Italians Value Gold Reserves - EU Deposits To Flow To Gold

Commodities / Gold and Silver 2013 Mar 26, 2013 - 06:02 PM GMTBy: GoldCore

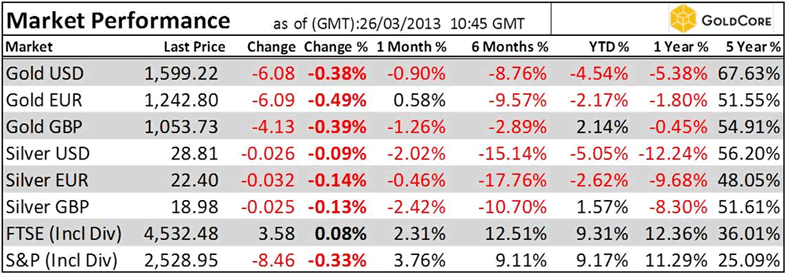

Today’s AM fix was USD 1,597.25, EUR 1,241.35 and GBP 1,052.21 per ounce.

Today’s AM fix was USD 1,597.25, EUR 1,241.35 and GBP 1,052.21 per ounce.

Yesterday’s AM fix was USD 1,602.25, EUR 1,232.97 and GBP 1,053.70 per ounce.

Silver is trading at $28.86/oz, €22.53/oz and £19.12/oz. Platinum is trading at $1,578.00/oz, palladium at $759.00/oz and rhodium at $1,225/oz.

Gold fell $3.20 or 0.2% and closed yesterday at $1,604.40/oz. Silver finished +0.41% at $28.81.

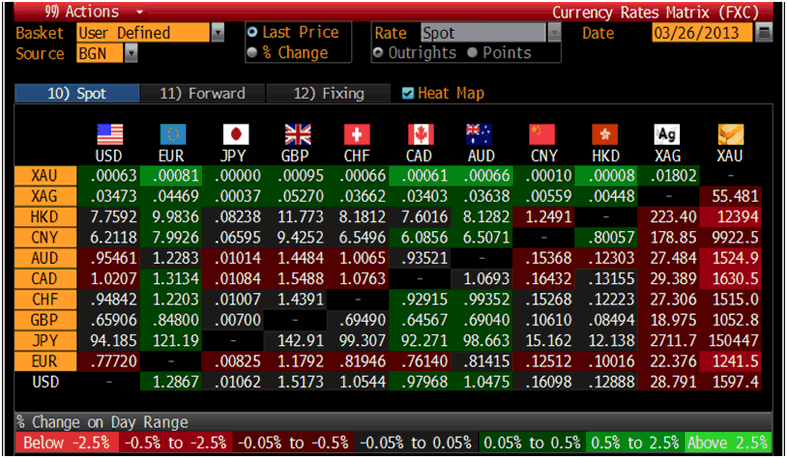

Cross Currency Table – (Bloomberg)

Gold is slightly lower in most major currencies this morning and to the surprise of most market participants has fallen below the $1,600/oz level again.

The president of Cyprus has announced "very temporary" capital controls, such as a continuation of a deposit withdrawal restriction of €100 per day, to stem a run on the island's banks. The history of capital controls shows that once introduced they can remain for longer than wanted.

An increase in safe haven demand, particularly in periphery European nations such Spain and Italy will likely support gold. Citizens in these countries are alarmed by how depositors in Cyprus were treated and the more aware and prudent ones are taking the requisite action in order to protect their families and businesses from the growing possibility of capital controls.

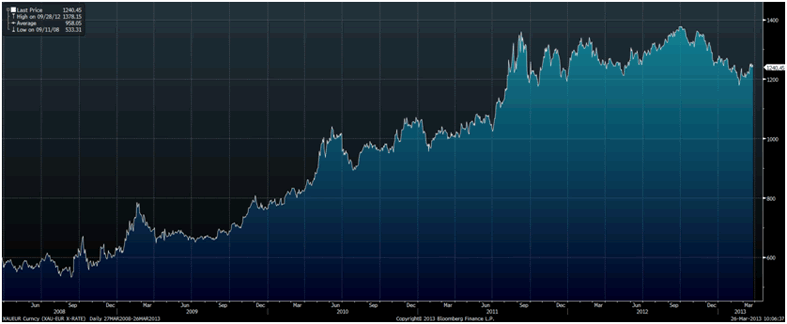

GOLD in EUR, 5 Year – (Bloomberg)

A survey for the World Gold Council found that just 4% of people in Italy would back plans to sell the nation’s gold reserves according to Bloomberg.

Some 52% of citizens and 61% of business people would support the use of the nation’s gold reserves to reduce debt costs, the World Gold Council said. The study by Ipsos MORI surveyed 1,009 Italian citizens aged 16-70 and 300 business leaders.

“Italy holds more than 2,000 tonnes of gold in its national reserves, but selling it is not the answer,” Natalie Dempster, director of government affairs at the World Gold Council, said in the statement. “A higher value option is to use gold as collateral and effectively produce five times its value, without selling it. The World Gold Council calculations show that by deploying the gold as security for sovereign bonds Italy could raise over 20% of its total two-year borrowing requirements.”

Whether to sell Italy's national gold reserves is an interesting question. A perhaps as interesting question and more important question in the light of the Troika expropriation of bank deposits is will Italians begin to diversify some of their savings in Italian banks into gold bullion?

The answer is almost certainly yes and the recent trickle of Italian money flowing into gold bullion, including into vaults in Switzerland, is likely to become something far more substantial in the coming weeks.

Capital flows out of periphery European banks and into gold has been quite low up until now but with deposits not safe now in the European Union that is likely to change and gold is likely to be one of the beneficiaries of the huge uncertainty that the Troika has managed to create about the banks in many European countries.

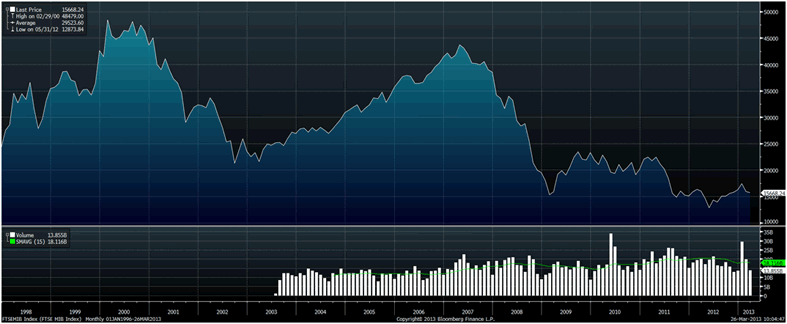

FTSE MIB INDEX, 1998 – Today – (Bloomberg)

Having all your life savings or all your business capital in periphery European banks is imprudent and diversification and holding some gold bullion remains wise.

We expect these increased capital flows from European bank deposits and into gold to support the price and to lead to higher prices and contribute to another year of gains for gold in 2013.

For the latest news and commentary on financial markets and gold please follow us on Twitter.

GOLDNOMICS - CASH OR GOLD BULLION?

'GoldNomics' can be viewed by clicking on the image above or on our YouTube channel:

www.youtube.com/goldcorelimited

This update can be found on the GoldCore blog here.

Yours sincerely,

Mark O'Byrne

Exective Director

IRL |

UK |

IRL +353 (0)1 632 5010 |

WINNERS MoneyMate and Investor Magazine Financial Analysts 2006

Disclaimer: The information in this document has been obtained from sources, which we believe to be reliable. We cannot guarantee its accuracy or completeness. It does not constitute a solicitation for the purchase or sale of any investment. Any person acting on the information contained in this document does so at their own risk. Recommendations in this document may not be suitable for all investors. Individual circumstances should be considered before a decision to invest is taken. Investors should note the following: Past experience is not necessarily a guide to future performance. The value of investments may fall or rise against investors' interests. Income levels from investments may fluctuate. Changes in exchange rates may have an adverse effect on the value of, or income from, investments denominated in foreign currencies. GoldCore Limited, trading as GoldCore is a Multi-Agency Intermediary regulated by the Irish Financial Regulator.

GoldCore is committed to complying with the requirements of the Data Protection Act. This means that in the provision of our services, appropriate personal information is processed and kept securely. It also means that we will never sell your details to a third party. The information you provide will remain confidential and may be used for the provision of related services. Such information may be disclosed in confidence to agents or service providers, regulatory bodies and group companies. You have the right to ask for a copy of certain information held by us in our records in return for payment of a small fee. You also have the right to require us to correct any inaccuracies in your information. The details you are being asked to supply may be used to provide you with information about other products and services either from GoldCore or other group companies or to provide services which any member of the group has arranged for you with a third party. If you do not wish to receive such contact, please write to the Marketing Manager GoldCore, 63 Fitzwilliam Square, Dublin 2 marking the envelope 'data protection'

GoldCore Archive |

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.