Banks Rig Global $5 Trillion Daily Currency Markets to Profit Off Clients

Commodities / Gold and Silver 2013 Jun 12, 2013 - 08:37 PM GMTBy: GoldCore

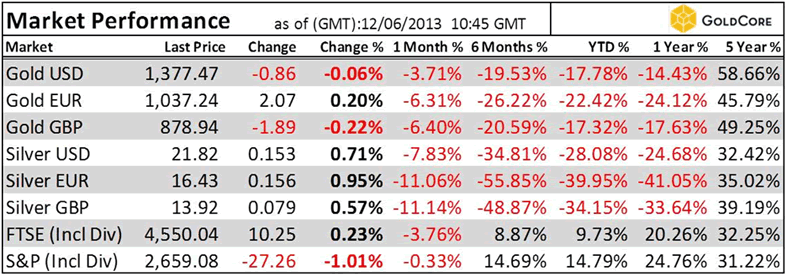

Today’s AM fix was USD 1,377.25, EUR 1,036.77 and GBP 878.40 per ounce.

Today’s AM fix was USD 1,377.25, EUR 1,036.77 and GBP 878.40 per ounce.

Yesterday’s AM fix was USD 1,369.50, EUR 1,031.10 and GBP 880.93 per ounce.

Gold fell $6.70 or 0.48% yesterday to $1,378.70/oz and silver slid to $21.49 and finished down 1.19%.

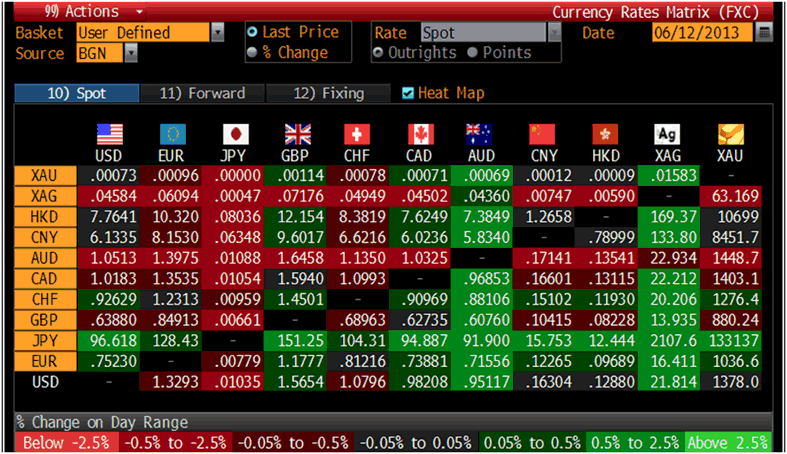

Cross Currency Table – (Bloomberg)

Gold prices are mixed today and while flat in US dollars are lower in Aussie dollars and higher in Japanese yen which has taken another pummelling on foreign exchange markets.

The world’s biggest banks have been manipulating benchmark foreign-exchange rates used to set the value of trillions of dollars of investments, according to a Bloomberg investigation.

Employees have been front-running client orders and rigging WM/Reuters rates by pushing through trades before and during the 60-second windows when the benchmarks are set, said five current and former traders, who requested anonymity because the practice is controversial.

Dealers colluded with counterparts to boost chances of moving the rates, said two of the people, who worked in the industry for a total of more than 20 years.

The behavior occurred daily in the spot foreign-exchange market and has been going on for at least a decade, affecting the value of funds and derivatives and all investments.

The Financial Conduct Authority, Britain’s markets supervisor, is considering opening a probe into potential manipulation of the rates, according to a person briefed on the matter.

Informed observers have long warned that the global $4.7-trillion-a-day foreign exchange market, the biggest in the financial system has all the hallmarks of a casino.

The inherent conflict banks face between executing client orders and profiting from their own trades is exacerbated because most currency trading takes place away from exchanges.

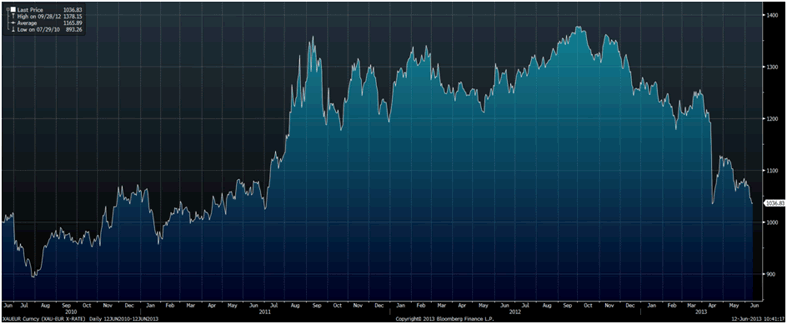

Gold in Euros, 3 Year – (Bloomberg)

The FCA already is working with regulators worldwide to review the integrity of benchmarks, including those used in valuing derivatives and commodities, after three lenders were fined about $2.5 billion for rigging the London interbank offered rate, or Libor. Regulators also are investigating benchmarks for the crude-oil and swaps markets.

“The price mechanism is the anchor of our entire economic system,” said Tom Kirchmaier, a fellow in the financial-markets group at the London School of Economics. “Any rigging of the price mechanism leads to a misallocation of capital and is extremely costly to society.”

The benchmarks are based on actual trades or quotes, rather than the bank estimates used to calculate Libor. Still, they’re susceptible to rigging, according to the five traders, who said they had engaged in or witnessed the practice.

The traders interviewed by Bloomberg News declined to identify which banks engaged in manipulative practices and didn’t specifically allege that any of the top four firms were involved. Spokesmen for Deutsche Bank, Citigroup, Barclays and UBS declined to comment.

It is becoming increasingly evident that many key financial markets are being rigged and manipulated by banks and central banks today. Some of the manipulation is overt, some is covert.

The world's largest banks are fixing prices in many key markets and benchmarks which is affecting the value of money itself and will ultimately leading to the value of money in your pocket becoming worth much less.

It is distorting markets and leading to a false sense of security and unwarranted and dangerous risk appetite.

It leads to a heightened risk of market dislocations, market crashes and monetary crisis. It could also lead to the much anticipated default on the COMEX as more and more nervous investors, individual and institutional, opt to take delivery of physical bullion.

This makes owning physical gold in your possession or in a vault that you can ship from at will more vitally important than ever before.

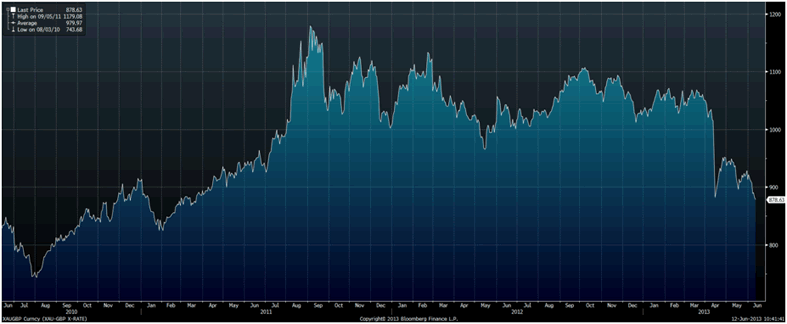

Gold In British Pounds, 3 Year – (Bloomberg)

Comex, Nymex Gold Delivery Issues, Stops for June 11

The following is a table detailing daily issues and stops related to deliveries of gold against expiring contracts traded on the Comex or the New York Mercantile Exchange for June 11, according to CME Group Inc.

The notices reflect the movement of metals to offset each long or short futures position with supplies held in exchange-monitored warehouses. Issuers are making deliveries, and stoppers are taking deliveries.

=============================================================================

June 11 June 10 June 7 June 6 June 5 June 4

2013 2013 2013 2013 2013 2013

=============================================================================

-------------------------- Gold ----------------------------

Issues/stops 18 195 132 318 826 333

Month to date 7,871 7,853 7,658 7,526 7,208 6,382

Settlement 1,377.0 1,386.2 1,383.0 1,415.7 1,398.4 1,397.1

Delivery date 06/13/13 06/12/13 06/11/13 06/10/13 06/07/13 06/06/13

Contract June 2013 June 2013 June 2013 June 2013 June 2013 June 2013

=============================================================================

June 11 June 10 June 7 June 6 June 5 June 4

2013 2013 2013 2013 2013 2013

=============================================================================

SOURCE: CME Group Inc. via Bloomberg

Comex Issues and Stops of Silver by Firm for June 11 (Table)

The following is a table detailing daily issues and stops by company related to deliveries of silver against expiring contracts traded on the Comex, according to CME Group Inc.

The notices reflect the movement of silver to offset each long or short futures position with supplies held in exchange-monitored warehouses. Issuers are making deliveries, and stoppers are taking deliveries.

======================================================================

Account Firm Issued Stopped

======================================================================

---------------------- June 11 -----------------------

Daily Total 55 55

Month to Date 90

---------------------------------------------------------------------

House Nova Scotia 0 21

Customer JP Morgan 36 0

House JP Morgan 19 0

Customer ABN Amro 0 34

======================================================================

Account Firm Issued Stopped

======================================================================

---------------------- June 10 -----------------------

Daily Total 2 2

Month to Date 35

---------------------------------------------------------------------

House Nova Scotia 0 2

Customer JP Morgan 2 0

---------------------- June 5 -----------------------

Daily Total 11 11

Month to Date 33

---------------------------------------------------------------------

House Nova Scotia 0 8

Customer JP Morgan 0 3

Customer ABN Amro 11 0

---------------------- May 31 -----------------------

Daily Total 2 2

Month to Date 22

---------------------------------------------------------------------

House Nova Scotia 0 2

======================================================================

Account Firm Issued Stopped

======================================================================

Customer PTG Div. Newedge 2 0

---------------------- May 30 -----------------------

Daily Total 20 20

Month to Date 20

---------------------------------------------------------------------

Customer Merrill 5 0

House Nova Scotia 0 13

Customer JP Morgan 0 5

House JP Morgan 15 0

Customer PTG Div. Newedge 0 2

======================================================================

SOURCE: CME Group Inc. via Bloomberg

For the latest news and commentary on financial markets and gold please follow us on Twitter.

GOLDNOMICS - CASH OR GOLD BULLION?

'GoldNomics' can be viewed by clicking on the image above or on our YouTube channel:

www.youtube.com/goldcorelimited

This update can be found on the GoldCore blog here.

Yours sincerely,

Mark O'Byrne

Exective Director

IRL |

UK |

IRL +353 (0)1 632 5010 |

WINNERS MoneyMate and Investor Magazine Financial Analysts 2006

Disclaimer: The information in this document has been obtained from sources, which we believe to be reliable. We cannot guarantee its accuracy or completeness. It does not constitute a solicitation for the purchase or sale of any investment. Any person acting on the information contained in this document does so at their own risk. Recommendations in this document may not be suitable for all investors. Individual circumstances should be considered before a decision to invest is taken. Investors should note the following: Past experience is not necessarily a guide to future performance. The value of investments may fall or rise against investors' interests. Income levels from investments may fluctuate. Changes in exchange rates may have an adverse effect on the value of, or income from, investments denominated in foreign currencies. GoldCore Limited, trading as GoldCore is a Multi-Agency Intermediary regulated by the Irish Financial Regulator.

GoldCore is committed to complying with the requirements of the Data Protection Act. This means that in the provision of our services, appropriate personal information is processed and kept securely. It also means that we will never sell your details to a third party. The information you provide will remain confidential and may be used for the provision of related services. Such information may be disclosed in confidence to agents or service providers, regulatory bodies and group companies. You have the right to ask for a copy of certain information held by us in our records in return for payment of a small fee. You also have the right to require us to correct any inaccuracies in your information. The details you are being asked to supply may be used to provide you with information about other products and services either from GoldCore or other group companies or to provide services which any member of the group has arranged for you with a third party. If you do not wish to receive such contact, please write to the Marketing Manager GoldCore, 63 Fitzwilliam Square, Dublin 2 marking the envelope 'data protection'

GoldCore Archive |

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.