Short Japan Bonds to Profit From the End of the Monetary System

Interest-Rates / International Bond Market Apr 11, 2013 - 05:30 PM GMTBy: Jeff_Berwick

While most people will lose their shirts as The End Of The Monetary System As We Know It (TEOTMSAWKI) continues down its predictable path there are some who will make fortunes.

While most people will lose their shirts as The End Of The Monetary System As We Know It (TEOTMSAWKI) continues down its predictable path there are some who will make fortunes.

At The Dollar Vigilante we’ve already been ahead of the curve on many profitable ventures related to TEOTMSAWKI. TDV Senior Editor, Ed Bugos, has been a proponent of owning gold since 2000 when it was at $200 and upon TDV’s founding in 2010 we immediately added gold as the largest part of our portfolio while it was trading near $1,200 and quickly saw that rise to nearly $2,000.

We’ve also been covering Bitcoin as an emerging currency and possibly a currency of the future during and after TEOTMSAWKI. We first began suggesting people get into Bitcoin on May 24, 2011 (“This Non-Fiat Currency Is Up Over 1000% in the Last Month”) when it was at $6. Today it trades for well over $200.

As you can see, the profits that are possible during TEOTMSAWKI can be massive. We believe the gold stocks will soon enter into a bubble for the ages and today we will let you in on another way that you could potentially make massive profits from betting against the system.

SHORT JAPAN DEBT

When looking to profit from TEOTMSAWKI, Japanese government debt has to be one of the most obvious shorting opportunities I’ve ever seen. And, as I’ll outline below, a number of recent events makes me believe the timing is now perfect to look at this trade.

When looking to profit from TEOTMSAWKI, Japanese government debt has to be one of the most obvious shorting opportunities I’ve ever seen. And, as I’ll outline below, a number of recent events makes me believe the timing is now perfect to look at this trade.

But first, let’s look at some facts and figures.

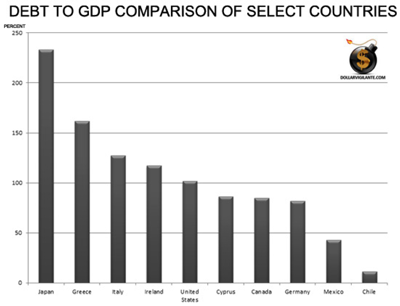

Which country stands out to you on this list of most indebted countries vis-à-vis GDP?

Chile might stand out on the right side for being so small, and that’s why we chose it as our first location of Galt’s Gulch. But, all the way on the left, Japan sticks out like a sore thumb. A heavily indebted sore thumb.

Japanese government debt apologists will point out that most of that debt is held by Japanese citizens and therefore it is not as bad as it seems.

We disagree with that premise. But, even if you do agree, some very important things have changed in the last few years that will change the game.

We disagree with that premise. But, even if you do agree, some very important things have changed in the last few years that will change the game.

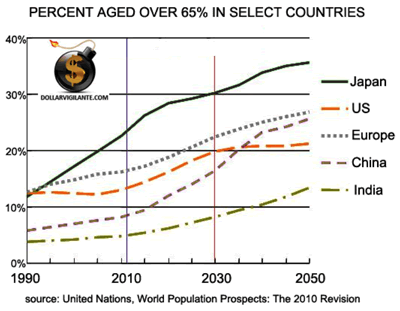

For starters is Japan’s aging population.

The amount of people over 65 in Japan has nearly tripled in the last twenty years and goes higher each year. These are the people who worked and “saved” in Japanese government bonds over the last few decades but now many of them are retired or retiring and will be withdrawing funds from those bonds to live off.

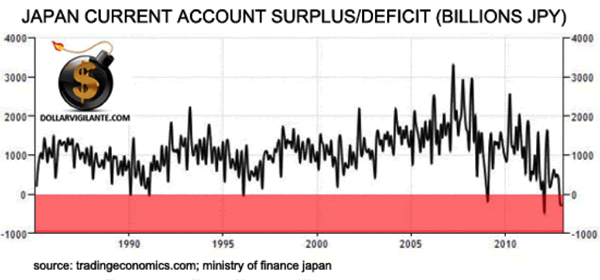

Much more importantly, in my estimation is the dramatic change in Japan’s current account in the last few years since Fukushima.

After decades of running significant current account surpluses Japan has now moved into negative territory on trade. Much of this was caused by the shuttering of nuclear plants after Fukushima in this country devoid of energy resources. With this unexpected to change it means that the large amount of savings in the country in the past will dwindle as it goes offshore in payment for trade.

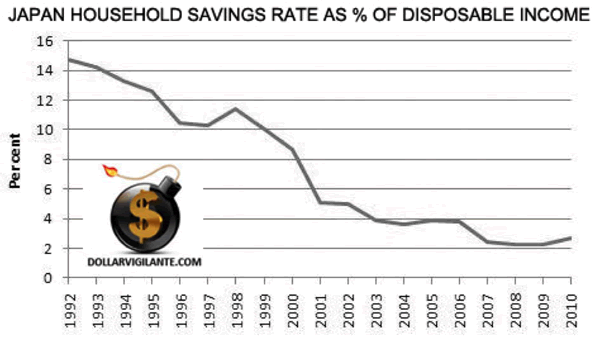

And today, there is hardly any savings to go into Japanese government bonds, anyway.

WHY SHORT JAPANESE GOVERNMENT DEBT NOW?

Some of the reasons for wanting to short Japanese government debt have been known for some time. So, why do I think the timing is right to wade into this bet against Japanese government debt now for decades?

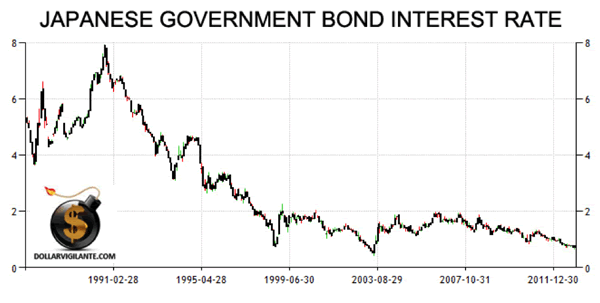

Betting against Japanese government debt has been a bad idea for decades as this chart of the JGB interest rate shows (interest rates are the inverse of the value of the bond).

But two things have happened recently that has me thinking the time is now.

April 4, 2013 will be an important date to remember in financial history. The Bank of Japan (BOJ) has embarked on a financial experiment that could put the Japanese on a collision course with default. The BOJ announced an aggressive attempt to generate 2% inflation and has committed itself to doubling the monetary base over the next two years. To put it mildly, this is Keynesian madness.

Has anyone stopped to consider what the Japanese central bank is doing with this strategy? The BOJ intends to weaken the yen by buying Japanese assets including bonds farther out on the yield curve than the five year limit previously set. The yen should and is weakening severely. The yen is roughly 30% off its highs versus the US dollar since November and some large investors like George Soros are warning of an “avalanche” of yen hitting the market.

Now ask yourself two simple questions. Why would a bondholder be willing to accept a 10 year bond that pays a .50% interest rate if there is an inflation target of 2%? Why would a bondholder be willing to lend the government money at .50% if he is going to be paid back in a devalued currency?

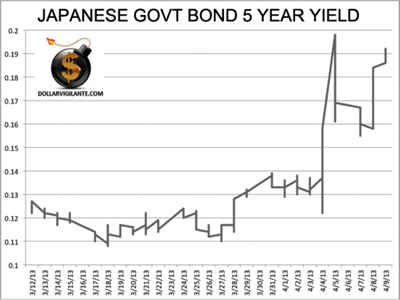

It is my opinion that market sentiment changed on April 4, 2013. When all that bond buying was announced, it would seem logical that bond prices rallied right? Government buys bonds = bond prices go up. Well, the Japanese Government Bond market is trading sharply BELOW levels they were trading at before the BOJ announcement. Something has changed!

Here’s the proof. After a Japanese Central Bank announcement, on April 5th, the Japanese bond market was rocked.

This is a massive move in the bond market and may show that the market has finally had enough.

HOW TO SHORT JAPANESE GOVERNMENT DEBT

I feel the time is now to begin wading into this market as a short trade. There’s just one problem. It’s not very easy to short the Japanese bond market.

I feel the time is now to begin wading into this market as a short trade. There’s just one problem. It’s not very easy to short the Japanese bond market.

Most individual investors think a trade of this type is exclusively the realm of the institutional world and they’ve been mostly right until recently.

A fund specifically set-up to short Japanese government bonds has been set up and is operated by a good friend of mine, Tres Knippa, who is an expert on shorting JGB’s and regularly featured on CNBC, Bloomberg, Fox Business and many others (It should be noted I have no financial incentive to market his fund – I just believe it is the best way to short Japanese debt). Tres uses exchange traded futures and options to execute a short position in Japanese Government Bonds.

His strategy seeks to give investors downside exposure limited to the cost of options while waiting for a significant move in bonds. In some ways, Tres views his strategy as a hedge for an existing portfolio. Why should the situation in Japan matter to investors around the world? Remember when Greece went through its debt restructuring? The United States stock market came under real pressure two summers ago as Greek bond markets swooned. Greece has the same GDP as the state of Indiana. Greece simply does not matter. Japan matters. Japan is the 3rd largest economy in the world. A debt crisis there will send bond and equity markets reeling. It is my opinion that having some position short the Japanese Government Bond market is a hedge against some very difficult times coming in the global economy.

You could trade the futures yourself but I don’t advise that to anyone except the most expert of futures traders as this strategy necessitates repeated roll-over of positions over time.

But, now there is an easy way for a retail investor to short JGBs and have an experienced trader, Tres Knippa, do it for you. The minimum allowed is $30,000 but for anyone who wishes to profit from the potential demise of the absolutely ludicrous policies of the Bank of Japan and a decent amount of money and time (give yourself two years to give yourself some leeway) to invest, I would suggest taking a look at Tres’ fund at ShortJapanDebt.com.

The fund is heavily levered so as even a move up in JGB yields by even 1% can create significant profits.

ANOTHER POTENTIALLY LUCRATIVE WAY TO PROFIT FROM TEOTMSAWKI

Shorting Japanese government debt is now officially another of the ways that I’ll be playing TEOTMSAWKI alongside owning precious metals, investments into Bitcoin related businesses, foreign real estate such as our expat development in Chile and speculative positions in gold stocks.

Anarcho-Capitalist. Libertarian. Freedom fighter against mankind’s two biggest enemies, the State and the Central Banks. Jeff Berwick is the founder of The Dollar Vigilante, CEO of TDV Media & Services and host of the popular video podcast, Anarchast. Jeff is a prominent speaker at many of the world’s freedom, investment and gold conferences as well as regularly in the media.

© 2013 Copyright Jeff Berwick - All Rights Reserved Disclaimer: The above is a matter of opinion provided for general information purposes only and is not intended as investment advice. Information and analysis above are derived from sources and utilising methods believed to be reliable, but we cannot accept responsibility for any losses you may incur as a result of this analysis. Individuals should consult with their personal financial advisors.

Jeff Berwick Archive |

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.