Silver’s Coming of Age

Commodities / Gold and Silver 2013 Mar 29, 2013 - 04:04 PM GMTBy: Richard_Mills

Silver is winning market share from gold buyers.

Silver is winning market share from gold buyers.

2008 - In March 2008, sales increased nine times over the month before - 200,000 to 1,855,000.

In April 2008, the United States Mint had to start an allocation program, effectively rationing Silver Eagle bullion coins to authorized dealers on a weekly basis due to "unprecedented demand."

On June 6, 2008, the Mint announced that all incoming silver planchets were being used to produce only bullion issues of the Silver Eagle and not proof or uncirculated collectible issues.

The 2008 Proof Silver Eagle became unavailable for purchase from the United States Mint in August 2008. The US Mint suspended sales of the silver bullion coins to its network of authorized purchasers twice during the year.

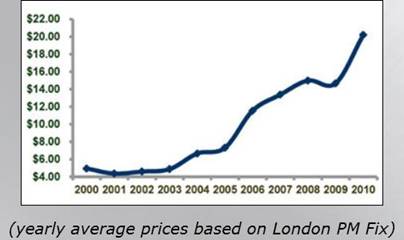

20,583,000 Bullion American Silver Eagles were sold in 2008. Silver averaged $14.99 an ounce and almost 80 percent more American Silver Eagles were sold then in any previous year.

“During 2008 there was a record inflow of over 93.1 million ounces (Moz) into the three main silver ETFs.Coins and medals fabrication jumped by an astonishing 63% to a record of 64.9 Moz. The main reason for this was a surge in investment-related purchases of bullion coins, both in the United States and Europe. Notably, fabrication of the U.S. Silver Eagle bullion coin achieved a record 19.6 Moz, approximately double the 2007 figure, and would have been higher if the U.S. Mint had sufficient blanks to produce coins to meet demand.” silverinstitute.org

2009 - 30,459,000 Bullion American Silver Eagles were sold.

On March 5, 2009, the United States Mint announced that the proof and uncirculated versions of the Silver Eagle coin for that year were temporarily suspended due to continuing high demand for the bullion version.

On October 6, 2009, the Mint announced that the collectible versions of the Silver Eagle coin would not be produced for 2009.

The sale of 2009 Silver Eagle bullion coins was suspended from November 24 to December 6 and the allocation program was re-instituted on December 7.

Total ETF holdings rose by 132.5 Moz and ended the year at 397.8 Moz. Coins and medals fabrication rose 21 percent to post a new record of 78.7 Moz.

Silver Eagle bullion coins sold out on January 12, 2010.

The average cost of an ounce of silver in 2009 was $14.67

2010 - No proof Silver Eagles were released through the first ten months of the year, and there was a complete cancellation of the uncirculated Silver Eagles.

2010 - No proof Silver Eagles were released through the first ten months of the year, and there was a complete cancellation of the uncirculated Silver Eagles.

Production of the 2010 Silver Eagle bullion coins began in January instead of December as usual. The coins were distributed to authorized dealers under an allocation program until September 3.

Silver posted an average price of $20.19 in 2010. World investment rose by an 40 percent in 2010 to 279.3 million troy ounces (Moz).

“Exchange traded funds (ETFs) registered another sterling performance in 2010, with global ETF holdings reaching an impressive 582.6 Moz, representing an increase of 114.9 Moz over the total in 2009. A significant boost in retail silver investment demand paved the way for higher investment in both physical bullion bars and in coins and medals in 2010. Physical bullion bars accounted for 55.6 Moz of the world investment in 2010. Coins and medals fabrication rose by 28% to post a new record of 101.3 Moz. In the United States, over 34.6 million U.S. Silver Eagle coins were minted, smashing the previous record set in 2009 at almost 29 million.” silverinstitute.org

2011 - Silver posted an annual average price of $35.12 in 2011, more than double the $14.67 average price for 2009.

Global investment in silver bars and coins & medals produced yet another historic high of 282.2 million ounces - the equivalent of $10 billion, itself a record high.

Physical silver bar investment grew by 67 percent in 2011 to 95.7 million ounces, global coins & medals fabrication rose by roughly 19 percent to an all-time high of 118.2 million ounces.

The US imported 6,600,000 oz of silver for consumption in 2011 – up from 2007’s imports of 4,830,000 oz.

In 2011 the US Mint sold 40,020,000 Bullion American Silver Eagle Coins.

2012 - United States Mint Authorized Purchasers (AP’s) ordered 3,197,000 Bullion American Silver Eagle Coins on January 3rd, the first day they went on sale. That opening day total catapulted January Bullion Eagle sales higher than half of the monthly totals in 2011.

As of January 25th 2012, 5,547,000 Bullion American Silver Eagle Coins had been sold.

As of January 25th 2012, 5,547,000 Bullion American Silver Eagle Coins had been sold.

From February to September monthly sales were weaker then the corresponding months in 2011.

In October demand started to pick up. In November, bullion sales took off with sales of American Silver Eagles more than doubling the figures from November and December 2011.

On December 17th the Mint said all remaining inventories of 2012 dated Silver Eagle bullion coins had sold out - no additional coins would be struck.

Since the 2013 dated coins would not be available to order until January 7, 2013 that left a three week void where no one was buying silver Eagles - yet Decembers sales were the third highest on record!

In 2012, the US Mint's silver coin sales surpassed the amount of physical silver produced via US domestic mine production.

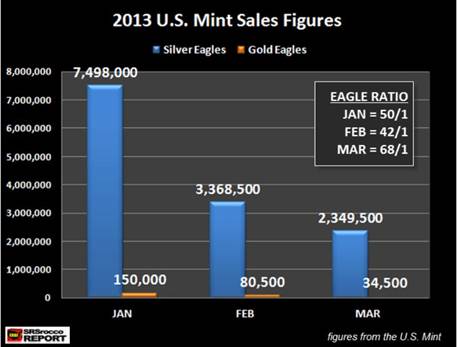

2013 – On January 7th the new 2013 one ounce Silver Eagle bullion coins went on sale and a new record of nearly 4 million were sold that day.

According to David Baker over at the Sprott Group:

- The US Mint's silver coin sales reached an all-time high of 13.2 million ounces in the first three months of 2013. If annualized, the Mint would sell 52.8 million ounces of silver in 2013 – a new record.

- The SPDR Gold Trust (GLD) has dumped 141 tonnes of gold year-to-date (March 22nd) while at the same time silver ETF's added more than 20 million ounces of silver.

- Finally from David comes the fact investors are buying 56 times more silver ounces than gold ounces – ask yourself if silver is 56 times more available then gold?

silverdoctors.com

The twin policies of zero interest rates and the continual creation of money and credit being enacted today, by all governments and central banks, means that the purchase of precious metals is the only way to protect the value of your assets.

"The major monetary metal in history is silver, not gold." Milton Friedman, Nobel Laureate

Investors are currently risk adverse and mining stocks are not well understood by the general investing public, but at least one thing is going to become very apparent to most - the best way to hedge yourself against inflation could be owning silver and the shares of a silver and gold producer.

Junior resource companies offer the greatest leverage to increasing demand and rising prices for silver. Junior resource companies are soon going to have their turn under the investment spotlight and should be on every investors radar screen.

If this is Silver’s Second Age we need to get ourselves some silver, both bullion and the leverage of shares.

Here’s a way to buy both bullion from, and the shares of, a primary silver producer…..

Great Panther Silver TSX-GPR

Great Panther Silver (TSX-GPL) is a profitable primary (66%Ag, 28%Au, 6% Pb-Zn) silver producing (silver and gold production un-hedged, no royalties) company operating two mines in Mexico, the Guanajuato and the Topia Mine:

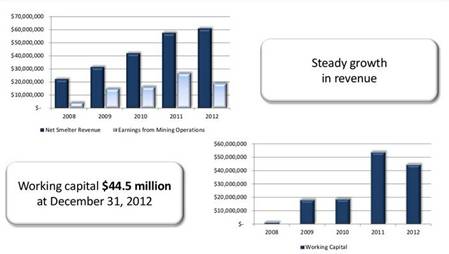

- 2010 - metal production was 2.26M ounces Ag. Eq.

- 2011 - production was 2.2M ounces

- 2012 - metal production was 2.38M ounces

- 2013 - the company forecasts a metal production target of 2.4M - 2.5M ounces

GPR also controls a number of exploration properties in Mexico, including a project which is likely to become Great Panther's next mine, the very promising 100 percent owned San Ignacio project:

- Current resource covers only 650m strike length out of a 4km potential on the La Luz vein system just five kilometers west of the principal Veta Madre structure that hosts Great Panther Silver's Guanajuato Mine Complex

- Step-out drilling continues to show excellent silver-gold mineralization

- Mineralization starts 50-100m below surface for easy ramp access, no need for a shaft

- Ore will be trucked 20km to the Cata processing plant at Guanajuato plant

- Ability to monetize project immediately to help pay for its development

The 100 percent owned El Horcon silver – gold project (7,908 hectares in 17 contiguous mining concessions) is a past producing underground mine with multiple veins in old workings - El Horcon hosts nine known veins, with the Diamantillo vein traceable on surface for more than four kilometres. Mapping and sampling is currently underway and an initial mineral resource is targeted for 2013. El Horcon lies within trucking distance, just 60km, from GPR’s Cata processing plant in Guanajuato - preliminary metallurgical testing at the Company's facilities in Guanajuato shows the El Horcon mineralization to be compatible with the existing mill feed.

Both San Ignacio and El Horcon show excellent potential to be satellite mines for GPR’s Guanajuato Operations.

Great Panther has spent a considerable amount of money improving operations & exploration/development at both mines over the last two years:

- Increased plant capacity to process ore from San Ignacio

- Completed an access drift for the underground transportation of ore from Guanajuatito. Ore from Guanajuatito can now be transported underground to the Cata shaft, thereby eliminating the need for truck hauling to surface and then on surface to the Cata mill. Underground haulage is faster, cheaper and reduces truck traffic through populated parts of the City of Guanajuato.

- Increased exploration at Guanajuato contributed to the discovery of new high grade mineralization. The drilling at Valenciana included an intercept of 2,900g/t silver and 26.00g/t gold over 1.30 meters, while the two new discoveries at Guanajuatito are highlighted by intersections of 1,010g/t silver and 6.67g/t gold over 1.10 meters and 1,460g/t silver and 4.79/t gold over 1.15 meters.

All of this investment should provide future benefits such as decreased costs and increased production.

Significantly higher production was reported for Q4 2012 compared to the fourth quarter 2011:

- Processed ore for Q4 was 67,659 tonnes, an increase of 30%

- Metal production for Q4 2012 was 672,690 Ag eq oz, a quarterly record and an increase of 23% over Q4 2011

- Silver production for Q4 was 453,934 ounces, an increase of 28%

- Gold production for Q4 was 2,826 ounces, an increase of 24%

"We are pleased to report a strong fourth quarter with several quarterly and annual production records. We have made and continue to make improvements and changes at both mines that will have a positive impact going forward.” CEO Robert Archer

Great Panther completed a $24 million bought deal financing in 2011 for an acquisition that later fell through. They still have this money and are continuing to look for the right ‘fit.’ Geographically they continue to focus on Mexico and Peru, the two largest silver-producing countries in the world.

Conclusion

Great Panther hit a rough patch in 2012, as net income for the year totaled $5.5 million, compared to $11.5 million for 2011. The decrease is attributable to a $7.7 million decrease in gross profit, a $1.5 million increase in general and administrative (G&A) expenses, a $1.5 million increase in exploration and evaluation expenses, and an increase in tax expense of $2.2 million.

"Gross profit was significantly impacted by lower silver prices and an increase in depreciation charges due to the substantial investments made in our mines, plant and equipment over the last year." Great Panther CEO Robert Archer

Great Panther would seem to have a lot going for it as we move forward into 2013:

- A very strong cash position and no long term debt

- Impressive high grade silver and gold discoveries at Guanajuato

- The substantial investments made in mines, plant and equipment

- The excellent potential of San Ignacio and El Horcon to be satellite mines for GPR’s Guanajuato Operations

- Cost control measures have been implemented and the one-time costs occurred in 2012 will not occur again

- A potential acquisition

Producing 66 percent silver with a 28 percent gold kicker GPR, with its strong profit margins of between 30 and 53% seems to be an excellent play on firstly silver and secondly combined precious metals.

If you can’t get your hands on any American Silver Eagles, Great Panther’s silver store can be accessed here.

With their 2013 focus squarely on improving the profitability of operations, and commencing the development of the San Ignacio Project in preparation for anticipated production in 2014 Great Panther Silver and its un-hedged royalty free silver and gold production in mining friendly Mexico should be on everyone’s radar screen.

Is it on yours? If not, maybe it should be.

By Richard (Rick) Mills

If you're interested in learning more about the junior resource and bio-med sectors please come and visit us at www.aheadoftheherd.com

Site membership is free. No credit card or personal information is asked for.

Richard is host of Aheadoftheherd.com and invests in the junior resource sector.

His articles have been published on over 400 websites, including:

Wall Street Journal, Market Oracle, SafeHaven , USAToday, National Post, Stockhouse, Lewrockwell, Pinnacledigest, Uranium Miner, Beforeitsnews, SeekingAlpha, MontrealGazette, Casey Research, 24hgold, Vancouver Sun, CBSnews, SilverBearCafe, Infomine, Huffington Post, Mineweb, 321Gold, Kitco, Gold-Eagle, The Gold/Energy Reports, Calgary Herald, Resource Investor, Mining.com, Forbes, FNArena, Uraniumseek, Financial Sense, Goldseek, Dallasnews, Vantagewire, Resourceclips and the Association of Mining Analysts.

Copyright © 2013 Richard (Rick) Mills - All Rights Reserved

Legal Notice / Disclaimer: This document is not and should not be construed as an offer to sell or the solicitation of an offer to purchase or subscribe for any investment. Richard Mills has based this document on information obtained from sources he believes to be reliable but which has not been independently verified; Richard Mills makes no guarantee, representation or warranty and accepts no responsibility or liability as to its accuracy or completeness. Expressions of opinion are those of Richard Mills only and are subject to change without notice. Richard Mills assumes no warranty, liability or guarantee for the current relevance, correctness or completeness of any information provided within this Report and will not be held liable for the consequence of reliance upon any opinion or statement contained herein or any omission. Furthermore, I, Richard Mills, assume no liability for any direct or indirect loss or damage or, in particular, for lost profit, which you may incur as a result of the use and existence of the information provided within this Report.

Richard (Rick) Mills Archive |

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.