U.S. Government Manipulated Economic Statistics

Politics / Economic Statistics Apr 27, 2013 - 12:22 PM GMTBy: Peter_Schiff

Don Draper, Mad Men's master advertiser likes to say "when you don't like what they are saying, change the conversation." When it comes to the current economic weakness, which was confirmed again today by the release of lower than expected GDP data, Washington would love do just that. Fortunately for them, they consistently outdo the master minds of Madison Avenue when it comes to misdirection. If the government doesn't like what people are saying, they don't bother just to change the conversation, they change the meaning of the words.

Don Draper, Mad Men's master advertiser likes to say "when you don't like what they are saying, change the conversation." When it comes to the current economic weakness, which was confirmed again today by the release of lower than expected GDP data, Washington would love do just that. Fortunately for them, they consistently outdo the master minds of Madison Avenue when it comes to misdirection. If the government doesn't like what people are saying, they don't bother just to change the conversation, they change the meaning of the words.

The latest example of this was revealed earlier this week when the Bureau of Economic Analysis (BEA) announced new methods of calculating Gross Domestic Product (GDP) that will immediately make the economy "bigger' than it used to be. The changes focus heavily on how money spent on research and development (R&D) and the production of "intangible" assets like movies, music, and television programs will be accounted for. Declaring such expenditures to be "investments" will immediately increase U.S. GDP by about three percent. Such an upgrade would immediately increase the theoretic size of the U.S economy and may well lead to the perception of faster growth. In reality these smoke and mirror alterations are no different from changes made to the inflation and unemployment yardsticks that for years have convinced Americans that the economy is better than it actually is.

Today's data release confirms that the economic "recovery" is weaker than expected and remains heavily dependent on Federal support. Personal spending was indeed up 3.2%, the biggest jump in two years, but real earnings were down by 5.3%, the biggest fall since 2009. Not surprisingly the buying was made possible by a drop in the savings rate, which came in at just 2.6%, the lowest since the 4th quarter of 2007. No doubt, rising home prices and falling mortgage rates (made possible by Fed stimulus) allowed Americans to refinance their homes and to borrow and spend the money that they did not earn. With GDP continuing to disappoint, a statistical make-over couldn't come at a more convenient time.

In the simplest terms, GDP is calculated by combining a nation's private spending, government spending, and investments (while adding trade surplus or subtracting trade deficits). Business spending on R&D, a portion of which comes in the form of salaries, has traditionally been considered an expense that does not explicitly add to GDP. But now, the United States will lead the rest of the world in redefining GDP. Washington has now declared that the $400 billion spent annually by U.S. businesses on R&D will count towards GDP. This equates to about 2.7% of our nearly $16 Trillion GDP. The argument goes that, for example, the GDP generated by iPhones has far exceeded the cost spent by Apple to develop the product. Therefore, Apple's R&D is not an expense but an investment.

The BEA also argues that the cost of producing television shows, movies, and music should count as investments that add to GDP. Supporters of the change often hold up the blockbuster television comedy Seinfeld as an example. Given that the show's billions in earnings far exceeded its initial costs, they argue that the production expenses should be considered "investments" (like R&D) and be added into GDP.

Economists who have staked their reputations on the efficacy of Keynesian growth strategies have argued that such changes will more accurately reflect the realities of our 21st century information economy. But their analysis ignores the failures so often associated with R&D and artistic productions. For every breakthrough iPhone there are dozens of ill-conceived gizmos that never get off the drawing board. For every Seinfeld, there are countless failures and bombs that leave nothing but losses.

In essence, the new methodology is an exercise in double accounting. For instance, suppose a company employs an accountant who works in the sales department, who is then transferred to the R&D department at the same salary. He still counts beans but now his salary will be billed to the R&D budget rather than sales. In the old methodology, the accountant's impact on GDP would come only from the personal consumption that his salary allows. Going forward, he will add to GDP in two ways: from his personal consumption and his salary's addition to his company's R&D budget. The same formula would apply to a trucker who switches from a freight company to a movie production company (for the same salary). If he moves refrigerators, he only adds to GDP through his personal spending, but if he hauls movie lights, his contribution to GDP is doubled. It makes no difference if the movie bombs.

These double shots are different from traditional investments, which inject savings (or idle cash) back into the marketplace. Until money from personal or corporate savings is invested, it is not adding to GDP.

Another change that will artificially boost GDP concerns how government salaries will be counted. Unlike most private sector compensation, wages, salaries, and pension contributions paid to government workers are added directly to GDP. This distinction makes sense and eliminates potentially double accounting. Profits generated by private companies add to GDP when they are ultimately spent or invested by the company. Wages reduce profits, and therefore reduce GDP. But that reduction is cancelled out by the consumption of the employee receiving the wages. Governments do not generate profits, so salaries are the only way that public spending adds back to GDP.

The new system magnifies the GDP impact of government pensions, which are a principal component of public sector compensation. Going forward, the pensions will be calculated not from actual contributions, but from what governments have promised. Under the old system, if a state had a $10,000 pension obligation but only contributed $1,000, only the $1,000 would be added to GDP. Under the new system the entire $10,000 would be counted. So now governments can magically grow the economy simply by making promises they can't keep.

The bottom line is that now certain private sector salaries (in R&D and entertainment) will be counted twice and public pension contributions will be counted even if they aren't made. The economy will not actually be any larger or grow any faster, but the statistics will claim otherwise. With the stroke of a pen, our debt to GDP ratio will come down. Will this soothe the fears of our creditors? Will critics of big government take comfort that spending as a share of GDP may be lower? My guess is that the government is confident that its trick will work, and that distracting attention with a statistical illusion is the sole motivation for the change.

A similar type of hocus pocus has been successfully used to make inflation appear much smaller. A few months ago I produced a video showing how changes in methods used to calculate the Consumer Price Index (CPI) have resulted in a widening gap between increases in real prices and the CPI. The changes, that incorporate such concepts as hedonic adjustments and substation bias, were made to make the CPI more "accurate," but have instead produced consistently lower results. Although I used a basket of 20 goods for that experiment, I gave particular attention to such things as newspaper and magazine prices and health insurance costs. But just recently I came across another data set that leads to the same conclusion.

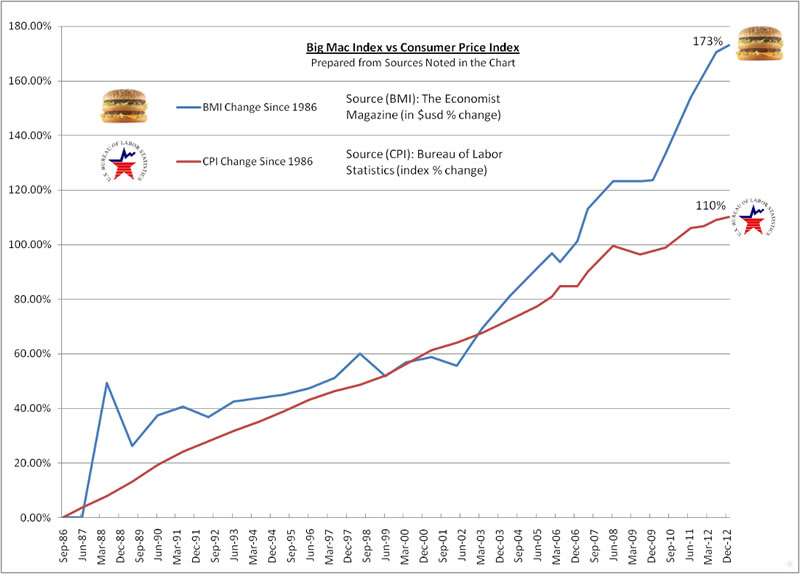

Since the late 1980's, The Economist Magazine has compiled something called the "Big Mac Index,"(BMI) a global survey of the cost of McDonald's signature hamburger. Although the index is primarily used as a means to compare purchasing power parity around the globe, it also can be used to track the prices of Big Macs in the U.S. over many years.

From 1986 to 2003 the U.S. BMI rose roughly in line with the CPI. Although the burger occasionally rose faster or slower, over that 17 year period both indexes increased by about 68% (or about 4% per year). But from April 2003 to January 2013 the CPI Index is up just 25% percent (from 183.8 to 230.28 or about 2.5% per year) while the BMI is up 61% (from $2.71 to $4.37 or about 6.1% per year), or more than twice the rate of inflation.

What could possibly account for the difference? Has the Big Mac gotten bigger, better, tastier, or healthier? As an iconic product, McDonald's has been reluctant to change a proven formula. If the Big Mac hasn't changed, is it possible that our inflation yardstick has?

It has been estimated that if the government used the same methodology to measure inflation that it used during the 1980's, we would be currently dealing with official inflation that would be many times higher than today's official 1.5% rate. The Big Mac appears to confirm this.

But now the government appears ready to distort the figures even further. With little resistance from the media or the public, the Obama Administration and Congressional Republicans seem ready to switch the inflation measurements used for Social Security away from the CPI in favor of the even more attenuated "Chain Weighted CPI." This index, which is consistently lower than the CPI, looks to incorporate changes in spending patterns when consumers switch to more affordable products (in other words, it measures the cost of survival, not the cost of living). And while many admit that this is a manipulation, no one really seems to care.

Similarly clumsy tricks have been used to make our unemployment problem appear less severe. Over the years new methods have been introduced to factor out those who have "dropped out" of the labor force or to count part-time or temporary workers as employed.

All this takes us right back to Don Draper. If you can't change the conversation, change the words. If that doesn't work, just change the dictionaries.

Peter Schiff is the CEO and Chief Global Strategist of Euro Pacific Capital, best-selling author and host of syndicated Peter Schiff Show.

Subscribe to Euro Pacific's Weekly Digest: Receive all commentaries by Peter Schiff, John Browne, and other Euro Pacific commentators delivered to your inbox every Monday!

And be sure to order a copy of Peter Schiff's recently released NY Times Best Seller, The Real Crash: America's Coming Bankruptcy - How to Save Yourself and Your Country.

Regards,

Peter Schiff

Euro Pacific Capital

http://www.europac.net/

Peter Schiff Archive |

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.