Spring Rally Directly Ahead for Gold Stocks

Commodities / Gold and Silver 2013 Mar 15, 2013 - 11:12 AM GMTBy: Jordan_Roy_Byrne

Last week in regards to Gold we wrote: We have the majority of sentiment indicators showing more pessimism than in 2008, an explosion in negative news coverage and news that major banks have downgraded their outlooks. Without knowing anything else, you’d expect Gold to be down considerably, yet it’s only off about 5% year to date and 10% in the past three and a half months. Most important, Gold hasn’t even broken support!

Last week in regards to Gold we wrote: We have the majority of sentiment indicators showing more pessimism than in 2008, an explosion in negative news coverage and news that major banks have downgraded their outlooks. Without knowing anything else, you’d expect Gold to be down considerably, yet it’s only off about 5% year to date and 10% in the past three and a half months. Most important, Gold hasn’t even broken support!

Gold has failed to break below its 2011 and 2012 lows and that is a telling sign, especially in the face of this pervasive bearish sentiment. Gold looks likely to close at a four week high and we expect it to challenge $1600 in the coming days. A close below $1620 would essentially confirm that the bottom is in.

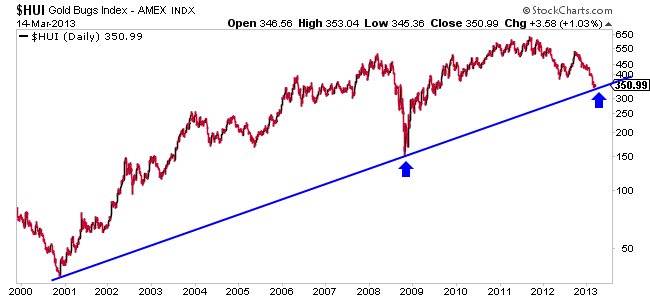

Meanwhile, the action in the mining shares has provided enough evidence that at the very least, a tradeable low is in. In recent writings we’ve noted the confluence of major support at HUI 336-337. The trendline connecting the 2000 and 2008 lows, the 62% retracement of the 2008 to 2011 cyclical bull and the 50% retracement from the 2000 low to 2011 high all coincided together very close the HUI 336-337. What was the recent low on the HUI? 337.

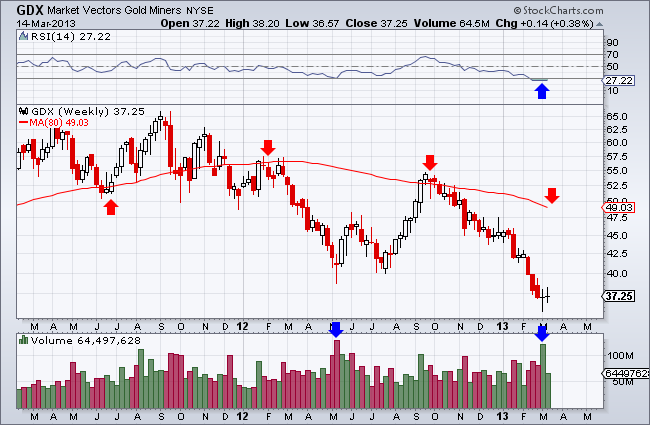

Next we want to turn your attention to the GDX and GDXJ ETFs. Starting with GDX we see the market formed a bullish reversal candle (hammer) last week with huge volume. In fact, the only higher weekly volume occurred at the May 2012 bottom when GDX also formed a bullish hammer.

Meanwhile, GDX’s little brother, GDXJ is showing the same reversal candle and with equally as large volume. Look for GDXJ to rally to $21 where a confluence of resistance (moving average, former support) should come into play.

It may take a few more days or another week to confirm but the gold shares are set to rebound and have their best rally since last summer. The market became extremely oversold, sentiment reached an extreme, the market tested strong support (HUI 337) and then put in a bullish hammer reversal and on huge volume. This is how bottoms form. At the least, we expect a very strong (in percentage terms) tradeable rally to go into the spring. We accumulated shares in advance of this bottom and more last week as the HUI rebounded off 337.

As always, readers are reminded that stock selection in this sector is critical to success. Due your own due diligence and you can far outperform the indices. Two criteria we’d use to begin screening companies are stocks that have held their 2012 lows and have strong working capital.

If you'd be interested in professional guidance in this endeavor, then we invite you to learn more about our service.

Good Luck!

Bio: Jordan Roy-Byrne, CMT is a Chartered Market Technician, a member of the Market Technicians Association and from 2010-2013 an official contributor to the CME Group, the largest futures exchange in the world. He is the publisher and editor of TheDailyGold Premium, a publication which emphaszies market timing and stock selection for the sophisticated investor. Jordan's work has been featured in CNBC, Barrons, Financial Times Alphaville, and his editorials are regularly published in 321gold, Gold-Eagle, FinancialSense, GoldSeek, Kitco and Yahoo Finance. He is quoted regularly in Barrons. Jordan was a speaker at PDAC 2012, the largest mining conference in the world.

Jordan Roy-Byrne Archive |

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.