Words from the Investment Wise for the Week that Was (23rd March)- Part 1

Stock-Markets / Financial Markets Mar 23, 2008 - 05:51 AM GMT Phew – what a tumultuous week! Once again, the fall-out of the subprime mess had a lot to do with it. For some variety, however, it was not only financial's that were in the limelight, but also commodities that corrected sharply.

Phew – what a tumultuous week! Once again, the fall-out of the subprime mess had a lot to do with it. For some variety, however, it was not only financial's that were in the limelight, but also commodities that corrected sharply.

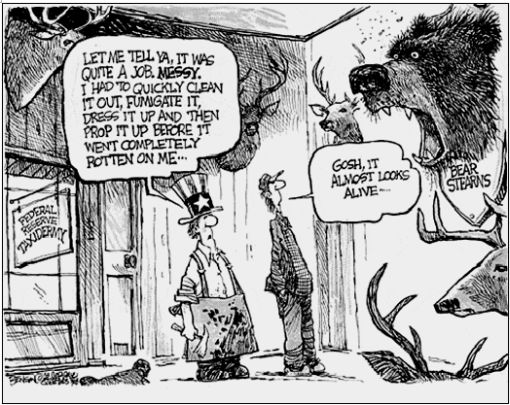

Unrelated to St Patrick's Day, the week started off with a sense of fear for a market meltdown after it had been announced over the weekend that the Federal Reserve of New York facilitated the sale of Bear Stearns (BSC) to JP Morgan Chase (JPM) for the princely sum of $2.00 per share.

Stock Trader's Almanac succinctly reminded us of the words of Norwegian playwright Henrik Ibsen who opined over a century ago: “Those heroes of finance are like beads on a string, when one slips off, the rest follow.” With faith in the US financial system fragile, pundits questioned whether Bear would be the only casualty. Though, better-than-expected earnings reports by Morgan Stanley (MS), Goldman Sachs (GS) and Lehman Brothers (LEH) allayed some of the market's concerns about the shape of the financial sector.

In the Fed's first weekend action in more than 25 years, it announced a 25 basis-point cut in the discount rate to 3.25% and created a new lending facility to provide financing to participants in securitization markets. “You only cut on a Sunday if you're trying to avert all-out panic on a Monday,” said John Hussman of Hussman Funds .

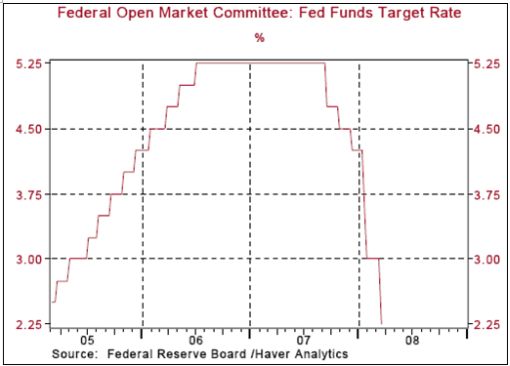

Two days later the Federal Open Market Committee (FOMC) cut the Fed funds rate by 75 basis points to 2.25% and the discount rate by another 75 basis points to 2.50%. Although the FOMC's statement noted increased uncertainty surrounding the inflation outlook, it still believed inflation would moderate. However, the downside risk to growth remained the Fed's main concern and it was implied that it was ready to cut rates again if necessary.

The Office of Federal Housing Enterprise Oversight (Ofheo) announced that it was relaxing the excess capital requirement for Fannie Mae (FNM) and Freddie Mac (FRE) in an effort to increase liquidity in the US mortgage market by as much as $200 billion .

Capping a busy week, the Fed also announced that it was planning to expand the list of eligible collateral for next week's Term Securities Lending Facility to include difficult-to-trade securities.

Before highlighting some thought-provoking news items and quotes from market commentators, let's briefly review the financial markets' movements on the basis of economic statistics and a performance round-up.

Economy

In addition to the Fed's interest rate announcements and other actions mentioned above, the past week's US economic reports included: industrial production showing a steep decline; higher-than-expected jobless claims, pointing to a weakening labor market; the Philadelphia Fed manufacturing survey showing contraction for the fourth consecutive month; and a current account deficit narrowing in the fourth quarter from 5.1% to 4.9% of GDP, partly as a result of the weak dollar.

The US Producer Price Index carried mixed news with total PPI up less than expected, but core-PPI, which excludes food and energy, exceeding the consensus number. On a year-to-year basis, total PPI was 6.4%, marking the fifth monthly reading in excess of 6.0%.

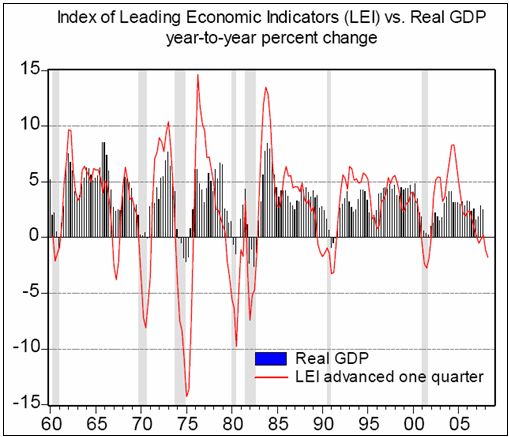

On balance, there appears to be a growing list of economic indicators that are signaling contraction in the US economy. This was also reflected by the Index of Leading Indicators, showing the biggest drop in the current cycle (on a quarterly basis) – consistent with readings seen in past recessions.

Elsewhere in the world, the Bank of England's minutes showed the BoE balancing strong inflationary pressures with slower economic growth. February retail sales surprised on the upside, but also suggested that UK consumers were continuing to drive themselves deeper into debt to fund purchases.

WEEK'S ECONOMIC REPORTS

| Date | Time (ET) | Statistic | For | Actual | Briefing Forecast | Market Expects | Prior |

| Mar 17 | 8:30 AM | NY Empire State Index | Mar | -22.2 |

-8.0 |

-7.4 |

-11.7 |

| Mar 17 | 9:00 AM | Net Foreign Purchases | Jan | $62.0B |

NA |

$60.0B |

$56.5B |

| Mar 17 | 9:15 AM | Capacity Utilization | Feb | - |

NA |

NA |

81.5% |

| Mar 17 | 9:15 AM | Industrial Production | Feb | -0.5% |

-0.1% |

-0.1% |

0.1% |

| Mar 17 | 9:15 AM | Capacity Utilization | Feb | 80.9% |

81.2% |

81.3% |

81.5% |

| Mar 18 | 8:30 AM | Building Permits | Feb | - |

NA |

NA |

1061K |

| Mar 18 | 8:30 AM | Core PPI | Feb | - |

NA |

NA |

0.4% |

| Mar 18 | 8:30 AM | Housing Starts | Feb | 1065K |

980K |

995K |

1071K |

| Mar 18 | 8:30 AM | PPI | Feb | - |

NA |

NA |

1.0 |

| Mar 18 | 8:30 AM | Building Permits | Feb | 978K |

1010K |

1020K |

1061K |

| Mar 18 | 8:30 AM | PPI | Feb | 0.3% |

0.1% |

0.3% |

1.0% |

| Mar 18 | 8:30 AM | Core PPI | Feb | 0.5% |

0.2% |

0.2% |

0.4% |

| Mar 18 | 2:15 PM | FOMC Policy Statement | - | - |

- |

- |

- |

| Mar 19 | 10:30 AM | Crude Inventories | 03/15 | 133K |

NA |

NA |

6177K |

| Mar 20 | 8:30 AM | Initial Claims | 03/15 | 378K |

355K |

360K |

356K |

| Mar 20 | 10:00 AM | Leading Indicators | Feb | -0.3% |

-0.3% |

-0.3% |

-0.4% |

| Mar 20 | 10:00 AM | Philadelphia Fed | Mar | -17.4 |

-20.0 |

-18.0 |

-24.0 |

Source: Yahoo Finance , March 21, 2008.

The next week's economic highlights, courtesy of Northern Trust , include the following:

1. Existing Sales (March 24): Sales of existing homes are predicted to have declined in February. Existing home sales have dropped 31.5% from their peak in September 2005. Sales of existing homes have fallen 22.4% from a year ago in January. Consensus : 4.85 million versus 4.89 million in January.

2. New Home Sales (March 26): Sales of new homes are expected to have fallen in February. Purchases of new homes have fallen 57.9% from their peak in July 2005. Sales of new homes have declined 34.9% from a year ago. Consensus : 575,000 versus 588,000 in January.

3. Durable Goods Orders (March 26): Durable goods orders (+0.5%) are predicted to reverse a part of the sharp 5.1% decline seen in January. Orders of aircraft and defense may have risen following a big drop in January. Consensus : 0.7% versus -5.1% in January.

4. Real GDP (March 27): The downward revision of retail sales in December and a smaller trade gap in December could result in no change in the headline GDP from the preliminary estimate of a 0.6% annualized increase. Consensus : 0.6%.

5. Personal Income and Spending (March 28): The earnings and payroll numbers for February suggest only a small gain in personal income (+0.1%). Auto sales were nearly flat in February and non-auto retail sales were noticeably weak, which points to likely drop in consumer spending (-0.1%). Consensus : personal income +0.3%; consumer spending 0.1%.

6. Other reports : Consumer Confidence (March 25).

Markets

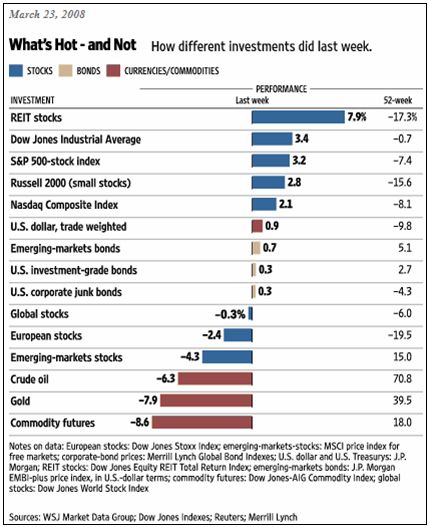

The performance chart obtained from the Wall Street Journal Online shows how different global markets fared during the past week.

Source: Wall Street Journal Online , March 23, 2008.

Equities

Global stock markets closed the week lower, with the MSCI World Index declining 0.3%. As was the case during the previous two weeks, emerging markets again came under strong selling pressure and lost 4.3%. European stocks (-2.4%) also dropped markedly.

The major US indexes closed the shortened week on a high note, with the Dow Jones Industrial Index recording a four-day gain of 3.4%, the S&P 500 Index +3.2%, the Nasdaq Composite Index +2.1% and the Russell 2000 Index (small stocks) +2.8%.

Dick Bove, highly-regarded analyst of Punk Ziegel, proclaimed the financial crisis was over. The Financial Sector SPDR jumped 10.5% over the week, followed by REIT stocks with a gain of 7.9%. The Materials Sector SPDR, however, reflected the sell-off in commodities with a loss of 5.8%. Gold stocks (-16.7%) and oil services stocks (-6.5%) fared particularly badly.

Click here for a scorecard for a number of global stock markets, indicating the index movements since each of the respective market's highs.

Bonds

The yield on the 3-month Treasury Bill dropped to 0.54%, marking its lowest level in nearly 50 years. “Pretty soon we'll be paying the Treasury for the privilege of owning T-bills. Yikes,” said Richard Russell, author of the Dow Theory Letters .

The past week saw a mixed performance of benchmark government bonds. The yield on the two-year US Treasury Note dropped 2 basis points over the week to 1.6%, the 10-year yield declined 21 basis points to 3.34% and the 30-year yield shed 30 basis points to 4.17%.

Fading prospects for an imminent rate cut in the eurozone area resulted in the yield of the two-year Schatz bond jumping 17 basis points to 3.32%.

Currencies

The beleaguered US dollar improved markedly after the FOMC's rate announcement and continued to rebound for the rest of the week. The greenback gained 1.4% against the euro during the week and also strengthened against the Swiss Franc (+1.1%), the British pound (1.7%) and the Japanese yen (+0.4%).

Commodity-related currencies were at the forefront of the selling pressure against the US dollar, with the Australian dollar losing 3.9%, the Canadian dollar 3.3% and the New Zealand dollar 2.8%.

The Swiss Franc and Japanese yen benefited as risk aversion caused investors to reduce carry trades.

Commodities

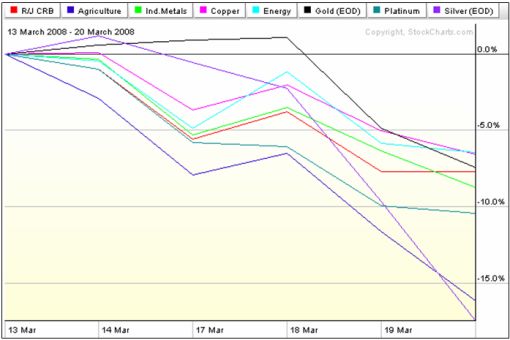

Commodity prices recorded all-time highs at the start of the week, but came under strong selling pressure as safe-have considerations became paramount and positions were de-leveraged before the Easter break. This resulted in the CRB Index experiencing its two sharpest daily declines (4.6% and 4.1% respectively) on record.

West Texas Intermediate oil hit a record $111.80 on Monday before correcting to $101.84 by the end of trading on Thursday. Gold plunged from an all-time peak of $1 030.80 on Monday to $920.30 by the close of the week, including its worst one-day fall (-5.9%) in 18 years on Wednesday.

The damage was equally bad across the rest of the commodities complex, as illustrated by the following chart:

Source: StockCharts.com

Click here for my recent post “Commodities – too much too quickly”.

Now for a few news items and some words and pictures from the investment wise that will hopefully assist in guiding us in making correct investment decisions in these uncertain times.

Source: Steven Benson, Slate , March 20, 2008.

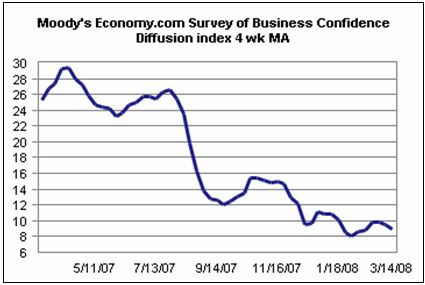

Moody's Economy.com: Global business confidence consistent with recession

“Global business confidence fell back in mid-March and is consistent with recession in the US, near recession in Europe and Canada, below potential growth in South America, and growth just at potential in Asia. Business assessments of current conditions and hiring weakened notably last week. Sales remain soft, and businesses continue to pare inventories. Real estate firms, financial institutions and business service firms are the most worried.”

Source: Moody's Economy.com , March 17, 2008.

IFO Viewpoint: The party is over

“With the United States teetering into recession, the global economic boom has ended. The boom was unusually long and persistent, with four years of roughly 5% growth – a period of sustained economic dynamism not seen since around 1970.

“The clearest sign that the boom is ending is the IMF's forecast of 1.5% growth for the US in 2008. That may not sound like a recession, but the Fund's marginally positive projection primarily reflects the growth overhang from 2007, with hardly any new contribution in 2008. It is compatible with three consecutive quarters of zero growth in 2008.

“Many argue that a US recession will no longer affect the world because China has supplanted America as an engine of the global economy. Wrong.

Although China is growing fast, its economic power remains tiny. While the US contributes 28% to world GDP, China accounts for only 5%. The whole of Asia, from Turkey to China, contributes 24%, less than the US alone.

“At some stage, the world may no longer catch a cold when the US sneezes, but that is far from being true now. 21% of China's exports and 23% of the EU's exports to non-member countries go to the US. Thus, the world cannot help but be pulled down by a US slump.”

Click here for the full article.

Source: Hans-Werner Sinn, IFO Viewpoint , March 18, 2008.

Charlie Rose: A discussion with Paul Volcker on the US economy

“Former Federal Reserve Chairman Paul Volcker said the Fed's decision to lend money to Bear Stearns to keep it from collapsing is unprecedented and ‘raises some real questions' about whether that's the appropriate role for the Fed. The wisdom of the decision depends on ‘how severe this crisis was and their judgment about the threat of demise of Bear Stearns,' Mr. Volcker said on the Charlie Rose Show on Tuesday evening. ‘That's a judgment they had to make and an understandable judgment.' It is ‘absolutely' not ‘what you want for the longstanding regulatory support system.'”

Source: Charlie Rose , March 18, 2008.

Jon Stewart (The Daily Show): Broken arrow

“Jon Stewart responds to President Bush's rosy outlook on Wall Street and Jim Cramer's terrible Bear Stearns advice.”

Source: Jon Stewart, The Daily Show , March 17, 2008.

Credit Suisse: US credit crisis – A monster with many heads

“The credit crisis continues to be the dominant issue in the financial markets and it's leaving its mark on the real economy. The US Federal Reserve has made moves to subdue the deepening credit crisis – at least for the short term. In an interview, Giles Keating, head of the Credit Suisse Global Economics and Strategy Group, sheds light on the issues impacting the world economy.”

Click here for the full article.

Source: Michèle Bodmer & Joy Bolli, Credit Suisse , March 17, 2008.

Bill King (The King Report): It's déjà vu all over again!

“Exactly one week from yesterday we had a 416-point DJIA rally after historic Fed intervention. It was extensively heralded as a clear sign of a bottom in everything, including Yankee pitching. The Street went CNBC jiggy. Three days later, the financial system almost imploded.

“The rally on March 11, just like yesterday's 420-point rally, occurred because the Fed, US solons and their Street stooges had to manipulate markets to prevent a financial system at the abyss from implosion. Once again Bubblevision and their barkers proclaimed ‘bottom' and ‘buying opportunity'.

“If the March 11, 416-points DJIA rally was a lark, a ruse, a product of legerdemain, what is different now – except Bear is gone, the Fed has less bullets and a worse balance sheet, the dollar is substantially lower and credit markets continue to flounder?

“There have been consecutive weeks of unprecedented Fed intervention in order to prevent a system implosion. Will we need weekly market interventions and manipulations to keep the system functioning? How about bi-weekly? Bi-monthly? Bi-quarterly? Is everything now okay?

“How many times will people fall into traps sprung by crafted bear market rallies, market intervention and manipulation and strident shilling by the financial media and Street? The answer is almost every time, because most people will lose the most money ‘all the way down.'”

Source: Bill King, The King Report , March 19, 2008.

Goldseek: Flashback – A good laugh at Art Laffer's CNBC's discussion with Peter Schiff

“Arthur Laffer (Laffer Investments) debates Peter Schiff on CNBC, August 28, 2006, allowing history to judge who was really off base. We would like to know why CNBC continues to provide Mr. Laffer prime exposure while Mr. Schiff has not been invited back since late 2007?

“We would also like to know if Mr. Schiff has received his penny …”

Source: Goldseek , , March 16, 2008.

Asha Banglore (Northern Trust): LEI report confirms weak US economic conditions

“The Index of Leading Economic Indicators (LEI) dropped 0.3% in February, the fifth consecutive monthly decline of the index. On a year-to-year basis, the index is down 1.5%, marking the sixth monthly decline. On a quarterly basis, the year-to-year change of the January-February fell 1.8% – the biggest drop in the current cycle and consistent with readings seen in past recessions. A larger negative reading would seal the case of a recession; it should not be surprising to see to this in the months ahead.”

Source: Asha Bangalore, Northern Trust - Daily Global Commentary , March 20, 2008.

Asha Bangalore (Northern Trust): FOMC meeting – growth is predominant concern

“The FOMC lowered the federal funds rate and discount rate 75 bps to 2.25% and 2.50% respectively. The Fed has lowered the federal funds rate from 5.25% to 2.25% in a six-month period, which works out to a 600 bps cut on an annualized basis. By contrast, the Fed raised the federal funds rate from 1.00% to 5.25% at a slower pace and extended the tightening cycle over a two-year period. The Fed's concern about financial market stress and economic growth are the main reasons for today's move.

“The statement indicated that the slowing of consumer spending, soft labor market, financial market stress and the deepening of the housing market contraction are factors affecting economic growth which justifies the aggressive move.

“The most telling aspect of the Fed's remarks today is that of the statements between December 11 and March 18, today's statement was the most concerned about inflation and yet the Fed lowered the federal funds rate 75bps, which leads one to conclude that were inflation more contained, the Fed would have moved more aggressively. Despite the tough stance about inflation, there is an element of optimism about the moderation of inflation in the statement because the Fed expects energy and other commodity prices to stabilize and pressures on resource utilization to diminish.”

Source: Asha Bangalore, Northern Trust - Daily Global Commentary , March 18, 2008.

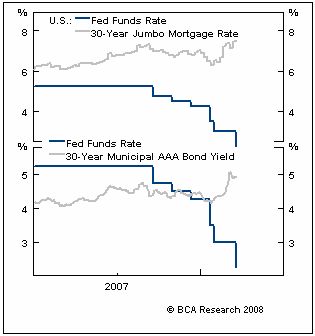

BCA Research: Fed Policy – An aggressive stance

“The Fed did not meet expectations of a 100 basis point rate cut, but policy is being eased at an aggressive pace. If the latest moves fail to work, then the next step probably is outright purchases of non-Treasury securities.

“The Fed is pulling out all the stops in its efforts to stabilize the credit markets and reduce risk aversion. Thus far, the main achievement has been to drive the dollar sharply lower, and in the process, push up oil and gold prices.

“Many key non-Treasury rates are still higher than in September, when the Fed started to lower the funds rate. A decline in these rates and in spreads would be the key indication that conditions are finally improving.”

Source: BCA Research , March 19, 2008.

Asha Bangalore (Northern Trust): If it is only a mild slowdown in economic activity, why are actions of the Fed unprecedented?

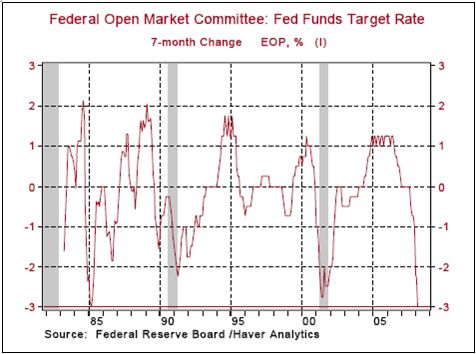

“The Fed's record in the August 2007 – March 2008 period will probably go down in history as the most aggressive and creative. The TAF, TSLF, and PDCF programs are its creative endeavors aimed at reducing the credit crunch and liquidity problems, while the sharp reduction in the federal funds rate is the aggressive feature of monetary policy changes in recent months. The FOMC has reduced the funds rate 300 bps between September 18, 2007 and March 2008. In nearly 26 years, such an eye popping drop in the federal funds rate in a seven-month period occurred only between August 1984 and March 1985 during Chairman Paul Volcker's term.

“In terms of a percent change, the latest 300 bps cut in the federal funds rate is the largest (57.1% drop) since September 1982. The only period when it was close to the recent drop was a 55.5% decline in the seven months ended November 2001.

“If in fact the economy is projected to show only a mild slowdown as the Fed expects why has the Fed undertaken a historically aggressive decline in the federal funds rate? The FOMC forecast is a 1.3% to 2.0% Q4-to-Q4 increase in real GDP during 2008.

“If the economy is projected to grow in 2008, according to the Fed's forecast and rhetoric, it is not clear why the Fed has taken these aggressive steps. The Fed may have to use the ‘R' word soon.”

Source: Asha Bangalore, Northern Trust - Daily Global Commentary , March 19, 2008.

Bloomberg: Harvard's Feldstein says US economy in recession

“Harvard University economist Martin Feldstein, a member of the group that dates business cycles in the US, said the nation has entered a recession that could be the worst since World War II.

“‘I believe the US economy is now in recession,' Feldstein, president of the National Bureau of Economic Research, told the Futures Industry Association conference in Boca Raton, Florida. ‘Could this become the worst recession we have seen in the post-war period? I think the answer is yes. I would emphasize the word ‘could'.'

“Feldstein's remarks represent the first time that a member of the NBER's business-cycle dating committee has publicly described the current downturn as a recession. The economy may not respond quickly to Federal Reserve interest-rate cuts, and a package of tax rebates and investment incentives will offer only a temporary boost, he said.”

“Bush administration officials including Treasury Secretary Henry Paulson have avoided saying the economy is in a recession. ‘We have slowed down very significantly,' Paulson said in a National Public Radio interview yesterday. ‘I'm not getting into' whether it is a recession.

“The economy expanded 0.6 percent at an annualized pace last quarter, and economists surveyed by Bloomberg News this month predicted the pace will slow to 0.1 percent in January to March.”

Source: Matthew Leising and Steve Matthews, Bloomberg , March 14, 2008.

The Washington Post: Mr. Bernanke's bet

“There are risks in the Fed's approach. It is possible that Mr. Bernanke's drastic steps will communicate desperation rather than, as intended, confidence to financial markets. His policy could exacerbate inflation, which is already above the Fed's target range; and it will further weaken the dollar, which is trading at an all-time low against the euro. Though it also drives up oil prices, the weaker dollar otherwise improves the US trade balance – and, though US officials don't like to say so publicly, it inflates away US debts to foreigners. It is not clear, though, how much longer investors in the rest of the world will let the Fed continue to play this game.

“Mr. Bernanke is well aware of these downsides. But faced with no good options – only bad and worse – he decided, with the Bush administration's support, to assume the risks. The hope is that he has correctly assessed the situation and that the Fed does succeed in averting financial catastrophe or spiraling inflation. If not, his actions could make a gloomy case study for some future professor of the dismal science.”

Source: The Washington Post , March 18, 2008.

Did you enjoy this posting? If so, click here to subscribe to updates to Investment Postcards from Cape Town by e-mail.

By Dr Prieur du Plessis

Dr Prieur du Plessis is an investment professional with 25 years' experience in investment research and portfolio management.

More than 1200 of his articles on investment-related topics have been published in various regular newspaper, journal and Internet columns (including his blog, Investment Postcards from Cape Town : www.investmentpostcards.com ). He has also published a book, Financial Basics: Investment.

Prieur is chairman and principal shareholder of South African-based Plexus Asset Management , which he founded in 1995. The group conducts investment management, investment consulting, private equity and real estate activities in South Africa and other African countries.

Plexus is the South African partner of John Mauldin , Dallas-based author of the popular Thoughts from the Frontline newsletter, and also has an exclusive licensing agreement with California-based Research Affiliates for managing and distributing its enhanced Fundamental Index™ methodology in the Pan-African area.

Prieur is 53 years old and live with his wife, television producer and presenter Isabel Verwey, and two children in Cape Town , South Africa . His leisure activities include long-distance running, traveling, reading and motor-cycling.

Copyright © 2008 by Prieur du Plessis - All rights reserved.

Disclaimer: The above is a matter of opinion and is not intended as investment advice. Information and analysis above are derived from sources and utilizing methods believed reliable, but we cannot accept responsibility for any trading losses you may incur as a result of this analysis. Do your own due diligence.

Prieur du Plessis Archive |

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.