Is Gold Mining Sector About to Explode Higher?

Commodities / Gold and Silver Stocks 2013 May 31, 2013 - 03:06 AM GMTBy: Graham_Summers

Is it time to buy Gold miners?

Is it time to buy Gold miners?

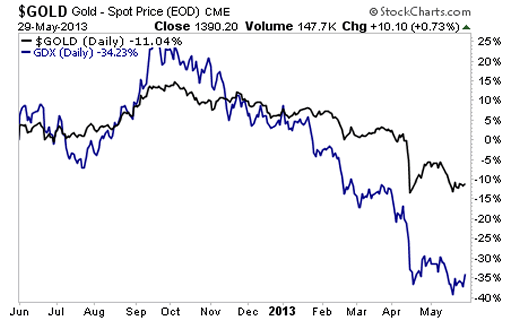

The precious metals mining sector was slammed with Gold’s sharp drop in prices in April. Mining companies are more “pie in the sky” than owning actual bullion, so mining shares typically move much more sharply than Gold does (see the figure below charting the price performance of Gold against the Gold mining ETF).

What’s interesting is that the Gold smackdown occurred just a few weeks before the Fed leaked that it was considering tapering its QE program. We know for a fact that the Fed has a tendency to leak critical information to its cronies and connected insiders. Looking at how Gold moved just a few weeks before the word “taper” was picked up by the media, one wonders if the Fed hinted what was coming to the connected few before the rest of us.

Regardless of Fed shenanigans, the Gold smackdown hit mining companies the hardest. As a result of this, numerous mining companies were trading at only slight premiums to their cash levels. With no debt on their books you were essentially getting their Gold reserves and infrastructure for free (provided there wasn’t too much political risk).

All you needed was for mining companies to bottom out… which looks to be happening now.

I alerted subscribers of my Private Wealth Advisory newsletter to this situation a few weeks ago, telling them about six mining companies in particular that were priced at bargain basement prices given their fundamentals.

As I write this, ALL of them are exploding higher. We’ve already closed out one for a 7% gain. And the others are destined for double digits in the coming weeks.

To find out their symbols and receive my hard-hitting analysis of their fundamentals, all you need to do is take out a subscription to Private Wealth Advisory.

To join us…

Graham Summers

Chief Market Strategist

Good Investing!

PS. If you’re getting worried about the future of the stock market and have yet to take steps to prepare for the Second Round of the Financial Crisis… I highly suggest you download my FREE Special Report specifying exactly how to prepare for what’s to come.

I call it The Financial Crisis “Round Two” Survival Kit. And its 17 pages contain a wealth of information about portfolio protection, which investments to own and how to take out Catastrophe Insurance on the stock market (this “insurance” paid out triple digit gains in the Autumn of 2008).

Again, this is all 100% FREE. To pick up your copy today, got to http://www.gainspainscapital.com and click on FREE REPORTS.

Graham also writes Private Wealth Advisory, a monthly investment advisory focusing on the most lucrative investment opportunities the financial markets have to offer. Graham understands the big picture from both a macro-economic and capital in/outflow perspective. He translates his understanding into finding trends and undervalued investment opportunities months before the markets catch on: the Private Wealth Advisory portfolio has outperformed the S&P 500 three of the last five years, including a 7% return in 2008 vs. a 37% loss for the S&P 500.

Previously, Graham worked as a Senior Financial Analyst covering global markets for several investment firms in the Mid-Atlantic region. He’s lived and performed research in Europe, Asia, the Middle East, and the United States.

© 2013 Copyright Graham Summers - All Rights Reserved

Disclaimer: The above is a matter of opinion provided for general information purposes only and is not intended as investment advice. Information and analysis above are derived from sources and utilising methods believed to be reliable, but we cannot accept responsibility for any losses you may incur as a result of this analysis. Individuals should consult with their personal financial advisors.

Graham Summers Archive |

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.