How to Succeed in the Low-Yield Inflationary Bond Market Matrix

Interest-Rates / US Bonds Jul 18, 2013 - 12:58 PM GMTBy: Money_Morning

Robert Hsu writes: In the 1999 sci-fi film, "The Matrix," the mentor Morpheus turns to the protagonist Neo and says, "Do you think that's air you're breathing now?"

Robert Hsu writes: In the 1999 sci-fi film, "The Matrix," the mentor Morpheus turns to the protagonist Neo and says, "Do you think that's air you're breathing now?"

The quote has become somewhat of a modern classic movie line, as the words serve to enlighten Neo that all is not what it seems in the world he perceives.

For income investors, there's a new matrix of sorts, and it's a world dominated by the very real toxic cocktail of low yields and rising inflation.

Income investors-most of whom are near or already in retirement-now are forced to breathe the thick air of dwindling income from traditional sources, and the rising costs of all sorts of goods and services.

On the yield front, we've seen the pernicious effects of the Federal Reserve's easy money policies on traditional yield-generating securities such as Treasury bonds.

For example, from the end of June 2010, which was the end of the first round of quantitative easing (QE1), up through May 21, 2013, when the dreaded "taper talk" began, the yield on the 10-Year Treasury note fell from 2.95% to 1.94%. In percentage terms, that's a decline in yield of nearly 35%.

Yes, we have seen yields come back sharply off their lows in recent weeks, but now that the fear over QE tapering has largely calmed, investors are left with the rather daunting proposition that yields in traditional "safe" investments like long-term Treasury bonds are going to continue to be meager for some time.

Low Expectations

Of course, it's not just Treasury bond yields that are going to continue being low. Even if rates do rise modestly, cash will still pay virtually nothing, and most bond funds also will continue yielding a mere pittance.

As for inflation, well, the "official" government line is that the CPI went up by a measly 2% last year. That may be true if you're a healthy 25-year old single guy who rarely leaves your rental apartment and lives on home-delivered pizza while playing video games all the time.

If you're in the income-investing demographic, however, this new matrix is particularly straining. The biggest expense areas this group has-healthcare and college tuition for children- are both skyrocketing.

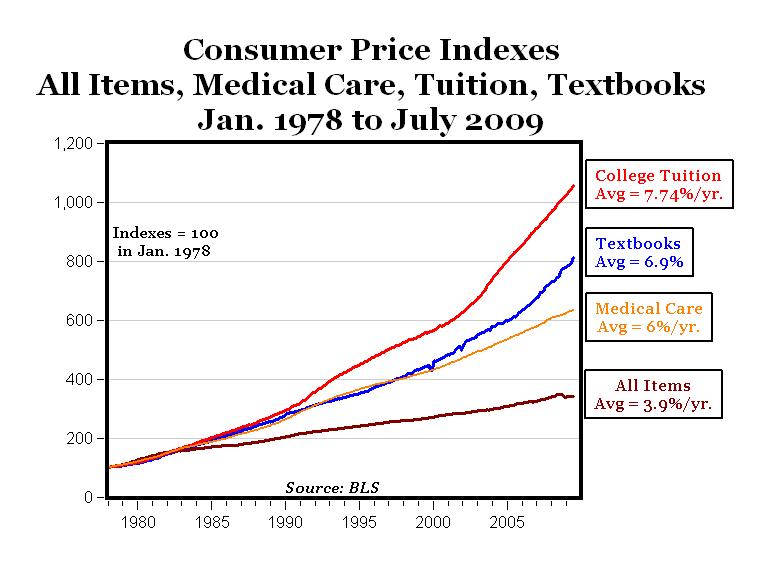

According to the Bureau of Labor Statistics, from 1978 through 2009, there's been an average annual increase of 6% for medical care. College tuition has risen 7.74% annually over that same time period.

The CPI rose by only 3.9% during the same period. In the 30 years since 1978, general CPI is up 215%, healthcare cost is up nearly 500%, and college tuition is up close to 1,000%.

Low-Yield Inflationary Matrix

Unfortunately, the passing and full implementation of Obamacare is likely going to cause those healthcare costs to spike much higher, at a time when income investors generally consume more healthcare services.

And thanks to government's not-so-invisible hand in the area of guaranteed student loans, college tuition around the country is likely to continue its relentless march higher.

The Other Shoe

What's more, this low-yield, high-inflation matrix confronting income investors is something that most traditional financial advisors are ill-equipped to navigate.

Here the common, and in my view grossly inadequate, "Rule of 100" still dictates the overall portfolio allocations recommended by many advisors: You take 100 and subtract your age, and the result is the maximum amount of your portfolio you should have exposed to equities.

The rest, so the story goes, should be in bonds. So, if you're 50 years old you should have 50% of your money in stocks and 50% in bonds.

This simple method is still used by many financial planners and asset allocators, but it fails to address the reality of the new income-investing matrix.

In a QE-dominated world of low yields and rising inflation-particularly on the things the income-investing demographic spends the most money on-a rule of 100-style return isn't likely to get you where you want to be.

If you want to generate the kind of income you're really going to need in this new matrix, you're going to have to be more aggressive, more sophisticated and more proactive than you've likely ever been.

You see, in this new matrix, it's not enough to simply think that's air you're breathing.

In this matrix, you have to confront the realities that the financial air you breathe is going to require a greater, smarter effort in order to achieve higher income and higher returns.

Like Neo, this reality may be shocking, but ultimately it's what you must confront if you are to free yourself from the reality of the low yield, inflationary matrix.

Welcome to the real world of quantitative easing.

How will retirees and others on fixed income cope with the new bond market? Find out about Robert's bond market strategies.

Source :http://moneymorning.com/2013/07/18/how-to-succeed-in-the-low-yield-inflationary-matrix/

Money Morning/The Money Map Report

©2013 Monument Street Publishing. All Rights Reserved. Protected by copyright laws of the United States and international treaties. Any reproduction, copying, or redistribution (electronic or otherwise, including on the world wide web), of content from this website, in whole or in part, is strictly prohibited without the express written permission of Monument Street Publishing. 105 West Monument Street, Baltimore MD 21201, Email: customerservice@moneymorning.com

Disclaimer: Nothing published by Money Morning should be considered personalized investment advice. Although our employees may answer your general customer service questions, they are not licensed under securities laws to address your particular investment situation. No communication by our employees to you should be deemed as personalized investent advice. We expressly forbid our writers from having a financial interest in any security recommended to our readers. All of our employees and agents must wait 24 hours after on-line publication, or after the mailing of printed-only publication prior to following an initial recommendation. Any investments recommended by Money Morning should be made only after consulting with your investment advisor and only after reviewing the prospectus or financial statements of the company.

Money Morning Archive |

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.