Water Resources Drying Up, Investor Opportunities Arise

Companies / Water Sector May 31, 2013 - 10:55 AM GMTBy: Money_Morning

Peter Krauth writes:

In a recent conversation about resources I had with Rick Rule, founder of Sprott Global Resource Investments, our talk kept coming back to water.

Peter Krauth writes:

In a recent conversation about resources I had with Rick Rule, founder of Sprott Global Resource Investments, our talk kept coming back to water.

Let's just say, Rick likes water. Or rather, the prospects for water investments.

Rick's offices are in California, so he knows only too well the supply problems plaguing southwestern U.S. states.

To put things bluntly, water is necessary, in short supply, and getting more expensive.

Water, Water Everywhere...

Few people think of water as a limited resource, much less as an investment prospect.

Sure, it covers two-thirds of planet E arth, but 97% is salt water. That makes it unfit for human consumption without a lot of expensive processing. It's also of no use for livestock consumption, nor for growing crops or industrial uses.

Just 3% is fresh water, and two-thirds of that is frozen in glaciers and in the polar icecaps. Which doesn't leave a whole lot to share.

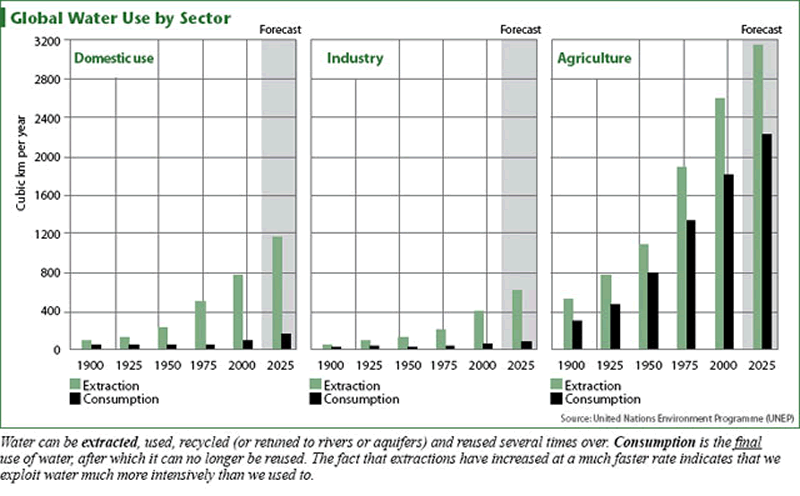

What's more, according to the U.N., in the past hundred years, humans have increased water use at more than double the rate of population growth.

Americans use a lot of water, to the tune of 100 - 150 gallons per person daily, on average. On the other side of the planet, in places like China and India, water use is closer to 20 gallons per day. But with nearly a third of the world population living in these two countries alone, their "water footprint" is still massive.

What's more, as numerous developing nations improve their incomes and graduate to the ranks of the middle class, their water consumption just keeps accelerating.

American Thirst

Although fresh water i s relatively abundant in North America, the resource certainly isn't spread out evenly. Areas along the U.S. west coast have tremendous climates to grow produce, but often lack sufficient water.

Twenty-seven million people in seven states depend on the Colorado River as their main source of water. The Colorado irrigates over 3 million acres of farmland. In Southern California alone, some 18 million residents look to this one river for 40% of their water needs.

But in the past decade, the Colorado has suffered a severe drought, draining it to a mere 59% of its reservoir capacity.

Three Water Positions

So needless to say, the fundamentals for solid water-related companies are very bullish, and that has Rick excited about the best of the best. But the angle he likes is not water processing, or water distribution, but rather water rights.

The first of these is JG Boswell Company (OTC: BWEL) , founded by James Griffin Boswell. This company is known as the world's largest privately owned farm, with primary crops including Pima cotton, alfalfa hay, tomatoes, onions and wheat, cultivated on 150,000 acres mostly in Kings County, CA.

But the water angle here is that Boswell is second-largest holder of private water rights in California. Apparently, there is an aquifer under the lakebed where Boswell grows its crops that could supply up to 3 million residents, and some say the water rights by themselves are worth several billion dollars.

According to Rick, Boswell trades only "by appointment." Volume is so thin, the average is only about 340 shares per day, and even then only on the OTC (over the counter) market. Shares trade for a hefty $860 apiece, and yield about 2% in dividends. In the last four years, the share price has doubled. But given how precious its assets are, it's likely a good buy on near-term weakness.

Limoneira Company (Nasdaq:LMNR) operates in three segments: agribusiness, rental operations, and real estate development in California. The agribusiness grows a number of citrus and other crops. Again though, it's the water rights that are especially attractive.

LMNR holds the rights to local groundwater and surface water where, for the most part, development costs have already been paid. When land is developed in the western U.S., it needs to be demonstrated that there's at least 20 years of reliable water supply.

The company has a $260 million market cap, yields 0.8%, and trades a reasonable volume of 45,000 shares daily.

Pico Holdings Inc. (Nasdaq: PICO) is also located in California, and operates in water resource, water storage, real estate, and agribusiness in the U.S. and internationally.

The water resource and water storage operations segment acquires and develops water resources for end-users, which includes utilities, developers and industrial users. Water storage purchases and recharges water for resale in the southwestern U.S. These operations are mainly conducted through its subsidiary, Vidler Water Company.

Vidler also sells or leases developed water resources to real estate developers or industrial users to advance their projects. PICO's market cap is $480 million, and trades about 100,000 shares daily.

Remember, water is not only a precious commodity, but one that's also a basic necessity to individuals, farming, and industry.

And these three water positions are attractive ways to play the favorable supply/demand dynamic of water and water rights, especially in the southwestern U.S.

As our population ages and gravitates to warmer climes, this is one sector that's likely to get a lot more attention in the not- too- distant future.

Source :http://moneymorning.com/2013/05/31/water-resources-dry-up-opportunities-arise/

Money Morning/The Money Map Report

©2013 Monument Street Publishing. All Rights Reserved. Protected by copyright laws of the United States and international treaties. Any reproduction, copying, or redistribution (electronic or otherwise, including on the world wide web), of content from this website, in whole or in part, is strictly prohibited without the express written permission of Monument Street Publishing. 105 West Monument Street, Baltimore MD 21201, Email: customerservice@moneymorning.com

Disclaimer: Nothing published by Money Morning should be considered personalized investment advice. Although our employees may answer your general customer service questions, they are not licensed under securities laws to address your particular investment situation. No communication by our employees to you should be deemed as personalized investent advice. We expressly forbid our writers from having a financial interest in any security recommended to our readers. All of our employees and agents must wait 24 hours after on-line publication, or after the mailing of printed-only publication prior to following an initial recommendation. Any investments recommended by Money Morning should be made only after consulting with your investment advisor and only after reviewing the prospectus or financial statements of the company.

Money Morning Archive |

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.