Gold Controls In India as Premiums Double on Strong Demand For Gold and Silver

Commodities / Gold and Silver 2013 Jun 27, 2013 - 12:29 PM GMTBy: GoldCore

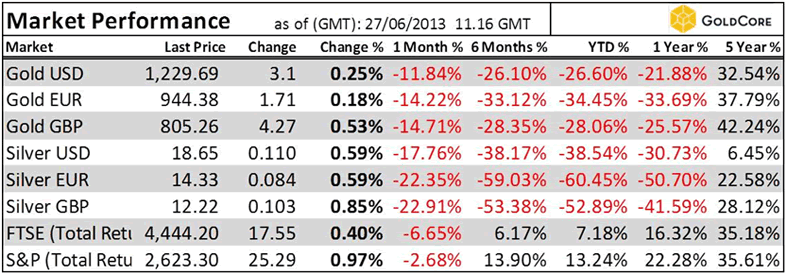

Today’s AM fix was USD 1,232.00, EUR 945.51 and GBP 806.07 per ounce.

Today’s AM fix was USD 1,232.00, EUR 945.51 and GBP 806.07 per ounce.

Yesterday’s AM fix was USD 1,229.00, EUR 942.85 and GBP 799.97 per ounce.

Gold fell $53.20 or 4.17% yesterday and closed at $1,224.10/oz. Silver slid to a low of $18.421 and finished down 5.46%.

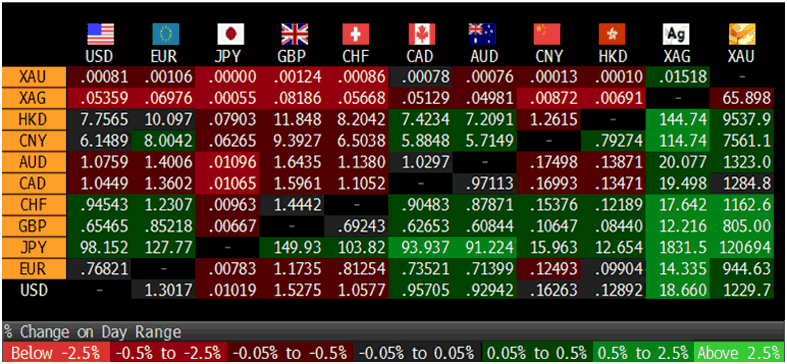

Cross Currency Table – (Bloomberg)

Gold inched upward today after investors and speculators viewed the recent price falls as excessive and some began to dip their toes back into the market.

Gold tumbled to its lowest level in nearly three years yesterday after concentrated selling in electronic trading on the COMEX, less liquid Asian trading Tuesday night that led to stop loss orders being triggered and further price falls.

Bullion dealers, mints and refineries have seen a small increase in clients liquidating physical bullion in June but nothing that would justify the scale of price weakness seen. There has been a small bit of panic selling which suggests capitulation and the market may be close to exhausting itself to the downside.

There are also many retail and wealthy buyers looking to accumulate at these lower prices – both in western markets and in Asia.

Physical demand remains robust internationally especially in China and India where premiums are moving higher again. In China, physical demand remains robust and premiums remain at elevated levels near $35/oz. In India, premiums charged shot to $20 an ounce overnight from $8-$10 on Tuesday.

Demand in both countries and in Asia in general is set to continue due to real and valid concerns about currency devaluations.

Despite futures prices falling in India to their lowest in more than a month, gold premiums doubled as dealers struggled to meet surging demand after a ban on bullion consignment imports.

India, the world's biggest buyer of gold, now requires importers to pay upfront for inventory, making it difficult for smaller jewellers with lower working capital to source supplies. The government also raised the import duty to 8% in May. India has ruled out a blanket ban on gold imports or any increase in customs duty from the current 8%.

Attempts to prevent Indians from buying gold are contributing to them buying poor man’s gold, or silver. There has been a massive increase in silver demand in India in recent months and the government's meddling and controls in the gold market will likely led to even more demand for silver.

While India imported 1,900 tonnes of silver in 2012, in the first five months of 2013 alone, imports have touched 2,400 tonnes.

Silver in USD, 5 Year – (GoldCore)

According to industry estimates, silver imports during the January-March quarter stood at 760 tonnes. Imports shot up 720 tonnes in April alone, and in May, they further swelled by 920 tonnes.

Gold Coin and Bar Sale Controls Create Deep Concern In India

Gold buyers in India are concerned after the India Gems & Jewellery Trade Federation asked its 42,000 member companies to stop selling gold coins and bars from July 1. The Indian government is believed to have put pressure on the powerful trade group in order to curtail India’s massive demand for gold.

Gold in Indian Rupees (2008 to 2013)

Indians are seeking ways to circumvent any prohibition and acquire gold which is the most popular form of saving in India. Many are concerned about the status of gold savings schemes that they had invested in to accumulate gold coins for future use.

The All India Gems and Jewellery Trade Federation, which represents 90% of jewellers, had come out with an open call on Monday to its members to stop selling gold bars and coins.

This has triggered a lot of concerns among consumers who have put their money in a few gold savings schemes – some of which were launched during the recent crash of the gold price in April.

Assuaging fears, president of the Madras Jewellers and Diamond Merchants’ Association Jayantilal Challani said, “Though we have asked our members to stop sales of coins by July 1, all the schemes will continue and consumers will get the promised quantity of gold, but may be in the form of jewellery of their choice.”

However, this has caused a lot of concern among the public as they stand to lose out due to the very high premiums on jewellery versus those on coins and bars. There are concerns that gold dealers will use this as an opportunity to sell much more expensive jewellery.

Another unintended consequence of the Indian government’s extremely anti gold policies will be the growth of smuggling and a black market in gold.

Ironically, it may also lead to Indian people, particularly the wealthier middle classes and high net worth Indians to store their bullion in safe jurisdictions which treat gold favourably such as Hong Kong, Singapore and Zurich. In a worst case scenario, it could lead to capital flight.

For the latest news and commentary on financial markets and gold please follow us on Twitter.

GOLDNOMICS - CASH OR GOLD BULLION?

'GoldNomics' can be viewed by clicking on the image above or on our YouTube channel:

www.youtube.com/goldcorelimited

This update can be found on the GoldCore blog here.

Yours sincerely,

Mark O'Byrne

Exective Director

IRL |

UK |

IRL +353 (0)1 632 5010 |

WINNERS MoneyMate and Investor Magazine Financial Analysts 2006

Disclaimer: The information in this document has been obtained from sources, which we believe to be reliable. We cannot guarantee its accuracy or completeness. It does not constitute a solicitation for the purchase or sale of any investment. Any person acting on the information contained in this document does so at their own risk. Recommendations in this document may not be suitable for all investors. Individual circumstances should be considered before a decision to invest is taken. Investors should note the following: Past experience is not necessarily a guide to future performance. The value of investments may fall or rise against investors' interests. Income levels from investments may fluctuate. Changes in exchange rates may have an adverse effect on the value of, or income from, investments denominated in foreign currencies. GoldCore Limited, trading as GoldCore is a Multi-Agency Intermediary regulated by the Irish Financial Regulator.

GoldCore is committed to complying with the requirements of the Data Protection Act. This means that in the provision of our services, appropriate personal information is processed and kept securely. It also means that we will never sell your details to a third party. The information you provide will remain confidential and may be used for the provision of related services. Such information may be disclosed in confidence to agents or service providers, regulatory bodies and group companies. You have the right to ask for a copy of certain information held by us in our records in return for payment of a small fee. You also have the right to require us to correct any inaccuracies in your information. The details you are being asked to supply may be used to provide you with information about other products and services either from GoldCore or other group companies or to provide services which any member of the group has arranged for you with a third party. If you do not wish to receive such contact, please write to the Marketing Manager GoldCore, 63 Fitzwilliam Square, Dublin 2 marking the envelope 'data protection'

GoldCore Archive |

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.