Waiting for the Stock Market SPX to Break Key Support

Stock-Markets / Stock Markets 2013 Apr 22, 2013 - 04:46 AM GMTBy: Andre_Gratian

Current Position of the Market

Current Position of the Market

SPX: Very Long-term trend - The very-long-term cycles are in their down phases, and if they make their lows when expected (after this bull market is over), there will be another steep decline into late 2014. However, the severe correction of 2007-2009 may have curtailed the full downward pressure potential of the 40-yr and 120-yr cycles.

Intermediate trend - SPX has started an intermediate correction.

Analysis of the short-term trend is done on a daily basis with the help of hourly charts. It is an important adjunct to the analysis of daily and weekly charts which discusses the course of longer market trends.

SPX TRYING TO HOLD KEY SUPPORT

Market Overview

Last week, SPX started to decline in earnest, and this probably resulted in the promotion of the 1597 top to intermediate status. With last week's retracement, the index has now lost a total of 61 points and, in spite of a 20-point rally by Friday's close, it does not look finished. This time, the DOW industrials joined in with a 443-point loss.

Both indices are in the process of re-testing the support level which contained the 4/05 decline and sent them on to make new all-time highs. However, it is doubtful that it will have the same effect this time. On Thursday, SPX breached 1539 and, although it rallied at the close, it could not stay above 1543 on the final tick. By closing at a new low, it technically puts it in a downtrend which could be nullified only if it went on to make a new high from here, and that does not seem likely. Over the next two weeks, the decline should progress lower and confirm the intermediate correction.

One factor which supports this being the beginning of a significant decline, is the probability that the yearly cycle -- which has been very regular since the 2009 low but pre-dates the bull market -- appears to be repeating its pattern with a high in April, and the next low most likely coming in May or June. We'll see if the market action continues to match former patterns. The only time that the cycle only caused a short-term correction was in 2009, during the very first phase of the new bull market when upward pressure was very strong, and yet, it still managed to create a 4-week decline of 87 points. With the 120-year cycle expected to bottom in October 2014, next April-May will be a time period to watch. In mid-May 2008, the yearly cycle made its high at 1440 and the next bottom was in March 2009, 759 points lower!

Chart Analysis

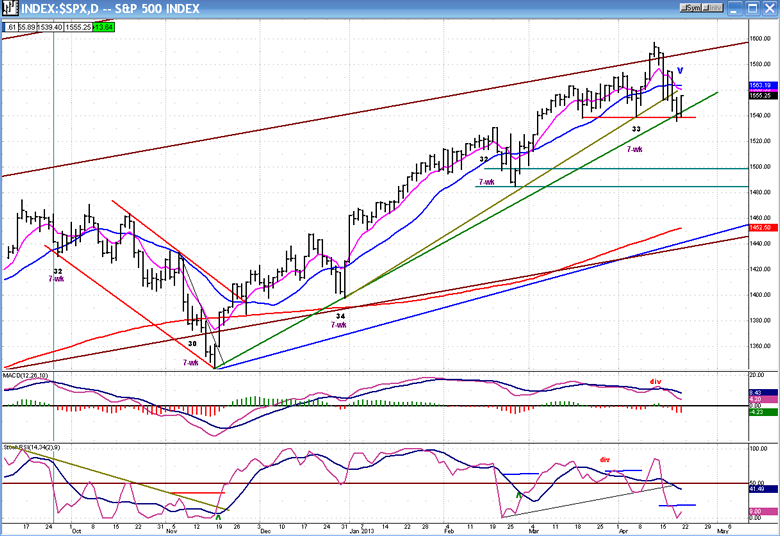

I am going to start my analysis by bringing back the weekly SPX chart (courtesy of QCharts) which clearly shows the yearly cycle pattern. This cycle has been very regular since the beginning of the bull market and, because it is at an early stage and because of the chart size, the reversal is not very visible in the price itself, although last week's bar is clearly longer than any single week's since 1343, and is evidence that intense selling was taking place. Nor is it visible in the MACD since the lines have yet to cross. But the SRSI has clearly turned down, crossed its lines, and has broken below the previous dip which corresponded to 1498 on the chart.

The sell signals can be seen much more clearly in the daily chart (also courtesy of QCharts). Initially, in the chart itself which shows the price breaking the trend line from 1398 and challenging both the trend line from 1343 and the 1539 support level, but they held and caused the index to rally on Friday. If, on the next challenge to that level the price punches through and closes at a lower low, we will have proof that the yearly cycle is alive and well and that the correction could continue down to one of the two green lines. On the other hand, should the support level hold again and a strong rally ensue, we will have to consider the possibility that the correction is already over.

Analyzing the indicators, the SRSI has given a strong sell signal (but is oversold) and the MACD has turned down (but is still positive). It will have to break below the zero line in order to confirm that the larger decline has started.

Positive divergence has developed in the A/D indicator at Thursday's low. If we are to extend the correction to one of the green lines, we don't want to see significant strength return to this index. The next couple of weeks will be critical in determining the market's intention.

Cycles

The next 7-wk cycle low comes in the third week in May and could end the correction. Market lows also have a tendency to come in July and October, so we will have to see how the market performs after May and if it shows an inclination to extend its decline into one of those time frames.

Breadth

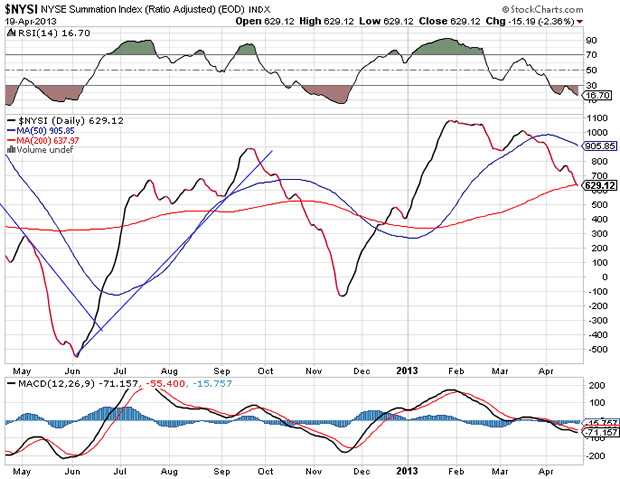

The McClellan Oscillator and Summation Index are shown below (courtesy of StockCharts.com).

These two indicators should help us determine whether the correction stops here or goes lower. The next week is particularly important and our eyes should be fixed on the McClellan Oscillator which, like my own A/D indicator under the daily chart (above), is showing some positive divergence. The bears will not want to see it becoming strongly positive anytime soon. If it does, it would turn the NYSI (and its RSI) back up, suggesting that the correction is probably over.

Sentiment Indicators

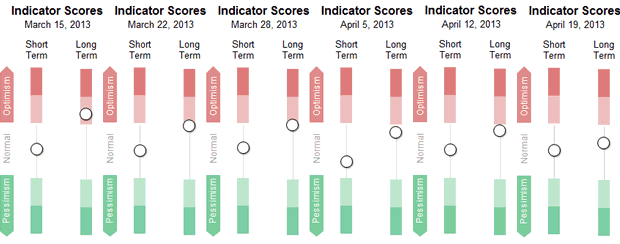

The SentimenTrader (courtesy of same) is the other indicator which is causing some uncertainty about the degree of weakness still to come in the market.

The reading of the long term indicator is barely above neutral and this is the most positive this indicator has been in the past 6 weeks. It never did get to the optimistic level desirable to start a significant downtrend. In the record of weekly closings shown here, the worst case scenario was on March 15, when the indicator actually got into the mildly optimistic zone - a considerably more negative reading for the market than the one shown this past Friday . This was followed by an SPX correction of 64 points, and then the index went sideways for a while before making another high.

This indicator alone is not sufficient to determine the state of the market, and it could recede into the green zone as the market declines before we have a low, but it is warning us that we should not expect too much weakness until it actually takes place.

VIX

VIX's attempt at breaking out was stopped by the intermediate downtrend line from 46 as well as the 200-DMA. If it goes through these after some minor consolidation, it will be a confirmation that the SPX is extending the decline that is currently underway.

The P&F chart gives VIX two counts: one to 22 and the other to 27. If the SPX has started an intermediate decline, either one of these projections could mark the low of the correction.

XLF (Financial SPDR)

XLF continues in a strong long-term uptrend, in sync with SPX and, like SPX, will have to drop below its support level (red line) to extend its correction. If it does, a good bet would be a decline to the next short-term low around 17.25.

BONDS

TLT has broken out of a corrective down-channel and, this past week, tried to extend its short-term uptrend. Over the near-term, the upside progress may be limited to the top of the broader channel that is being created. The P&F chart suggests that it could extend the move slightly beyond, to about 127. This is also where it would meet resistance from previous short-term peaks.

GLD (ETF for gold)

Gold suffered a major loss in the past week. When it broke the important support level of 149, GLD collapsed all the way down to 130.51 -- even lower than my next price projection of 134. On a log scale, that put it slightly below the trend line connecting the 2005 and 2008 lows but by Friday, GLD had rallied above it. That trend line represents major support and, with the next 25-wk cycle low due in the later part of June which could bring the index down to 127, a decisive break below it could turn an intermediate correction into a long-term downtrend.

The collapse in gold is part of a deflationary cycle which is affecting most commodities and which could have some longer term implication for them.

UUP (dollar ETF)

UUP is consolidating its recent advance and, in doing so, has found support on a former peak whose level coincides with the 200-DMA. Because it has a P&F count up to 23.30, it is likely that it will try to reach that target after its consolidation is complete. I have drawn a short-term channel in which the index could travel on the way to its projection.

USO (United States Oil Fund)

Oil is another commodity which is being affected by the deflationary trend. I have marked the target which has been generated by the triangle formation and which also coincides with a P&F count. USO is barely halfway to that target. If it is going to meet it, will GLD join it in a continuing decline?

Summary

SPX has returned to the 1539 support level which held the last time it was tested and was followed by a new all-time high. This time could be significantly different if that level gives way, as this would generate much lower prices. While the odds favor the latter scenario, we need to wait for confirmation and it should come over the next week or so.

FREE TRIAL SUBSCRIPTON

If precision in market timing for all time framesis something that you find important, you should

Consider taking a trial subscription to my service. It is free, and you will have four weeks to evaluate its worth. It embodies many years of research with the eventual goal of understanding as perfectly as possible how the market functions. I believe that I have achieved this goal.

For a FREE 4-week trial, Send an email to: ajg@cybertrails.com

For further subscription options, payment plans, and for important general information, I encourage

you to visit my website at www.marketurningpoints.com. It contains summaries of my background, my

investment and trading strategies, and my unique method of intra-day communication with

subscribers. I have also started an archive of former newsletters so that you can not only evaluate past performance, but also be aware of the increasing accuracy of forecasts.

Disclaimer - The above comments about the financial markets are based purely on what I consider to be sound technical analysis principles uncompromised by fundamental considerations. They represent my own opinion and are not meant to be construed as trading or investment advice, but are offered as an analytical point of view which might be of interest to those who follow stock market cycles and technical analysis.

Andre Gratian Archive |

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.