share of world GDP and overseas profits is set to gain ground against the US. And why shouldn't it? Globalization and the unfavorable conditions preventing repatriated earnings to the US has fueled US corporations equitably distributing around the developing world more career opportunities. Those career opportunities create wages and profits, and those profits are also distributed around the world for reinvestment and expansion. The refusal from both government to change regulation and corporations to repatriate profits is actually a force factor upon this trend to be energized, and to further continue.

The US is merely one of many markets US firms reinvest and expand into. Due to the choice of 192 markets to expand into, this shift naturally means that less profit from US corporations come from the US itself. And so a stock price of a company is simply the reflection of how it has done across all markets, not only just in the US market. This means that the Dow is not an accurate indicator of the domestic US economy.

The decreasing percentage of US corporate domestic profits as a whole has been an ongoing trend since 1996, and if the dynamics driving this shift do not change, then this trend will continue as corporate career opportunity and consumer choice is diversified and democratized across the world. In turn, profits will also be democratized and will result in reinvestment and expansion efforts distributed to these 192 markets across the world. It is the interest of these corporations to expand and develop each of these markets to their optimal saturation point, and so it should be no surprise that there is a declining share of investment and expansion into the US, a market that is already at or close to the saturation point in relative comparison to other markets.

The Obama administration as well as other national leaders are concerned about exactly this change. But short of long-arm legislation tactics to somehow restrict foreign investment of these US companies, or a legal mandate that US corporations must invest a certain part of their profits in the US, the US can only adjust its business conditions to make its market competitive amongst the other 191 markets out there. In a time where capital is increasingly taking share of the market over labor, labor has little recourse to demand where US corporations operate and to what concentration placed upon which market. Labor also possesses a weak hand in most countries regarding the call for legislative change to protect labor's interests. Capital, thus, will flow to the destination with the most favorable conditions allowed to it.

US corporations have had a huge head start over other nations' corporations, and thus US corporations have been reporting record profits. As other nations get into the globalized market game, it will be more of a competition, as opposed to what it has been- a situation of the early bird getting the worm. So in this environment, again, it is no wonder why US corporations have been absolutely raking it in over the last decade and longer.

Under this lens, it becomes clear that persistent unemployment and other negative economic metrics in the US do not make or break a global US corporation anymore. This trajectory is not set in stone, and there can of course be events that can change the course of how this plays out. But currently, little is being done from the US side in order to counteract this. Agreements such as a real, two-way, equitable fair trade agreement between Canada and China for instance, would mean 0% or equitably proportional import tariffs at the two countries' borders, ending the argument of a mercantilist China and creating a truly free, free trade arrangement. This would lower the bar of entry for US companies wishing to enter the Chinese market. It would then be a matter instead of who China has a mercantilistic relationship with, rather than an across the board mercantilistic nation intent on draconian import tariffs. This is an example of how events can make huge trajectory changes previously unseen, and new shifts and trends to emerge. Yet the path for the US is very clear if the US remains on the trajectory that it is on.

Ultimately, the refusal from both government to change regulation and corporations to repatriate is a gridlock dynamic that enables this trend to continue. After all, there is no logical recourse for US corporations to repatriate any of this cash if it will be taxed at amounts not advantageous to the corporation. Of course globalization will occur if a government creates conditions where it is not logical to repatriate a corporations cash, and does not create legislation to otherwise incentivize or punish a corporations behavior and operations. Hence, emerging markets stand poised to continue to being opened if these conditions for repatriation remain the same. Take a look at this chart and factor in how a sizable chunk of those profits over more than a decade have not being reinvested in the US and have been reinvested elsewhere. Do the math on how the US economy fares in that scenario.

By Keith Hilden

unlimitedinsights.blogspot.com

Keith Hilden holds a degree in Economic Crime Investigation and researches Asia Pacific and Cyber Security issues for Wikistrat. He also is a contributing analyst for 2point6billion and Fair Observer.

© 2013 Copyright Keith Hilden - All Rights Reserved

Disclaimer: The above is a matter of opinion provided for general information purposes only and is not intended as investment advice. Information and analysis above are derived from sources and utilising methods believed to be reliable, but we cannot accept responsibility for any losses you may incur as a result of this analysis. Individuals should consult with their personal financial advisors.

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.