Gold Gains As 14% Plunge Overdone - Speculators Sell, Central Banks To Buy

Commodities / Gold and Silver 2013 Apr 16, 2013 - 03:23 PM GMTBy: GoldCore

Today’s AM fix was USD 1,378.00, EUR 1,054.00 and GBP 900.48 per ounce.

Today’s AM fix was USD 1,378.00, EUR 1,054.00 and GBP 900.48 per ounce.

Yesterday’s AM fix was USD 1,416.00, EUR 1,083.31 and GBP 924.52 per ounce.

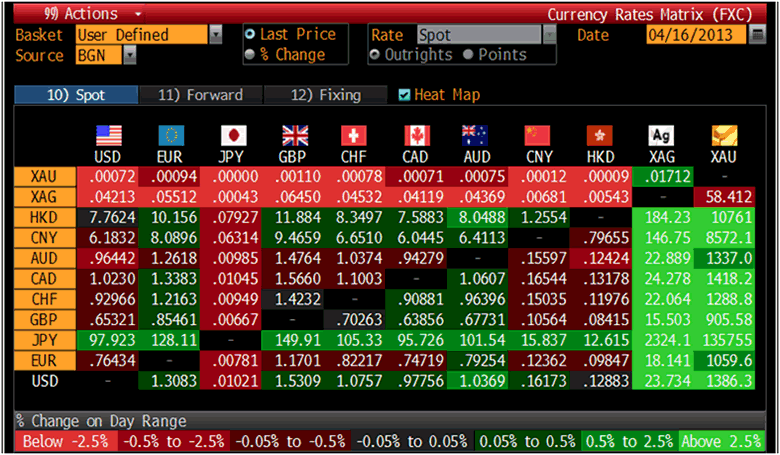

Gold fell sharply $131.10 or 8.81% yesterday to $1,357.00/oz and silver slid to $22.80 finished -12.69%.

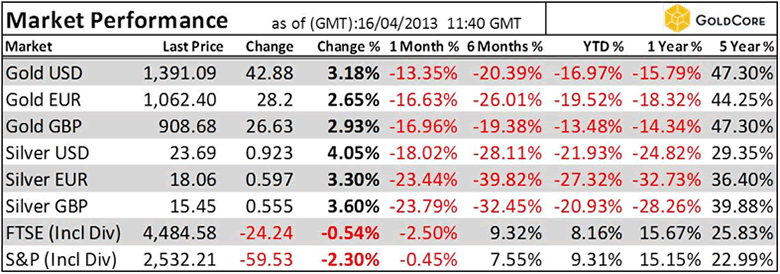

Cross Currency Table – (Bloomberg)

Gold rebounded as store of value and diversificaiton buyers deemed a 14% plunge over two days to be excessive and an Asian central banker said that policy makers may take the opportunity to buy.

Gold in USD, 1 Month – (Bloomberg)

Silver, platinum and palladium also advanced. At 11.30am GMT silver is 23.44(+0.75), platinum is $1,438.00(+39.00) and palladium is $677.00(+26.00).

Prices fell 9.1% yesterday, the most since 1983, and have lost 28% since reaching a record in September 2011.

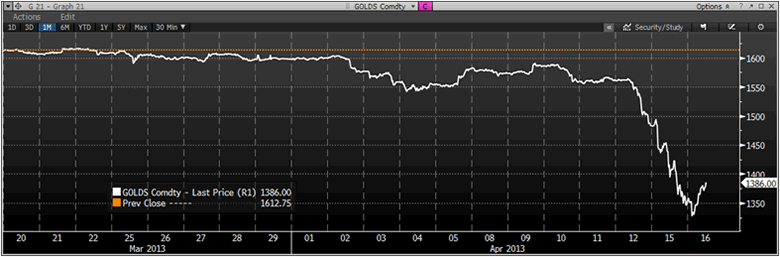

XAU/EUR, 1 Month – (Bloomberg)

Banks such as Soc Gen and Commerzbank have admitted that the sell was ovedone.

Societe Generale SA said that the slump was overdone as quantitative easing, or QE, will continue.

“Everything isn’t looking that rosy, so gold should hold up,” said David Poh, Singapore-based regional head of portfolio-management solutions at Societe Generale Private Banking. “This tumbling over the past few days is overdone. We think a good time to accumulate is at the $1,300 level.”

The decline in prices would give central banks an opportunity to buy, Central Bank of Sri Lanka Governor Ajith Nivard Cabraal said in an interview on Bloomberg Television today.

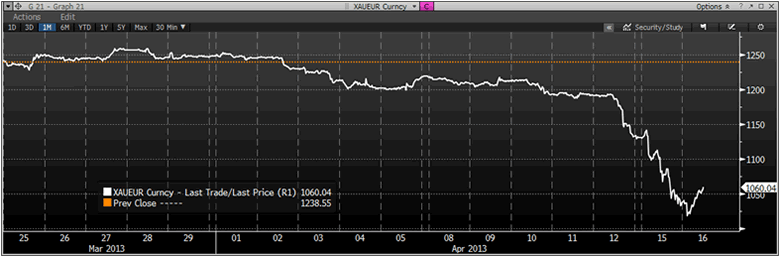

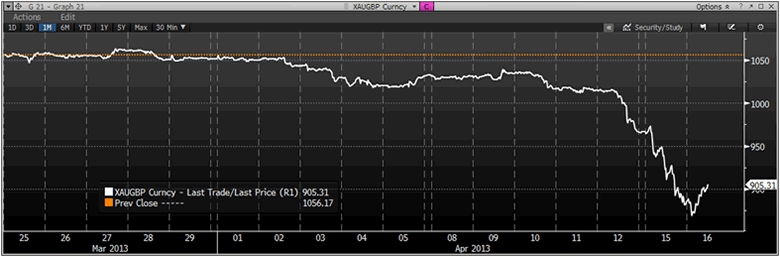

XAU/GBP, 1 Month – (Bloomberg)

The Bank of Korea said that bullion’s drop isn’t a big concern as the bank’s holdings are part of a long-term strategy for foreign-exchange reserves according to Bloomberg.

Bullion for June delivery was 1 percent higher at $1,374.70 an ounce on the Comex in New York after losing as much as 2.9 percent to $1,321.50. CME Group Inc. will increase margin requirements on gold trading, raising the minimum cash deposit for futures 19 percent to $7,040 per 100-ounce contract at the close of trading today, Chicago-based CME said in a statement.

Spot silver rallied 2.4 percent to $23.305 an ounce after losing 3 percent to $22.07, the lowest level since October 2010. Platinum climbed 2.8 percent to $1,442 an ounce, rebounding from $1,375.50, the cheapest price since December 2011. Palladium dropped as much as 1 percent to $647.25 an ounce, the lowest level since November, and then gained 3.8 percent to $678.

Gold’s drop was spurred by massive concentrated selling in the futures market and as speculators sold the metal to raise cash to cover other positions.

Holdings in the SPDR Gold Trust, the biggest ETP backed by bullion, fell to 1,154.34 tons yesterday, the lowest level since April 2010, data on the company’s website showed. That’s 15 percent, or 199 tons, below the peak reached in December. Holdings in all ETPs compiled by Bloomberg dropped 1 percent to 2,382.43 metric tons yesterday, the biggest loss since Feb. 21.

Smart money such as Bill Gross and Marc Faber have reiterated why they see gold as a long term buy and important diversificaiton for porfolios.

For the latest news and commentary on financial markets and gold please follow us on Twitter.

GOLDNOMICS - CASH OR GOLD BULLION?

'GoldNomics' can be viewed by clicking on the image above or on our YouTube channel:

www.youtube.com/goldcorelimited

This update can be found on the GoldCore blog here.

Yours sincerely,

Mark O'Byrne

Exective Director

IRL |

UK |

IRL +353 (0)1 632 5010 |

WINNERS MoneyMate and Investor Magazine Financial Analysts 2006

Disclaimer: The information in this document has been obtained from sources, which we believe to be reliable. We cannot guarantee its accuracy or completeness. It does not constitute a solicitation for the purchase or sale of any investment. Any person acting on the information contained in this document does so at their own risk. Recommendations in this document may not be suitable for all investors. Individual circumstances should be considered before a decision to invest is taken. Investors should note the following: Past experience is not necessarily a guide to future performance. The value of investments may fall or rise against investors' interests. Income levels from investments may fluctuate. Changes in exchange rates may have an adverse effect on the value of, or income from, investments denominated in foreign currencies. GoldCore Limited, trading as GoldCore is a Multi-Agency Intermediary regulated by the Irish Financial Regulator.

GoldCore is committed to complying with the requirements of the Data Protection Act. This means that in the provision of our services, appropriate personal information is processed and kept securely. It also means that we will never sell your details to a third party. The information you provide will remain confidential and may be used for the provision of related services. Such information may be disclosed in confidence to agents or service providers, regulatory bodies and group companies. You have the right to ask for a copy of certain information held by us in our records in return for payment of a small fee. You also have the right to require us to correct any inaccuracies in your information. The details you are being asked to supply may be used to provide you with information about other products and services either from GoldCore or other group companies or to provide services which any member of the group has arranged for you with a third party. If you do not wish to receive such contact, please write to the Marketing Manager GoldCore, 63 Fitzwilliam Square, Dublin 2 marking the envelope 'data protection'

GoldCore Archive |

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.