Gold and Silver 'Orchestrated Panic'

Commodities / Gold and Silver 2013 Apr 19, 2013 - 08:09 AM GMTBy: Jesse

"Oh what a tangled web we weave,

When first we practise to deceive."

Sir Walter Scott

In particular listen to what Jeff Sachs has to say. If you do nothing else, listen to what this man has to say.

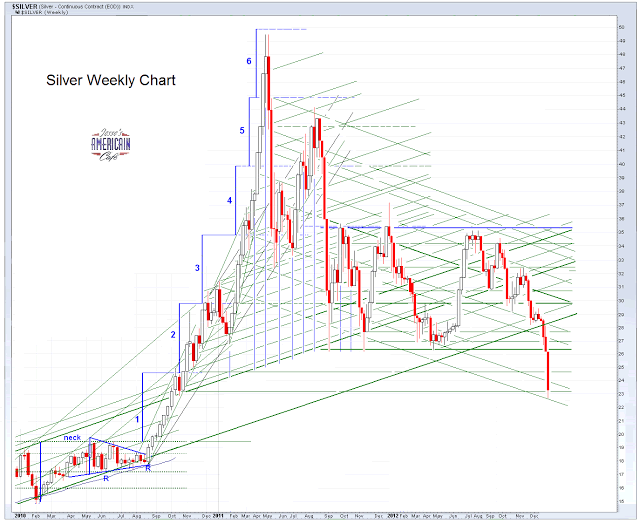

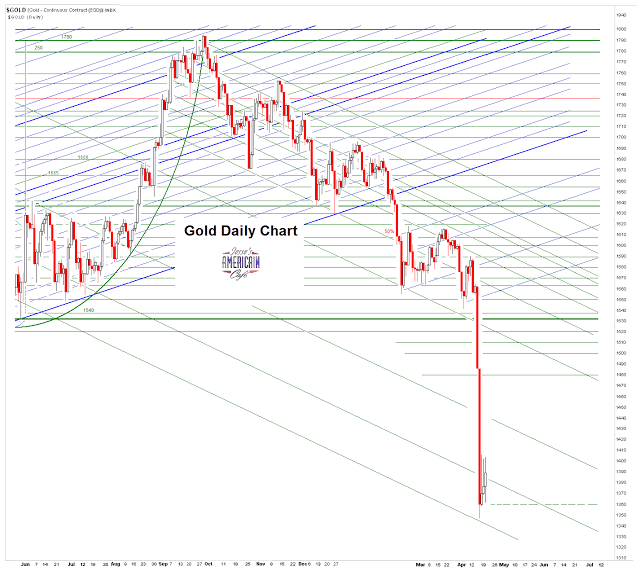

John Brimelow calls the most recent action in the metals markets an 'orchestrated panic.'

And it may not be over. The underlying causes for this, besides the usual opportunity for looting, most likely remain. The system is failing and the masters of the universe are afraid.

As a reminder, next week on the 25th is the precious metals option expiration on the Comex.

I thought it was interesting that the IMF Has Told the UK To Rethink Austerity. Oops.

Lars Schall has a very good interview with Norbert Haering: Money Lies Disguise Banking Truths.

And to everyone's delight the DharmaDude has a new piece out, Unklung Goldenfreude. He gives Herr Krugman a light spanking with his own words. Where is Mademoiselle Le Moderateur?

And finally Denver Dave serves up a piece on The Law of Unintended Consequences.

Russia is running the G20 this year. They have scheduled a conference in May titled Global Finance in Transition. An intriguing title, and yet so few have heard of it. The BRICs are not happy campers.

On May 7-8, 2013, Istanbul (Turkey) will host the Global Finance in Transition conference. The event is organized by the Central Bank of the Republic of Turkey jointly with the Reinventing Bretton Woods Committee and the Russian Ministry of Finance.

Representatives of G20 finance ministries and central banks, international organizations, research institutions and businesses will take part in the conference. Head of Turkey's Central Bank Erdem Basci, Deputy Minister of Finance of Russia Sergei Storchak and Executive Director for the Reinventing Bretton Woods Committee Marc Uzan will give the opening remarks at the conference.

Five panel discussions are planned as part of the event. They will cover the international financial architecture, in particular, changes in the flow of global investments, local bond markets and growth in emerging economies, incentives and determinants of investment and other issues. In addition it is expected that new instruments and incentives for making the global financial system safer will be suggested during the forum

Change occurs slowly, and greatest changes occur very slowly and almost imperceptibly. Until they make themselves known that is, and then it is like lightning flashing across the sky.

By Jesse

http://jessescrossroadscafe.blogspot.com

Welcome to Jesse's Café Américain - These are personal observations about the economy and the markets. In plewis

roviding information, we hope this allows you to make your own decisions in an informed manner, even if it is from learning by our mistakes, which are many.

© 2013 Copyright Jesse's Café Américain - All Rights Reserved

Disclaimer: The above is a matter of opinion provided for general information purposes only and is not intended as investment advice. Information and analysis above are derived from sources and utilising methods believed to be reliable, but we cannot accept responsibility for any losses you may incur as a result of this analysis. Individuals should consult with their personal financial advisors.

Jesse Archive |

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.