The Fed’s Forked Tongue, Means Gold's Price Rise Will be Explosive

Commodities / Gold and Silver 2013 Jun 26, 2013 - 11:18 AM GMTBy: Darryl_R_Schoon

When Helicopter Ben Bernanke

When Helicopter Ben Bernanke

Said the helicopter would descend

The markets reacted and quickly fell

Fearing the party would end

But they forgot that Ben’s a banker

A breed whose trust is low

And they didn’t stop to consider

It might only be part of the show

On June 22nd, Robert Lenzer in his article, Stocks React Like Junkies As Bernanke Yanks Away Low Rates, pointed out in Forbes Magazine the flawed reasoning behind Bernanke’s threat to end the Fed’s trillion dollar life-line to US and global markets.

…If the U.S. economy grows at 2.5%, which the Federal Reserve figures is about as strong as growth can be, then we would create only 113,000 to 158,000 new jobs each month. That would bring us by year-end 2013 to an unemployment rate of 7.2%-7.3%, hardly the 6.5% target Bernanke indicated previously would allow him to reduce the additional bond buying from the $85 billion a month now….Actually, the spontaneous liquidation of stocks and bonds alike were staggering, given that according to the Fed’s projections the unemployment rate can’t fall to 6.5% until the second quarter of 2015. Look at these declines in the SPY, QQQ and DIA since May 17 as the yield on the 10-year note has shot higher by 24 basis points.

Markets fell and borrowing costs rose after Bernanke’s threat

http://www.forbes.com/sites/robertlenzner/2013/06/21/stocks-react-like-junkies-as-bernanke-yanks-away-low-rates/

THE FED’S TRANSPARENT MISDIRECTION

Misdirection is a form of deception in which the attention of an audience is focused on one thing in order to distract its attention from another.

Ben Bernanke’ threat to end the Fed’s bond buying in 2014 should be taken with a millennium’s worth of salt. After all, Bernanke’s statement is subject to his caveat the bond buying would end if unemployment fell below 7 %, a possibility as remote as Faux News supporting an Obama third term or Dick Cheney embracing Edward Snowden as an American hero.

Nomura analyst Bob Janjuah has come up with a far more probable reason for Bernanke’s controversial and consequential statements:

The Fed is not going to taper because the economy is too strong or because we have sustained core (wage) inflation, or because we have full employment—none of these conditions will be seen for some years to come…Rather, I feel that the Fed is going to taper because it is getting very fearful that it is creating a number of significant and dangerous leverage driven speculative bubbles that could threaten the financial stability of the U.S. In central bank speak, the Fed has likely come to the point where it feels the costs now outweigh the benefits of more policy.

http://www.cnbc.com/id/100825448

Janjuah’s insight notwithstanding, this does not mean the Fed will taper or end its bond buying as Janjuah and the markets now assume. Ben Bernanke is a one-trick pony and running the printing presses, i.e. bond buying, is Bernanke’s only trick. Bernanke, a central banker, however may have a less transparent motive in mind.

Bernanke knows the Fed’s bond-buying has led to speculative bubbles around the world. But Bernanke also knows that without the Fed’s continuing lifeline, US demand would plummet sending the world into perhaps another deflationary depression.

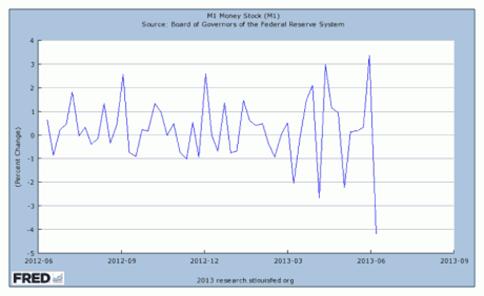

On June 24th, Telegraph columnist, Ambrose Evans-Pritchard, in his article, The Bernanke Fed Is Playing With Deflationary Fire, used two charts to illustrate this point.

Consumer demand and the velocity of money are now plunging. Capitalism, like a bicycle, doesn’t do well at slow speeds and Bernanke’s threat to end Fed bond buying could push America and the world over the edge into a deep deflationary abyss.

BERNANKE’S GAMBIT

Damned if he does and damned if he doesn’t, Bernanke may nonetheless believe he can have his cake and eat it too. By falsely telegraphing the Fed will end its bond-buying, i.e. Bernanke’s gambit, Bernanke has actually begun to deflate speculative bubbles in stocks, bonds and commodities without actually ending the Fed’s bond buying.

If successful, this will allow the Fed to continue pumping even more liquidity into now deflating markets for far longer than central bankers would otherwise consider prudent. In so doing, however, Bernanke may have inadvertently awoken the monetary hounds of hell from their decades-long slumber in the world’s bond markets.

The dénouement of capitalism will take place in the bond markets. Debt, i.e. capitalism’s ‘capital’, is the banker’s substitute for savings in the banker’s 300-year old ponzi-scheme of credit and debt; and, in the end-game, debt, not credit, will be the final arbiter of the bankers’ fate.

WHITHER GOLD

In my February 28th article, Goldman Targets $1200 Gold, I noted Jim Sinclair’s October 2012 prediction that the bullion banks would drive down the price of gold in order to exit their increasingly vulnerable short positions order to then go long.

They now have done so. The bullion banks are now long gold.

Alasdair MacLeod writes of this significant shift:

The largest four commercials are net long 26,000 gold contracts, and net short 22,700 silver contracts. In the case of silver, the next four largest traders are actually long. In both cases their risk exposure has not been so low at least since 2006. The message is clear: if the largest bullion banks have de-risked their trading books, logically they must expect prices to increase. And given they have fooled the hedge fund community into taking the shorts, the price move, when it comes, should be explosive as hedge funds wake up and rush to close.

http://www.goldmoney.com/gold-research/alasdair-macleod/banks-taking-the-long-side-of-the-trade.html

This does not mean, however, the price of gold will soon rise. It does mean that when it does—and it will—the bullion banks (the lap-dogs of central banks) will profit from its explosive ascent.

In my current youtube video, The Cosmic Outpatient Clinic, EDD, I answer an email from a viewer who voices the predicament of today’s youth, e.g. few jobs, rising debt, a selfish and corrupt elite, the growing evidence of government tyranny in a democratic guise, etc. While the possibilities he poses are both true, I proffer a third. See http://youtu.be/OMrocJzc-ks

The bankers’ battle to insure the survival of their debt-based ponzi-scheme is not over. They will fight to the bitter end hoping to preserve their highly profitable and parasitic 300-year franchise; but, in the end, they will lose—and we will win.Buy gold, buy silver, have faith.

By Darryl Robert Schoon

www.survivethecrisis.com

www.drschoon.com

blog www.posdev.net

About Darryl Robert Schoon

In college, I majored in political science with a focus on East Asia (B.A. University of California at Davis, 1966). My in-depth study of economics did not occur until much later.

In the 1990s, I became curious about the Great Depression and in the course of my study, I realized that most of my preconceptions about money and the economy were just that - preconceptions. I, like most others, did not really understand the nature of money and the economy. Now, I have some insights and answers about these critical matters.

In October 2005, Marshall Thurber, a close friend from law school convened The Positive Deviant Network (the PDN), a group of individuals whom Marshall believed to be "out-of-the-box" thinkers and I was asked to join. The PDN became a major catalyst in my writings on economic issues.

When I discovered others in the PDN shared my concerns about the US economy, I began writing down my thoughts. In March 2007 I presented my findings to the Positive Deviant Network in the form of an in-depth 148- page analysis, " How to Survive the Crisis and Prosper In The Process. "

The reception to my presentation, though controversial, generated a significant amount of interest; and in May 2007, "How To Survive The Crisis And Prosper In The Process" was made available at www.survivethecrisis.com and I began writing articles on economic issues.

The interest in the book and my writings has been gratifying. During its first two months, www.survivethecrisis.com was accessed by over 10,000 viewers from 93 countries. Clearly, we had struck a chord and www.drschoon.com , has been created to address this interest.

Darryl R Schoon Archive |

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.