The Best Reasons to Own Gold NOW!

Commodities / Gold and Silver 2013 Jul 08, 2013 - 12:04 PM GMTBy: Money_Morning

Michael Checkan writes: Whether you own gold or have been sitting on the sidelines, you must be wondering whether now is the time to buy more or to finally get in the game.

Michael Checkan writes: Whether you own gold or have been sitting on the sidelines, you must be wondering whether now is the time to buy more or to finally get in the game.

The answer is one of refreshing clarity in these uncertain times.

1. Gold prices are now at or below production costs.

With gold falling to its current levels, we are very near gold production costs ($1,000 - $1,100 an ounce) for many mining companies around the world.

You can now buy gold at or near the price it would cost a mining company to get it out of the ground. Buy now and you buy right.

And don't be afraid of further price dips. Here's the likely scenario: Any further falls in prices will cause miners to cease production and/or stop opening new mines.

Supply will have a harder time keeping up with demand. Prices will rise and you will sell right. Buy low, sell high and protect your portfolio from rapid fluctuation in the market value for your securities.

Your overall nest egg will be healthier by including gold, because you can wait out the market uncertainty in your stock and bond holdings.

2. You can buy more ounces of gold for your money now.

The dollar is stronger. So you get more ounces of gold for your money. The printing of U.S. currency by the government has devalued our dollar and will continue to do so.

When, as now, there is a small window of strength in the dollar we want to take this rare opportunity to buy gold. Now is that time.

Don't expect that U.S. dollar strength to last long.

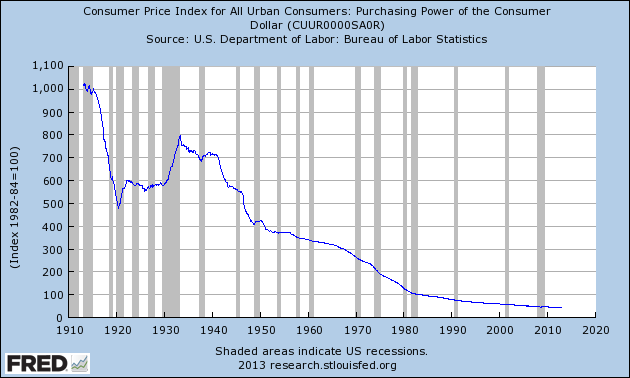

Since 1913, the dollar has lost 96 percent of its value to buy goods and services. Now more than ever, it is critical for everyone to own gold. We have passed beyond the slippery slope of currency debasement.

It is not a question of if, but rather when the dollar becomes the latest addition to the fiat currency graveyard.

3. Gold is now, as always, a core asset that is essential in a political, economic or personal crisis.

Gold has millennia of history as a tangible asset negotiable as payment for your everyday needs, when cash and paper investments fail you.

Look at the pathetic decline of the purchasing power of the dollar. We need to own an asset that maintains our buying power, now.

Gold, by contrast, is "wealth insurance" that will protect you and your family from an unfortunate monetary crisis, over which you have no control.

And the best part is that with prices at their lowest in years, you can buy gold for what it costs mining companies to produce it. It's like owning your own mine.

4. The only thing that has changed now is the price of gold. Not its wealth power.

Paper profits continue to disappear as we desperately try to balance our portfolios with traditional stock and bond securities.

But, asset allocation no longer works when markets are manipulated by a word or two from the White House or the Fed; and when billions reside in ETF's and funds that go up and down in tandem.

The lesson is clear: In a monetary crisis, gold is the very best insurance you can have.

This is true whether it's the gradual erosion of purchasing power, as we are seeing now with the U.S. dollar, or the sudden, catastrophic plunge of a currency due to economic, social or political unrest which has occurred many other times, in many other countries, throughout history.

Gold works. It has before. It will again. Make sure you heed this lesson of history. And make sure that you take advantage of today's price and "mine" your own gold.

Interested in something even easier for your portfolio or retirement IRA?

Visit www.asipmdirect.com, ASI Precious Metals Direct, and form an online relationship with ASI in less than 10 minutes. You can trade in seconds and place your order 24/7 to be executed during normal market opening hours. Over a dozen wholesalers will bid for your order and you will get the best price. Choose to take deliver or have your metals stored in New York City, Salt Lake City, London Singapore, Australia or Hong Kong; all from your computer, iPhone or iPad.

Never heard of online buying of gold, silver, and palladium, platinum in coins, rounds or bars? Well, ASI was the first to innovate and make it as simple as online stock trading.

Rick Rule in this Money Morning video How to Invest in Gold: Tips from an Expert on the Yellow Metal provides additional gold investing tips

Source :http://moneymorning.com/2013/07/08/the-best-reasons-to-own-gold-now/

Money Morning/The Money Map Report

©2013 Monument Street Publishing. All Rights Reserved. Protected by copyright laws of the United States and international treaties. Any reproduction, copying, or redistribution (electronic or otherwise, including on the world wide web), of content from this website, in whole or in part, is strictly prohibited without the express written permission of Monument Street Publishing. 105 West Monument Street, Baltimore MD 21201, Email: customerservice@moneymorning.com

Disclaimer: Nothing published by Money Morning should be considered personalized investment advice. Although our employees may answer your general customer service questions, they are not licensed under securities laws to address your particular investment situation. No communication by our employees to you should be deemed as personalized investent advice. We expressly forbid our writers from having a financial interest in any security recommended to our readers. All of our employees and agents must wait 24 hours after on-line publication, or after the mailing of printed-only publication prior to following an initial recommendation. Any investments recommended by Money Morning should be made only after consulting with your investment advisor and only after reviewing the prospectus or financial statements of the company.

Money Morning Archive |

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.