This Is The Most Critical Time For The Stock Market Since 2007!

Stock-Markets / Stock Markets 2013 Mar 29, 2013 - 10:56 AM GMTBy: Sy_Harding

The economic recovery has stumbled in the spring and summer of each the last three years.

The economic recovery has stumbled in the spring and summer of each the last three years.

It’s not the market’s biggest problem, but it looks like it might happen again this year. Reports this week showed new home sales unexpectedly fell 4.6% in February, the biggest monthly decline in two years. Pending home sales declined 0.4%. Basic durable goods orders (ex-volatile aircraft orders) declined 2.7% in February. The Conference Board’s Consumer Confidence Index fell sharply in March, dropping from 68.0 in February to 59.7 in March. The Chicago PMI Index, which is often a bellwether for the national ISM Mfg Index, unexpectedly fell from 56.8 in February to 52.4 in March. New weekly unemployment claims jumped by 16,000 last week.

Perhaps more ominous, FedEx, the global shipping giant, reported a 31% decline in quarterly earnings and warned that global trade has slowed to levels not seen since the last two significant economic downturns. And Caterpillar, the giant global manufacturer of construction and mining equipment, also considered to be a bellwether for global economic conditions, reported an unexpected 13% plunge in orders in the three-month period from December through February. The company said its Asia-Pacific sales plunged 26%, and North American sales fell 12%.

Those reports are not good omens for the stock market. As the economic recovery stumbled in each of the last three years, the S&P 500 experienced a 15.6% correction in 2010, a 19.4% correction in 2011, and a 10.8% pullback last year.

But that’s not what makes this the most critical time for the market since 2007.

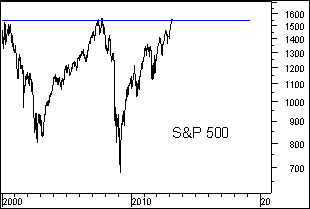

The potential problem is; if we are still in the secular bear market that began in 2000 the S&P 500 has reached the level of its previous peaks again.

First let’s define a secular market move as opposed to a cyclical market move.

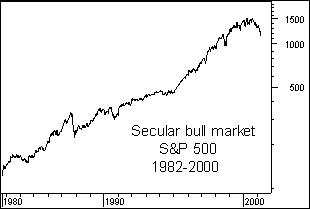

A secular bull market is a long-term rising market in which periodic cyclical bear markets take place, as in the 1980s and 1990s, but the long-term rising trend to ever higher highs soon resumes.

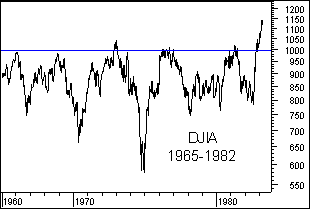

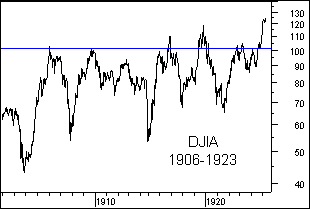

A secular bear market is a long-term sideways market, in which there are periodic cyclical bull markets that take the market back up to its previous peaks, but a cyclical bear market soon takes over and plunges the market back down from those peaks. There have been three secular bear markets over the last 110 years.

In the last one, the Dow reached 1000 for the first time in 1966, creating much excitement. But the subsequent cyclical bear market turned out to be the beginning of a 17-year sideways secular bear market. Cyclical bull markets returned the Dow to 1000 numerous times, but each time a cyclical bear market took back the gains. It was a wonderful time for market-timers but a devastating time for buy and hold investors, until the Dow finally broke out above 1000 for good, and launched into the powerful 1982-2000 secular bull market.

It was a similar situation in 1906, when the Dow reached 100 for the first time. It was 17 years again, in 1923, before the sideways secular bear market ended and the market broke out above 100 for good, launching into the powerful bull market to the 1929 peak.

So it’s not just the signs that the economic recovery may stumble again this year, but that unlike the last three summers, this year as a stumble threatens the cyclical bull market from early 2009 has the S&P 500 back up to its previous peaks again.

And thus my recent advice to “Remain invested – but alert!”

Sy Harding is president of Asset Management Research Corp., and editor of the free market blog Street Smart Post.

© 2013 Copyright Sy Harding- All Rights Reserved

Disclaimer: The above is a matter of opinion provided for general information purposes only and is not intended as investment advice. Information and analysis above are derived from sources and utilising methods believed to be reliable, but we cannot accept responsibility for any losses you may incur as a result of this analysis. Individuals should consult with their personal financial advisors.

Sy Harding Archive |

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.