Gold Blind Panic, Possible Bloodbath Plunge to $1,000!

Commodities / Gold and Silver 2013 Apr 14, 2013 - 07:18 PM GMTBy: Clive_Maund

A number of subscribers have written in to me asking how I knew to load up with Puts on Thursday ahead of Friday's massive smash in the gold market. The answer to that is that when you have been watching markets and price movements for as long as I have and understand how Big Money thinks and operates, you develop a "sixth sense" for the kind of stunts they can pull.

A number of subscribers have written in to me asking how I knew to load up with Puts on Thursday ahead of Friday's massive smash in the gold market. The answer to that is that when you have been watching markets and price movements for as long as I have and understand how Big Money thinks and operates, you develop a "sixth sense" for the kind of stunts they can pull.

We have pointed out repeatedly in the recent past the immense importance of the strong and clearly defined support levels for gold and silver at about $1500 - $1530 and $26 respectively, which have generated several significant reversals over the past 18 months or so. We also made clear that if we know how important these support levels are (were) then for sure Big Money does, and that they would plot to crash these support levels and trigger waves of stops if it was in their interests to do so.

Now that they have done so, let's consider why - what is their motive? There has been a big drawdown in physical gold warehouse stocks at the Comex this year, and a really dramatic drawdown at the J P Morgan Chase depository. If, as a result of this, stocks are too low to meet deliveries, gold would have to be bought in the open market, driving prices sharply higher, and they for sure don't want that now that their stocks are so low. So the game is to smash the gold price so that they can replenish their stocks on the cheap - and they are not short of friends in high places who can assist them in this endeavor.

The first "smoke signal" came over a week ago with some members of the Fed purported making rumbling noises about reining in QE, as reported in the latest Minutes. That served to get the gold market nervous. Then there were widely circulated reports last week about the "tiny island", Cyprus, having to sell 400 million euros worth of gold on to the market - not bad for a "tiny island" - which, although unfounded, depressed and weakened gold further. By the way Cyprus is not tiny, it is BIG, and I invite any more ignorant or sloppy commentators referring to Cyprus as a "tiny island" to come with me to the island, where I will gladly drop you off at a remote location with a decent pair of walking boots, and then relax in the capital and see how long it takes you to join me on foot, no buses or hitchhiking permitted.

Finally, just by coincidence you understand, after waves of selling in New York during the day on Friday had softened gold up nicely and brought it down close to its critical support, the London physical market locked up on Friday afternoon. Some investors entertain the romantic notion that this physical market is like an old fashioned cattle auction, with a guy in a tweed jacket and a hat spouting 200 words a minute of auctioneers jargon. It is not. It is computerized and the computers froze on Friday shutting out would be sellers who then went into blind panic, entering the futures market to hedge or short. This tipped the market into a vertical plunge that completed the job of crashing the key support level.

So what now? We can expect a wave a margin calls to go out over the weekend that could crash the market further next week, possibly causing the vertical plunge that began on Friday to continue, perhaps for several days. The ball may be kicked further downhill by Big Money's media pals having a field day over the weekend proclaiming the death of the gold bullmarket. Once all the stops in the $1500 area and beneath have been triggered, it will take a lot of pressure off Big Money and the Comex to meet deliveries - and it will also enable them to replenish inventories at knockdown prices. This is why we were in favor of Puts rather than being stopped out, and thus becoming victims of the trap that they had set.

So, is the gold bullmarket over? Only if the Fed and other Central Banks choke off QE, and there is no sign of that happening, nor is it logical for them to do so as it would trigger a devastating deflationary implosion. The bull case for gold remains intact, as a trader friend in California put it this weekend !

"Did gold fall off the cliff because the dollar index ripped higher? NO! Did Uncle Ben Bernanke say they were stopping the $85 billion + QE immediately? NO! Has physical gold become more abundant than any time in the recent past? NO! Are the world's central banks stopping their counterfeiting operations by devaluing their currency by stopping the printing presses? NO! It's quite the opposite, Japan, U.S., and the EU are increasing the money supply.

Things to look at that are happening. Are Russia, China, and India amongst other nations still buying huge amounts of gold? YES! Is QE going to continue? YES! They cannot stop it now, because they'll have a HUGE deflationary episodes which those in power do not want. It would be what is needed to reset the scales of the financial system and debts around the globe, but would mean huge financial losses to the powers that be. Silver isn't becoming more abundant, it is rarer than gold, so why is it around $26 bucks per ounce?

As we look at the charts on the precious metals, just remember, not all is what it seems. In chess you disguise your true intentions by moving the pieces around the board, setting them up for the attack; better deception skills you have, the more likely you'll win the game. Think 2-3 moves ahead of your opponent, and you'll always come out a winner."

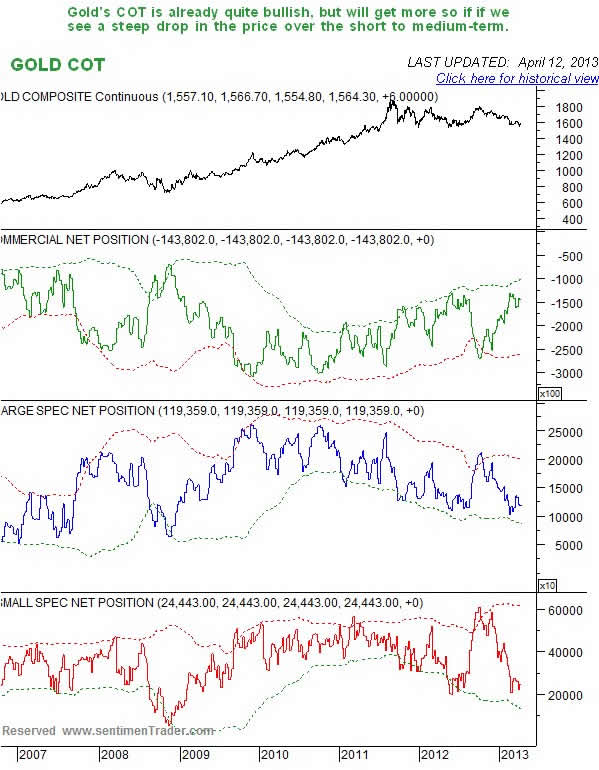

Apart from these correct observations by my friend, COTs and sentiment for gold and especially silver remain wildly bullish, which is why we have maintained a bullish stance overall in recent weeks, whilst remaining fully aware of the possibility of a Big Money Viking style "rape and pillage" operation such as we are now seeing. Having seen it coming in the nick of time, we are hidden behind the stockade waiting and watching for when it's safe to come out again. The Big Money individuals behind this operation are doubtless cracking open the champagne this weekend and laughing gleefully at all the poor slobs faced with margin calls this weekend.

So, we can fairly conclude that Big Money has organized this raid to trigger stops and run people out of their positions, in order that they can ease pressure on deliveries and replenish their stocks at low prices. This means that after a possible panic phase next week caused by margin call liquidation, we can look forward to stabilization, followed by a strong recovery.

Now let's go swiftly through the charts to see what happened.

On its 3-year chart we can see that gold spectacularly crashed the support at the bottom of its major trading range on Friday, in so doing confirming the range as a top, not a period of consolidation, as we had earlier reasonably suspected. Luckily we well aware of this possibility and had taken due precautions. The high volume on the breakdown is bearish, as is the failure of the channel shown. Gold must quickly get back above the breakdown point to forestall a severe decline - and there is little chance now of that happening given the change in psychology that this breakdown has engendered.

The 7-year chart for gold reveals the true seriousness of the situation, as in addition to breaking down below key support, gold has at the same time broken down from its long-term uptrend channel. We had expected this to generate another upleg. Of particular note is that there is no strong support until the $1000 level is approached and our worst case scenario is now a near vertical bloodbath decline towards this major support, which, should it occur, would be a signal to close out Puts etc and go aggressively long.

The latest COTs for gold are now quite bullish, with Commercial short positions having been scaled back substantially and Large Spec long positions having moderated substantially. Should gold now suffer a severe decline, these positions can be expected to get a lot more extreme, and should assist us in calling the bottom.

The dollar had little or rather no role to play in gold's breakdown, as we can see on its 6-month chart. It appears to be topping out beneath a "Distribution Dome", a view which is supported by its latest COT chart. Actually it has dropped away from its Dome rather quickly towards its rising 50-day moving average, so it is entitled to minor relief rally soon before it heads lower.

The latest dollar COT chart is strongly bearish, with the Commercials having gone heavily short and the Large Specs heavily long, no doubt assisted in their decision making process by the mainstream media.

We will end with a crumb of comfort for bulls. Gold stock sentiment is at its lowest level ever, apart from a brief moment at the nadir of the 2008 crash. It is at 0 and the great news is that it can't go lower than that. Sadly, however, this doesn't mean that stocks can't drop more. They will if gold and silver crash, but at least it tells us that we should be on the lookout for a bottom occurring before too much lower.

By Clive Maund

CliveMaund.com

For billing & subscription questions: subscriptions@clivemaund.com

© 2013 Clive Maund - The above represents the opinion and analysis of Mr. Maund, based on data available to him, at the time of writing. Mr. Maunds opinions are his own, and are not a recommendation or an offer to buy or sell securities. No responsibility can be accepted for losses that may result as a consequence of trading on the basis of this analysis.

Mr. Maund is an independent analyst who receives no compensation of any kind from any groups, individuals or corporations mentioned in his reports. As trading and investing in any financial markets may involve serious risk of loss, Mr. Maund recommends that you consult with a qualified investment advisor, one licensed by appropriate regulatory agencies in your legal jurisdiction and do your own due diligence and research when making any kind of a transaction with financial ramifications.

Clive Maund Archive |

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.