Recent Action in Silver ETFs Is Bad News for Precious-Metals Bears

Commodities / Gold and Silver 2013 Apr 03, 2013 - 02:17 AM GMTBy: Jeff_Clark

Two weeks ago we looked at the difference between gold ETF outflows vs. physical gold purchases, and showed that most sales were coming from the former while aggressive buying was coming from the latter.

Two weeks ago we looked at the difference between gold ETF outflows vs. physical gold purchases, and showed that most sales were coming from the former while aggressive buying was coming from the latter.

This week we examined the same data for silver – and discovered a rather striking trend. Not only are silver ETFs seeing no net outflows, their holdings are increasing. Bearish investors who treat the two precious metals as being the same, interchangeable thing, and sell silver along with gold are at risk of missing the boat.

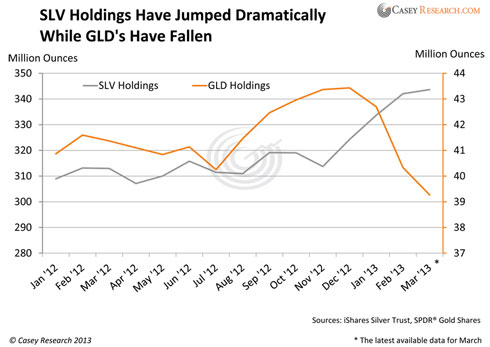

Here's how holdings in SLV, the world's largest silver ETF, compare to those of GLD…

The divergence between gold and silver funds is clearly evident. As of March 28, SLV holdings stand at 344,128,478 ounces, up 5% so far this year and just 7% below 2011's record high.

It's not just SLV. As a group, silver exchange-traded products (ETPs) have seen their holdings rise for four consecutive months.

Why the stark divergence between the two precious-metals funds?

As most readers know, silver has a dual nature, serving as both a precious metal and an industrial metal. As a precious metal, it's a store of value like gold – but since roughly half of its use is devoted to various industrial applications, its performance has a strong correlation to economic growth. And since most mainstream analysts are bullish on the global economy, the current surge in silver ETFs is likely a result of this optimism. After all, if you see economic recovery ahead, industrial demand for the metal will grow and the price would be expected to rise.

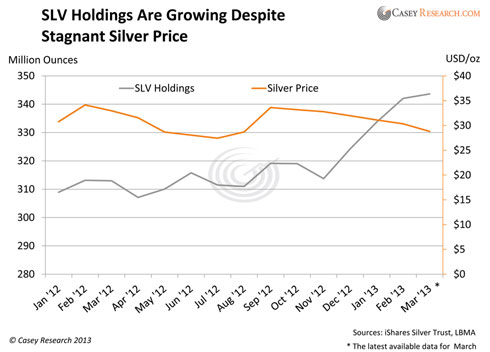

Further, these massive inflows are occurring at a time when the silver price is mostly flat, whereas the previous peak in holdings took place when the price was soaring (spring 2011). Here's a picture of SLV holdings since January 2012, along with the silver price.

What's interesting is that the increase in SLV holdings has not had a significant impact on silver's price – yet. Since the price usually receives a boost when industries start buying more of it, many of these "paper" buyers are likely adding silver in anticipation of economic recovery, the very reason others are selling gold.

Let's take a look at physical demand.

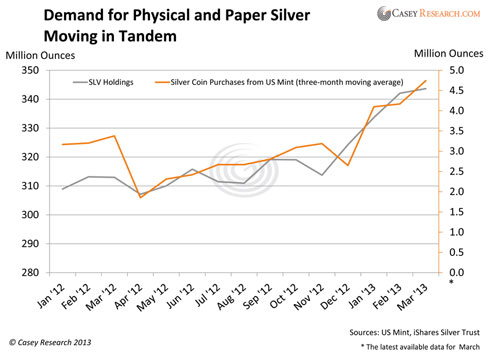

As with gold, buyers of physical silver tend to have a long-term investment horizon and buy mostly from a currency standpoint. With prices near the bottom of their 22-month range, many investors continue to see opportunity: January sales of American Eagle silver bullion coins spiked to an all-time record of 7.5 Moz, and February's demand was 3.4 Moz, up 126% from last February's sales of 1.5 Moz. Cumulative silver coin demand for the first two months of this year already hit 10.87 Moz, a full third of total coin sales in 2012.

You can see that silver is being sought by both paper and physical buyers.

Whether it's mainstream investors buying in anticipation of economic recovery or physical buyers loading up due to currency concerns, investors collectively see big potential for silver.

Investor Implications: Is Silver a No-Lose Proposition?

It's a simplistic conclusion but not necessarily inaccurate: silver rises if the economy improves and industrial demand grows – or it rises if the world's major currencies continue to be debased, regardless of whether the economy is on the mend. Two different reasons, the same investment solution.

What if we get both outcomes: a robust economy and high inflation? That, of course, would be music to the ears of silver owners... the demand from industry strains supply, while bullion owners refuse to sell. Prices would go ballistic.

Does this mean silver is a no-lose proposition? Of course not. No investment comes without risk. An outright depression would be destructive to industrial demand. Roughly two-thirds of silver is used in industry and jewelry, so Doug Casey's Greater Depression could severely impact the biggest portions of current demand. The same events would increase monetary demand for silver, but the two trends may not have equal weight on the price of silver at the same time. We thus wouldn't make silver our sole investment, but we see a lot of upside in the metal under current market conditions.

At the end of the day, we're more inclined to buy silver for the same reasons we buy gold. While a case can be made for an improving economy, there's an overwhelming one already built for government money-printing to result in a massive loss of purchasing power, and that argues for seeking the safe haven of precious metals – both of them.

Don't miss this opportunity: Prices are low right now, and that makes it time to buy.

It's an even better time to buy gold and silver producers – especially select junior mining companies. Right now, the sector is so badly beaten down that even the best-of-the-best outfits are selling at discounts of 50% or more, giving you a rare opportunity to get in at the bottom of what could be the next great investment bubble.

To help you more fully appreciate the magnitude of this opportunity – and to give you concrete investment strategies – some of the world's top natural-resource speculators and economic minds will appear in a special, online video event on April 8, titled Downturn Millionaires. They include: contrarian investment legend Doug Casey; Agora Inc. publisher Bill Bonner; Sprott US Holdings Chairman Rick Rule; Mauldin Economics Chairman John Mauldin; and Casey Research Chief Metals and Mining Investment Strategist Louis James.

The event is free and is a must-see for serious investors. Get more information and register today.

© 2013 Copyright Casey Research - All Rights Reserved

Disclaimer: The above is a matter of opinion provided for general information purposes only and is not intended as investment advice. Information and analysis above are derived from sources and utilising methods believed to be reliable, but we cannot accept responsibility for any losses you may incur as a result of this analysis. Individuals should consult with their personal financial advisors.

Casey Research Archive |

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.